naphtalina/iStock via Getty Images

I’ve been meaning to write a follow-up on Standard Lithium (NYSE:SLI) for some time, but frankly, what’s to say? The company is doing quite well with a $100 million dollar injection by none other than powerhouse Koch. Additionally, SLI has signed a deal with ze Germans via Lanxess (OTCPK:LNXSF) (OTC:LNXSY).

We are now at the stage of just sitting back and letting the pieces slide into place as the projects continue to move forward in lithium friendly Arkansas. Yet, I have been seeing chatter that the insiders are just dumping stock left and right via forums and even a recent article. Is that true? Let us find out.

The Standard Rumor Control

I can understand how people could glance at insider sales and come away with the wrong assessment. At a glance it appears that insiders are indeed selling and guess what — they are! However, they are selling to acquire additional shares via options, which leads to a net increase in shares held. To sum it up, insiders are expanding the total position they have in Standard Lithium. Let me explain how all of this works and how it might look odd on the surface.

Contrary To Rumors, Insiders Are Buying

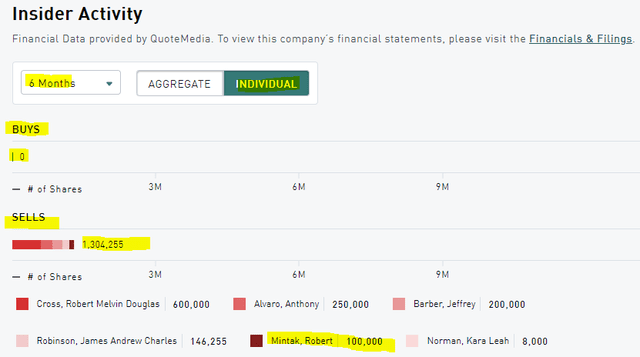

First, let us pull up some insider sales from a piece of automated software that has been referenced elsewhere to see how things look weird at a glance. Going to money.tmx.com (and setting the time frame at 6 months, with individual selected) we see what appears to be a mass dumping of stock. No buying whatsoever is present, right? (Note: Yellow highlights are the author’s)

Incomplete insider transactions (money.tmx.com) |

At a glance, this looks very bad. Selling across the board from everyone and even the CEO Robert Mintak, however this is not accurate.

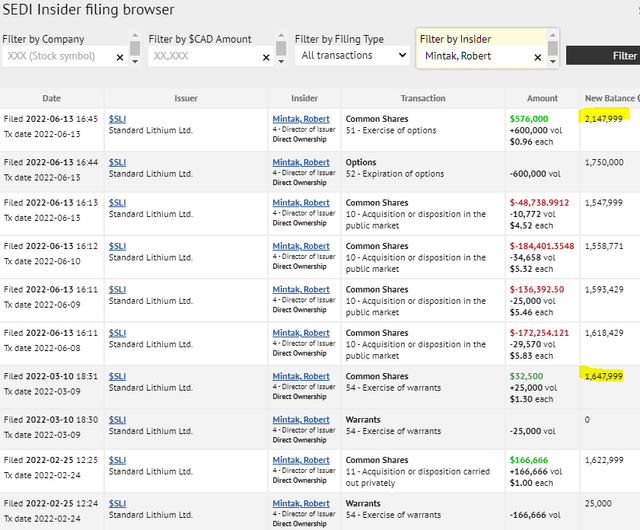

You see, the website is not pulling all the data. I do not know why. Maybe it has not populated into the system. Maybe it does not pull options trades, but let’s look at options to see what is really going on. To get a complete picture, we need to pull the SEDAR data. Going to Ceo.ca and pulling up Standard Lithium’s CEO Robert Mintak, we see the following transactions from SEDAR to include options trades.

Insider buying & selling (Ceo.ca) |

Looking at the above graphic, we see (in the author’s yellow highlights) that the CEO had 1,647,999 shares as of 03/09/2022 having exercised some warrants. Then starting in June, he does in fact sell 100,000 shares spread over 4 transactions (noted in red). However, he sold the share in order to exercise his 600,000 shares of options. In essence, he sold 100,000 shares to acquire 600,000 shares via soon to expire options. His new balance of shares went from 1,647,999 to 2,147,999 shares (a 36.4% increase).

