JHVEPhoto

Investment Thesis

Stantec Inc (NYSE:STN) reported good results in the third quarter of 2022 despite recessionary concerns. The end market in which the company operates continues to remain healthy. This is demonstrated by strong demand across all segments, particularly in the United States, as a result of increased Federal investments through the Infrastructure Investment and Job Act (IIJA), the CHIPS Act, and the Inflation Reduction Act (IRA). Furthermore, at the end of the third quarter, the company had a healthy backlog of C$6.2 billion, with higher levels of organic growth and margins in the backlog. Healthy end-market demand, increased public funding, a strong backlog, and the opportunities from the Cardno acquisition should also help the company to deliver good revenue growth. On the margin front, wage inflation is putting pressure on the company’s margins and management is trying to offset it by increasing rates on certain projects and improving its project selection. While I am optimistic about the company’s topline growth and margin prospects, I believe they are getting appropriately reflected in the stock price at the current valuations. Hence, I have a neutral rating on the stock.

Last Quarter Earnings

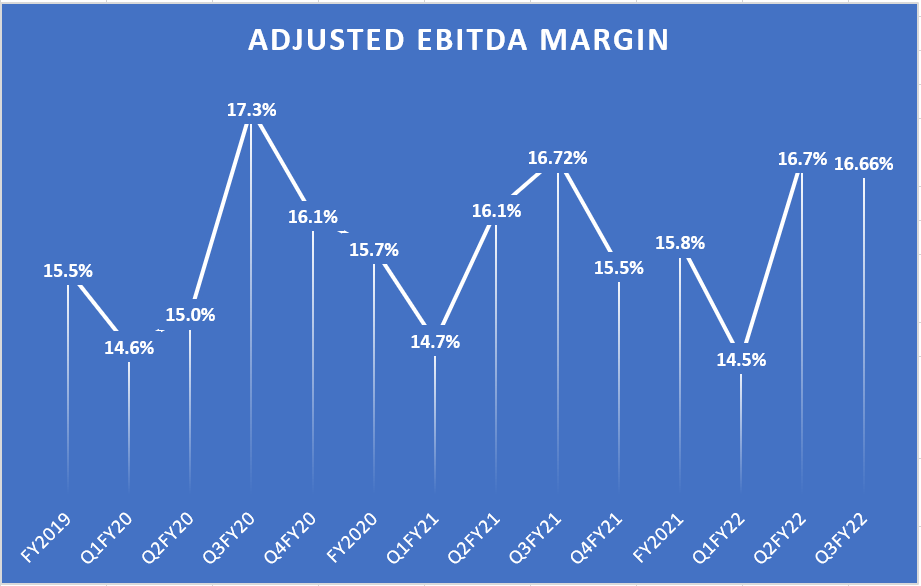

Stantec reported strong results for the third quarter of 2022. Net revenue for the quarter was C$1.2 billion, up 24.3% Y/Y and adjusted EPS was C$0.86, up 19.4% from the year-ago quarter. The company’s adjusted EBITDA grew 23.9% Y/Y to C$193.3 million, while the EBITDA margin at 16.7% represents a decrease of 6 basis points (bps) Y/Y. Revenue growth was attributed to higher demand across all segments and strong backlog execution. Higher volume generation as a result of higher organic growth contributed to the increase in adjusted EBITDA and EPS. The decrease in margin was due to pressure from wage inflation.

Revenue Growth Prospects

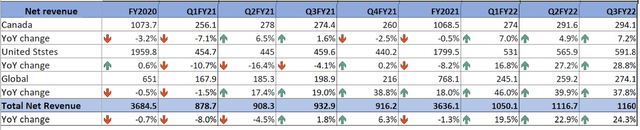

In the third quarter of 2022, Stantec’s net revenue totaled C$1.2 billion, reflecting an increase of 24.3% from the year-ago quarter. Organically revenue grew by 11.0%. The increase was attributed to healthy demand across all business segments driven by aging infrastructure, climate change, and the reshoring of domestic production. In addition to healthy demand, strong backlog execution also contributed to higher net revenue.

In the Canada segment, net revenue grew 7.2% on an organic basis to C$294.1 million. The increase was due to strong growth in Environmental Services and continued demand for permitting work in archaeological services. Power transmission and distribution as well as energy transition work generated ongoing opportunities in Energy & Resources. Infrastructure revenue increased as a result of ongoing community development work in the housing market, bridge work in Quebec, and ongoing recovery efforts in British Columbia from last year’s flooding. Growth in the Building unit was driven by work on public health care and private commercial projects. Strong public and private spending drove up demand across all business units in the segment.

