JHVEPhoto

Thesis

Stanley Black & Decker, Inc. (NYSE:SWK) stock has faced intense selling pressure since it collapsed from its highs in May 2021. The worsening macroeconomic environment and an increasingly hawkish Fed have added fuel to bearish investors as they pummel SWK. Consequently, SWK remains more than 60% below its 2021 highs as the bottom continues to elude buyers.

However, we deduce that the selling momentum should be closing in on its long-term bottom, despite the impending housing market correction. We surmise that the market has de-rated SWK significantly in anticipation of these challenges. Stanley Black & Decker would also be lapping less challenging comps from 2023, following the massive consumer-driven boom from its COVID bottom. Also, we expect inflation and supply chain headwinds to continue abating through FY24, supporting the company’s cost-cutting and business transformation efforts to recover its gross margins.

Hence, we postulate that the reward-to-risk profile at the current levels favors a highly attractive mean-reversion opportunity for investors who add at the current levels. Notwithstanding, we need to accentuate that we have yet to observe a sustained bottoming process that suggests the bears are running out of momentum. Therefore, investors should still expect near-term downside volatility, which we posit should be considered an opportunity to average down.

As such, we rate SWK as a Buy and encourage investors to start layering in.

SWK Has Been De-rated Substantially

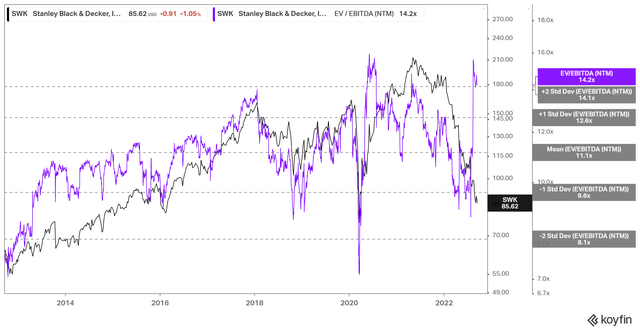

SWK NTM EBITDA multiples valuation trend (koyfin)

As seen above, SWK’s NTM EBITDA multiples reached the one standard deviation zone below its 10Y mean at its July lows. While its falling EBITDA estimates have impacted its forward multiples, we urge investors to look forward to past 2023 as Stanley Black & Decker executes its profitability recovery plans.

Therefore, we deduce that the market has already de-rated SWK substantially, de-risking the current levels for investors, given the near-term headwinds.

SWK’s Growth Has Already Normalized

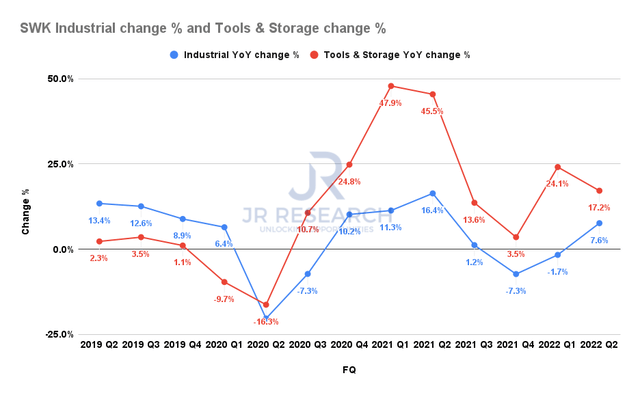

SWK revenue by segment change % (Company filings)

SWK has seen growth in its critical Tools & Storage segment cratered from the highs in H1’21, as seen above. Despite its 17% increase in Q2, it derived a 7% contribution from its MTD and Excel acquisitions, coupled with pricing changes.

Despite that, the Industrial has continued its recovery momentum from its nadir in Q4’21, given the strong cadence from its auto and aerospace customers. However, it was insufficient to lift the impact on its Tools & Storage segment.

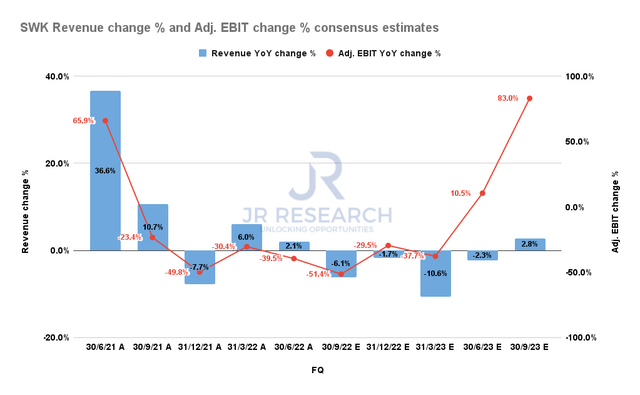

SWK revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

The consensus estimates (neutral) indicate that the headwinds on its revenue and operating profit growth should continue through FQ1’23 before recovering. Management remains confident that we should expect some of its near-term headwinds relating to elevated commodity prices and supply chain costs to abate moving forward.

Our analysis of the commodity markets indicates that costs have indeed fallen through H2’22. Furthermore, global freight costs have continued to fall through September, down more than 20% from early August. Similarly, global supply chain pressure has declined markedly, reaching early 2021 levels in August. Therefore, we are confident that the estimates are credible as SWK seeks to rejuvenate its operating leverage gains.

