Theo Wargo/Getty Images Entertainment

Investment Thesis

Spotify (NYSE:SPOT) is the world’s number one music streaming platform, and it has kept this position despite intense competition from the likes of Apple (AAPL). In fact, it overtook Apple Podcasts as the top podcast platform in the US, and across many other markets.

There is a lot to like about this company, but it is constrained heavily by the royalty payments to music artists, resulting in gross profit margins that have consistently been around 25% – with very limited profitability in the business itself.

So, does Spotify have what it takes to turn its global platform into a money making machine? I took it through my investment framework to find out.

Business Overview

Spotify’s mission is to unlock the potential of human creativity, by giving a million creative artists the opportunity to live off their art and billions of fans the opportunity to enjoy and be inspired by their creators. It is the world’s leading audio streaming platform, with 422m MAUs (monthly active users) and 182m Premium Subscribers across 183 different markets. Originally a pure music streaming platform, Spotify entered the podcasting arena in 2017 and has expanded to become the world’s leading podcast platform as well.

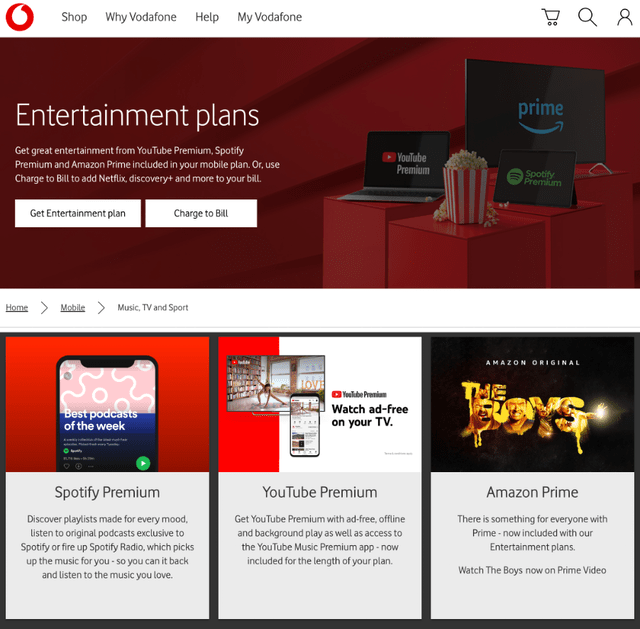

Spotify operates a freemium business model, wherein users can other use the company’s Premium Service or its Ad-Supported Service. The Premium Service offers unlimited online and offline streaming access to Premium Subscribers, without interruptions from advertisements. Spotify offers a variety of plans (Standard, Family, Student etc.) sold either directly to users or through partners such as telecoms companies that bundle the subscription together with their own services.

The company also has an Ad-Supported Service with no subscription fees, and this provides users with limited on-demand online access to Spotify’s streaming services that are frequently interrupted by display, audio, and video advertisements. This serves as an acquisition channel for the Premium Service, but it also provides a great option to individuals who want to stream music but do not wish to pay a subscription fee.

As Spotify is involved in the music industry, it shouldn’t come as a surprise that royalty fees eat up a lot of this revenue. From its launch up until December 2021, Spotify has paid more than €26 billion in royalties to record labels, music publishers, and other rights holders. These substantially limit the gross profit margin that Spotify can make from the music side of its business.

