krblokhin/iStock Editorial via Getty Images

Investment Thesis

Operating across 23 states with a total of more than 380 locations, Sprouts Farmers Market (NASDAQ:SFM) specializes in offering natural and organic food options to consumers in the continental United States primarily south of Pennsylvania. After their Q1 earnings report projected weaker short-term performance than expected in light of inflation-driven sales loss, Sprouts saw share prices decrease from a high of $35 in April to as low as $23 in May. Today, as share prices remain around $25 per share, investors appear to be more focused on short-term fundamental tailwinds than what management is doing to establish long-term shareholder value. Given higher customer retention rates, the expected increase of store locations is poised to combat smaller units per basket figures going into the future. Add in the strong likelihood that management will continue share buybacks near term, Sprouts Farmers Market appears to be an impressive long candidate.

Q1 Earnings Sell-Off

First-quarter earnings brought both good and bad news; specifically, a beat in earnings per share and an unfortunate, yet very close, miss in terms of revenue. The $8.55M miss in revenue is unlikely the culprit for the stock’s more than 25% decrease from the times of earning, only some of which has been regained in the past month or so. Instead, what seemed to have brought most of these losses was a significant Bank of America downgrade to under-perform from a buy rating. On top of this slight miss in revenue and a sudden double-downgrade from analysts, guidance from management did not seem to offer any immediate relief from these extensive losses. Following an update that this year’s total sales growth would be near the lower end of guidance issued in February, Chief Financial Officer Chip Molloy would follow that up by stating:

For the second quarter, comparable sales should be close to flat and earnings per share is expected to be between $0.49 and $0.53.”

In hearing that neither sales growth nor earnings will grow dramatically in the near term, a decrease in share prices, which were then trading roughly 15 times earnings, was understandable. However, during that same Q1 earnings call, management mentioned numerous catalysts which are likely to add shareholder value in the long term, something that is especially attractive now that Sprouts is trading at less than 12 times its earnings.

Future Growth Trumps Short-Term Tailwinds

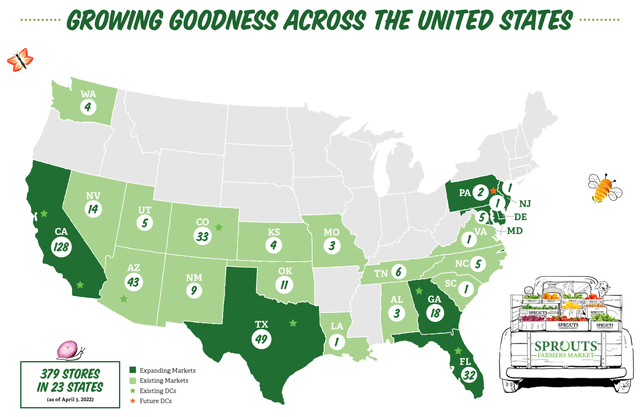

With management’s focus on expanding locations throughout the country, overcoming a loss of revenue due to a slight decrease in unit sales per basket is quite likely given higher customer retention rates. Compared to last year, when revenues were at their highest, less items are being placed in carts and this decrease in sales, according to Chief Executive Officer Jack Sinclair, can be attributed to both an increase in travel as well as inflationary concerns among shoppers. Despite this loss, the addition of six stores throughout the first quarter and plans to add 15-20 stores throughout 2022 within growing markets such as California, Texas, Florida, and Pennsylvania, looks to offer an opportunity to make up this loss revenue. This is backed by the addition of 34 new locations throughout 2020 and 2021, representing no sign of slowing down going forward, especially as the organic food market continues to expand at a CAGR of 12.2%.

Sprouts Farmers Market Locations and Growing Markets as of April (Q1 Earnings Fact Sheet)

Helping this increase in store count make up for a loss in units per basket is the positive trend in customer retention. Speaking on the improving relations with their customer base in the Q1 earnings call, CEO Jack Sinclair shared the following:

We continue to see our customer engagement grow from a digital standpoint with increases in account sign ups, active e-mail users and tech subscriptions. We also saw positive trends in customer retention rates, while our customer satisfaction scores remain very high (Q1 Earnings Call).”

