Avid Photographer. Travel the world to capture moments and beautiful photos. Sony Alpha User

Introduction

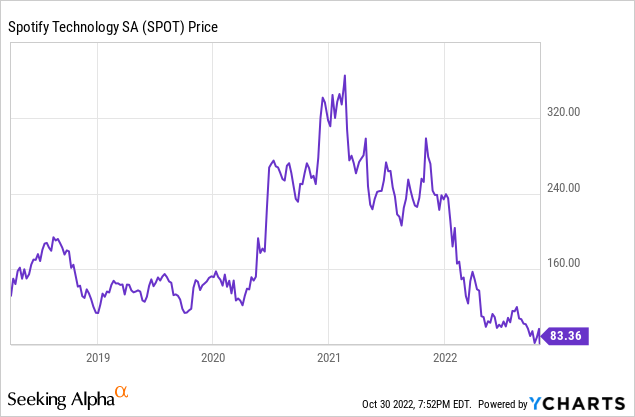

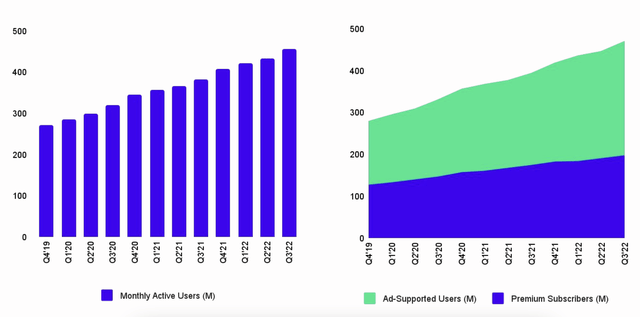

Spotify (NYSE:SPOT) is the largest global audio streaming platform with 456m monthly active users (MAUs) and 195m premium subscribers. Despite consistent 20%+ MAU growth and a strong market leadership position, Spotify as an investment has attracted significant scepticism from investors.

Bulls point to Spotify’s demonstrated track record of growing MAUs and premium subscribers, rave customer reviews (4.8/5 on the App Store from 23.6m reviews), excellent brand recognition, industry-leading churn rates, strong balance sheet, and a visionary CEO (Daniel Ek) who some have argued single-handedly rescued the music industry from potential extinction.

Bears point to Spotify’s lack of gross margin expansion since IPO due to high dependence on record labels like Universal Music Group (AMS:UMG), lack of consistent operating profitability, and a management team that cares little about representing shareholder interests. In short, the main bear case for Spotify has always been that while it may be a good “product”, it is not a good “business” or “investment”.

So far, the bears appear to be winning. Spotify has struggled to gain traction in the public markets, falling 44% from their IPO price in April 2018 and 66% in 2022 alone.

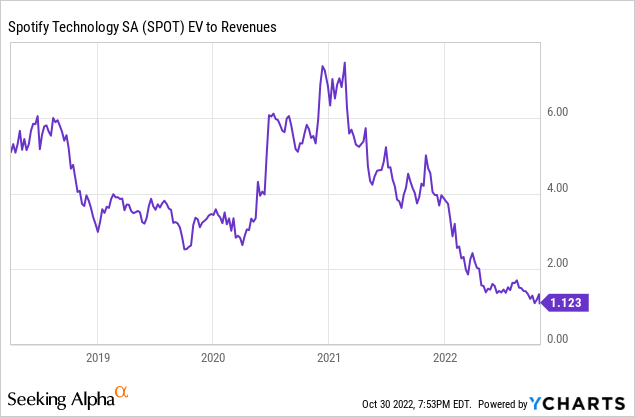

Indeed, Spotify trades at comfortably their lowest EV/LTM revenue multiple (1.1x) since their IPO, reflecting investor scepticism around their business model.

In this article, I present my thoughts on Spotify’s latest Q3 2022 results. While I remain a committed long-term shareholder (and have continued to average down throughout 2022), my patience is beginning to wear thin. It’s time for Spotify management to begin to “walk the walk” rather than “talk the talk”.

User growth shows no signs of slowing down

While other entertainment streaming platforms like Netflix (NFLX) appear to be fast approaching peak subscriber saturation, Spotify’s user growth has either remained flat or accelerated over the past few quarters.

In Q3, Spotify reported 20% YoY growth in total MAUs from 381m to 456m (vs. guidance of 450m) and 13% YoY growth in premium subscribers from 172m to 195m (vs. guidance of 194m). Ad-supported MAUs increased by 24% YoY from 220m to 273m, driven primarily by strength in developing markets like Brazil and India.

Spotify User Growth (Spotify Q3 2022 Shareholder Deck)

While bears can criticise Spotify’s lack of gross margin expansion since IPO, it is difficult to criticise their user growth or engagement, which has increased like clockwork each quarter.

Slowing revenue growth was masked by currency tailwinds

This was a weak quarter for Spotify’s revenue growth, which was masked by significant currency tailwinds. Total Q3 revenue was €3.04b, which was up 6% QoQ and 21% YoY, but in FX neutral terms, total revenue only grew 12% YoY, Spotify’s slowest rate of revenue growth in several years.

In FX neutral terms, revenue from paid subscribers only increased 13% YoY while ad-supported revenue grew a measly 3% YoY in constant currency. This marks a notable slowdown from growth rates reported over the previous four quarters and is a testament to a challenging global macroeconomic environment, leading both consumers and businesses to “tighten their belts”.

| Quarter | Premium revenue growth | Premium revenue growth (FX neutral) | Ad-supported revenue growth | Ad-supported revenue growth (FX neutral) |

| Q3 2022 | 22% | 13% | 19% | 3% |

| Q2 2022 | 22% | 14% | 31% | 17% |

| Q1 2022 | 23% | 18% | 31% | 22% |

| Q4 2021 | 22% | 18% | 40% | 34% |

| Q3 2021 | 22% | 21% | 75% | 75% |

Concerningly, Spotify’s CFO Paul Vogel expects the slowdown in ad-supported revenue to continue next quarter:

On the advertising front, we are seeing some modest improvement from where we were a month or two ago, but the macro environment still has a reasonable amount of uncertainty. As such, we expect another quarter of decelerating growth in Q4, but we continue to remain confident in the long-term potential of the [ad-supported] business.

– Spotify CFO Paul Vogel, Q3 2022 Earnings Call

However, such a slowdown in ad-supported revenue is not isolated to Spotify but is rather a function of weakening macroeconomic conditions. For example, large-cap tech peers which derive a large portion of their revenue from advertising also reported weaker-than-expected Q3 results, including Alphabet (GOOG) (GOOGL), Meta Platforms (NASDAQ:META), and Snapchat (NYSE:SNAP).

Podcast growth remains strong

As of Q3 2022, Spotify had 4.7m podcasts on their platform, up 47% from 3.2m as of Q3 2021. Demand for podcasts is also increasing, with the number of MAUs engaging with podcasts growing by the “substantial double-digits” YoY.

We’ve seen podcast MAU as a percent of our total MAU continue to increase. It was up again in Q3. And then podcast consumption per podcast MAU is also up year-on-year. So we’ve seen really strong trends in general across all of podcasting.

– Spotify CFO Paul Vogel, Q3 2022 Earnings Call

Thus, while investments in original/exclusive podcasts and to build out podcast infrastructure are a short-term drag on gross/operating margins, it is pleasing to see continued strength with podcast engagement amongst Spotify’s base of MAUs.

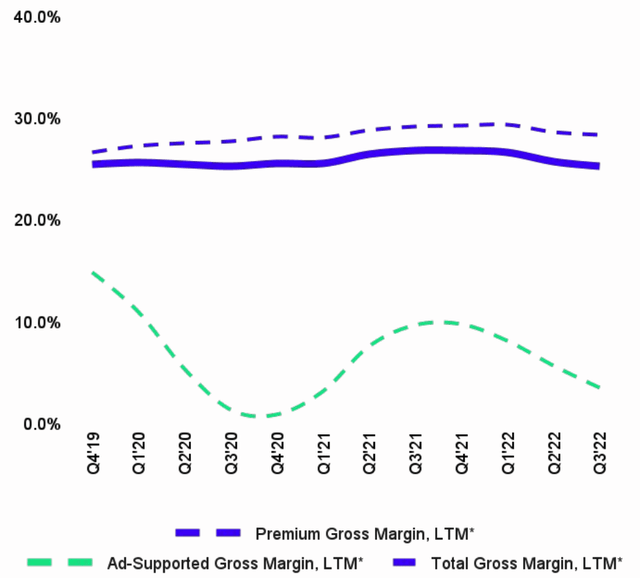

Gross margins came in below expectations … again

The main bear case for Spotify has always been that they will never be able to expand gross margins to reach their long-term goal of 40% recently outlined in their 2022 investor day. This argument assumes that Spotify will forever be beholden to powerful record labels like Universal Music Group. Given this predominant bear narrative, Spotify’s gross margin is arguably their most anticipated financial metric when they report quarterly results.

Unfortunately for shareholders, Spotify missed gross margin expectations for Q3, reporting a gross margin of 24.7%, well below their internal guidance of 25.2%.

Broken down by vertical, Spotify’s premium gross margin was 28.0% (down from 29.1% in Q3 2021), while ad-supported gross margin was 1.8% (down from 10.5% in Q3 2021).

Spotify Gross Margins (Spotify Q3 2022 Shareholder Deck)

Such gross margin weakness came despite another quarter of >100% YoY growth in total campaign volume for sponsored artist recommendations, which is a very high-margin revenue source.

The main drivers of gross margin compression for Spotify were:

- Increased publishing rates and a one-off change in accruals.

- Continued investments to build out their podcast/audiobook digital infrastructure.

While Spotify’s poor ad-supported gross margins are easily attributable to the launch of new products and being in an “investment supercycle” (note: this also occurred during 2020 and caused a temporary suppression of gross margins), it is concerning to see the medium-term plateau in Spotify’s premium gross margin, which is suggestive of reduced bargaining power with suppliers (i.e., the record labels).

However, Spotify management is confident that gross margins will improve in 2023 as the digital infrastructure to support their multi-product strategy becomes more established, reducing the need for further product investments.

So I’d say at a high level, we still remain very confident with the margin profile and margin guidance we gave at the Investor Day. We said a number of times that 2022 is going to be an investment year. You’ve seen it show up in both gross margin and on the operating expense line, and we expect to see improvements as we move into 2023.

– Spotify CFO Paul Vogel, Q3 2022 Earnings Call

Investors want to see operating profitability

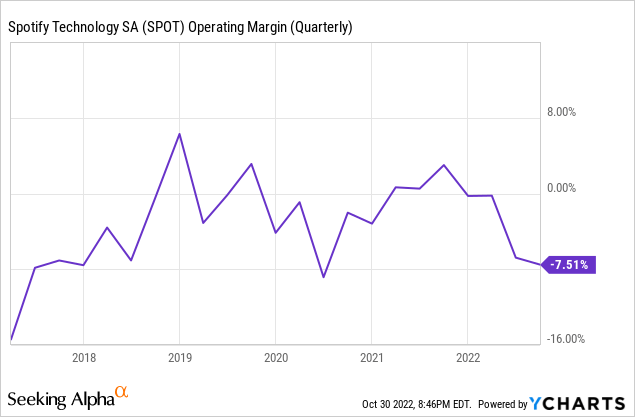

Despite Spotify’s market leadership position and immense scale with 456m MAUs, they have struggled to generate consistent operating profits.

In Q3, Spotify reported an operating loss of €228m (vs. guidance for an operating loss of €218m), representing a negative 7.5% operating margin. Although around €85m of this operating loss was due to currency fluctuations, it is worth noting that in the prior corresponding period (Q3 2021), Spotify generated an operating profit of €75m (3.0% operating margin).

This lack of consistent operating profitability is clearly testing the patience of some investors, particularly after Daniel Ek’s recent guidance for 20% long-term operating margins at their 2022 investor day.

So, what costs are driving Spotify’s declining operating margins? Large increases in both research and development (R&D) and sales and marketing (S&M) costs over the past four quarters. In contrast, Spotify has been relatively disciplined at controlling general and administrative (G&A) expenses, with a QoQ decline in G&A spend as a percentage of gross profit from Q2 2022 (24%) to Q3 2022 (21%).

| Quarter | R&D as a % of gross profit | S&M as a % of gross profit | G&A as a % of gross profit |

| Q3 2022 | 51% | 58% | 21% |

| Q2 2022 | 48% | 56% | 24% |

| Q1 2022 | 37% | 44% | 20% |

| Q4 2021 | 36% | 48% | 18% |

| Q3 2021 | 31% | 42% | 16% |

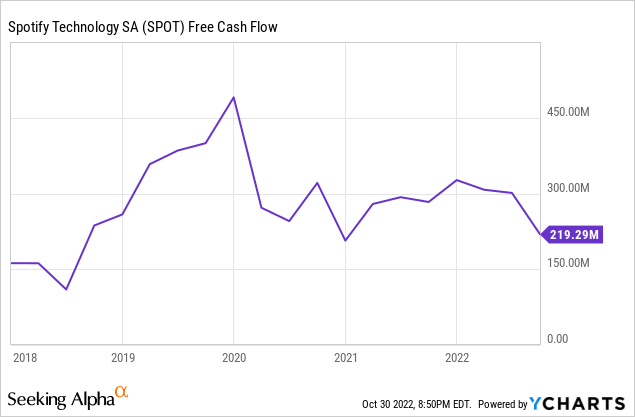

While Spotify’s lack of consistent operating profitability is undeniably frustrating, I am not overly concerned for the following reasons:

First, Spotify is in no danger of a capital raising with consistent positive free cash flow and a fortress balance sheet consisting of €3.7b cash, cash equivalents, and short-term investments.

Second, in a weakening macroeconomic environment, digital advertising costs generally decrease, which should theoretically lower Spotify’s customer acquisition costs. As such, if Spotify is able to acquire customers that are valuable in the long-term (i.e., have a high customer lifetime value), it makes sense to be more aggressive with S&M investments to gain market share and strengthen their MAU lead over competitors like Apple (AAPL) and Amazon (NASDAQ:AMZN).

Third, Spotify is currently in the midst of an “investment supercycle” with high R&D spend to build out new products (e.g., ad marketplace, live audio, podcasts, audiobooks), which should theoretically result in a better customer experience, leading to lower churn and higher pricing power. Such R&D costs should naturally decrease once Spotify’s recently launched products become more established and the heavy upfront product-related investments are complete.

Fourth, Daniel Ek acknowledged in the Q3 earnings call that the hurdle rate for new investments would increase going forward, so we should expect to see spending moderate in 2023:

But I also want to reiterate that we’re keenly aware that this is an uncertain time and the cost of capital has increased. So inevitably, you should expect our hurdle rate for new investments to be higher. And consequently, you should also take this to mean that we will be more selective with our overall spending moving forward.

– Spotify CEO Daniel Ek, Q3 2022 Earnings Call

Overall, Spotify management expect margins to improve from 2023 onwards, which provides some comfort for investors. However, we’ll need to wait until next quarter for concrete guidance on margins.

And while it’s too early to provide any guidance with respect to 2023, we do expect our profitability rates to improve relative to 2022 as we grow revenue, lap certain investments and deploy capital more efficiently.

– Spotify CFO Paul Vogel, Q3 2022 Earnings Call

Q4 guidance implies more of the same for Spotify

Investors hoping for Spotify management to change their tact and adopt a strict focus on reducing cash burn and optimising operating profitability were left seriously disappointed by their Q4 guidance.

Indeed, I see several similarities between the plight of Spotify and Meta Platforms, in that the sharp drops in share price and investor pessimism are largely self-inflicted as the founders continue to make heavy long-term investments, despite weakening macroeconomic conditions. Such investments have continued (or even accelerated in the case of Meta Platforms) despite substantial public pressure from investors/analysts to cut costs.

Spotify’s Q4 guidance for MAUs and premium subscribers was strong, forecasting 479m MAUs (+5% QoQ; +18% YoY) and 202m premium subscribers (+4% QoQ; +12% YoY). However, bears will be licking their lips at guidance for gross margins to further decline to 24.5% and for operating losses to widen to negative €300m, largely due to the same factors as in Q3 (slowdown in ad-supported revenue, heavy product investments, and currency fluctuations).

Moreover, free cash flow is projected to become negative on a one-off basis in Q4 due to the timing associated with cash receipts between quarters.

And given the timing within quarters, we may see free cash flow turn negative in Q4, but we still expect to be free cash flow-positive for the year and moving forward.

– Spotify CFO Paul Vogel, Q3 2022 Earnings Call

Overall, Q4 guidance implies more of the same for Spotify. Demand for their platform remains strong across both premium and ad-supported users, but Spotify is yet to truly make the “business model of audio” stick and produce sustained gross margin expansion with consistent operating profitability.

An investment in Spotify requires faith in Ek’s long-term vision

Daniel Ek is Spotify’s visionary Co-Founder/CEO who owns 7.3% of outstanding shares, equating to a multi-billion dollar stake in the business. Despite the sharp 72% drop in Spotify’s share price over the past 12 months, Ek remains committed to executing against his long-term vision for Spotify, despite short-term pressure from investors/analysts.

Daniel Ek (Spotify – For the Record)

Indeed, Ek’s central thesis for heavily investing to build a multi-product platform is that newer products (e.g., podcasts and audiobooks) do not have the same artificial gross margin constraints as their premium music revenue. As such, Ek remains confident that revenue attributed to podcasts and audiobooks should have materially gross margins at scale than music-related revenue:

And as we’ve said before, this heavy investment that we’ve done on the podcasting side is going to reverse in 2023 as it starts moderating. And then last point I would just add is to say that structurally, as the revenue mix shifts to more and more non-music content, so both podcasting but also audiobooks, et cetera, those gross margins in those categories is going to be significantly higher than the ones we’ve had in the music business, too. So that’s going to be a net positive as more and more of the revenue starts shifting to those categories.

– Spotify CEO Daniel Ek, Q3 2022 Earnings Call

While part of me admires Ek’s courage to stay the course on his long-term strategy despite changing market conditions, another part of me is becoming increasingly frustrated with Ek constantly pushing back the timeline for meaningful gross and operating margin expansion.

However, given Spotify’s rapid ascent to become the global leader in audio content and Ek’s high inside ownership, I’m inclined to back him to execute and reclaim Spotify from the depths of “stock market purgatory”.

Conclusion

Overall, Q3 involved more of the same for Spotify. Excellent user growth that beat guidance, strong headline revenue growth (with some weakness under the surface for their ad business when considering currency fluctuations), but plateauing gross margins and widening operating losses.

While Spotify’s current losses are harmless in the context of a balance sheet with €3.7b cash, cash equivalents, and short-term investments, 2023 will be a crucial year for Spotify to reclaim the trust of investors and demonstrate the viability of their long-term guidance for 40% gross and 20% operating margins.

Next quarter is unlikely to change anything material about the “stock story” for Spotify, but I’ll be closely watching management’s guidance for 2023 margins. Until then, I’ll likely pause adding to my position.

Be the first to comment