sharply_done/E+ via Getty Images

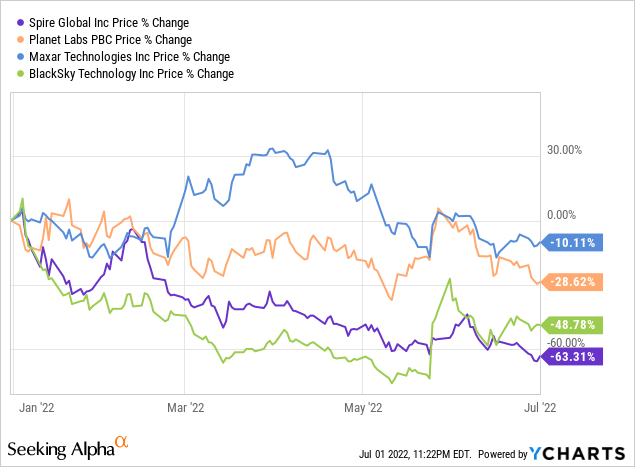

Space, the final frontier… Lately, that frontier has been an epic bloodbath! Space services companies took advantage of the market and SPAC boom of 2020 & 2021 to introduce themselves to public markets, with great initial fanfare. However, since November of 2021, just about all space service companies have been slaughtered by the market.

In this article, I would like to focus on Spire Global (NYSE:SPIR), which is by far the least sexy of the recent space tech bunch. However, I believe this company has carved out a potentially valuable niche in the market, along with presenting a compelling current valuation.

Overview

Spire Global competes in the exciting space tech category by way of a deployed constellation of over 100 radio frequency “listening” satellites. These types of satellites and the information that they collect, puts Spire Global on the opposite side of the spectrum to imaging company’s BlackSky (BKSY), Planet Labs (PL) and Maxar Technologies (MAXR).

Being in an exciting new field, such as space technology, has certainly not translated to investor profits just yet as the entire sector has been taken to the woodshed so far in 2022, with Spire Global by far faring the worst.

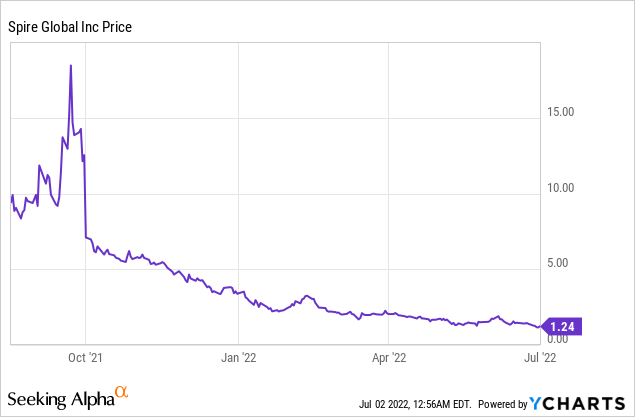

A slightly longer chart would also put into graphics what many current Spire investors know has been a stunning 87% loss of value since the 2021 SPAC transaction.

I would suspect that a fair amount of the markets seeming hatred for this stock is rooted in a fundamental misunderstanding of the actual business along with the lack of flashy pictures of ships and tanks being splashed all over our T.V screens during Russia’s invasion of Ukraine.

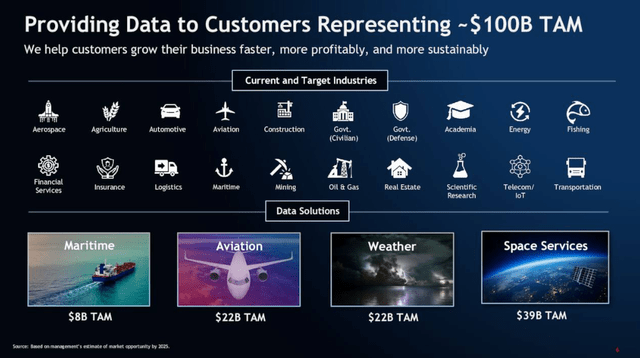

Spire Global has positioned its focus solely on radio frequency satellites and into four distinct markets per the company’s SEC filings:

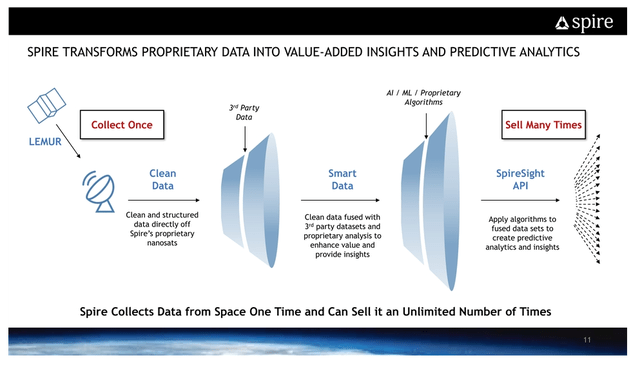

Our platform applies our value-add insights and predictive analytics to this proprietary data to create commercially valuable datasets. We offer three data solutions to our customers, which vary in complexity and price and can be delivered in near real-time via our API that can be easily integrated into our customers’ business operations:

•Maritime: Precise space-based data used for highly accurate ship monitoring, ship safety and route optimization.

•Aviation: Precise space-based data used for highly accurate aircraft monitoring, aircraft safety and route optimization.

•Weather: Precise space-based data used for highly accurate weather forecasting. For each data solution, we have the capability to offer customers a variety of features and additional value.

