We Are/DigitalVision via Getty Images

Investment Thesis

Star Bulk Carriers Corp (NASDAQ:SBLK) remains well-poised for profitability growth over the next few quarters, due to the record low order book, supply inefficiencies, and slower vessel speeds due to new environmental regulations from 2023 onwards. The macro issues in China and Ukraine causing temporary headwinds in trade volumes have been more than offset by the projected 3.3% YoY increase in ton mileage from the strong global demand for coal in the EU and India, owing to the hyperinflated oil and gas prices so far. Combined with the still elevated TCE rates for FQ3’22, we expect SBLK to outperform again in November 2022.

Nonetheless, since the stock is also obviously trading at a slight premium, we prefer to wait for the current rally to be digested, before recommending a buy. Assuming that the trade volumes continue to fall due to China’s Zero-COVID Policy from President Xi’s re-election in November 2022, the rising inflation/ the Fed’s hike in interest rates, and the bearish stock market through 2023, we expect further downward pressure on SBLK’s stock performance ahead, triggering a potential disconnect between its price and fundamental performance. The S&P 500 Index had tragically fallen by 21.8% in H1’22, though we are starting to see a potential bull run ahead. Interested investors, take note of the potential volatility.

SBLK’s Management Continues To Deliver Excellence

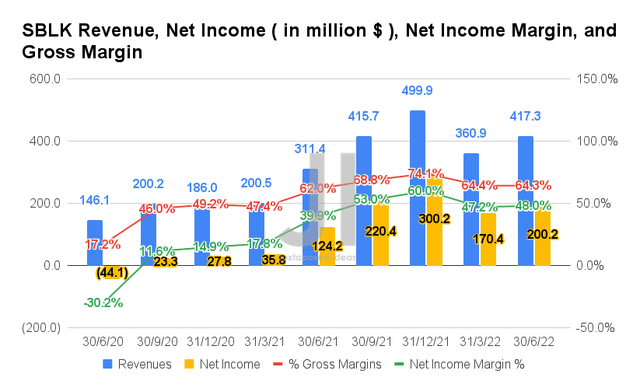

It is evident that SBLK had benefitted from the elevated TCE rates thus far, given the massive growth in its revenues and net incomes for the past five quarters. The company recorded a TCE of $30.45K in FQ2’22, representing a notable growth of 33% YoY from $22.92K in FQ2’21 and a tremendous increase of 323.9% from $9.4K in FQ2’20.

Therefore, it was not surprising that SBLK reported revenues of $417.3M and gross margins of 64.3% in FQ2’22, representing excellent YoY growth of 34% and 2.3 percentage points, while recording tremendous increases of 264.4% and 46.9 percentage points from FQ2’19 levels, respectively. In the meantime, the company reported net incomes of $200.2M and net income margins of 48% in FQ2’22, representing an increase of 61.1% and 8.1 percentage points YoY, respectively, and 598.2% and 73.5 percentage points from FQ2’19 levels.

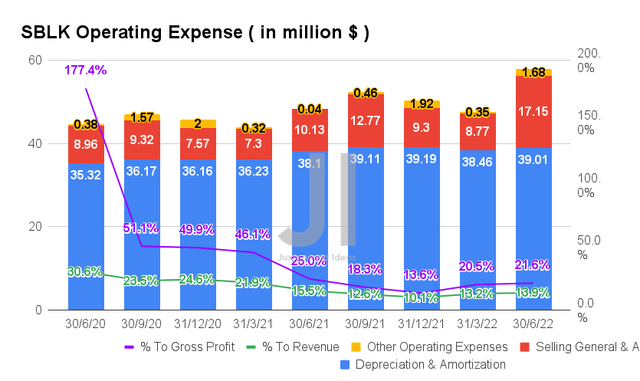

SBLK has also been expanding its operations over time, with a total of $57.84M in operating expenses in FQ2’22, representing a notable increase of 14.5% QoQ, 12.8% YoY, and 32.8% from FQ2’19 levels. Nonetheless, we are not worried, since the ratio has been moderating steadily thus far to 21.6% of its growing revenues and 13.9% of its gross profits in FQ2’22. This reflects very positively on its much improved operating efficiency, compared to 25% of revenues and 15.5% of gross profits in FQ2’21, or 25.2% and 145.2% in FQ2’19, respectively.

This improved efficiency is also reflected in SBLK’s TCE less OPEX less G&A of $24.76K in FQ2’22, compared to $17.52K in FQ2’20 and $5.6K in FQ2’19. The company also reported excellent Free Cash Flow (FCF) generation of $233.98M and an FCF margin of 56.1% in FQ2’22, representing a massive improvement of 263.2% and 27.6 percentage points YoY, respectively. Thereby, beefing up its cash and equivalents to $385.6M simultaneously. As nearly 94% of its vessels are also scrubber-fitted, we expect the management to continue reporting improved net income and FCF profitability, due to the elevated TCEs and limited supply ahead, despite the potential headwinds from the macro issues.

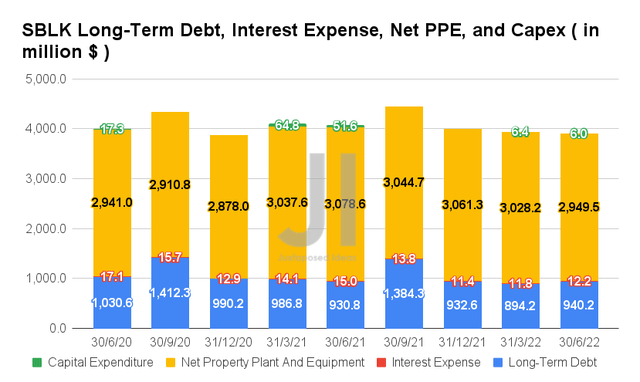

Despite the notable growth in its fleet from 118 vessels in FQ2’19 to 128 vessels in FQ2’22, SBLK had skillfully maintained its debt level very reasonably in the past three years at $0.94B by FQ2’22. These were also helped by the management’s continued debt optimization thus far, with a reduction of $4M in annual interest expenses and an extension of up to 4.4 years in debt maturities, through a mixture of new and existing debt refinancing. It pushed the nearest debt maturity, namely the Atradius Facility, to March 2024.

Therefore, this strategy frees SBLK’s short-term capital use for shareholders’ return in the form of future dividends and share repurchase programs, with $19.7M outstanding at the time of writing. In the last twelve months, the company had already paid out $6.55 dividends per share, representing a handsome dividend yield of 21.89%. Thereby, returning much value to long-term SBLK investors indeed.

We May See An Upwards Re-rating Of SBLK’s FY2022 Revenue Ahead

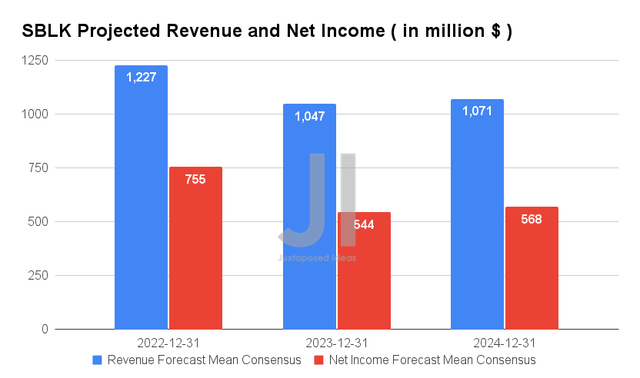

Over the next three years, SBLK is expected to report an apparent normalization of revenues and net income growth, at an adj. CAGR of 5.45% and 103.69% since FY2019, respectively. Nonetheless, we must also highlight the massive improvement in its net income margins, from -2% in FY2019, to 47.7% in FY2021, and finally to a projected 53% in FY2024. Stellar indeed, given that SBLK has been struggling to report sustained profitability pre-pandemic.

In the meantime, consensus estimates that SBLK will report revenues of $1.22B and a net income of $0.75B, representing a YoY decline of -14% though an improvement of 11%, respectively. However, we expect the company to easily smash estimates, since they already reported total revenues of $778.21M by H1’22. Based on management’s Q3 guidance of 61% booking with TCE of $29K/day per vessel, it is not far-fetched to assume that SBLK will report excellent FY2022 revenues of $1.44B, potentially indicating an excellent 18% upside from estimates. Therefore, speculatively triggering another stock rally ahead.

So, Is SBLK Stock A Buy, Sell, or Hold?

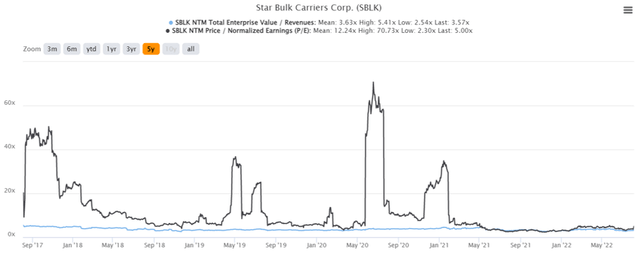

SBLK 5Y EV/Revenue and P/E Valuations

SBLK is currently trading at an EV/NTM Revenue of 3.57x and NTM P/E of 5.0x, lower than its 5Y mean of 3.63x and 12.24x, respectively. The stock is also trading at $25.58, down 24.7% from its 52 weeks high of $33.99, though at a premium of 43.7% from its 52 weeks low of $17.80. However, it is evident that consensus estimates remain optimistic about SBLK’s eventual recovery, given their price target of $36.40 and 42.3% upside.

SBLK 5Y Stock Price

SBLK’s current premium, however, should be viewed with caution because the stock is trading with a combination of excellent fundamental performance and hype surrounding global supply chain issues. Especially since the company recently reported stellar FQ2’22 earnings call on 04 August 2022. As a result, we encourage interested investors to wait for the current rally to be digested before adding SBLK to their portfolio. In the meantime, long-term investors should definitely sit back and enjoy their rich dividend payouts in times of economic turbulence.

Therefore, we rate SBLK stock as a Hold for now.

Be the first to comment