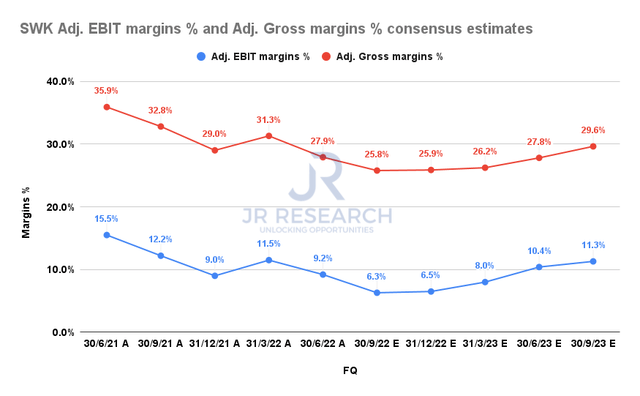

SWK Adjusted gross margins % and Adjusted EBIT margins % consensus estimates (S&P Cap IQ)

The company has planned to recover its adjusted gross margins to 35% by 2024. As seen above, Stanley Black & Decker posted an adjusted gross margin of 27.9% in Q2, as inventory charges and a reduction in scale impacted its profitability.

However, the company expects underlying costs to improve further, coupled with its extensive costs rationalization program to lift its margins further. In addition, it also expects its supply chain reorganization to boost its recovery on its medium-term gross margins target moving ahead.

Hence, investors are urged to assess the company’s progress from Q1’23, as the consensus estimates suggest that its nadir could occur only in Q4’22.

Is SWK Stock A Buy, Sell, Or Hold?

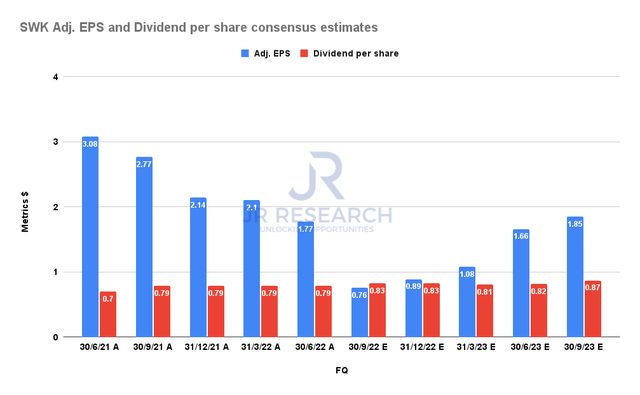

SWK Adjusted EPS and Dividend per share consensus estimates (S&P Cap IQ)

Despite the compression in its adjusted EPS from its 2021 highs, the company’s payout ratios remain reasonable. As a result, we are confident that its dividend strategy should not be impacted. Also, the recovery in its profitability growth through FY23 should underpin the growth in its forward dividend payouts.

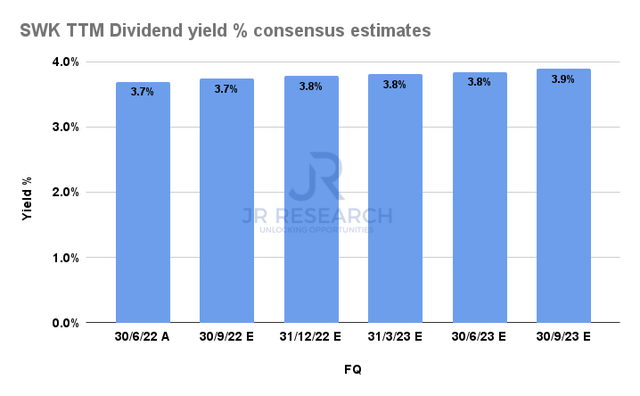

SWK TTM Dividend yield % consensus estimates (S&P Cap IQ)

Therefore, we assess that its TTM dividend yield on a next-twelve-month basis of 3.8% is attractive (Vs. 10Y mean of 2.08%). Hence, we believe it should help underpin the recovery momentum of SWK, given the significant battering it endured since its 2021 highs.

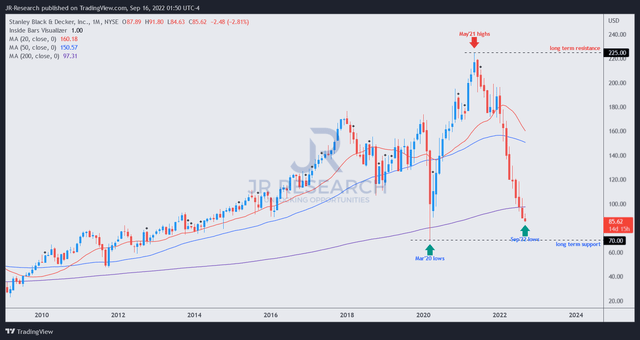

SWK price chart (monthly) (TradingView)

The hammering in SWK over the past year has sent it crashing close to its long-term support predicated on its March 2020 lows.

Although it appears to threaten its long-term uptrend bias, we postulate the extent and pace of its decline seems to be a rapid de-rating to de-risk its valuations to more reasonable levels. Hence, we don’t expect SWK to move into a secular downtrend, given the expected recovery of its medium-term profitability.

Hence, we believe the reward-to-risk profile looks attractive for SWK, given the significant mean-reversion potential to its long-term moving averages. Despite the potential for near-term downside volatility, we think investors should find the opportunity for a medium-term re-rating attractive at the current levels.

Accordingly, we rate SWK as a Buy.

Be the first to comment