Neilson Barnard/Getty Images Entertainment

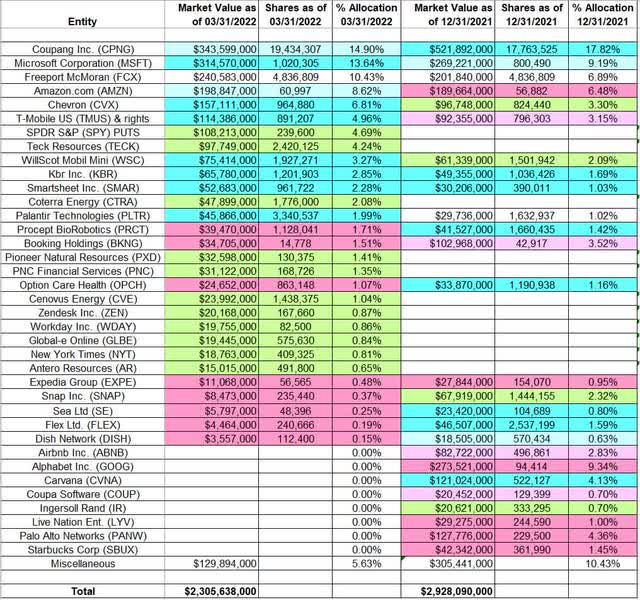

This article is part of a series that provides an ongoing analysis of the changes made to Duquesne Family Office’s 13F stock portfolio on a quarterly basis. It is based on Stanley Druckenmiller’s regulatory 13F Form filed on 5/16/2022. The 13F portfolio value decreased ~21% from $2.93B to $2.31B this quarter. The holdings are concentrated with recent 13F reports showing around 50 positions, many of which are very small. There are 29 securities that are significantly large (more than ~0.5% of the portfolio each) and they are the focus of this article. The largest five stakes are Coupang, Microsoft, Freeport McMoRan, Amazon.com, and Chevron. They add up to ~54% of the portfolio. Please visit our Tracking Stanley Druckenmiller’s Duquesne Portfolio series to get an idea of their investment philosophy and our previous update for the fund’s moves during Q4 2021.

Stanley Druckenmiller started the family office in Q4 2011 after closing his hedge fund Duquesne Capital in 2010. Prior to that, he managed George Soros’s Quantum Fund between 1988 and 2000. He follows a trend following a trading style that is similar to George Soros. To know more about Druckenmiller’s trading style check out Trend Following: Learn to Make Millions in Up or Down Markets.

New Stakes:

SPDR S&P 500 Index (SPY) Puts: The 4.69% of the portfolio short position through Puts was established as SPY traded between ~$416 and ~$478. It currently trades at ~$390.

Teck Resources (TECK): TECK is a fairly large 4.24% of the portfolio stake purchased this quarter at prices between ~$29 and ~$42 and the stock currently trades near the low end of that range at $31.69.

Note: TECK is back in the portfolio after a quarter’s gap. It was a 2.47% of the portfolio position built in Q4 2020 at prices between ~$12.25 and ~$18.85. There was a ~40% stake increase next quarter at prices between ~$18 and ~$23.75. The position was sold down to a very small 0.84% of the portfolio stake in Q3 2021 at prices between ~$19.50 and ~$26.80. The remainder stake was sold last quarter.

Coterra Energy (CTRA): The ~2% of the portfolio stake in CTRA was established at prices between ~$19 and ~$29 and the stock is now at $26.35.

Antero Resources (AR), Cenovus Energy (CVE), Global-e Online (GLBE), New York Times (NYT), Pioneer Natural Resources (PXD), PNC Financial Services (PNC), Workday, Inc. (WDAY), and Zendesk, Inc. (ZEN): These small (less than ~1.5% of the portfolio each) stakes were established this quarter.

Stake Disposals:

Alphabet Inc. (GOOG): The large (top three) ~10% GOOG stake was established in Q4 2019 & Q1 2020 at prices between ~$1215 and ~$1521. The next three quarters had seen the position reduced by ~85% at prices between ~$1100 and ~$1830. The position was rebuilt over the three quarters through Q3 2021 at prices between ~$1735 and ~$2917. Last quarter saw a ~20% reduction at prices between ~$2665 and ~$3014. The disposal this quarter was at prices between ~$2529 and ~$2961. The stock currently trades at ~$2371.

Carvana (CVNA): The 4.39% CVNA position saw a ~70% stake increase in H2 2021 at prices between ~$224 and ~$315. The position was sold down by ~60% next quarter at prices between ~$302 and ~$370. It was rebuilt last quarter at prices between ~$204 and ~$303. The elimination this quarter was at prices between ~$104 and ~$240. The stock is now at $31.52.

Palo Alto Networks (PANW): PANW was a large 4.63% of the portfolio position established in H2 2020 at prices between ~$163 and ~$238. There was a ~15% trimming over the next three quarters. That was followed with a ~43% selling last quarter at prices between ~$470 and ~$568. The stake was sold this quarter at prices between ~$475 and ~$625. The stock is now at ~$511.

Airbnb (ABNB): ABNB was a ~3% of the portfolio stake established in Q2 2021 at prices between ~$133 and ~$190. The position was sold this quarter at prices between ~$132 and ~$187. The stock is now at ~$104.

Starbucks Corp (SBUX): SBUX was a 1.54% stake built in 2020 at prices between ~$63 and ~$107. Q1 2021 also saw a ~14% stake increase. Last quarter saw the position sold down by ~80% at prices between ~$106 and ~$117. The remainder stake was sold this quarter. The stock is now at $78.11.

