Drew Angerer/Getty Images News

Introduction

The music industry has been forced to evolve over the years. Piracy hurt the labels deeply but Spotify (NYSE:SPOT) has led the charge to help labels restore revenue through streaming. Spotify continues to evolve on the music side but they are also adapting to give consumers benefits with other audio verticals such as podcasts and audiobooks. My thesis is that Spotify will continue to evolve in the audio space.

At the time of this writing, €1 is fairly close to $1; the exchange rate is €1 for $1.02.

Marketplace

No longer just a music streamer, Spotify has morphed into a marketing arm for labels with their two-sided marketplace system. At the September Evercore Conference, CFO Paul Vogel talked about the two-sided marketplace being the vast majority of the increase in gross margin for the core music business. Evercore’s Mark Mahaney mentioned the 2021 figure of 160 million. CFO Vogel repeated that marketplace tools and services are used by labels and he made clarifications with respect to the accounting:

And so they’re actually not revenue. They’re not revenue benefiting. They’re actually our contra cost to some of the other payments we have, so they actually benefited gross margin, even though they don’t show up in revenue. So ironically, if they were revenue products, our revenue would actually grow, could actually be probably a lot faster, but it’s just not the way the accounting works. But it’s been a big driver. We have a lot of services on the marketing side that are working. Yes. And I’d say it’s – some labels are more invested than others.

My read on this is that the cost of revenue for 2021 would have been €160 million higher without the marketplace. This is amazing seeing as the marketplace only had a gross profit benefit of €20 million in 2018! The marketplace gross profit benefit is expected to be 30% higher or €208 million in 2022. In 2021, Spotify had a cost of revenue of €7,077 million such that they had gross profit of €2,591 million on revenue of €9,668 million. Their overall gross margin with the marketplace system was 26.8% and their overall gross margin without the marketplace system would have been closer to 25.1%.

Podcasting

Spotify listeners now have access to 4 million podcasts and a June WSJ article by @AnneMarieSteele and @JeffreyT1 says 1/3rd of Spotify listeners now use the platform for podcasts, accounting for 7% of listening hours. Spotify’s expertise is music personalization is unmatched and now they’re continually making personalization improvements in the podcast vertical.

Head of Talk Maya Prohovnik explained Spotify’s podcast innovations at the 2022 Investor Day:

We’ve been able to replace RSS for on-platform distribution, which means that podcasts created on our platform are no longer held back by this outdated technology. This has opened up a new world of opportunities to add features and formats to the podcast listening experience that have never been possible before. So Spotify is now not only differentiated by our catalog of content, but also by delivering a truly superior product for podcast listeners and creators.

Head of Talk Prohovnik went on to lay out the way in which Spotify evolved to make it easier for podcast creators to include music in their shows.

Audiobooks

A June Variety article by @xpangler discusses the details behind Spotify closing the Findaway acquisition:

According to Spotify, Findaway’s technology gives the company access to the growing audiobooks market – which Spotify execs said is expected to grow from $3.3 billion today to $15 billion by 2027. “We believe this presents a unique opportunity to introduce music and podcast listeners around the world to audiobooks and drastically expand that market,” Spotify global head of audiobooks Nir Zicherman said last week at the investor day presentation.

Citing Spotify Audiobook Head Nir Zicherman’s statements, the June WSJ article mentioned earlier notes that Amazon’s Audible is the only major player in audiobooks and that a lack of competition can keep innovation limited. It quotes Spotify’s Zicherman as saying that Spotify will push the audiobook industry forward.

A September TechCrunch article by @aiishamalik1 talks about Spotify using machine learning to improve personal recommendations for audiobooks:

During its second Investor Day in June, the company suggested it could leverage its existing machine learning models to grow the audiobooks category on its service by way of personalized recommendations as it has done with music and podcasts.

Valuation

The valuation range is the estimated amount of cash that can be pulled out of the business from now until judgment day. The competitive landscape is an important part of this estimate and big tech companies like Amazon (AMZN) threaten future cash flows. However, big tech is being heavily scrutinized right now and companies like Amazon are incentivized to not steer too far outside of their lane. As an example, an August article in the Financial Times reports that Amazon is being investigated by the FTC:

The FTC’s investigation has been extended to four other Amazon subscription services including its ebook service Kindle Unlimited and music streaming platform Amazon Music.

