Avid Photographer. Travel the world to capture moments and beautiful photos. Sony Alpha User

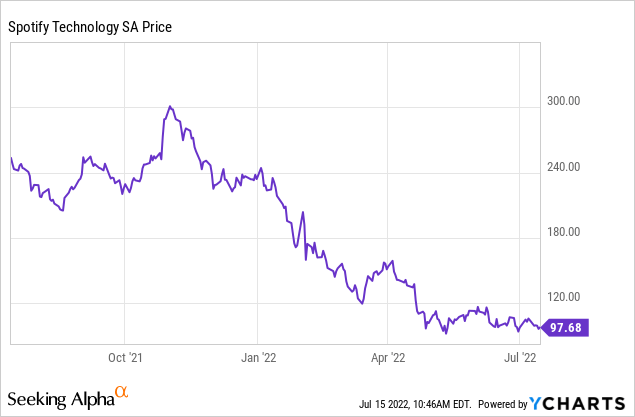

If you’re like me and you are banking on a year-end rebound, stock selection is of paramount importance. Specifically, I’m looking to pick up shares of iconic companies that are trading at severe discounts due primarily to weakened sentiment. Spotify (NYSE:SPOT), for example, has been the victim of undue pessimism this year. The global leader in music streaming has of course had a number of fundamental slowdowns, but nowhere near enough to justify the 60% drop in its stock since then.

Spotify is now trading at all-time lows. Even pre-pandemic, the stock had traded higher – in spite of the fact that the business has grown tremendously since then (especially in new areas like podcasting), and the fact that our reliance on streaming has never been more pronounced. It’s a great time, in my view, for investors to scoop up shares of Spotify at a discount.

I remain fervently bullish on Spotify and am a big buyer of the stock below $100. Of course, I won’t say that Spotify is completely risk-free. There has been some degree of increased risk here, specifically around slowing user growth. This impact was compounded by pressure from the Russia fallout, which impacted 5 million (roughly 1%) of the company’s MAUs and 1 million (about half of 1%) of the company’s Premium subscribers.

I would venture to say, however, that investors’ expectations have reset to a new, lower baseline – and from here, Spotify should be able to rebuild some of its value. When we step away from the short-term noise, I still find the following factors to be incredibly powerful drivers of the Spotify bullish thesis:

- Spotify continues to roll out new products and prove that it has something for everyone. In 2021, Spotify rolled out a new paid tier called “Spotify Plus,” its cheapest offering at just $0.99/month. While this tier is still supported by ads, it gives users the ability to skip as many songs as they’d like within an hour, potentially opening Spotify up to a bigger batch of lower-end consumers. Alongside consumer innovations, Spotify has also improved the partner experience, with innovations including the Spotify Audience Network for podcast advertisers, giving them the ability to more effectively target podcast listeners and hopefully helping to increase monetization in podcasts (Spotify’s biggest growth category).

- Successful price increases for Premium. Spotify raised the price of its Family plan in the U.S., the Family/Duo/Student plans in the U.K., and all plans in Brazil. The fact that Spotify reported no meaningful change in churn since the price changes went into effect is a testament of its relative inelasticity when it comes to music streaming. In addition, Spotify has proven itself to be a very sticky platform, with content like podcasts and playlists keeping subscribers hooked to the platform.

- Two-sided marketplace. Another nascent revenue opportunity for Spotify: paid marketplace tools for content creators represent another way to fully integrate Spotify into the music ecosystem and expand its wallet share.

- Margin builds and rich free cash flow profile. Higher advertising rates, a mix shift into podcasting, and the general economies of scale that come from paying for music content spread across a bigger base of users have helped Spotify dramatically increase its gross margin and free cash flow profile.

- Work from anywhere. Spotify announced a remote-work option for all of its employees globally, which I view as a positive move that can reduce Spotify’s real estate footprint and drive lower operating costs in the long run.

From a valuation perspective, Spotify has never traded more cheaply. At current share prices near $98, Spotify trades at a market cap of $18.75 billion. After we net off the €4.22 billion of cash and €1.15 billion of debt (on a dollar basis) on the company’s most recent balance sheet, the company’s resulting enterprise value is $15.65 billion.

Meanwhile, Wall Street analysts are expecting Spotify to generate $11.64 billion in revenue this year, representing 9% y/y growth (with growth expected to accelerate to 16% y/y in FY23; data from Yahoo Finance). This puts Spotify’s valuation at just 1.3x EV/FY22 revenue – a downright steal, especially as this revenue stream yields positive free cash flow and the potential for further margin expansion (through economies of scale on music rights plus the mix shift to podcasting).

The bottom line here: there’s abundant pessimism on Spotify right now, but when we take a step back from the prevailing sentiment of the day, I struggle to find any long-term risks with the global leader in music streaming. Stay long here.

