Hirurg/iStock via Getty Images

Company Overview

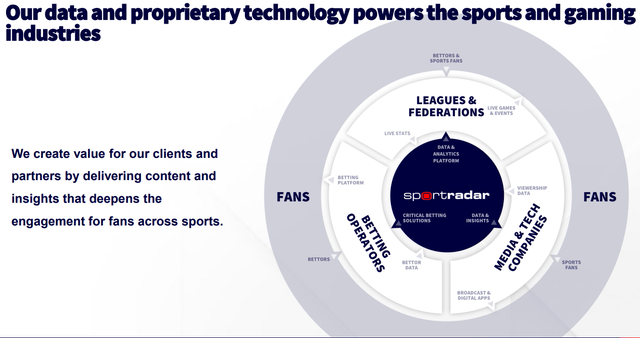

Sportradar Group AG (NASDAQ:SRAD) is a leading global technology platform and solutions provider enabling next generation engagement in sports and sports content. The company is currently the top provider of B2B solutions to the global sports betting industry based on revenue. SRAD provides mission-critical software, data and content via subscription and revenue share arrangements to sports leagues, betting operators and media companies. SRAD also offers sports entertainment and gaming solutions, as well as live streaming services for online, mobile, and retail sports betting. Its software offerings cover the full sports betting value chain, from traffic generation and advertising technology to data collecting, processing, and extrapolation, as well as visualization and risk management solutions and platform services.

Per the annual report, core offerings are listed below:

“For Betting Operators: Our offerings include pre-match data and odds, live data and odds, as well as sports audiovisual content. Our full-suite of software solutions includes managed trading services, managed platform services, betting entertainment tools, virtual games and programmatic advertising solutions.

For Sports Leagues: We provide access to over 900 sports betting operators and over 500 media companies to distribute their data and content globally. We give them greater reach and serve as an intermediary to the highly regulated betting industry. We also provide leagues with a range of tech-enabled solutions including fraud and manipulating monitoring, anti-doping, professional sports team technology and services, and OTT production and technology.

For Media Companies: Sportradar provides a range of services to media companies including data feeds and APIs, sports audiovisual content, broadcasting solutions, digital services, research and analytics, OTT streaming solutions and programmatic advertising solutions.” Source: Company Annual Report

Investment Case

Sportradar was founded in 2001. Over the last 20 years, the company has gone from being a niche industry player to being a global provider of sports technology and media solutions. Along the way, SRAD has built a strong business model with recurring revenue streams, proprietary technology offerings based on a history of innovation, and a global network of customers. These and other factors form a strong investment thesis for SRAD.

Compared to other sports betting industry players, SRAD is a truly global company operating in many diversified markets. Today, the company counts over 1,700 customers in 123 countries globally. Further, its operations include partnerships with 900 sports betting operator customers, and coverage of over 890,000 events annually across 92 sports, including live data coverage of 790,000 events across 32 sports. From a coverage standpoint, this is almost the triple amount of events covered annually by its nearest competitor. SRAD also serves 250 sports league partners and more than 500 media customers. With this global scale, SRAD has been able to carve a “core” position in the sports industry ecosystem.

Beyond market positioning, the company has built what is arguably the deepest and most sophisticated portfolio of sports data and content across the world. SRAD’s offerings are fine tuned to provide low-latency, accurate, real-time, structured data 24/7 and 365 days a year. The company works with over 8,300 independently contracted data journalists which use SRAD’s proprietary technology tools to collect live data from events globally. Additionally, SRAD has been at the forefront of deploying innovative solutions to capture in-game data. SRAD is deploying computer and machine vision systems to capture in-play data in real-time and then leveraging machine learning and artificial intelligence solutions to distribute advanced data to leagues, betting and media customers around the globe. The commentary from management below illustrates the strength of SRAD’s data solutions:

We also operate five data collection centers which are strategically located around the world to provide 24/7 uptime and supported by over 799 full time equivalent data experts, with all processes being ISO 9001 certified for Quality Management. These data collection processes are enhanced by in-stadium verification technology and augmented by direct feeds from sports leagues, computer vision and AI technology. The proof that our system works is in the numbers-up to 30 million odds changes per minute, across more than 40 languages served, and with 99.9% proven accuracy-and underpins our market leadership. Source: Company Annual Report

SRAD’s data lakes can be an important source of competitive advantage going forward. With its proprietary datasets, the company can analyze user behavior to further drive customer interactions and potentially even provide personalized experiences. These investments enrich the data collected, reduce the cost of data collection through automation, reduce latency and enable new AI use cases. This data feeds into a large collection of proprietary, in-depth specific odds models for a wide variety of sports, setting SRAD apart from competitors by making the company essential to sports betting operators who cannot achieve this in-house for all the sports they cover. In the long run, the company hopes its real-time data and analytics for in-play betting will enable experiences that are similar to stock and bond trading for online brokerages.

