EtiAmmos

Thesis Summary

The stock market is breaking down, inflation runs rampant, and growth is slowing down. Sentiment is at an extreme low, and most investors seem to believe stocks have nowhere to go but down. However, history shows that years of global recession have been amongst the best performing in history. Furthermore, just as inflation “surprised” us in 2022, deflation will surprise us in 2023.

Stocks are already near their pre-pandemic levels at much more reasonable valuations. I believe we have the perfect recipe for another bullish run in the next year or two.

Recession Obsession

Inflation came in hot once again, with food prices and rent leading the way. However, we did get more encouraging data from the Producer Price Index, which saw prices fall by 0.1% MoM.

Of course, some inflation could be justified if growth was high and accelerating, but the opposite seems to be true. Some of the largest economies in the world, the US, Europe, and China, are all facing growth slowdowns and many other issues.

Europe has to contend with energy shortages and high prices after being cut off from Russia’s gas. China is facing a fully-fledged housing crash, and the US has to deal with inflation, labour shortages, and a stubbornly strong dollar. Not to mention that the strong dollar is also causing problems for countries outside the US:

It seems undeniable that we are entering a global recession, and while this may be bad for the economy, I believe it could be very bullish for stocks moving forward.

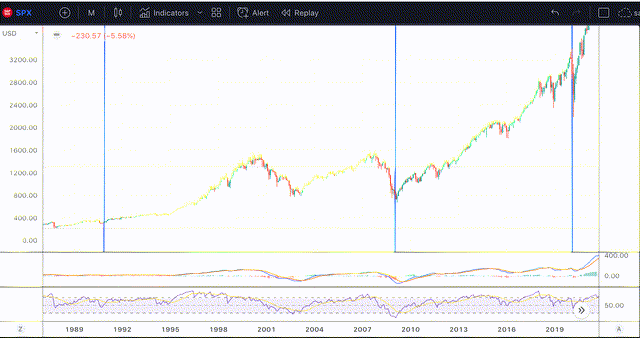

SPX in Global Recessions (Author’s work)

In the SPX chart above, I have marked in blue the beginning of years that the IMF qualifies as global recessions. The pattern is clear. Markets fell leading up to recessions but rallied strongly during and after them. In 1991 the S&P appreciated by over 30%, in 2009, the index returned 25.94%, and in 2019 markets went up by a whopping 31.49%.

This makes perfect sense since markets are forward-looking. 12 months ago, as we were finally putting to rest the pandemic problems, it might have come as a surprise that we’d be seeing inflation out of control and a dramatic slow-down in growth. Now, though, the market, which is down over 15% since its ATH, has clearly digested this news.

There could certainly be another leg lower, but I see a reversal in 2023 as highly likely.

Downplaying Deflation

The other big issue with the current stock market crash narrative is that I believe we are also very close to a change in the Fed’s monetary policy. The US Central Bank has been raising rates since March, and as is often the case, I believe they are underestimating the effects of their monetary policy.

In fact, we have seen numerous people come out and warn of the threat of deflation, including Cathie Wood and Elon Musk. Although hard to imagine now, we are already getting early warning signs. Commodity prices have cooled off, and MoM inflation is already near 0.

The key thing to understand here is that changes to the system, like rate hikes and a stronger dollar, take months to impact the economy. The Fed has only been raising rates for 8 months. An argument could be made that inflation would have come down by itself, even without the Fed’s intervention, and all these rate hikes are going to do is set us up for a period of deflation.

In a few months, inflation data will be measuring prices today with prices at peak inflation, and it will paint a very different picture. This will be after months of lower commodity prices, a stronger dollar, which makes imports cheaper and an overall slowdown in demand. I find it very hard to believe that prices will be higher in March 2023 than in March 2022.

Risks

First, let’s make clear that while I see a bull market in 2023, there could still be some more pain in the next 2-3 months. With that said, though, what are the risks to this bull thesis?

On the one hand, it could be that inflation does not die down, and the Fed indeed continues raising rates. I see this as unlikely, though, and I think an exogenous factor would have to play a part, like another supply shock.

Alternatively, it could be that I am right about deflation but that the economic havoc caused by this is greater than the Fed can handle and that even with lower rates and more QE, stocks fail to bounce back. Again, this seems unlikely. Even under an unprecedented worldwide pandemic, monetary policy managed to perk up stocks.

Takeaway

In conclusion, though the economy may face a challenging year in 2023, the market has been pricing this in 2022. I expect higher stock prices on the back of “surprisingly” low inflation and a 360-degree change in monetary policy.

Be the first to comment