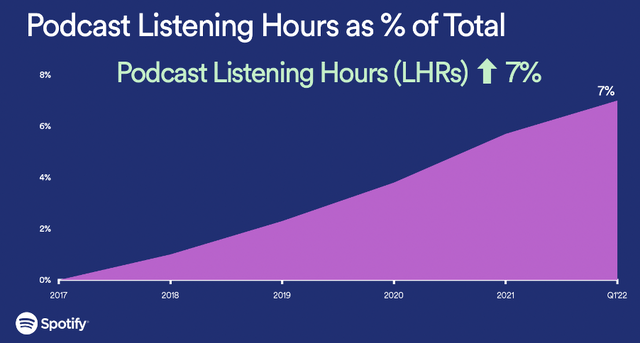

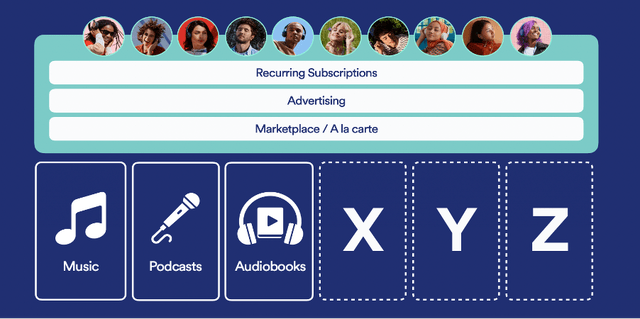

The good news for Spotify is that it is looking to diversify away from being a music-only streaming platform, and it has successfully done this through its focus on podcasts. Having only launched 5 years ago, podcasts now make up 7% of all listening hours on Spotify’s platform – with ~30% of all users listening to podcasts as of Q1’22.

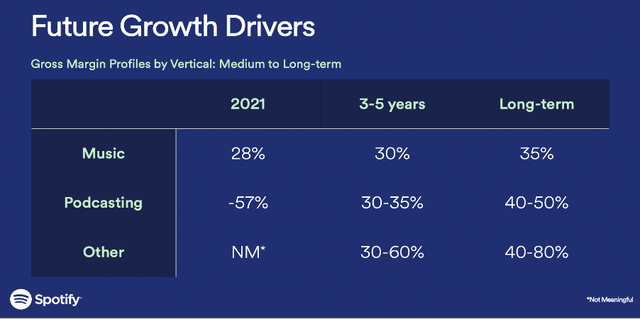

This shift away from the royalty model should enable Spotify to further expand its margins over time; currently podcasts are a drag on the company’s gross profit margin, however it is expected to grow podcast margins to 30%-35% over the next 3-5 years, with long-term ambitions to reach up to 50%.

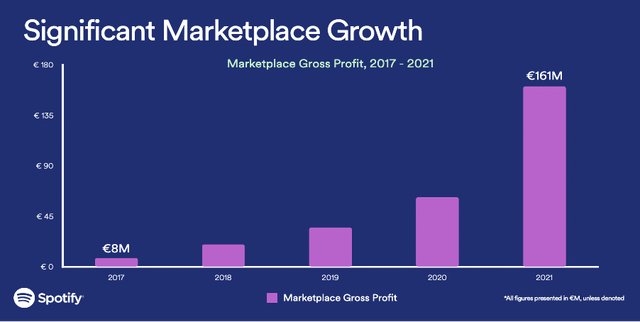

Another new revenue driver that Spotify launched a few years ago was its Spotify for Artists, which offers a multitude of services including what is, essentially, and advertising platform where artists pay Spotify to recommend their songs to listeners. This is a great way for artists to boost their fanbase, and also another way that Spotify could take advantage of all the data is has collected over the years – by enabling greater targeting of adverts. Whilst only making up 6% of Spotify’s 2021 growth profit, this is a fast growing segment that should see over 30% growth in 2022.

So whilst the royalty model has limited Spotify’s ability to benefit from its scale thus far, there are several opportunities down the line that could enable growth and margin expansion over the upcoming decade.

Economic Moats

With every business, I look to see if there are any durable competitive advantages (aka economic moats) that will help the company continue to thrive whilst protecting itself from competition.

The first economic moat I’ll look at for Spotify relates to switching costs – which may surprise you. A music streaming subscription doesn’t seem like it would have high switching costs, but I beg to differ.

I have personally used Spotify for over 10 years now, and all of my playlists over that time remain on the platform; it offers me something nostalgic whenever I want it. I also have my current playlists already on the platform, and there is not really any incentive for me to move to an alternative streaming platform, especially since I’d have to go and recreate all of my previous playlists. In terms of podcasting, Spotify have done a great job in securing exclusive podcast deals (although the price paid for these deals has been questionable), and that results in switching costs for any fans of these podcasts.