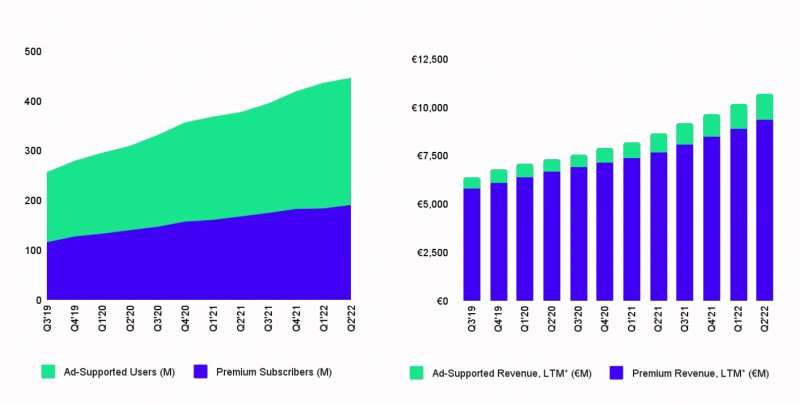

Spotify has pointed out that they are different from Netflix (NFLX) in terms of the pull-forward Netflix saw from the covid pandemic. Per the 2Q22 slides, Spotify is still increasing their user base consistently whereas Netflix has struggled in this area the last 2 quarters:

User growth (2Q22 slides)

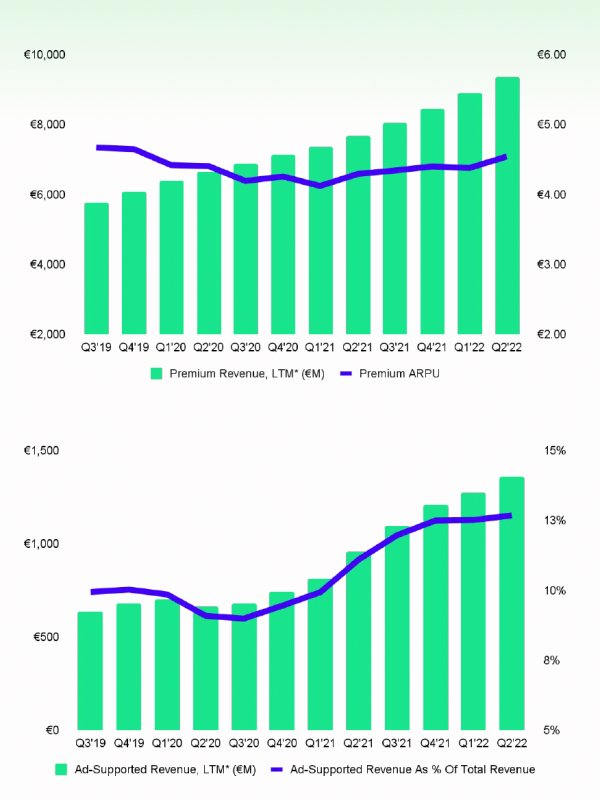

Analysts were concerned when the premium average revenue per user (“ARPU”) declined from 3Q19 to 1Q21 but these concerns were an overreaction as premium revenue kept marching up the whole time:

Revenue growth (2Q22 slides)