With a complete technology stack that provides software solutions to address the entire sports betting value chain, from traffic generation and advertising technology, to the collection, processing and extrapolation of data and odds, to visualization solutions, risk management and platform services, SRAD has built a platform which is benefitting from significant network effects. The more betting operators and media companies are brought onto their platform, the broader distribution SRAD gets globally. This attracts new sports leagues to partner with and, in turn, with each new league partner comes more events, deeper sports data and insights, and new opportunities for betting operators and media companies to engage fans. For SRAD, this creates a revenue flywheel effect that should benefit the company and shareholders for years to come.

SRAD’s revenue model is another area that is core to the investment thesis. Management has built a revenue model that includes both recurring features and usage-based upside. The revenue model is primarily structured as follows:

“We generate revenue primarily via two types of contracts: subscription and revenue sharing. We believe this mix of subscription-based revenue and revenue sharing provides us with a stable, predictable base of revenue and allows us to participate in the upside from growing betting volume around the world, especially in more nascent geographies. Typically our contracts related to Betting services are renewed every year, while RoW AV contracts tend to be longer in duration as they are frequently linked to the duration of our major AV rights. Revenue generated from subscription contracts are priced based on the amount of matches, data and the types of products received and include surcharge components based on scale or usage where relevant.” Source: Company Annual Report

SRAD definitely seems to be finding success with this structure. As of Q4 2021, the company reported a Dollar Based Net Revenue Retention rate 125% globally.

In addition to the factors above, growth opportunities for SRAD appear to be numerous and could lead to a significant boost in long-term valuation if the company can successfully execute. To start with, it’s worth highlighting that industry analysts believe global sports betting is a $49 billion market today that will grow to $128 billion by 2030.

While it’s nice to have this industry tailwind, there are many other growth areas SRAD is targeting. For starters, the company is a leader in virtual sports. SRAD has built one of the most realistic virtual sports products around that is designed to simulate actual matches and races on the back of Sportradar’s data expertise in real sports, AI and machine learning capabilities, and advanced 3D graphics technology. This virtual sports technology could become much more widely adopted as bettors look for more sophisticated simulation solutions to improve their betting capabilities.

Additionally, management has moved quickly into the e-sports betting markets as well. Although global e-sports betting remains just a fraction of the market today, SRAD’s first mover capabilities in this space could pay off handsomely down the road. Further, the company is also exploring interactive content, augmented reality and gamification solutions which could greatly enhance the user experience. Although these types of opportunities may be smaller today, SRAD management is planning for the future and trying to enhance its “revenue flywheel.”

Also core to SRAD’s growth strategy is the ability to expand its B2B service offerings. Management is bullish here, noting that:

“Expand Offerings in B2B Products and Services For example, our Radar360 data research platform is used by leagues and is increasingly being utilized by broadcasters to provide pundits with reliable, accurate data. Logs show that our Analytics Engine over the last six months did over 55 million queries and provided a response within milliseconds. Providing more innovative solutions will further strengthen our relationships with leagues, enabling us to cost-effectively secure access to official rights and position ourselves favorably for the expected opening of new segments, such as college sports in the United States.” Source: Company Annual Report

Lastly, as part of the investment case, it’s important to highlight the strength of the company’s leadership. SRAD’s Founder and Chief Executive Officer, is Carsten Koerl, a successful entrepreneur in the sports betting market and is the driving force behind its vision, mission and culture. Koerl founded the online betting platform, betandwin Interactive Entertainment, in 1997 and led the company through a successful listing on the Vienna stock market in 2000. Over the last 20 years, Koerl has built SRAD into a global sports and media technology enterprise. Outside of the leadership team, SRAD has also secured a prominent network of sports industry investors and advisors such as Mark Cuban and Michael Jordan.

Investment Risks

The investment case above certainly offers a number of bullish themes for potential investors to evaluate. Although the investment thesis for SRAD is strong, there are several risks that investors will want to watch as well.

In the 2021 annual report, management disclosed a material weakness in its financial reporting. According to the company, the material weakness is related to insufficient design and implementation of controls, IT systems and segregation of duties. SRAD is rolling out new ERP systems to address this issue, though there could be integration and transition complexity over the next couple of years. As a newly public company, management will need demonstrate that this weakness is remedied or risk possible significant losses of investors if there’s little faith in the financials.

Control and corporate governance are other watch areas. As of December 31, 2021, the Founder, Carsten Koerl, holds all of the issued and outstanding shares of the Class B ordinary shares, which, together with his outstanding Class A ordinary shares, constitutes approximately 81.7% of the total voting power of the outstanding share capital. Investors considering SRAD need to be aware that the company’s future will largely be defined by Koerl’s ambitions and that investors may not have the opportunity to bring alternative proposals up for evaluation.

Much of SRAD’s future is largely dependent on 2 key areas – the company will need to maintain its global portfolio of sports data rights and also drive further end – user usage of its products and solutions in order to benefit from the upside of sports betting. Loss of data rights from Tier 1 sports leagues (NBA, MLB, NHL, UEFA, etc.) could lead to material revenue reductions. The company will also need to continue to innovate around its user experiences to help continue to drive more business, data, and users through its platform. Although SRAD is in a strong position today, continuing to grow will require significant innovation and flexibility from management.

