sandsun/iStock via Getty Images

Star Bulk Carrier logo (Star Bulk Carrier Corporation)

Investment thesis

For those that have followed me here in SA over the years, you will know that I have worked in the dry bulk shipping industry in the past.

You might also have picked up from reading my numerous articles on companies such as Navios Maritime Partners (NMM), which I, unfortunately, did own, and Golden Ocean (GOGL) which I have yet to own but cover here, that I do have a preference towards shipping companies that have long term charters rather than those that rely on more unpredictable and changing spot markets.

As a result, we channeled funds toward SFL Corporation (SFL) which we have owned for several years and still like at the present share price.

Why did we include Star Bulk Carriers Corporation (NASDAQ:SBLK) in the portfolio?

1. Favorable fundamentals of the business

First and foremost, we think that the supply and demand dynamics are positive for ship owners.

Supply of new vessels will be minimal until we see clarity around new lower carbon-emitting propulsion systems. Once that becomes clear, owners will most likely have to place orders for new vessels. All this will take at least another 3 to 5 years before the fleet may start to increase in size.

Demand is presently stable with a growth of low single digits for most commodities. This is assuming we are not entering a deep and prolonged recession. If that takes place next year the demand will drop as will the rates for all shipping assets.

Looking back, we did see good earnings for dry bulk vessels last year which culminated in September 2021.

5-year Baltic Dry Index as of 18 Nov 2022 (CNBC)

As can be seen from the 5-year graph of the Baltic Exchange Dry Index, we are now near the lower range of where the index has been.

Users of iron ore in China seem to be of the opinion that steel production is going to pick up next year. This is validated through the forward market for iron ore.

According to a recent article by Reuters, the most-traded iron ore contract on China’s Dalian Commodity Exchange just ended at RMB 753.50 which equates to $105.76) per ton for iron ore delivered in North China in January.

This is based on China fine-tuning its zero-COVID strategy. However, the number of new infections in China is surging, so there is a risk that we get more lockdowns towards the traditional holiday period.

The Australian bank ANZ is projecting a “softer landing” now for the Chinese property sector, and they have forecasted for China’s 2023 steel output to go up from 1.01 billion tonnes to 1.05 billion tonnes

2. Star Bulk Carriers fleet

SBLK has a large fleet of 128 vessels. This gives them scale and can benefit in terms of lower operating costs and an ability to offer their clients flexibility in terms of scheduling their shipments.

In fact, it is the largest dry bulk fleet of any publicly listed company.

We also like the mix of the different sizes, with 32% in the Capesize/ Newcastlemax segments, 39% in the Panamax/Kamsarmax segments and finally 29% in the Ultramax/Supramax segments.

This makes them less reliant on just iron ore and coal.

SBLK’s M/V “Star Polaris” (Star Bulk Carrier website)

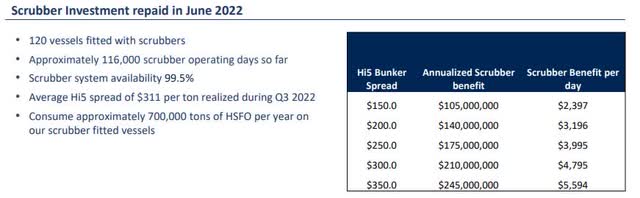

120 of these vessels are fitted with scrubbers. In our last article on Frontline, we highlighted the huge difference in earnings between scrubber-fitted VLCCs and those that were not. With the continued large spread in the price of fuel, for these very large vessels, the difference can be as high as USD 20,000 per day.

For smaller vessels like those that SBLK owns, it still works out to a difference of around USD 3,000 per day.

SBLK scrubber investment (Star Bulk Carrier Q3 2022 presentation)

The fuel spread between HSFO and VLSFO currently hovers around $240 per metric ton based on bunker prices in Singapore where SBLK purchases about 60% of its annual fuel demand. During Q3 the spread was $311 per metric ton.

Although the company made a large investment of USD 250 million to fit these vessels with scrubbers, this has already been paid back since June this year.

