krblokhin/iStock Editorial via Getty Images

Investment Thesis

Sprouts Farmers Market (NASDAQ:SFM) makes a strong case for a long-term, buy-and-hold, value-oriented investor. Admittedly, macro factors such as rampant inflation and a rapidly slowing economy make it unlikely for price convergence to occur in the near-term. However, owed largely to their ability to quickly pass on rising input costs to consumers, grocers are historically strong defensive plays and typically will fare better in market downturns than other sectors. My DCF, using what I believe are conservative assumptions, shows SFM has an intrinsic value in the range of $41 and $47, representing the base and bull cases, respectively. With a current share price of ~$25 (as of 06/20), there is room for potential upside of 44%-65%. There is risk that SFM fails to deliver on their growth strategy, or inflation outpaces their ability to pass on costs slowly compressing margins, so I believe they will need to demonstrate consistent and sustainable growth for convergence to happen. Nonetheless, shifting consumer trends, inflation supported revenue growth, rational management and a well-defined growth strategy make SFM a stock any value investor should be carefully considering adding to their portfolio.

Company Overview

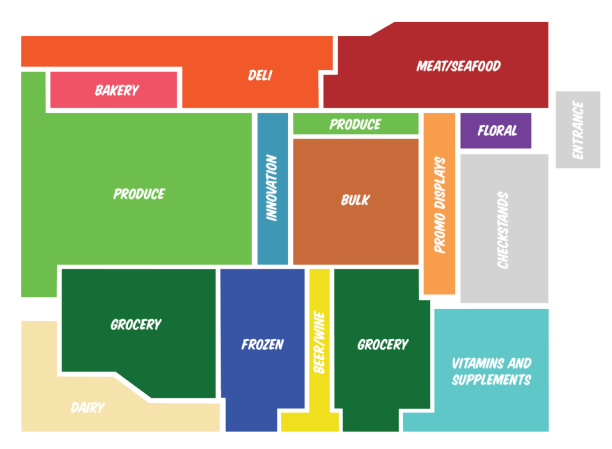

Store Layout (SFM Investor Deck)

Founded in 2002, SFM has been around for ~20 years and has managed to hold its own through some dramatic recessions. Sprouts offers a unique grocery experience focusing on affordable, fresh, natural, and organic products with locally sourced produce at the heart of their stores. Kind of like a lower cost Whole Foods. Unlike other grocers, Sprouts formats their stores with produce at the center and dedicate ~20% of floor space to the offering, higher than their peers. They attempt to replicate a farmers’ market experience utilizing open layouts and low displays.

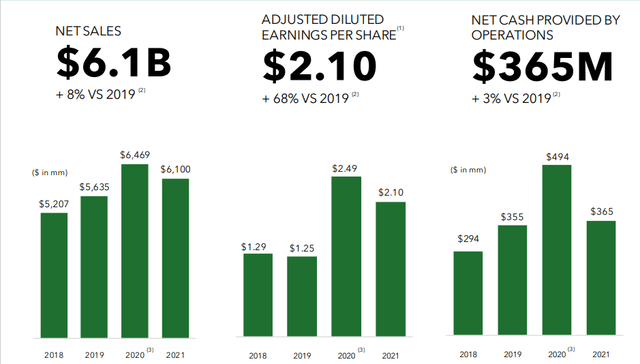

Central to Sprouts’ mission is sourcing fresh, locally produced goods and to facilitate this, they aim to have all stores within 250 miles of one of their distribution centers. Currently they have more than 85% of their stores meeting that target which not only helps with the provision of fresh and local produce but should also work to improve margins as they continue to vertically integrate the supply chain.

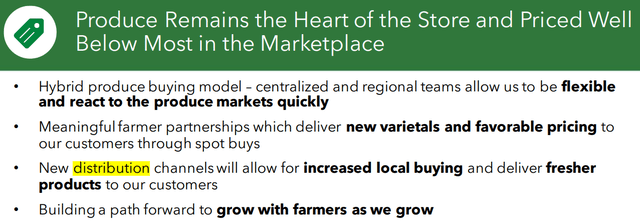

Slide from Investor Deck (SFM Investor Deck)

As of January 2022, the company had 374 stores located in 23 states with the intention to grow at a rate of 10% beginning FY2023.

SFM Store Growth (SFM Earnings Deck)

SFM’s commitment to their attribute-driven business model gives me confidence in their ability to execute and continue their growth trajectory.