The betting and data markets are characterized by a vast number of rules, regulations and licensing procedures. Failure to comply with regulatory requirements in a particular jurisdiction, or the failure to successfully obtain a supplier license or authorization applied for in a particular jurisdiction, could impact SRAD’s ability to execute on its strategic vision.

On a macro level, investors will also want to keep an on the global economic outlook. Lowered demand for some of SRAD’s solutions is likely to result during worsening economic times, with consumers having less disposable income and pulling back on discretionary activities like sports betting. COVID also presents a somewhat unique risk for SRAD, as many of its sports league partners are located in international areas where significant lockdowns occurred and stopped sporting events.

M&A activity and integrations are also a risk for SRAD. Since 2010, the company has completed 13 acquisitions. Although management has successfully navigated these transactions to date, SRAD is a much larger company now with more operational areas that it must juggle alongside of any M&A activity.

From a competitive standpoint, SRAD primarily competes with Genius Sports Limited (GENI), privately held Stats-Perform, and IMG Arena (EDR). It likely will not be easy for new competitors to enter this market, as these 4 companies largely have locked up the most valuable sports data rights for many years to come. However, among these 4, competition is quite strong. Management summed up the competitive landscape very well in the 2021 annual report:

“Certain competitors could use strong or dominant positions in one or more markets to gain a competitive advantage against us, such as by integrating competing platforms or features into products they control such as search engines, web browsers, mobile device operating systems or social networks; by making acquisitions; by making access to our platform more difficult; or by employing more aggressive bidding strategies with our sports league partners. Further, current and future competitors could choose to offer a different pricing model or to undercut prices in the market or our prices in an effort to increase their market share. Failure to compete effectively against any of these or other competitive threats could adversely affect our business, financial condition or results of operations.” Source: Company Annual Report

Financial Overview

In recent years, SRAD has demonstrated strong financial execution. 2021 revenue grew 39% and reached 561 million euros. However, the company may have benefitted from easy YOY comps as 2020 was impacted by COVID. Moving down the income statement, SRAD has gross profit margins of 49% in 2021. The significant costs of sales/goods reported are largely due to the costly sports data rights SRAD requires to run its business. In 2021, net margin was 2.3%. While these margins are ahead of many of the company’s competitors, it should also be noted that net margins have largely been stuck in the 2-3% range since 2019.

Having recently gone public, it’s not surprising to see that SRAD reported having 743 million euros of cash on the balance sheet at YE 2021. A portion of this cash will undoubtedly go to paying off some of its 411 million euros of long-term debt, as well as its 253 million euros of current liabilities (including sports rights payments). Overall debt seems manageable, as SRAD has a debt to equity ratio of 0.55 at YE 2021.

According to Seeking Alpha data, free cash was 61.3 million euro in 2021, up 19% YOY. In the coming years, I’ll be looking to see both growth in FCF, as well as an improved FCF yield.

Looking ahead to 2022, the company is guiding to revenue of 665 million to 700 million euros, representing a 20-23% increase. According to analyst projections, the company will maintain a 20% growth rate for 2023 and achieve revenue of 800 million euros.

For 2021, return on total capital clocked in at 3.64%. This is less than half SRAD’s sector median of 7.91%.

Valuation and Recommendation

When valuing SRAD, there are a lot of factors to consider. Value enhancers include its strong market positioning, end-2-end product offering, global operations, revenue/growth optionality, innovative and proprietary technology, experienced leadership and revenue flywheel. Value detractors include a very competitive market, slowing growth, weak profitability and weak financial comps as company that desires to be valued in the SaaS category. In my view, valuing SRAD on a price-to-sales basis is the right methodology since profitability is low and the future free cash flow outlook is unclear at this time.

SRAD has a current market cap of $4.9 billion, meaning that it’s trading at 8.0x TTM sales and 6.0x 2022 sales. For comparison, DraftKings (DKNG) currently trades at 5.0x 2022 sales. At the moment, I’d argue SRAD appears to be fairly valued for a company that’s growing its topline at 20% per year. Some may feel that SRAD deserves a higher multiple as a SaaS company, but current growth makes it difficult to justify this premium and the content rights costs also make it hard to consider SRAD as a true SaaS. Using the 6.0x multiple and 2023 sales of $890M SRAD could hit a valuation of $5.3 billion in 2023.

While there’s much to like about SRAD’s strategic positioning, including its proprietary data and technology solutions, customer relationships and global positioning, there does not appear to be enough growth at the moment to rate the company a buy today. For the time being, a neutral / hold rating is fair, though, given the quality of the overall company, there’s a strong case for keeping SRAD on the watchlist to see if growth re-accelerates in the future. Alternatively, a market cap closer to $4 billion would offer a much safer entry point for potential for improved returns.

SRAD is a high quality company, with a proven business model, strong leadership and growth potential. However, there’s likely a better entry point for this stock, especially given current market volatility.

Be the first to comment