The four forms of data we monetize are:

•Clean data: Clean and structured data directly from our proprietary nanosatellites;

•Smart data: Clean data fused with third-party datasets and proprietary analysis to enhance value and provide insights;

•Predictive solutions: Big data, AI and ML algorithms applied to fused data sets to create predictive analytics and insights; and

•Solutions: Data-driven actionable recommendations to solve specific business problems, utilizing the full spectrum of our data analytics suite.

As our fourth solution, we are also pioneering an innovative business model through our Space Services solution. We leverage our fully deployed infrastructure and large-scale operations to enable our customers to obtain customized data through our API. Our customers can begin receiving data in less than a year after engaging with us and receive data by entering into a subscription agreement. Our Space Services offering provides our customers with fast, scalable and reliable access to space. Our solutions are offered to customers across numerous industries. We have the opportunity not only to upsell within each solution but also to cross-sell among all our solutions. We provide our solutions to global customers through a subscription model or project-based solutions.

Spire Global

In essence, Spire has decided to focus on the fundamental building blocks of nearly every business on earth, real time, global, situational awareness. This focus is certainly not small potatoes, it is potentially a massive business given the pervasive need for businesses and governments to utilize every avenue to more efficiently structure their organization or services they provide.

The amount of waste and inefficiency in each of the company’s target industries is absolutely colossal, providing the company with a very compelling value proposition to customers.

Spire believes that they currently operate one of the world’s largest “listening” constellations, observing the earth utilizing radio frequency sensors. In addition, and perhaps more importantly, the company has designed customized APIs to integrate and organize the data that they provide efficiently into its customers business systems and process. The company currently collects and processes over five terabytes of data, per day and operates 70 ground-based antenna stations.

The type of data and insights that the company provides, along with the availability of a subscription service for this data, is only in its infancy as before the private sector space boom, this area was almost completely dominated by absurdly expensive government satellites who hoarded nearly all of the truly useful information to themselves.

The development of functional API’s that can deliver useful and actionable data directly into business systems for customers in the maritime, aviation and massive weather data market cannot be understated in its importance or utility.

The data that the company collects, it claims, is data that has no terrestrial alternative, meaning that only space-based satellites are able to collect the data that they sell and in addition, due to the proprietary nature of this data, the company can sell it an unlimited amount of times across broad industries, making this a highly scalable business with a relatively fixed cost structure.

Spire has also entered the space-as-a-service category by way of the Lemur satellite system, which is a flexible platform designed to accommodate hosted payload integration and is offered as a subscription service to aerospace and defense customers.

Each of Spire’s satellites are “multi sensor” functional, meaning that each one is capable of AIS maritime tracking operations, GNSS-RO weather data collection and ADS-B aircraft sensors, allowing the company to operate in all three categories using the same satellites.

Risks

This is certainly a risky stock and I will not go over every factor that I see, however, I would like to take a moment to focus on what I see is the greatest risk factor for Spire in the medium term, which rings true for nearly all space technology company’s currently, this is the lack of a defensible moat.

At this time, I see no truly unique moat that the company possesses. The company’s satellites are highly advanced and the company has a distinct first mover advantage in the field, however nothing that I see is preventing a competitor from building a similar constellation.

Certainly, the company is generating gobs of proprietary data and has built unique API’s which are quite valuable, but if this model becomes highly profitable and widely adopted by customers, I would imagine that space may become flooded with similar satellites providing perhaps identical services.

Currently, I view this as a more medium-term threat given the absolutely brutal beating that nearly all space stocks have taken since IPO, thus likely making the venture market take a pause for competing players, however, the lack of a defined and defensible moat is noteworthy and is likely to come into play eventually.

Valuation

At current share price levels, Spire is priced as a walking corpse. Wall Street has thoroughly chewed up the shares over the course of the last year, taking the price down from a high of $18.45 in September of 2021 all the way down to the current $1.24.

The above chart certainly does not reflect the underlying business however as the company in Q1 reiterated 2022 guidance for $85-$90 million in revenue along with free cash flow positivity in 22-28 months or early to mid-2024.

Analysts are currently predicting revenue to grow at well over 50% rates into 2024 and the company trades at a rather paltry 1.55 EV/S ratio based on 2022 estimates. This compares favorably with others in the space tech sector as Black Sky trades at a 3.10 EV/S ratio, with Planet Labs at 3.78, indicating Spire is trading at a huge discount to others in the field even while having a better current margin profile.

One part of Spire that investors have noted as a reason to dump shares is the relatively small cash balance of $91 million as of Q1 2022 and the need for a capital raise in the semi-near future. Thankfully, the company on June 14th seemingly addressed this issue by entering into a financing agreement with Blue Torch Capital, raising $120 million.

The company plans to use these proceeds to pay off its $71 million credit facility and may now have enough funds on the balance sheet to reach profitability. I really like this move, even though the terms are not the most favorable I have seen, however an equity raise at these levels was simply not acceptable.

Bottom Line

This is not the absolute best business I have ever looked at, given the lack of a viable moat, however, the share price makes it one of the most compelling higher risk opportunities in the current market given the massive disconnect between the business fundamentals and the value awarded by the market.

In my opinion, Spire has been tainted by the SPAC curse to an unreasonable level and investors are not seeing the full picture, nor appreciating the massive scalability of this company.

I have been watching each of the space technology companies for some time now and in my opinion, Spire’s offering simply makes sense to me as a viable and potentially highly profitable business for the long term. Given the current share price, I would think that as the company makes progress towards profitability over the coming years, the returns from the current $1.24 per share, could be asymmetric.

This is a very risky stock and as such, any potential investors should be prepared to potentially lose your entire investment. Given that, I have opened a small speculative position at a cost basis of $1.25 that I plan to grow should shares remain at current levels.

Let me know your thoughts in the comment section below. Thank you for reading and good luck to all!

Be the first to comment