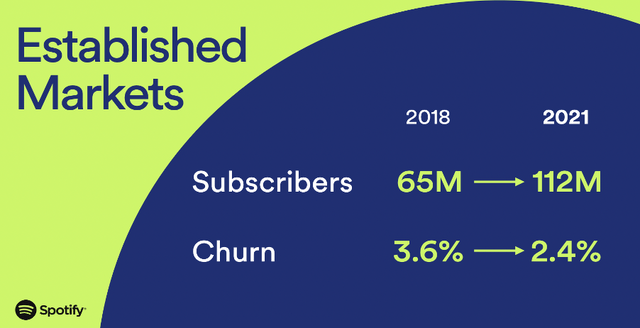

But don’t just take my word for it. Spotify has been continually lowering its churn rate over the past 5 years, with churn of 3.9% highlighted in Spotify’s 2022 Investor Day alongside churn of only 2.4% in established Spotify markets.

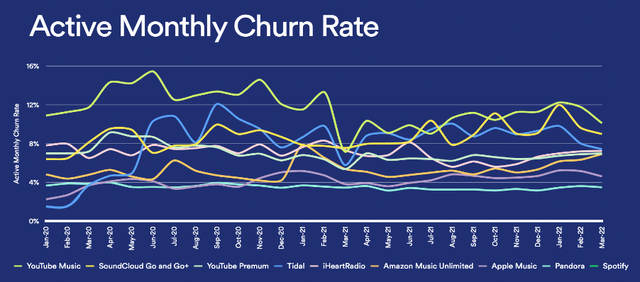

The company also highlights the monthly churn rate of Spotify and its competitors below; I know it might be hard to make out which line is which, so I’ll tell you the important part – Spotify is the line at the bottom, with the lowest churn rates.

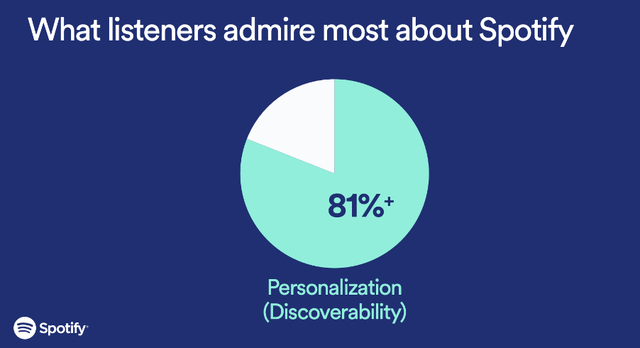

Spotify also benefit from a network effect that comes with being the world’s leading music streaming service, and having held that title for many, many years. The company uses machine learning to understand what its users enjoy listening to, and it uses this information to recommend new songs, artists, and customized playlists to listeners. Clearly the company has done a very good job at this, since 81% of listeners admire Spotify’s ability to offer personalized recommendations & help them discover new artists.

So the network effect is this: more users leads to more data, more data leads to better personalization, better personalization leads to more users, more users leads to more data, and repeat. Network effects related to machine learning are generally dubious due to their ‘black box’ nature, but I think there is enough evidence here to say that Spotify has got it right – and, whilst this may not necessarily be a tool for growing its user base, I think this network effect will certainly improve retention levels.

Another network effect to give Spotify credit for relates to the musicians on its platform. I’m sure we’ve all heard the news stories about artists’ dislike for Spotify and streaming, but this should not necessarily phase investors.