Their ability to maintain loyal customers, especially during continued expansion, will aid in bringing earnings back to all-time highs, as will the stable profit margin of 37.3% which beats out many of their (larger) competitors. For comparison, Albertsons (ACI), Walmart (WMT), and Costco (COST) have gross profit margins of 29%, 25%, and 12%, respectively. Assuming that competitive edge, likely deriving from the largely-organic product selection customers are willing to spend extra dollars on, continues, Sprouts will be in an even better position to make use of these additional locations and drive future earnings.

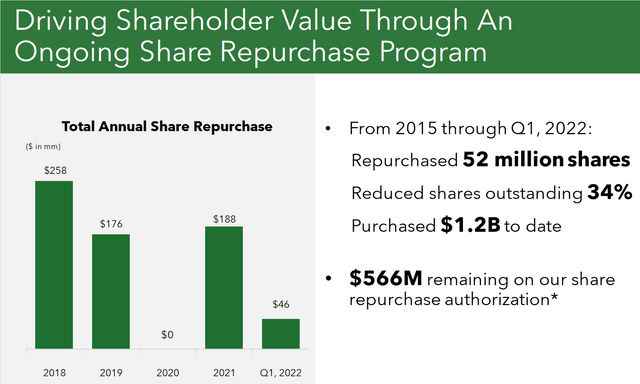

Excellent Usage of Cash Flow

Beyond an increasing location count, Sprouts Farmers Market has also utilized their large cash flow to perform a number of share buybacks in an effort to drive shareholder value, all while signaling that they are believers that share prices are undervalued. Especially with the high levels of cash on hand right now (approximately $324M), their authorization of $600M in further share buybacks continues what has so far brought shares outstanding down by 34% according to their Q1 earnings presentation:

Sprouts Farmers Market Repeated Practice of Share Buybacks Looks to Continue Adding Value (Q1 Earnings Deck)

Considering that very little of that $600M repurchase authorization has been exercised, with where share prices stand today, it is likely that Q2 earnings (expected July 29th) and future reports will continue this favorable trend in decreasing shares outstanding and increasing shareholder value.

Overcoming Inflation-Related Risk

Inflation is, and has been, a key concern for investors not only in Sprouts but in most every investment; accordingly, the recent decline in Sprouts’ share price can be attributed to the slowed growth that was brought by inflation’s impact on consumer trends. As management repeatedly made mention of during their earnings call, customers across stores were reducing the number of items within their carts and this was largely attributed to the inflationary impact had on more-expensive, organic, foods. Taken from the Q1 earnings call:

Inflation is not slowing and customers continue to put 1 to 2 fewer items in their basket this year than last (Q1 Earnings Call).”

Despite the slight reduction in items purchased per transaction, I expect this trend of fewer items in one’s shopping cart to get no worse as inflation either worsens or remains similar to where it stands today. I come to this conclusion via Engel’s Law which posits a greater proportion of one’s income is devoted to food spending as their income decreases, something many are coming to realize as their buying power decreases with inflation.

Technical Rebound in The Making

The quarter one announcement that earnings in the short-term will likely be on the lower end of estimates led many investors to close their positions without realizing the long-term growth potential that is still in store for Sprouts Farmers Market. Driven by the continued addition of locations nationwide in addition to a greater ability to retain new shoppers, share prices should continue their long-term trend within a bullish channel as contact with the lower support line repeats. With an expectation that this line will not be surpassed extensively, opening a long position in the sub-$26 region appears to offer an excellent opportunity.

Price action appears bounded by a bullish channel. MACD and 200 MA Included. (TradingView)

Adding in the Moving Average Convergence Divergence approaching the baseline (signaling a potential bullish trend in the making), Sprouts Farmers Markets appears to be in a fantastic spot for a rebound. Assuming that share prices reflect off the shown support line, investors should also take note of the 200-day moving average which could act as a future line of resistance; however, previously in that lengthy channel, this moving average line has been surpassed.

Final Thoughts

Sprouts Farmers Market, following concerns from its Q1 earnings report over short-term performance, has seen share prices too far removed from the value that will be generated as a result of additional stores, impressive retention, and share buybacks. In its recent bearish activity, each of these catalysts which are likely to build shareholder value have been overlooked and are yet to be adequately priced in. Expecting a technical rebound to initiate a share price rebound in the near-term, greater fundamentals will further this performance into the long term; as such, I see a strong possibility for shares to return to their all-time highs and further. With that, a proven ability to grow in recent economic conditions and a strong track record of returning shareholder value, Sprouts Farmers Market looks to be an incredible long opportunity for patient investors.

Be the first to comment