Q1 download

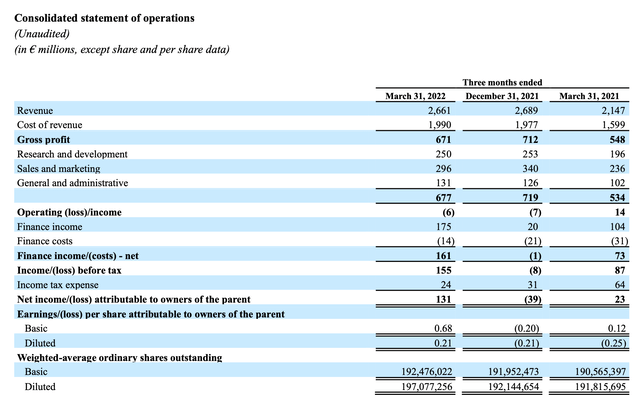

Let’s now go through Spotify’s latest Q1 results in greater detail. The Q1 earnings summary is shown below:

Spotify Q1 results (Spotify Q1 earnings release)

Spotify’s revenue in Q1 grew 24% y/y to €2.66 billion, which came in well ahead of the company’s guidance of €2.60 billion.

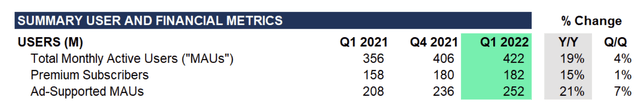

Several factors contributed to that growth. First, users continued to grow. Total MAUs grew 19% y/y to 422 million. There is one caveat here: in March (the last month of the quarter), the company reported that a service outage caused a number of users to be involuntarily logged out of Spotify. Unable to access their old accounts, they created new ones to log back in.

Spotify user metrics (Spotify Q1 earnings release)

In April, this trend reversed, and the company lost 3 million MAUs. So, excluding this unusual behavior, the company gained 13 million net-new MAUs (to 419 million) in the quarter and achieved 17% y/y MAU growth. Premium subscribers, meanwhile, got a 2 million boost in the quarter and grew 15% y/y.

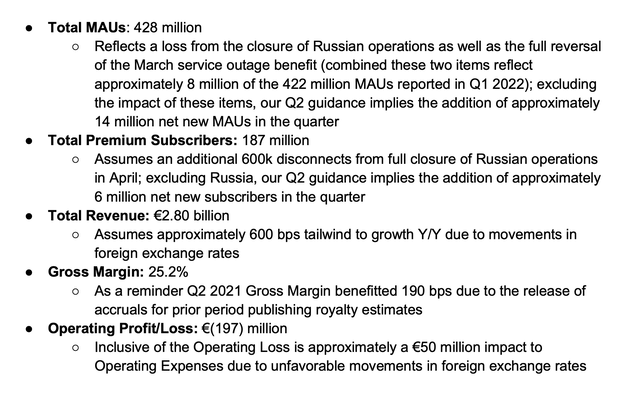

It’s worth noting that Spotify expects subscriber growth to continue picking up in Q2. The company expects total MAUs of 428 million in the quarter (+9 million versus Q1’s adjusted base of 419 million, and +14 million after adjusting for the loss of Russia subscribers). In addition, excluding Russia, the company expects to add 6 million net-new Premium subscribers, which is much higher than 2 million this quarter.

Spotify Q2 outlook (Spotify Q1 earnings release)

The second driver behind revenue growth is Premium ASP expansion. As previously noted, the company has been successful at pushing through price increases; and as a result, the company grew Premium ARPU by 6% y/y.

The company has also driven growth in ad revenue – partially driven by the company’s new “Spotify Plus” plan, which is partially supported by subscription fees and partially by ad revenue. Ad revenue grew 31% y/y to €282 million, which represented a record 11% of the company’s overall revenue.

Here’s some helpful anecdotal commentary from CEO Daniel Ek on the strength of Spotify’s streaming platform, made during his prepared remarks on the Q1 earnings call:

The data clearly outlines the role Spotify and streaming are playing in growing the entire music ecosystem. Not only is streaming driving record revenues in the music industry, but there are more artists sharing in that success than ever before.

In fact, the worldwide growth is truly staggering as more artists hit milestones across all revenue levels. So for the first time, over 1,000 artists generated over $1 million and over 50,000 artists generated more than $10,000 on Spotify alone. For those who are interested in learning more, I would encourage you to check out the loud and clear website. So, our core business remains incredibly strong. And this strength is built on the investments we continue to make in constantly enhancing our platform, which in turn elevates the experience for users and creators. We are especially investing in our core platform capabilities. These are multiyear investments to enable a constant iteration across our products, tools and services. And given the positive results we are seeing, you should expect this to continue for the foreseeable future. And I recognize that many of you want more clarity around when the benefits of all these investments will be realized, including when they will show up in our financial statements.”

Key takeaways

To me, Spotify comes down to a fairly simple thesis: if you believe streaming will still be the dominant form of music consumption for years to come, I see no reason not to invest in Spotify at all-time lows. Take advantage of the huge dip as a buying opportunity.

Be the first to comment