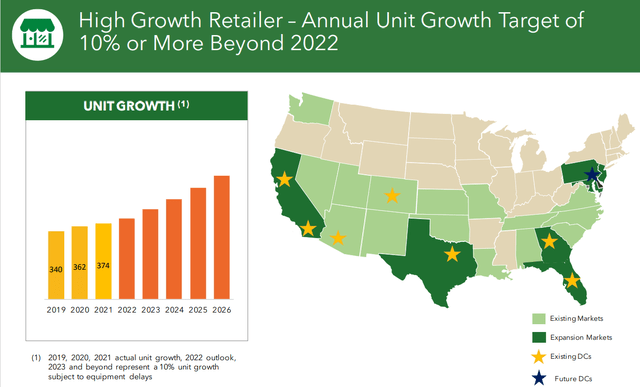

Earnings

Much like other companies who benefited from the pandemic, SFM saw a significant increase in their top and bottom lines during FY2020 and saw a decline in revenues of ~5% for FY2021 as well as a slight compression in margins and earnings. This is expected however and observable across the market. Furthermore, as Graham and Dodd’s argued in Security Analysis, it is not the trend that is dependable, but the average, and this is simply a reversion to the mean. Relative to 2019 (pre-pandemic) earnings are up across several metrics and margins are stable.

Earnings Slide (SFM Earnings Presentation)

Q1 Metrics are up significantly compared to previous quarters, indicating structural changes implemented by management are starting to take hold and provide returns. (Structural changes will be discussed further below.)

Market Opportunity

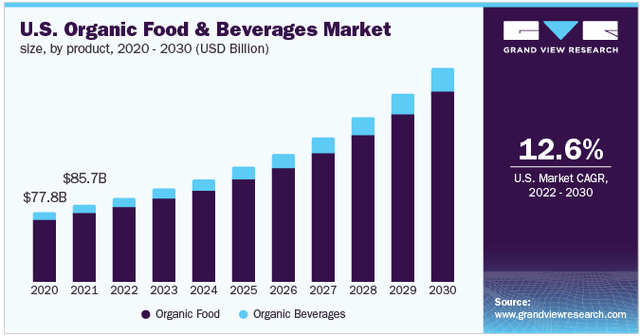

The organic food and beverage market had ~$85 billion in sales in 2021 and is expected to grow at a CAGR of 12.6% through to 2030.

U.S. Organic Food & Beverages Market Outlook (Grandview Research)

COVID-19 has been a driver for increasing health awareness among consumers as it demonstrated the importance of a strong immune system for preventing and mitigating the impact of such viruses. This provides a tailwind for companies like SFM that focus on products that support overall wellness, including vitamins and supplements.

Inflationary Pressure

While I have previously argued inflation to be a tailwind for grocers given their ability to expediently pass on rising costs to consumers, inflation is reaching levels such that analysts are concerned consumers may not continue to eat the rising costs. While possibly naïve, value investing places much greater importance on the fundamentals of the business, not the macro-economic environment. SFM has weathered high inflationary environments and recessions in the past and while the macro environment isn’t ideal at the moment, fundamentally SFM is still a strong business which is highly likely to continue to thrive beyond this cycle. With consistent positive cash flows, an interest coverage ratio of ~28x, and a strong track record, I have confidence in SFM’s ability to push through this market cycle.

Peers

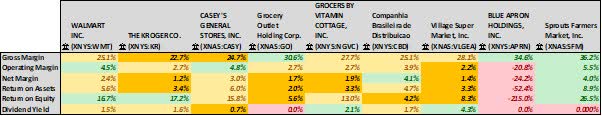

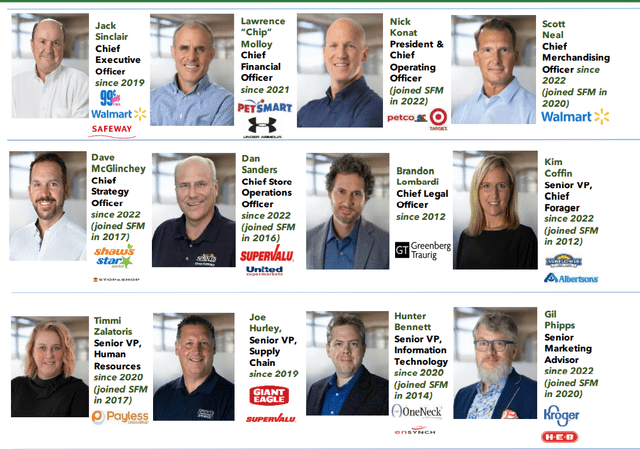

My comparable analysis of SFM and its peers shows it to be the strongest prospect, based only on a quantitative analysis.