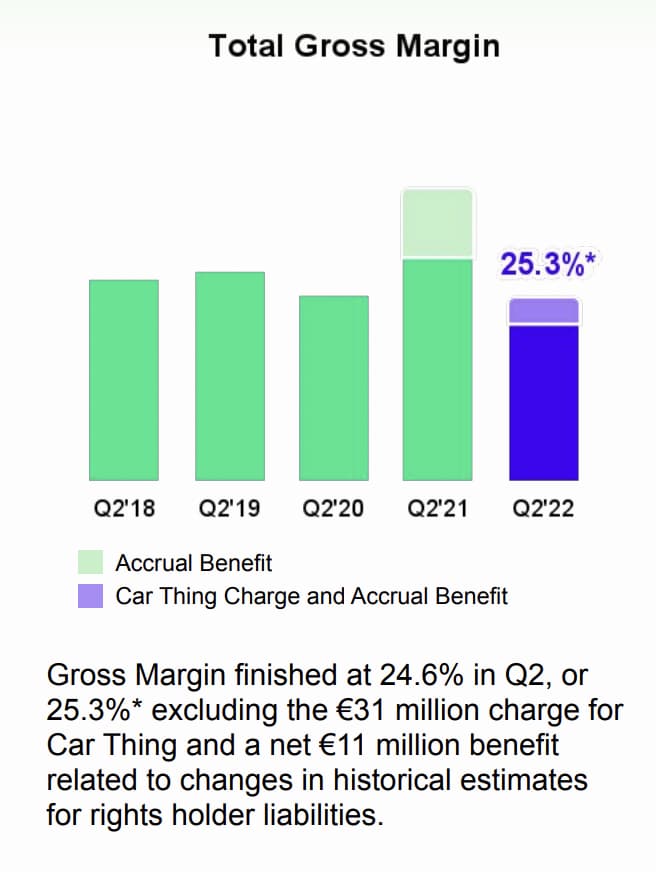

We need to understand gross margins for a valuation framework, both from a reported/accounting standpoint and an economic standpoint. Spotify’s reported quarterly numbers for 2Q22 show a gross profit of €704 million from revenue of €2,864 million for a gross margin of 24.58%. Management shows that adjusted gross profit would be €724 million and the adjusted gross margin would be 25.27% if we add back the one-time Car Thing charge of €31 million and subtract the €11 million accrual benefit:

Overall gross margin (2Q22 slides)

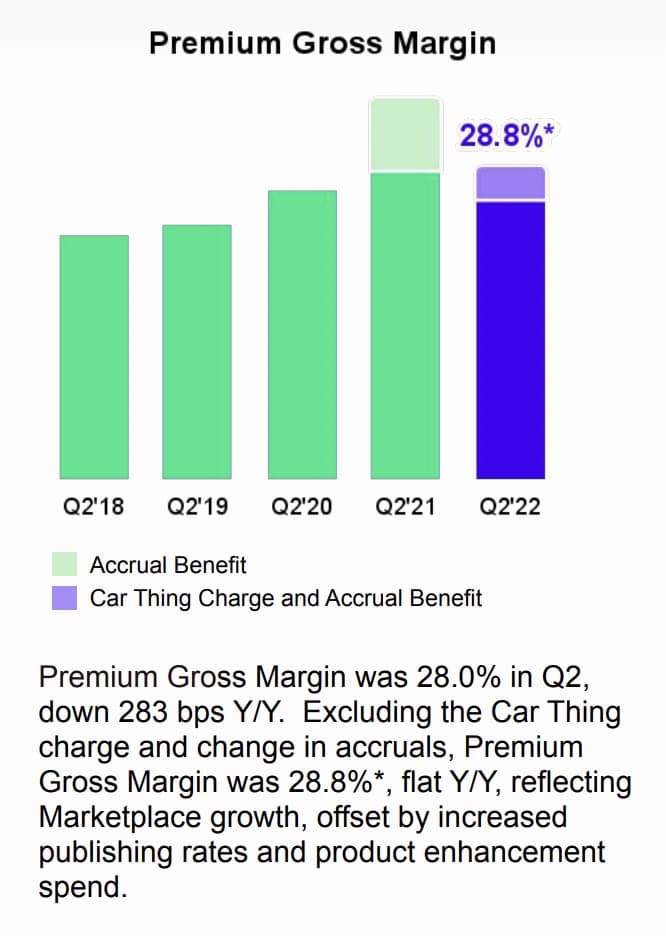

Premium gross margin for 2Q22 was 28% and adjusted premium gross margin was 28.8% when we take the Car Thing charge and the accrual benefits into account:

Premium gross margin (2Q22 slides)