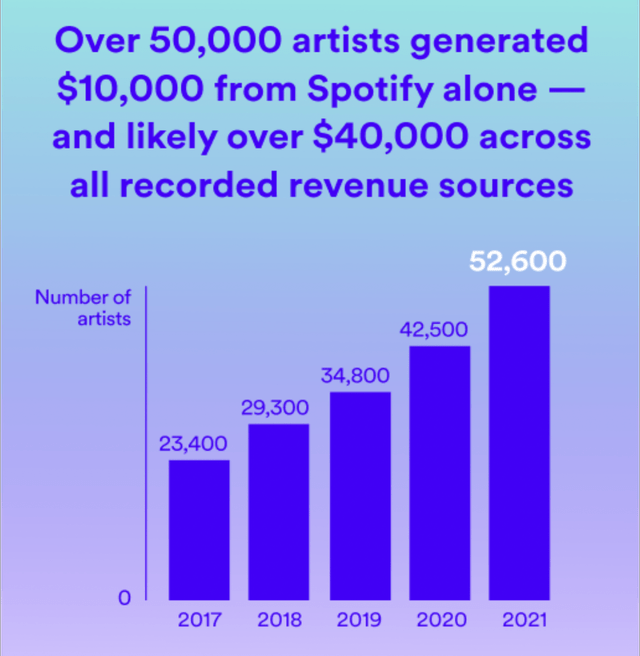

Sure, Spotify needs the artists, but the artists also need Spotify. As the world’s largest streaming service, any music artist will have to put their music on Spotify to reach as large an audience as possible, and so all fans of these artists would also be inclined to use Spotify in order to listen to them. This is a weak network effect, but it should continue to help growth in both users and artists. In fact, through Spotify, more and more artists are generating over $10,000 annually.

The final moat for Spotify is its brand. The company is the world’s biggest audio streaming service, and so it’s no surprise to see that the brand name is instantly recognizable & top of mind for anyone looking to stream music. This will help with new customer acquisition, and Spotify has also strengthened its brand through viral social media campaigns with the likes of Spotify Wrapped – a summary of your year in Spotify, which has a habit of being the top trend on Twitter (TWTR) when it gets released.

Since everyone is desperate to know, here are the Top Artists in my 2021 Spotify Wrapped – although I can only take credit for #2, the rest are down to various members of my family.

Spotify

Outlook

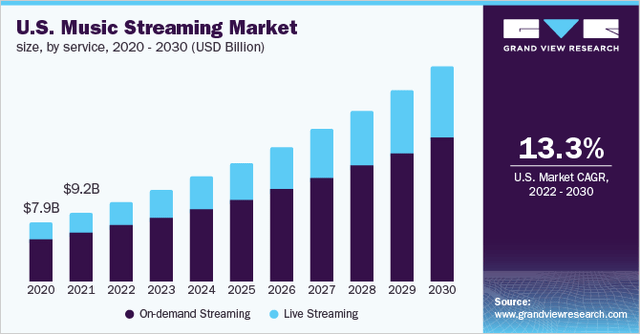

According to Grand View Research, the global music streaming market size was valued at $29.45bn in 2021, and is expected to grow at a 14.7% CAGR from 2022 through to 2030 driven by the rising penetration of digital platforms, additional podcast genres, & the growing number of smart devices.

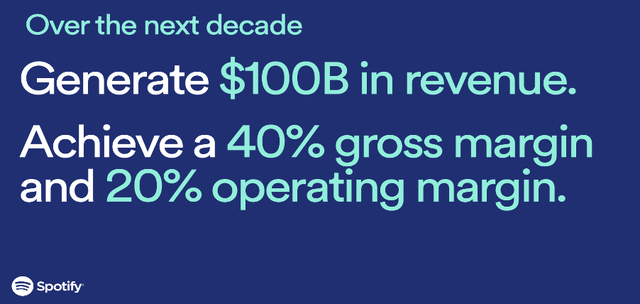

Spotify also has ample room to expand its margins and operating leverage, primarily because the company’s margins are pretty poor right now. The company is looking to move away from its dependence on the royalty-constrained music streaming industry towards verticals such as podcasting (which it has successfully done), audio books, and additional future verticals such as news and sport related audio content.

Management

When it comes to fast-paced, innovative companies, I always aim to find founder-led businesses where inside ownership is high. I am happy to say that we have this in Spotify thanks to its Co-Founder & CEO Daniel Ek – who I am a particular fan of thanks to his recent desire to purchase Arsenal FC (the football team myself and Ek support) in order to boost the club’s future prospects, but I won’t let that sway my judgement…

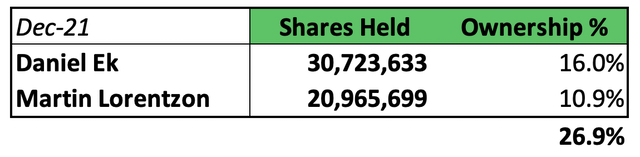

I want to invest in companies where leadership has skin-in-the-game, and Spotify has this in abundance through Ek’s 16% ownership as well as the other co-founder & member of Spotify’s Board of Directors Martin Lorentzon, who owns 10.9% of Spotify.

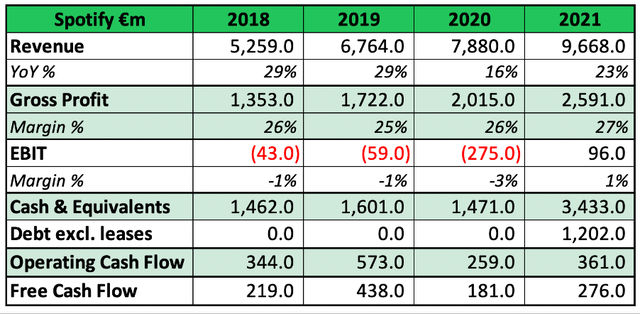

Spotify 2021 Annual Report / Excel

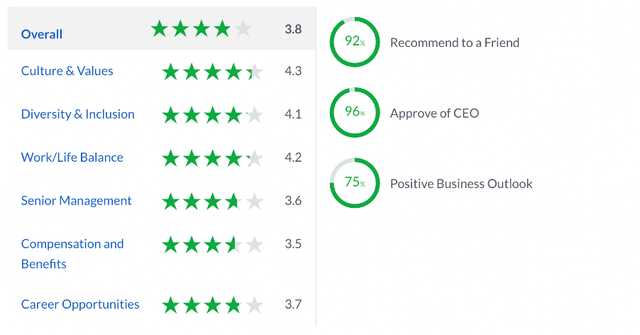

I also like to take a quick look on Glassdoor to get an idea about the culture of a company, and Spotify gets some pretty good scores from the 994 reviews left by employees. Any score over 4.0 is impressive, and Spotify has one of the widest distributions in scores that I’ve seen. The company gets poor scores of 3.5 and 3.6 in Compensation and Benefits and Senior Management, with both of these being potential sources of demotivation for employees.

On the flip side, Spotify gets great scores in Culture & Values, Work / Life Balance, and Diversity and Inclusion, which gives me the impression that this feels like a great place to work. Furthermore, Ek gets an incredible 96% CEO approval rating (must be because he’s an Arsenal fan), and 92% of Spotify employees would recommend it to a friend as a place to work. So a mixed bag, but I think there are a lot of positives to take from this – if Spotify can improve its financials, then hopefully the Compensation and Benefits score might get bumped up as well.

Financials

Spotify has seen revenue grow at a 23% CAGR over the past few years, which is fairly impressive given that it is already the market leader & as such, investors may have expected less room for growth. As we can see, the gross profit margin is weak for a platform business, but we expected this purely due to Spotify’s royalty-based business model. I think that any investing thesis for Spotify has to revolve around its ability to monetize users in a better way, outside of this model.

EBIT margins have been hovering around 0% for the last few years, and finally turned positive in 2021 with a solid 1% margin. Clearly this is a company not yet optimized for profitability, but that’s okay because it has a strong balance sheet and has consistently generated positive operating and free cash flows.

I think this company’s success lies in the future, but it’s good to see that positive cash flow – it gives me confidence that Spotify will continue to stick around, giving it the chance to reinvest and grow other more profitable sides of the business.

Valuation

As with all high growth, disruptive companies, valuation is tough. I believe that my approach will give me an idea about whether Spotify is insanely overvalued or undervalued, but valuation is the final thing I look at – the quality of the business itself is far more important in the long run.

