Petmal

Investment Thesis

Sociedad Química y Minera de Chile (NYSE:SQM) continues to benefit from a very strong lithium market. Even though SQM has other segments too, I contend that the core of the investment thesis should be focused on lithium.

I highlight both positive and negative considerations that investors should think about as we head into SQM’s Q3 earnings. As a reminder, Q3 earnings are expected next Thursday.

Here’s why investors should remain bullish on SQM’s prospects.

What’s Happening Right Now?

As I noted in my previous article, 70% of SQM’s gross profits come from its lithium operations. That means that what happens in the lithium market has a huge impact on SQM.

That’s not to say that there are no other interesting potential opportunities, such as its potassium, but instead to highlight that lithium has an overreaching impact on SQM’s prospects.

Put simply, I don’t believe potassium or the other chemicals are going to move the needle on this investment thesis here.

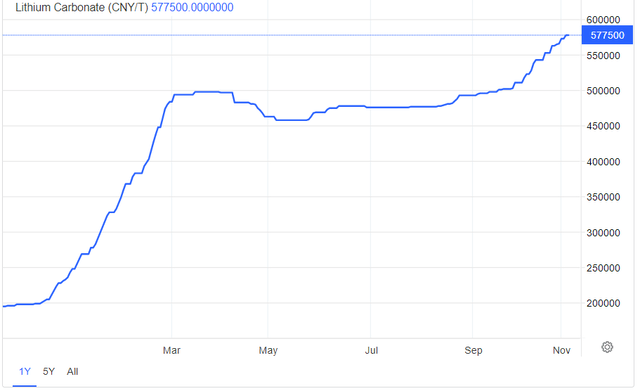

Trading Economics

As you can see above, the spot price for lithium is marching higher. And doing so at a rapid rate.

Essentially, the backdrop here is clearly bullish, but there’s more to consider too.

Revision to My Bearish Considerations

In my previous analysis, I noted Tesla’s (TSLA) commentary that the EV market was seeing some supply constraints, which led me to conclude that perhaps the US and European EV market was slowing down near-term.

However, with more time and more commentary from companies since I made those original comments, I believe that I should now update my insights.

What I should have said, is that even if near-term the EV is slowing down, the EV market could be one of the few areas of growth left in this market. Allow me to explain, why this is not a contradiction.

Many areas of the market are now slowing down.

You can look towards real estate prices (Z) to PC demand (AMD), from fitness (PTON) to fashion (FTCH), as well as, countless areas of the market that are now clearly struggling for growth, even in the tech space, such as the adtech sector.

But the EV market remains resilient. Perhaps, it could be that Tesla’s comments may have been more relevant to its own underlying near-term prospects.

Consequently, this is my point. On a relative basis, EV demand is robust, particularly compared to other pockets of the market.

That being said, what I didn’t discuss at the time were the likely headwinds to SQM’s profit margins in 2023. And so, that’s where we now turn our focus.

The Pace of Profit Growth Will Moderate

As we look ahead to 2023, we should expect SQM’s free cash flow growth rates to moderate. There are two reasons for this.

In the first instance, I don’t believe that lithium prices will continue to climb anywhere near as aggressively as they did in 2022.

Keep in mind that in 2022, even though the year is not over, lithium prices are up 100% year to date. This pace of increase is highly unlikely to continue in 2023. Even if the near-term is extremely rosy right now. Particularly compared with other pockets of the market.

Secondly, many miners throughout the world are seeing a substantial increase in production costs. From the companies that I follow, I’ve seen commentary for inflation costs to be up approximately 15% y/y to 20% y/y in 2023.

That clearly does not break SQM’s bull case, but it does add a perspective that investors should bear in mind.

Think of it this way, if you have gone to university and spent a lot of time and money specializing over the past several years, are you more likely to be a miner or some other highly skilled professional?

And the answer to that question highlights the problem at hand. There are simply not enough people willing to work in the mining industry. And that’s going to be a huge drag on commodity companies’ profitability in 2023. As there are too few workers willing to specialize and seek out a mining profession.

Consequently, mining companies are now left competing over whatever unemployed miners there are left. Or else, they’ll have to convince and train workers to become miners.

To illustrate, consider one of SQM’s competitors, Albemarle (ALB), which has already reported its Q3 results stating that freight and higher energy costs are going to dampen its 2023 margins relative to 2022.

In fact, it’s not difficult to envision this commentary being discussed in SQM’s upcoming Q3 earnings.

Risks of Investing in a Foreign Company

A lot of investors would skew away from SQM, given that it’s viewed as a foreign company.

To that, I would reply that substantial capital has also been lost being invested in the likes of Meta (META), a US-blue chip company.

So, if investors are going to lose capital, it’s probably more to do with a change in a company’s prospects, rather than due to the misallocation of free cash flows.

The Bottom Line

All considered, I suspect that in 2022 SQM will print approximately $4.5 billion of free cash flow. This puts SQM at 6x this year’s free cash flow.

It’s difficult not to get excited about this mid-single-digit free cash flow multiple.

But beyond this low multiple, this is what investors should think about when SQM reports its Q3 results next week.

Because let’s be honest, investors should expect SQM’s earnings to come in sizzling hot. But investors should look beyond these Q3 results to gain any insights into 2023.

Has SQM been able to renegotiate some of its long-term lithium contracts more in line with the current lithium spot market?

Also, what is SQM’s plan for mitigating higher input costs? Further, by how much will SQM increase its capex in 2023 beyond $1 billion?

Despite portraying a very nuanced analysis throughout, I should note that I’m very bullish on SQM’s prospects.

Be the first to comment