Comps Analysis (Author’s Model)

Across the board, their metrics show them to be trading at valuation multiples significantly lower than the industry averages

SFM Valuation Multiples (SA)

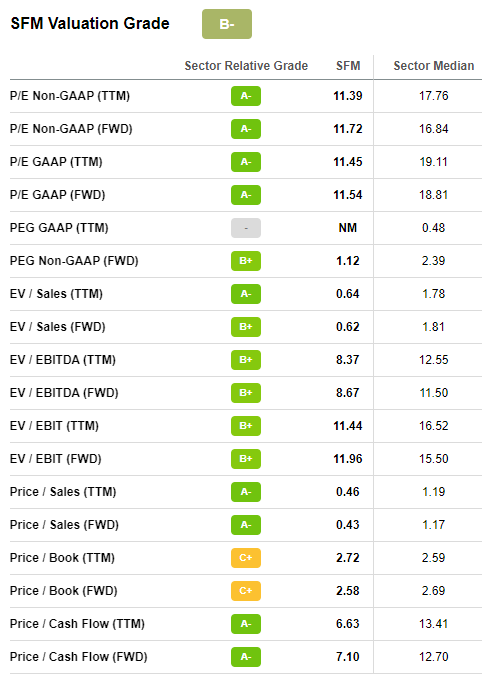

Management Analysis

After the sudden resignation of CEO Amin Maredia in 2019, Sprouts brought on seasoned grocer executive Jack Sinclair as his replacement. With 35 years of industry experience, Sinclair has been a strong replacement and has built up his executive team including hiring a new CFO, CMO, and Chief Merchandise Officer. The team has implemented important structural changes and, while still early days, have been increasing margins and returns as well as making rational capital allocation decisions.

Executive Team (SFM Earnings Presentation)

While it does not pay a dividend currently, SFM has repurchased 52 million shares, reducing the overall shares outstanding by 34% and representing a return of capital to shareholders of $1.2B. Management has been approved for a $600M buyback of which they have only spent $34M. There can be many reasons for buybacks, but I typically see it as management not only returning capital to shareholders, but also indicative of management’s belief that their shares are undervalued at the current market price – a sentiment I would agree with. With a market cap of around $2.7B, investors can gain a significant ROI from buybacks alone.

Strategy and outlook

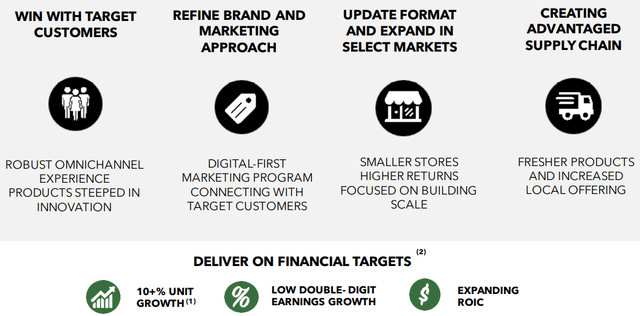

Management implemented a new strategy for growth in 2020 focusing on five key areas:

SFM Earnings Presentation (SFM Earnings Presentation)

Win With Target Customers

CEO Jack Sinclair outlined in 2020 the company’s intention to move away from inefficient promotions and focus on their core customer base who is less concerned with deep discounts. They have also been working to deliver a more streamlined omnichannel experience developing the Sprouts app and offering in-store pick up as well as delivery.

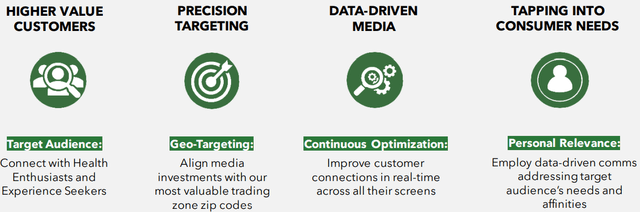

Refine Brand and Marketing Approach

Prior to 2020 and the new management team, Sprouts utilize physical mail and leaflets. It has since eliminated this entirely and is now exclusively digital focusing on precision and brand awareness to increase market share.

SFM Earnings Presentation (SFM Earnings Presentation)

Update Format and Expand in Select Markets

Taking their average store footprint from between 28k and 30k square feet and reducing it to between 21k and 25k square feet, as well as updating the format of the stores, management is aiming to reduce margins and improve operational efficiency.

Creating Advantaged Supply Chain

Sprouts aims to have all their stores within 250 miles of a distribution center. They currently have 85% of their stores within this range and intend to open more in the coming years.

As well as all of the above, Sprouts has a private label which is growing rapidly. The private label accounted for 16% of all revenue in 2021 and they launched 5700 new and unique private label products that year also.

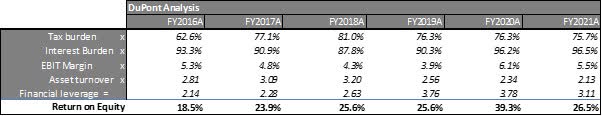

With already strong ROE, if Sprouts can execute and increase their margins, they should be able to increase returns for investors also.