Coming to the United States segment, net revenue increased by 28.8% Y/Y or 11.9% on an organic basis to C$591.8 million. Net revenue benefited from high levels of public and private investments like the IIJA, the CHIPS Act, and the IRA. Each of the business units in the segment reported growth last quarter. The ramp-up of the public sector and projects, as well as the company’s work on large-scale water security projects addressing water scarcity risks in the Western U.S., drove organic growth in water. The infrastructure unit reported good organic growth from work on transportation projects as well as industrial and residential land development activities. The company also benefited from increased building activity, with investments continuing to flow into health care and science and technology. Energy & Resources delivered strong organic growth, fueled by an increase in activity on mining projects as well as significant reservoir and dam projects in the western United States. Demand for environmental services in the United States was also strong.

Lastly in the Global segment, net revenue was C$274.1 million, an increase of 37.8% Y/Y or 14.1% on an organic basis. The increase was attributed to organic growth in each business unit. The Water business continues to grow significantly due to long-term framework opportunities in both the United Kingdom and New Zealand. The company continues to see strong demand for its services and community development in the infrastructure unit. Environmental services and mining both experienced growth as a result of high copper and other metal prices.

STN’s Historical Revenue (In C$ millions) (Company Data, GS Analytics)

Backlog, an indicator for future revenue growth, also grew at a healthy rate in the third quarter, despite macroeconomic headwinds. The total backlog increased 31.6% Y/Y to C$6.2 billion, with a 15.1% organic growth since the 2021 year-end. In the Canada segment, the backlog grew by 10% organically to C$1.3 billion, reflecting the good demand environment in Infrastructure and Environmental Services. The United States segment saw an increase of 20.9% on an organic basis in the backlog and expanded to C$3.9 billion. The organic growth was attributed to increased strength across all business units. In the Global segment, the backlog increased to C$954 million with organic growth of 3.2%. Global backlog was driven by continued strength across the majority of the business units.

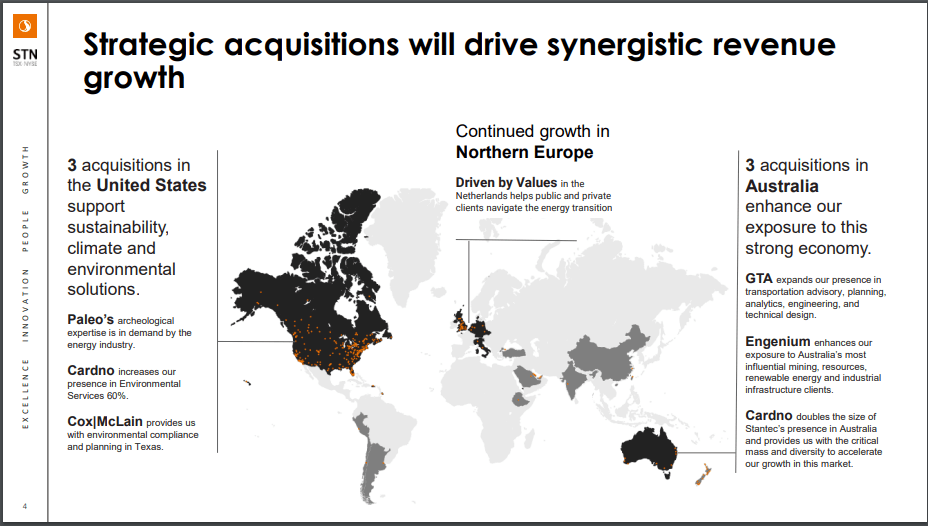

In addition to healthy demand across all major geographies, Stantec’s three-year strategic plan also contributed to revenue and backlog growth. The strategic plan involves improved execution within the organization and growth through synergistic acquisitions. The acquisitions are targeted at small to medium-sized firms, which increases Stantec’s presence in key business lines and geographies, to drive revenue synergies. The company acquired Cardno in 2021, one of its major acquisitions, to expand its market share in the U.S. and Australia. Cardno’s half of the business is related to Environmental Services which should help Stantec significantly enhance its platform to address the demand in the energy transition market. The remainder of Cardno’s services are related to Infrastructure, Community Development, Education, and Water, increasing Stantec’s overall exposure to infrastructure stimulus spending in the United States and Australia, which should be a key driver of growth in the coming years.

STN’s revenue synergy prospects (STN’s Q4 2021 Presentation)

The market in which Stantec operates continued to remain healthy across all the regions despite macroeconomic concerns. In the Canada segment, the company won several major project awards. To name some, in British Columbia, the company was chosen as the prime consultant for the client Metro Vancouver’s Cape Horn Pump Station no. 3. In Ontario, it won a contract for continued service for Metrolinx expansion in the Greater Toronto Area. The Infrastructure and Buildings businesses demonstrated strong performance with an architecture and engineering project for an 18,580-square-meter academic building and a 12,080-square-meter student housing facility at Douglas College, as well as contracts for two major healthcare projects.