However, shipowners are facing many regulatory changes these days that cost them a lot of money. Apart from the scrubbers, another thing is ballast water treatment systems which all ships need to have now.

Fortunately, 98% of SBLK’s fleet is fitted with such a system by the end of Q4 this year.

3. Their low net debt

While some other companies were busy distributing dividends during the previous boom, SBLK was paying off some of its debt.

Between the end of June 2020 and the end of September 2022, they have reduced their net debt from $1,653 million to $799 million.

During Q3 they agreed to refinance totaling about $400 million which decreased their annual regular debt repayments by $12.5 million and reduced their interest costs by about $5 million per year.

Their coming 12 months’ amortization is $186 million.

The book value of their fleet is $2,916 million as of Q3.

With cash from operation in Q3 of $185 million and a fleet with at least another 12 years of life left on average, the freight market will have to get really bad before SBLK would have any problem servicing its debt.

4. Shareholder-friendly policy

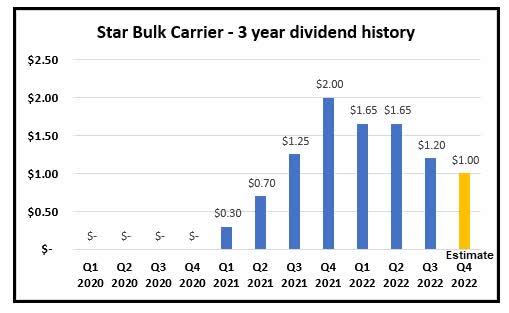

Over the last twelve months, SBLK has distributed to shareholders a dividend of $6.50 per share which works out to $670 million.

Star Bulk Carrier’s dividend history (Data from SBLK. Graph and estimate by author)

We had estimated that the dividend for Q3 would come down to $1.25 and SBLK declared $1.20, so we were not that far off.

Based on a lower spot earning in Q4 that we are now seeing in the general market, and their Q3 committed market coverage of 66% of the fleet/days in Q4 at an average rate of $ 22,772 per vessel per day, we believe that the average earnings will drop to about $20,000 per day in the present quarter.

As such we lower our estimate for a dividend of about $1.00 per share in Q4.

It is important to understand that their dividend will continue to fluctuate in line with the market. If you as an investor are looking for a stable and fairly predictable dividend, SBLK is not for you.

Share buyback was done in the past but is not the preferred way to return capital to shareholders at this moment.

On the 17th of November, SBLK delivered its Q3 financial results.

Let us look at this.

Third Quarter 2022 Financial results

Net income for Q3 came in at $109.7 million and the adjusted net income was $136.3 million. This translates to an adjusted EPS of $1.34 million

Their average time charter equivalent rate was $24,365 per vessel per day which was quite a drop from the average of $30,451 they achieved in Q2.

SBLK started Q3 with a pro forma cash balance of $431 million and generated a positive cash flow from operating activities of $184.5 million. After including debt repayments, Capex payments for ballast water treatment systems, and the dividend payment in Q2, they had a cash balance of $392.7 million at the end of Q3.

Conclusion

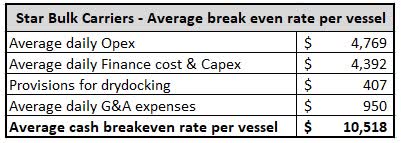

With a low level of debt on the vessels and low operating costs, SBLK will make money even at these lower spot market levels.

They also have time on their side, as their fleet is modern and efficient and can ride out a low market waiting for things to improve.

Their average break-even rate is much lower than the low $20,000 average earnings we estimate for Q4.

Star Bulk Carrier average break-even rates (Data from Star Bulk Carrier. Compilation by author)

Should the BDI fall below 1,000 and stay there for a prolonged period, it does become harder for SBLK to make money.

That is a real risk to this thesis, but we think it is unlikely to happen as we believe China will calibrate its response to the pandemic and will take steps to invigorate the economy. This should translate into higher demand for dry bulk materials.

It may not happen before their January CNY celebration, but by Q2 of 2023, there are good reasons to be an optimist.

We have initiated a small position and will add on potential weakness in the share price.

Be the first to comment