DuPont Analysis (Author’s Model)

Catalysts for convergence

For the market price of SFM to converge with its intrinsic value, I expect the market would need to see consistent quarter over quarter growth in revenues, cash flow, and at least stable EBITDA and profit margins. This would demonstrate management’s execution. Further, it is unlikely for convergence to happen while inflation is still trending upward, and the market overall is in a downturn. I would not expect convergence to happen any time soon, but I am confident in the long- term compounding prospects.

Risks

Sprouts outline a number of risk factors in their most recent 10-k. I will discuss several of what I believe to be most relevant below.

Inflation

With inflation at 40-year highs, margins for grocers run the risk of being crushed if they’re not able to pass on rising costs to consumers quickly enough. This applies to all companies though, and like mentioned above, grocers are far better positioned to pass on these costs than companies in other sectors. It is likely that in the near-term margins will suffer, but in the long-term SFM is still a fundamentally strong business.

Highly Competitive Environment

SFM operated in a highly competitive industry and are up against not only natural and organic food retailers, but also generic supermarkets, mass or discount retailers, membership clubs, online retailers, specialty food stores and even restaurants and home deliver services. It’s important that SFM is able to increase their brand awareness and market penetration. This is something they are focusing directly on through their marketing strategy, and they have identified expansion markets to drive growth.

Sourcing

SFM depends heavily on sourcing perishable products from local farmers. The success of this model relies heavily on a great number of difficult to control variables such as climate change, weather patterns, relationship management, and geopolitical factors such as tariffs and trade agreements. SFM has not had difficulty in maintaining their sourcing so far, however it is certainly something to consider.

Valuation

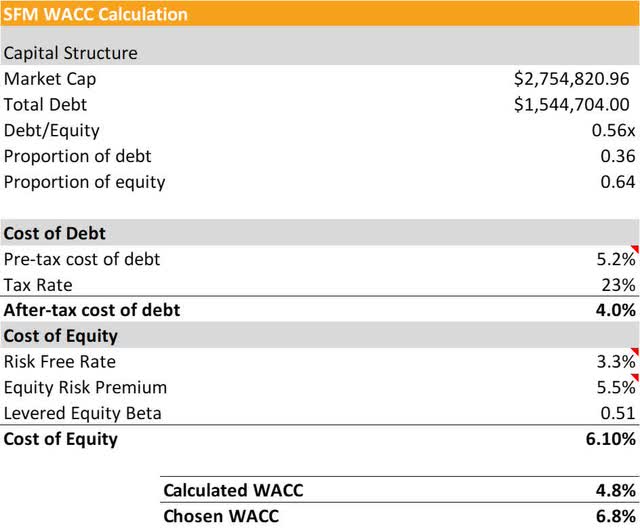

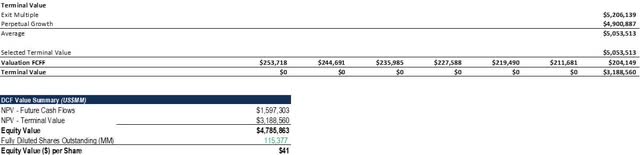

Using relatively conservative assumptions, my DCF shows the intrinsic value of SFM to be in the range of $41 and $47 in the base and bull cases, respectively. I used a first-year revenue growth rate of 2.6%, the U.S. GDP growth rate expected by Morgan Stanley. I used this as it is slightly lower than consensus, so it provides a greater margin of safety.

I also projected stable EBITDA margins of 7.5% and FCF margins of 3%. In the bull case I multiplied base assumptions by 1.25. To calculate the terminal value, I used the average of one terminal calculated using a 3% perpetual growth rate and one value using an 8.5x EBITDA multiple (slightly lower than the industry average).

I discounted terminal value and cash flows using a 6.8% discount rate. I calculated a WACC of 4.8% for SFM using comparable company betas but to provide a greater margin of safety I added 2% to this.

WACC Calculation (Author’s Model)

The downside case, which I consider to be very unlikely, is the base multiplied by .75 and results in the $36/share – Still significant upside.

Key Takeaways

SFM has a demonstrated track record of consistent earnings and positive cash flow. They are a rapidly growing company with strong and strengthening brand awareness and deep penetration across the United States. They operate a unique business model sourcing most all of their produce from local farmers and ensuring the majority of their stores are within 250 miles of a Sprouts distribution center. Vertically integrating their supply chain like this promotes better access to locally sourced fresh products and supply chain efficiency, ultimately likely to increase margins and profitability. The majority of their products are also sourced sustainably and humanely adding to the appeal for their target customer base.

With a new and strong management team installed around 2019, structural changes to their operating model and marketing strategy seem likely to also lead to structural improvements in their operating results. Trading at multiples much lower than the peers, with arguably a more convincing business model and growth prospects, if SFM is able to consistently achieve conservative revenue growth while maintaining margins, market price will eventually converge with intrinsic value.

Be the first to comment