Coupa Software (COUP), Ingersoll Rand (IR) and Live Nation Entertainment (LYV): These small (less than ~1.3% of the portfolio each) stakes were disposed during the quarter.

Stake Increases:

Coupang, Inc. (CPNG): CPNG had an IPO last March. Shares started trading at ~$49 and currently goes for $12.91. Druckenmiller had a 10.5M share stake that went back to funding rounds prior to the IPO. There was a ~50% stake increase in Q3 2021 at prices between ~$28 and ~$44.50. Last quarter saw another ~15% stake increase at prices between ~$26 and ~$31. This quarter also saw a ~9% stake increase. It is currently their largest stake at ~15% of the portfolio.

Microsoft Corporation (MSFT): MSFT is now a top-three ~14% of the portfolio position. It is a frequently traded stake and has seen previous roundtrips. The current position was built in 2017 at prices between ~$60 and ~$90. The stake has wavered. Recent activity follows. Q1 2021 saw a ~20% stake increase at prices between ~$213 and ~$245. There was a ~63% reduction over the next two quarters at prices between ~$236 and ~$305. This quarter saw a ~28% stake increase at prices between ~$276 and ~$335. The stock is now at ~$268.

Amazon.com (AMZN): AMZN is currently a top-five position at 8.62% of the portfolio. The original stake was built in 2017 at prices between ~$38 and ~$60. The stake has wavered. Recent activity follows. There was a ~25% stake increase in Q2 2021 at prices between ~$158 and ~$175. Last quarter saw a ~42% reduction at prices between ~$160 and ~$185. The stock is now at ~$117. There was a ~7% increase this quarter.

Chevron Corp. (CVX) and WilScot Mobile Mini (WSC): These positions established last quarter were increased this quarter. CVX is a 6.81% of the portfolio stake purchased at prices between ~$102 and ~$171 and the stock currently trades at ~$145. WSC is a 3.27% stake purchased at prices between ~$32 and ~$41 and it currently goes for $34.50.

T-Mobile US (TMUS) & rights: The ~5% TMUS stake was established in Q2 2020 at prices between ~$82 and ~$107. Next quarter saw a ~20% stake increase while in Q4 2020 there was a similar reduction. There was a ~63% selling over the next three quarters at prices between ~$118 and ~$149. The stock currently trades at ~$137. There was a ~7% trimming last quarter while this quarter there was a ~12% increase.

Smartsheet (SMAR): The 2.28% of the portfolio stake in SMAR was built over the last two quarters at prices between ~$43 and ~$80. The stock currently trades below that range at $34.76.

KBR, Inc. (KBR) and Palantir Technologies (PLTR): The 2.85% KBR stake saw a ~40% stake increase over the last two quarters at prices between ~$40 and ~$56. The stock is now at $48.14. The ~2% PLTR position saw a stake doubling this quarter at prices between ~$10.50 and ~$18.50. The stock currently trades just below that range at $10.19.

Stake Decreases:

PROCEPT BioRobotics (PRCT): PRCT had an IPO last September. Shares started trading at ~$37.50 and currently goes for $33.90. Druckenmiller’s 1.71% of the portfolio stake goes back to funding rounds prior to the IPO. There was a ~175% stake increase last quarter at prices between ~$24.60 and ~$46.30. This quarter saw a one-third selling at prices between ~$17 and ~$36.

Booking Holdings (BKNG): BKNG is a 1.51% of the portfolio stake established in Q1 2021 at prices between ~$1886 and ~$2462. There was a ~45% stake increase in Q3 2021 at prices between ~$2068 and ~$2491. This quarter saw a roughly two-thirds selling at prices between ~$1817 and ~$2703. The stock is now at ~$1931.

DISH Network (DISH), Expedia Group Inc. (EXPE), Flex Ltd. (FLEX), Option Care Health (OPCH), Sea Ltd. (SE), and Snap Inc. (SNAP): These small (less than ~1.1% of the portfolio each) stakes were reduced during the quarter.

Kept Steady:

Freeport-McMoRan (FCX): FCX is a large (top three) 10.43% of the portfolio position purchased in Q4 2019 at prices between ~$10 and ~$13.50. Next quarter saw a ~70% selling at prices between ~$5.50 and ~$12.90. Q2 2020 saw the stake rebuilt at prices between ~$6.25 and ~$10.90. The two quarters through Q3 2021 had seen a ~25% selling at prices between ~$30 and ~$45. The stock currently trades at ~$31.

The rest of the stakes are minutely small (less than ~0.5% of the portfolio each). They are AbCellera Biologics (ABCL), ACADIA Pharma (ACAD), Alnylam Pharmaceuticals (ALNY), Anaplan Inc., British American Tobacco (BTI), Caribou Biosciences (CRBU), Cazoo Group (CZOO), CCC Intelligent Solutions (CCCS), Compass Inc., IHS Holding (IHS), iShares MSCI Brazil Capped ETF (EWZ), Las Vegas Sands (LVS) Calls, Mosaic Company (MOS), Netflix, Inc. (NFLX), Opendoor Tech. (OPEN), Oscar Health (OSCR), Phillips 66 (PSX), Reata Pharma (RETA), Recursion Pharma (RXRX), Sea Ltd. (SE), Sensei Biotherapeutics (SNSE), SolarEdge Technologies (SEDG), and Sunrun Inc. (RUN).

Below is a spreadsheet that highlights the changes to Stanley Druckenmiller’s Duquesne Family Office 13F stock portfolio as of Q1 2022:

Stanley Druckenmiller – Duquesne Family Office’s Q1 2022 13F Report Q/Q Comparison (John Vincent (author))

Be the first to comment