stockcam

As my readers know, I have followed exchange-traded fund (“ETF”) firm Ark Invest quite extensively over the past couple of years. Founder Cathie Wood and her team saw their funds under management grow massively after the pandemic, as many of her holdings surged in value. As those massive gains have shifted to large losses, some of these ETFs have consolidated their positions throughout this year. One example of that process has been streaming music service Spotify Technology S.A. (NYSE:SPOT), which I’d like to look at today.

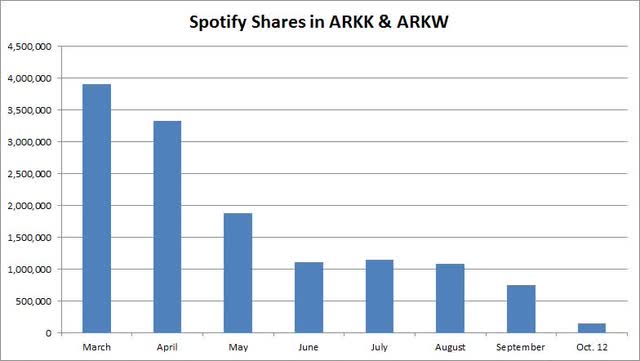

Earlier this year, Spotify was one of the more meaningful positions in the Ark complex. The stock was a top 10 holding in both the flagship Ark Innovation ETF (ARKK) and the Ark Next Generation Internet ETF (ARKW). At the end of March, these two funds held more than 3.9 million shares of the company, which was more than 2% of the total number of outstanding shares, making Ark Invest one of the largest institutional holders.

At the end of March, the flagship ARKK Innovation ETF had just under 4% of its fund in Spotify. The weight in ARKW was almost 4.5%, and these two holdings collectively totaled almost $590 million. In the chart below, you can see how end-of-month holdings have come down considerably since. While some of these decreases were due to fund redemptions, the majority of them were due to allocation sales, which were seen in Ark Invest’s daily trade e-mails.

Wednesday marked a milestone day for the Spotify holding, as ARKK sold the last 300 shares it held of this once nearly 3.2 million share position. ARKW still holds almost 143,000 shares, but that’s down nearly 80% from the end of March level. When you combine the two ETFs, Ark Invest’s holding is less than 3.7% of what it was at the end of Q1. In theory, ARKW could completely exit its position any day now, although there haven’t been any sales of Spotify in the last week.

Like many Ark holdings, Spotify was a name that had been growing revenues nicely in recent years but was losing money. Through the first six months of the current fiscal year, the company has shown solid revenue growth, with net income being just above the flat line. However, Q2 did show a much larger loss than the prior year period, and recent reports suggest that layoffs are occurring. As the graphic below shows, analysts are projecting a bright future for the company’s top line.

Spotify Revenue Estimates (Seeking Alpha)

Since early 2021, Spotify has seen its shares plunge, like many Ark Invest names. After peaking at over $387, the stock closed at just $82.65 on Thursday, and it hit a multi-year low of $78.50 during the day before rebounding with the overall market. The current average Street price target above $136 implies significant upside from here, but that number was over $320 last year before falling almost as fast as the stock has. If U.S. markets retest their recent lows or go even lower due to Fed rate hike fears amidst high inflation, Spotify is a name that isn’t likely to be spared during this ongoing rout.

In the end, it appears that Cathie Wood and her team are close to done selling their position in Spotify. The streaming company’s shares have already seen a complete exit from the flagship ARKK ETF, and ARKW has seen its position reduced by 80% since the end of March. While some of these sales have been due to fund redemptions, the majority were allocation sales reported in the ETF firm’s daily trade e-mails. Ark Invest was once a major holder of more than 2% of Spotify, but a complete exit could happen at anytime now unless Cathie and her team decide to hold a token amount moving forward.

Be the first to comment