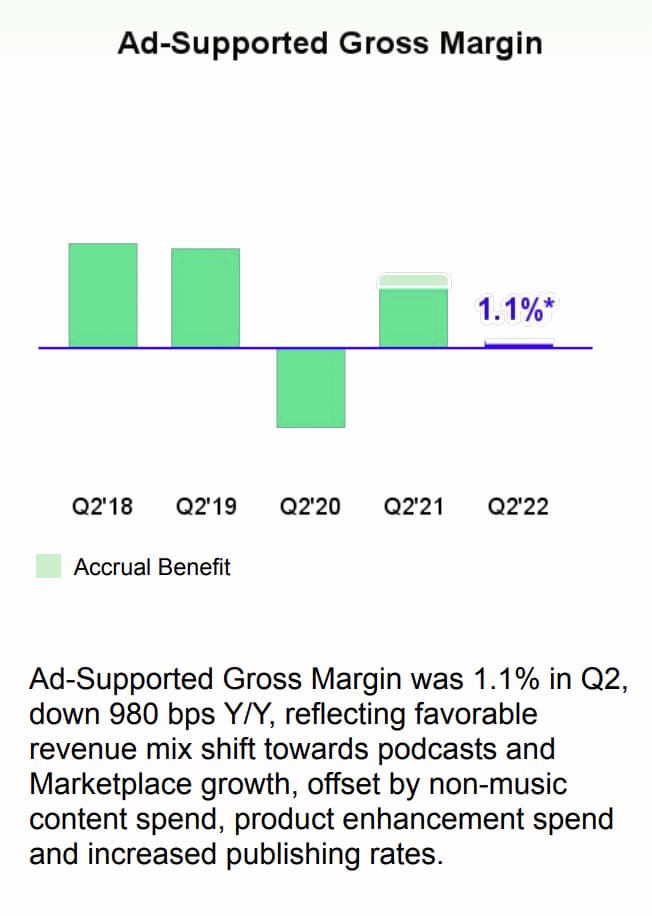

We know the ad-supported gross margin is a drag on the overall gross margin seeing as podcast investments are still in the early innings:

Ad-supported gross margin (2Q22 slides)

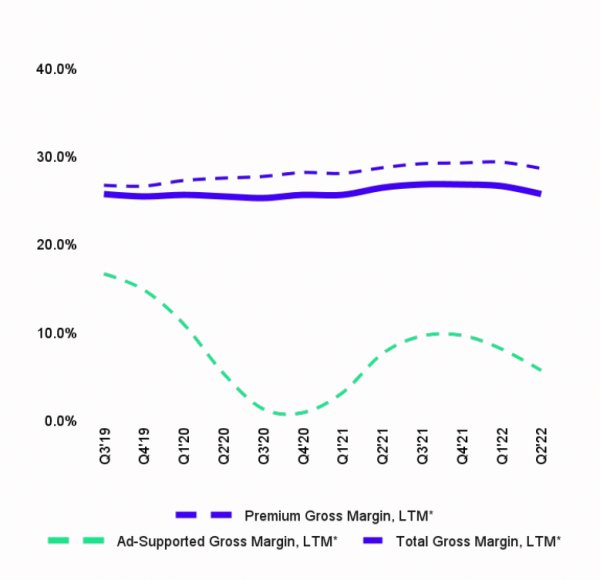

Going back more than just the last 5 quarters, we see that premium gross margins have improved because of the two-sided marketplace and ad-supported gross margins have been more of a drag as podcast investments have intensified:

Gross margin segments (2Q22 slides)

Revenue has climbed nicely from €6,764 million in 2019 to €7,880 million in 2020 and €9,668 in 2021. Again, this doesn’t include the gross margin benefits of the marketplace. Looking at the 2021 20-F and the 2Q22 6-K, trailing-twelve-month (“TTM”) revenue is €10,715 million or €5,525 million + €9,668 million – €4,478 million. We’ve seen that management has made progress with gross margins and I believe this will continue such that there will be opportunities to expand operating margins as well. At the 2022 Investor Day, management said they’d like to get to a 20% operating margin in the next decade. I’m optimistic that they can get to 15% in less than 10 years. If we use a hypothetical 15% operating margin on today’s revenue then we have hypothetical operating earnings of €1,607 million. A multiple of 18 to 20 times seems reasonable to me, implying a valuation range of €28,926 million to €32,140 million.

Today’s market cap is about $21 billion based on the September 9th share price of $110.28 and the 192,948,032 basic shares outstanding from the 2Q22 6-K. My valuation range is higher than today’s market cap and I think the stock is undervalued.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment