Adriana Romanova

Thesis

Star Bulk Carriers Corp.’s (NASDAQ:SBLK) FQ3 earnings release led to an initial selloff, firmly supported by shipping bulls the following week. However, there’s little doubt that near-term market trends in dry bulk shipping have continued to weaken.

With the global economy moving closer to a potential recession, we believe the market has priced in significant pessimism in SBLK’s valuation. Management’s commentary suggests that the company is well-positioned to ride through the downcycle. With a much stronger balance sheet, lower debt load, and still elevated time charter equivalent (TCE) rates, we are confident in management’s execution.

Furthermore, IMO 2023 regulations, elevated inflation, and energy costs should also succor slower streaming, mitigating the demand impact. Coupled with a record low order book relative to the global fleet, the supply dynamics remain favorable.

And there’s one critical headwind that could reverse into a significant tailwind from 2023/24: China’s progressive refinement from zero-COVID restrictions. While still early, China’s refinement of its COVID policies is highly constructive.

Recent COVID protests in China could also have bolstered policymakers’ impetus to reconsider their stringent lockdowns. Notwithstanding, any suggestion that the protests could lead to Chinese President Xi Jinping accelerating China’s easing of COVID restrictions should be considered speculative for now.

Still, we believe China is already at “ground zero” for the subsequent easing of its COVID lockdowns. Hence, it could provide a welcome lift to Star Bulk moving ahead.

However, we postulate a near-term re-rating remains uncertain for now, given the significant macro and industry-specific headwinds. Notwithstanding, we assess that buyers’ momentum remains constructive at SBLK’s long-term support.

Hence, we urge investors to consider capitalizing on significant downside volatility below the $20 level (and closer to its $16.5 level) to add exposure.

Maintain Buy with a medium-term price target of $24.

SBLK: Already Battered Heading Into Q3 Earnings

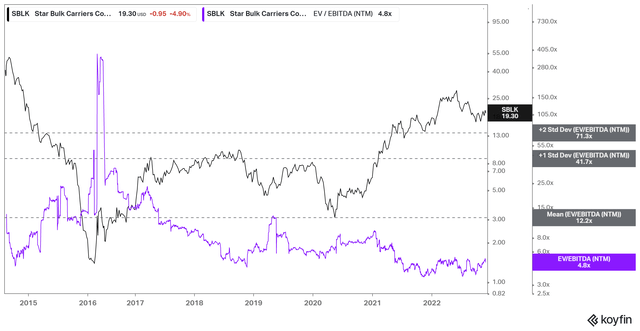

SBLK NTM EBITDA multiples valuation trend (koyfin)

Despite the surge in SBLK from its COVID lows, the market had not re-rated SBLK, as seen above. As such, SBLK last traded at an NTM EBITDA multiple of 4.8x, well below its average of 12.2x. Also, SBLK trades at a discount against its shipping peers’ median of 6x NTM EBITDA (according to S&P Cap IQ data).

Hence, we postulate that the market had already reflected significant pessimism in SBLK’s valuation, as it anticipated the normalization of its pandemic-induced tailwinds.

Given the shipping industry’s exposure to global macro headwinds, even leading dry bulk shippers like Star Bulk is not immune. However, the critical question is whether the current positioning is conducive to a medium-term recovery.

Near-Term Challenges Likely To Continue

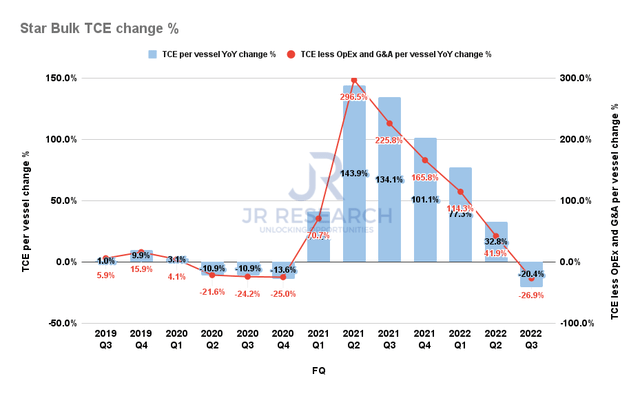

Star Bulk TCE rate change % (Company filings)

Star Bulk posted an average TCE rate of $24.37K in FQ3, down 20.4% YoY. As such, it continued a significant moderation since the highs of Q2’21. In addition, when factoring costs, its TCE less-costs were also impacted markedly, resulting in the moderation of its TCE revenues.

Furthermore, management highlighted that the company had secured a TCE rate of $22.77K in Q4, covering 66% of its available days. Hence, investors should continue to expect further moderation in its TCE revenue in the near term.

However, we believe it has already been reflected in the revised consensus estimates. The critical question is whether we could be on the cusp of a significant global recession.

Management’s commentary highlighted that it didn’t expect a severe recession, in line with the revised IMF forecasts. In a recent article, we also explained why the current market positioning is appropriate for a soft landing.

As such, we believe while near-term challenges are likely to persist, Star Bulk’s medium-term outlook remains constructive.

Furthermore, we believe the tailwind from China’s progressive easing from its COVID restrictions has not been reflected in SBLK’s valuation. Goldman Sachs highlighted that it saw a possible path toward an earlier reopening due to the recent COVID protests. China was also reported to be accelerating the vaccination of its vulnerable seniors. Notably, Bloomberg Intelligence highlighted previously that the government would be concerned over any premature reopening moves that could threaten the surge in caseloads for its most vulnerable population segments.

Also, China has been increasingly laying out measures to recover its property malaise, which should lift the iron ore trade in FY23. Star Bulk also highlighted in its commentary that it gleaned improved sentiments in China’s steel production. As such, we postulate that green shoots of recovery in China could be spurred by more decisive action over China’s zero COVID restrictions, lifting the somber outlook in dry bulk shipping.

Is SBLK Stock A Buy, Sell, Or Hold?

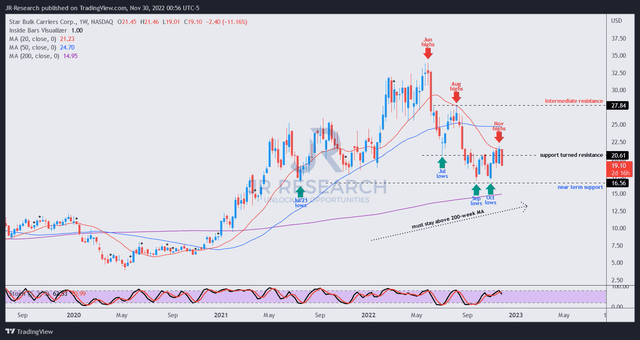

SBLK price chart (weekly) (TradingView)

We highlighted that SBLK must robustly hold its 200-week moving average (purple line) to protect its long-term bullish bias.

Therefore, the post-earnings selloff didn’t lead to a re-test of its October lows, suggesting the market had likely anticipated a weak release and outlook.

Notwithstanding, we see intense resistance at the current levels. Therefore, a near-term re-rating is unlikely, but we remain confident of its medium-term recovery.

We urge investors to consider leveraging downside volatility toward the $16.50 zone to add positions over time but avoid adding positions above $20 for now.

Maintain Buy with a PT of $24.

Be the first to comment