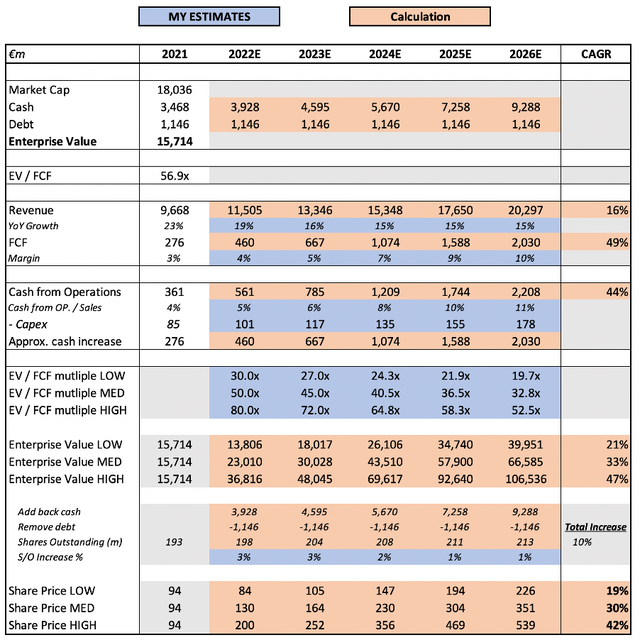

Note that my valuation model is in euros, not the usual US dollars.

I have assumed fairly steady revenue growth, given the existing size of Spotify, with the revenue growth for 2024 onwards being fairly in line with the 14.7% CAGR that Grand View Research expects to see through to 2030. I do, however, think the company could exceed my expectations here if it successfully moves into new verticals.

In their latest Investor Day, Spotify stated its aim to achieve $100bn in revenue over the next decade – which would require a revenue CAGR of 25%, compared to my assumption of 16%. Maybe I’m being too negative, maybe Mr. Ek is being too optimistic, or maybe the truth is somewhere in the middle.

I have, however, assumed margin expansion for Spotify over the upcoming few years – specifically when it comes to free cash flows, which it is already pretty good at generating. As it continues to scale, increases the profitability of podcasting, and potentially expands into new verticals, I would expect this free cash flow margin to expand substantially.

I have used EV / FCF multiples that I feel are appropriate for a company expected to achieve Spotify’s level of growth beyond 2026, including a multiple of 32.8x in my mid-range scenario. For context, the company has had an average EV / FCF multiple of 94x over the past year, but this has fluctuated between highs of 227x and recent lows of 28.7x – yet the entire market, and particularly growth stocks, has faced substantial multiple compression recently & I do not expect this to continue in perpetuity. I think it is driven by wider macroeconomic concerns, and the assumption that future free cash flows will fall.

Put that all together, and I think Spotify’s shares are capable of achieving a 30% CAGR through to 2026 in my mid-range scenario. Perhaps even more impressively, the low range of my assumption would still lead to a 19% CAGR! I do think I’m conservative in my valuation models, so let me know in the comments if you think otherwise, but this is a very compelling case for Spotify’s shares right now.

Risks

There are some standard risks for investors to be aware of: the possibility of higher churn potentially driven by a recession (although I think Spotify is fairly recession-resistant), the possibility of competition from the likes of Apple resulting in a loss of market share etc., but these are risks that Spotify has always faced & has continued to successfully deal with.

There is but one long-term risk of consequence to Spotify right now, and that is the risk that they fail to achieve their lofty ambitions of expanding meaningfully into non-music related verticals. The company has seen success with its podcasting, but shareholders are yet to see that translate into any financial benefit – if the company is to be believed, this will increase margins over the next 3-5 years.

Furthermore, their expectation of multiple new audio-delivered verticals is crucial to any investment thesis for Spotify right now. If the company fails to deliver, then it could go from a potentially spectacular investment to a very mediocre investment.

Bottom Line

There is a lot to like about this founder-led, globally dominant business – in fact, almost everything excluding the fact that its margins are terrible! Yet as my valuation model shows, this a company whose shares are really not priced for success, and that provides an opportunity to long-term investors.

At a 30% CAGR in my mid-range scenario, why am I not rating Spotify a ‘strong buy’? Simply put, this is because I need to see evidence of either the positive financial impacts from its podcasts or real progress in additional verticals.

Currently, I am seeing its commercial success with podcasts & the additional revenue stream of Spotify for Artists. This is enough to convince me that Spotify is heading in the right direction, and that the current share price represents a risk / reward level that is too good for me to ignore.

I didn’t own Spotify shares before writing this article – I certainly will own them in the very near future.

Be the first to comment