Motortion

The market action has turned decisively bullish with the S&P 500 (NYSEARCA:SPY) up over 13% from its June cycle low. What we’re seeing is a shifting narrative where the major macro headwinds from the first half of the year are being left behind with stocks starting to price in improving conditions. The news flash is that the doom-and-gloomers with apocalyptic calls for a depression-style crash may end up being wrong. The momentum in stocks right now is real and our message here is that we expect more upside.

A Technical Recession Is No Problem

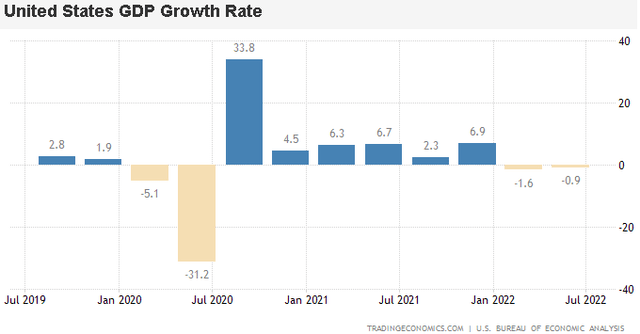

Inflation has been hot, interest rates are higher, and the latest Q2 GDP data confirmed a technical recession. That being said, the overall economy appears relatively stable or resilient with room to emerge out of this rough patch. The bigger point here is that Q2 is history with an understanding that stocks are forward-looking. From a macro perspective, the scenario we see playing out is the soft landing.

Briefly, our take on the 0.9% decline in the Q2 GDP is to keep in mind that the economy was historically strong in 2021, growing by a massive 5.7%, in part fueled by the record stimulus last year. The result left both a tough comparison base and added a layer of volatility beyond the headline-making supply chain disruptions and geopolitical issues that defined the quarter. What’s more positive is the real growth on a 2- and 3-year stacked basis from pre-pandemic levels. It’s also encouraging that the quarter-over-quarter decline narrowed compared to the Q1 trend.

Other data has been more positive including the low unemployment rate and latest retail sales. In our view, the U.S. consumer as a group has been bruised, but otherwise alive and well.

Peak Inflation and Peak Fed Hawkishness

All indications are that inflation will begin to trend lower which removes one of the main culprits of the recent economic weakness. From there, the latest Fed rate hike likely marked “peak hawkishness” by removing the urgency to get more and more aggressive at future meetings. Inflation, as it relates to a near double-digit annual rate, may very well end up being transitory if we’re allowed to un-retire that word.

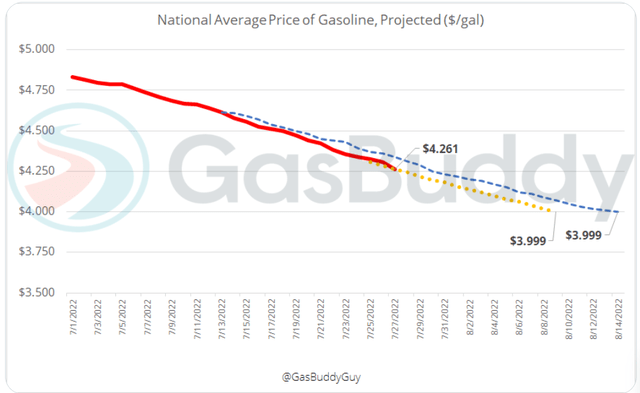

The most positive indication is the sharp drop in gas prices which will directly hit the CPI over the next few months. According to data from “GasBuddy“, the national average for gas prices in the U.S. is down 78 cents from its peak in mid-June and forecast to drop under $4.00 per gallon over the next few weeks. Consumers are spending less on gas today than last month which means more money for other stuff.

Companies complaining about high costs are set to get some breathing room. Most commodities are down 10-20% or more from their highs. Furthermore, we can highlight that reports of major retailers moving to discount merchandise to deal with a glut of inventory will also help cool inflation on the goods side. This is important because it plays into both a potential rebound of consumer sentiment and improved economic activity into 2023.