Additional Standard Lithium Insider Transactions

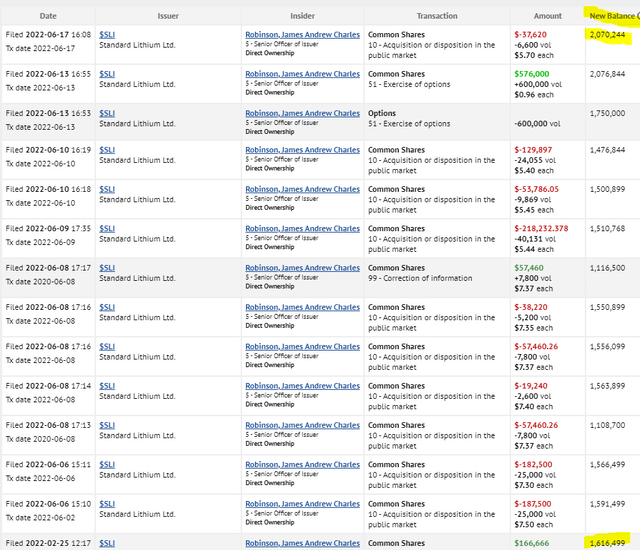

Let’s try another insider, such as James Robinson.

Insider buying & selling (Ceo.ca) |

Pulling up Robert Cross, we see shares go from 307,401 as of 03/04/2022 to a peak of 1,649,000 on 03/08/2022 and then dropping to 1,524,000 two days later.

Lastly, looking at Jeffrey Barber, we see he had 225,000 shares as of 3/30/22 and sold them down to 50,000 as of 03/31/2022. That is quite the decrease percentage wise from last March, but by now the market should have fully digested the data. It might be useful to pull up SEC / SEDAR documents and see if he has any options lurking around. Overall, I’m not seeing a mass exodus of insiders selling Standard Lithium shares. Verdict = Nothing Burger.

Craps Tables, Emotions, and Stocks

Moving on, if you want to understand stocks, you really need to spend some time at a craps table at a casino in order to understand the players’ emotions.

A craps table is the physical embodiment of the stock market. You have many sucker bets (“big 8” bet anyone?) and several normal long bets (such as the “pass line”). Short bets are also possible via the “Don’t Pass” or “Don’t Come”. The point, however, is craps tables can get volcano hot with shooters hitting point numbers and everyone becoming very excited as the money flows in. When this happens, you will see players making irrational bets.

On the flip side, tables can get ice-cold. Shorts lurk in the shadows playing don’t pass (raking in profits) while the vast majority at the table slurk around bemoaning how icy the table is. Few bets are placed, and players generally wander off to other games of chance.

The same can be said of the stock market. You can have a great stock that is simply cold for no real reason other than lack of news or that patience will be required for the stock to pan out. Many investors lack patience. They would rather chase things. Patience can pay off if we connect the dots and identify future catalysts before they happen. If we can pick good companies, eventually the news will arrive that excites the masses into buying or long-term company fundamentals come into play as the company evolves.

Run Silent, Run Deep

Right now, Standard Lithium suffers from a lack of excitable news to rile up the masses. The company is in silent running mode, much like a submarine, after the $100 million dollar injection by Koch and the follow-up deal with Lanxess. News, however, will return. These are the days to acquire shares while few are interested.

How We Are Playing It

Simply owning the common stock is fine. However, one might sell covered calls against a portion of what they own. The August 19th $5 call yields .40 cents a contract. Given SLI is at $4.52 a share, this represents an 8.8% return. Granted profits would be capped at a mere $5 a share. Yet, if the stock continues to trade sideways, it might prove to be profitable to sell these as we wait for a catalyst to impact the stock. Thus, a portion of what we own would be taken away via covered calls, but we retain the bulk of our SLI to ride any upside.

Extra

For anyone wanting to know more about the pending FBI investigation into the short seller attack against SLI (among others) we covered it in great detail here and here.

Patents

Pending patents can be found here.

Be the first to comment