In addition to Canada, the United States segment also secured healthy levels of projects. The growth was boosted by Federal funding across all business units. Major infrastructure awards include a 51-kilometer California high-speed rail project that was partially funded through the Rebuilding American Infrastructure with Sustainability and Equity program. The Colorado Department of Transportation also awarded the company a bridge and structures project for Construction Management, construction inspection, and materials testing. The company reported high levels of bidding activity in the water business. Among these are the design of an alternative water source program in Illinois, project management and a biological review for underground water systems in California, and projects for water quality and dam improvements in the Western United States. Lastly, investments in energy transitions boosted project awards in the Environment Services unit. The Global segment also saw healthy levels of project awards in the third quarter. These include the development of African transport corridors. Stantec has been awarded project management services for an airport expansion project in Asia, demonstrating the company’s expansion into Asian markets.

Looking forward, I believe Stantec should be able to deliver good revenue growth. The company’s healthy backlog, strong demand across all the major geographies, and increased level of public investments through IIJA, the CHIPS Act, and IRA, which is expected to flow majorly in 2023, along with the recent Cardno acquisition should help the company in higher revenue generation in the coming years.

However, the company needs to ramp up its employee count in order to achieve this. The job market remains tight and if the company is not able to hire employees fast enough it could lead to delayed project execution. The company is working on increasing its headcount, and while I am optimistic, its execution in this regard should be a key focus area for investors/analysts over the coming quarters.

Margin Outlook

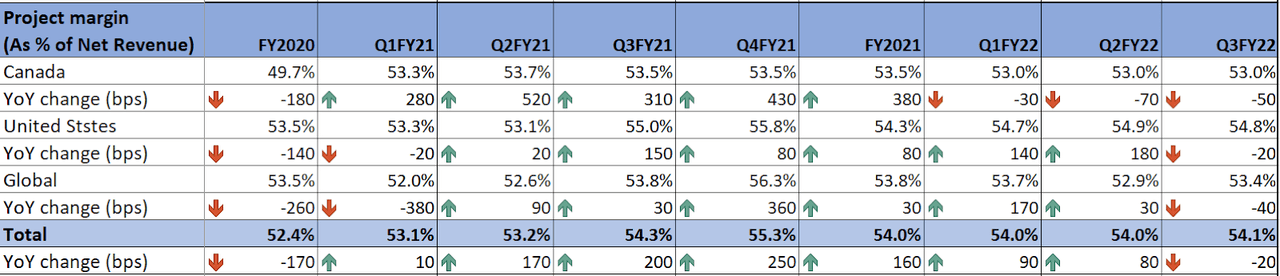

In the third quarter of 2022, Stantec reported its project margin as a percentage of net revenue of 54.1%, a decline of 20 bps Y/Y from 54.3% in Q3 2021. The decline was primarily due to higher payroll costs from wage inflation in the economy. In Canada and United States segments, project margin as a percentage of net revenue decreased by 50 bps Y/Y to 53.0% and 20 bps Y/Y to 54.8% respectively. The decline was due to higher wages and a shift in the project mix in both segments. Similar to Canada and the United States segments, the Global segment also reported a decline of 40 bps Y/Y to 53.4%. In addition to wage inflation, the decline in the global segment was also a result of tough comps from the year-ago quarter which benefited from recoveries realized on certain projects in Q3 2021.

STN’s Project Margins as a % of net revenue (Company Data, GS Analytics)

Looking at adjusted EBITDA and EBITDA margin, Stantec reported an adjusted EBITDA of C$193.3 million, an increase of C$37.3 million or 23.9% Y/Y. The increase was attributed to higher levels of organic growth across all the segments and operating business units. However, the adjusted EBITDA margin declined slightly by 6 bps to 16.66%. The decline was due to higher wage cost inflation.

STN’s Historic Adjusted EBITDA Margin (Company Data, GS Analytics)

Looking forward, I believe, project margin as a percentage of net revenue should improve slightly in the coming years as a result of the company’s better selection of projects and higher volume leverage. Adjusted EBITDA margin should benefit from higher organic growth and better margins in the backlog along with the benefit from higher margin Cardno acquisition. So, I am optimistic about the company’s margin outlook.

Valuation and Conclusion

Stantec is currently trading at a P/E of 19.43x 2023 consensus EPS estimate which is almost in line with its historic 5-year average forward P/E of 19.82x. The company has growth good prospects. However, I believe these prospects are already appropriately reflected in the stock price at the current valuations. Hence, I have a neutral rating on the stock.

Be the first to comment