Investors need to start looking ahead toward the July CPI data release on August 10th. It’s not a stretch to imagine that a cold inflation rate print that day will be read positively and can work as a catalyst for the next leg higher in stocks. The Fed may come into September FOMC with some swagger based on evidence their strategy is working. Call it effective execution, good timing, or just dumb luck; but a combination of inflation expectations trending lower while leading economic indicators rebound higher is a strong setup for risk assets. That’s why we’re bullish.

The Earnings That Really Matter

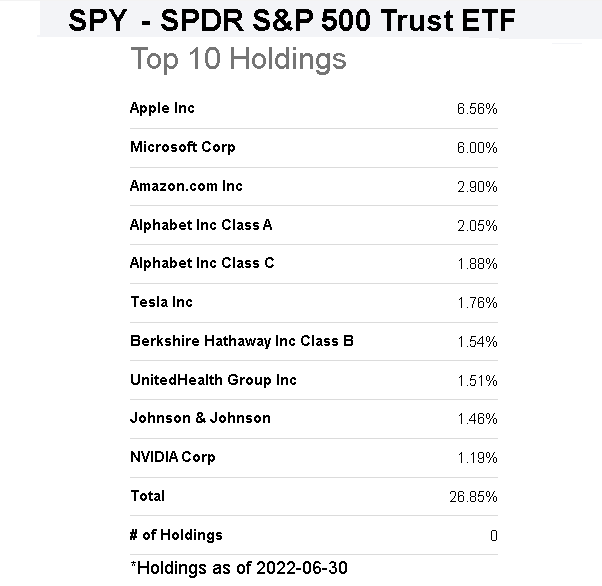

With Q2 earnings season in full swing, what we’re seeing is that the companies that matter, being the mega-cap leaders, are proving capable of effectively navigating the current environment. The bullish case for the S&P 500 got a lift this week with Amazon.com (AMZN) and Apple Inc. (AAPL) both beating estimates adding some confidence to both economic conditions and the market earnings trajectory.

The reports from other high-profile names like Alphabet Inc. (GOOGL), Microsoft Corp. (MSFT), and Tesla, Inc. (TSLA) were also positive. Notably, these stocks are among the largest constituents of the S&P 500 which makes the index hard to bet against. At the end of the day, earnings growth is the most important driver for stock market performance.

Seeking Alpha

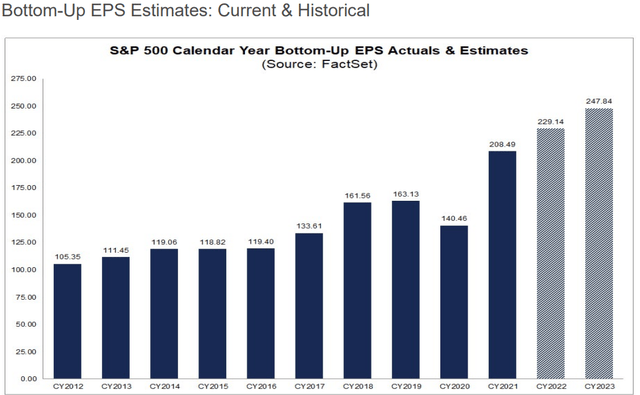

One of the most controversial data points right now is the outlook for S&P 500 earnings to climb 10% this year to $229.14. Any bearish case for stocks essentially needs that number to be wrong and drastically underperform expectations, maybe from a collapse in the economy. It hasn’t happened thus far and we don’t think it will. The Q2 earnings season is helping to reaffirm the S&P 500 bottom-up EPS estimates.

