Khanchit Khirisutchalual

Inflation-linked bonds have recovered slightly following the brutal selloff seen over the past year. The rally in TIPS has occurred despite a fall in breakeven inflation expectations over the past few months, as the fall in regular bond yields has more than offset this effect. Going forward, I expect to see real yields fall significantly further as interest rate expectations fall and inflation expectations rise. The SPDR Portfolio TIPS ETF (NYSEARCA:SPIP) offers exposure to the sector with a minimal expense ratio of just 0.12%.

The SPIP ETF

SPIP tracks a market-value-weighted index of inflation-protected U.S. Treasury with a remaining maturity of at least one year. The ETF has a real yield of 1.6%, which is what investors should expect to achieve after inflation over the maturity of the bond fund, which is currently 7.8 years. However, as I will explain below, I believe that returns are likely to be significantly higher than this over the coming 12-24 months. The SPIP is similar to the iShares TIPS Bond ETF (TIP) and the Schwab U.S. TIPS ETF (SCHP). The SPIP has a slightly higher weighted average maturity compared to its peers, suggesting a slightly higher degree of volatility.

Peak Monetary Tightening Has Now Passed

From its peak in November last year to its recent low, the SPIP fell by an uncharacteristically large 21%, which was greater than the crash seen during the global financial crisis and the taper tantrum of 2013. Even when taking into account the substantial income received from elevated inflation prints, the total return loss has still been 16%, again larger than the previous two bear markets.

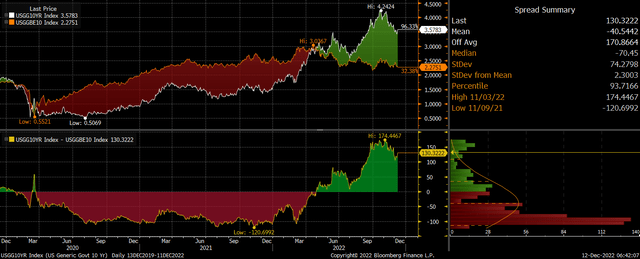

US Breakeven Inflation Expectations Vs Bond Yields (Bloomberg)

The significant losses seen on the SPIP over the past year have been caused by a unique set of circumstances. In response to rising inflation, the Fed’s aggressive tightening cycle not only saw bond yields rise across the entire curve, but it also caused a drop in inflation expectations as investors anticipated tight monetary conditions would bring down inflation. As a result, the yield on 10-year inflation-linked bond yields rose from a low of -1.2% in November 2021 to a high of 1.8% in October. As inflation prints continue to moderate, we are likely to see a reversal of the trends seen over the past year or so. Falling headline inflation is likely to allow the Fed to adopt a more dovish stance, driving down bond yields and raising inflation expectations.

U.S. To Join Their Peers With Negative Real Yields

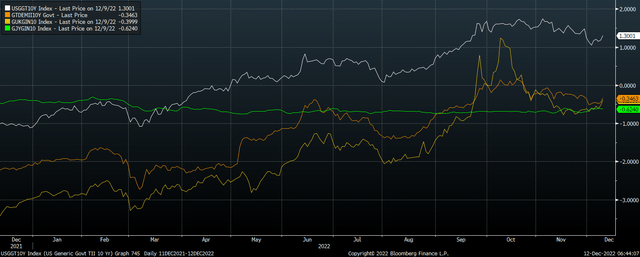

I actually expect long-term real bond yields to fall back below zero over the coming years, as is the case in most developed market bond markets. As the chart below shows, the U.S.’ positive real yields stand in stark contrast to those in Germany, Japan, and the U.K. In the case of Germany and the U.K. yields briefly moved into positive territory in September and October before tighter credit conditions began to weigh on the real economy, causing yields to fall back below zero.

10-Year Inflation-Linked Bond Yields: US, German, UK, Japan (Bloomberg)

As I argued in a previous article on TIPS last month (see ‘CPI Decline Gives Green Light To TIP Investors‘), economic and fiscal realities will ultimately necessitate a return to negative real bond yields. Firstly, real bond yields are closely linked to the real growth rate of the economy. I expect real GDP growth to average less than 1% over the long term for reasons explained here. Secondly, persistent fiscal deficits will need to be funded by increasing levels of debt, and the Treasury will be keen to keep borrowing costs down to prevent a ballooning of interest costs. Thirdly, continued high real bond yields pose risks to the corporate sector, which is also sitting on record levels of debt. So far, the rise in real Treasury yields has had little impact on credit markets as credit spreads have remained subdued, but should we see a rise in risk aversion, the Fed is likely to try to force down real yields to ease pressure on highly indebted corporates and prevent a rise in bankruptcies.

Should we see real bond yields fall back to zero, this would result in gains of almost 10% for the SPIP ETF, in addition to the returns linked to the CPI. This is a particularly attractive proposition considering the relatively low duration of the fund, its low correlation with traditional bond funds and the stock market, and the tendency for the ETF to perform well during weak economic conditions.

Summary

The SPIP offers investors a low-cost opportunity to benefit from an unwinding of the monetary tightening seen over the past year. The 1.6% real yield on the ETF is high relative to its long-term average and the yield seen on international inflation-linked bonds, and there is also potential for significant capital gains as yields move back down towards zero.

Be the first to comment