source: FactSet Research Systems

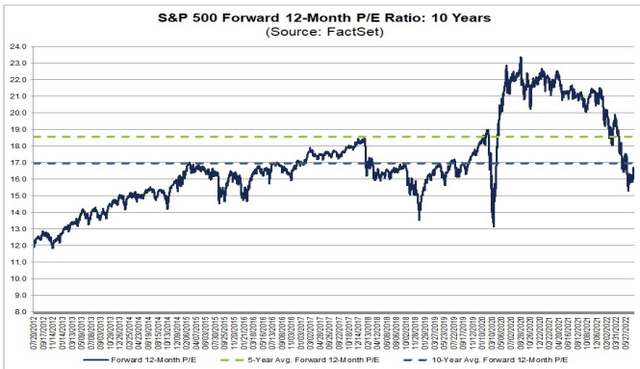

The other side to the earnings trend is the impact on valuations. The chart below makes it clear that the market is cheap considering earnings are climbing even as stock prices are down from their peak. With the S&P 500 currently trading at around the index level of 4100, the implied 12-month market forward P/E is 17x, which is below the 5-year average of 18.5x, around 9% higher. The upside here should consider that as macro conditions improve, earnings estimates have room to be revised even higher, making stocks appear even more attractive. A dynamic of multiples expansion can take hold.

Behavioral Biases Are Dangerous

Putting it all together, we attempted to show that some of the biggest storm clouds are passing and there is light at the end of the tunnel. Anyone with a short position on stocks or even sitting on the sidelines is likely sweating amid the rally in recent weeks.

We sense that a large segment of the market is falling for a couple of textbook behavioral biases related to cognitive dissonance. The main concept here is the trap of getting too emotionally attached to the bearish (or bullish) case in stocks for any number of reasons.

In truth, the allure of being a market bear is tempting. There is just something extra gratifying about shorting a stock and making money while the big wigs on Wall Street have a buy rating. Doom and gloom commentary against the grain always seems to come off as extra smart. Similarly, it’s fair to say that the current political environment is conducive to keeping a cynical view on things. A call against the market may seem like a referendum against the status quo or even a judgment on global Central Banking orthodoxy. It’s understandable, we get it, but it doesn’t work like that. The market doesn’t care about opinions and keeping an open mind is the way to go.

It’s important to incorporate new information to make more objective decisions to overcome what’s known as conservatism bias. Bears may also be expressing some confirmation bias by only valuing the data points that help reaffirm their pessimistic outlook. The headline of Q2 GDP decline may have fed into a view that the economy is falling apart and stocks will crash lower, but what we say was the S&P 500 surged by over 1% on the report.

What’s Next?

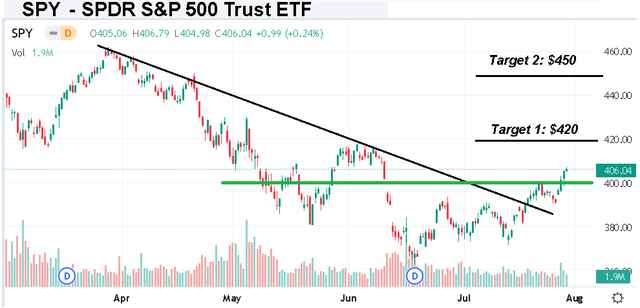

The next test for the S&P 500 will be at the index level of 4,200 corresponding to around $420 in the SPY ETF. Let’s go. We then see SPX retesting 4,500 which is a level it last traded at in mid-April. On the downside, 4,000 is the first level of support while a break under 3,800 or $380 in SPY would be indicative of a more serious deterioration.

On that point, it’s always worth covering some of the risks. We can bring up the ongoing Russia-Ukraine war, which still has the potential to escalate, would force a reassessment of global stability. Energy prices are also a key monitoring point. Significantly higher oil and gas prices could kickstart a new round of inflation which would undermine the bullish case for equities.

The way we see it playing out is that the market narrative will take some time to change. Some don’t want to believe it. People are still talking about high gas prices and record inflation. The Q2 GDP print and big recession word is the headline de jour.

Fast forward, the door for economic data to come in better than expected over the next few months sets the stage for a new theme of recovery and stronger sentiment. If stocks continue to trend higher, the action will evolve into a fear of missing out for anyone on the sidelines while shorts rush to cover. The momentum can accelerate. Bears were winners to start 2022 but may ultimately be left just holding a participation trophy.

Be the first to comment