alphaspirit/iStock via Getty Images

Spero Therapeutics (NASDAQ:SPRO) surprised its shareholders last week with a deal with GlaxoSmithKline (GSK) that secures the future and development of its most advanced asset, Tebipenem HBr. The deal was very positively received by the market and the share price tripled at its peak within a very short period of time.

In my opinion, the example of Spero Therapeutics is a very good example of how irrational biotech stocks are currently valued by the market. On the one hand, the enormous surge in market capitalization shows very clearly how undervalued Spero Therapeutics was before the deal was announced. Ultimately, the value was not created by positive trial data and progress in Spero’s clinical development pipeline, but the existing pipeline value was simply validated by an external partner. On the other hand, I think the current price shows that the market is still having difficulties valuing the deal.

In the following article, I will analyze whether the share price surge is justified and derive a fair value for Spero.

Business of Spero Therapeutics

Logo of Spero Therapeutics (Source: Company Homepage)

It is our mission to bring hope to patients and families of loved ones suffering from serious infections. Source: Company Homepage

Founded in 2013, Spero Therapeutics is a clinical-stage biopharmaceutical company headquartered in Cambridge, Massachusetts. The company focuses on treatments with a novel therapeutic approach to treat multi-drug resistant and life-threatening bacterial infections and rare diseases. With its multiple, late-stage assets, Spero addresses indications with both a major unmet medical need and a strong commercialization opportunity.

In anticipation of approval of its lead asset, Tebipenem HBr, Spero began ramping up commercial activities for the US market earlier this year. However, feedback from the Late Cycle Meeting from the FDA had serious consequences for the company and resulted in a strategic re-alignment. This realignment ultimately led to the recently announced exclusive licensing agreement with GSK.

Investment Thesis

Before going into more detail, I want to explain my investment thesis. While I believe most of the other companies presented are undervalued due to their pipeline, the key driver for Spero is the inadequate recognition of the GSK deal. In my opinion, the current market capitalization does not reflect the potential value of future milestones from the GSK deal.

In this article, I will focus in particular on the deal with GSK and the associated impact on Spero’s financial position (among other things, due to Seeking Alpha’s guidelines regarding the Microcap Coverage Policy. For biotech stocks, the threshold is a market capitalization of $500 million). However, I could imagine evaluating the potential of the pipeline beyond Tebipenem HBr in further articles.

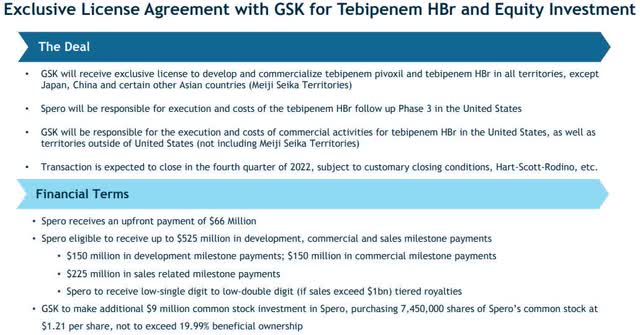

Assessing the Deal with GSK

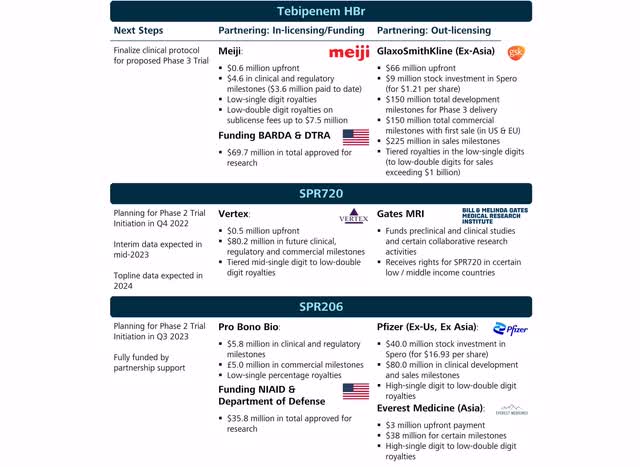

The agreement grants GSK worldwide rights for the development and commercialization of Tebipenem HBr except for certain territories in Asia. Spero will be responsible for the further clinical development, in particular the costs for a follow-up phase 3 clinical trial. From this date, GSK will be responsible for regulatory approval and commercialization activities. The deal is expected to close in the coming weeks, subject to customary closing conditions.

Spero benefits on the one hand from the immediate strengthening of its own financial position and on the other hand from the long-term performance of Tebipenem HBr in the form of future milestones.

Summarizing the deal with GSK (Source: Company Presentation)

Instant Footprint: Boosting the Financial Position

The partnership with Tebipenem HBr gives Spero the immediate benefit of a much-needed cash boost. Spero will receive a non-dilutive upfront payment of $66 million, and GSK will also purchase shares of Spero for $9 million at a price of $1.21.

With the closing of the deal, Spero is in an excellent financial position to further advance its pipeline and to conduct the follow-up Phase 3 study to obtain additional milestones. The current cash balance even exceeds the current market capitalization of $95 million, resulting in a negative pipeline value of $20 million. The cash balance already includes the payments from GSK and the $5 million milestone payment from Pfizer related to SPR206.

Financial Overview of Spero Therapeutics (Source: Author’s Chart)

The financial situation and the comfortable cash runway beyond 2024 provide the foundation for my investment thesis, but the real value drivers are the milestones.

Milestones: Patience is All Investors Need

The deal includes highly attractive milestone payments, which are very special as they are only partly dependent on the future success of tebipenem HBr. These milestones have the potential to boost Spero’s market capitalization from current levels. In total, Spero may receive up to $525 in milestone payments.

In order to value the future potential milestone payments, it is possible to calculate the Net Present Value (NPV). This involves multiplying the value of the future payment with the probability of success and subsequently discounting it. In the following, I will assign a fair NPV to the milestones based on this calculation.

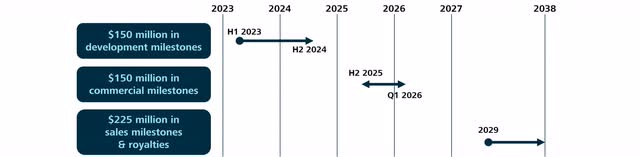

The first and easiest milestone of $150 million includes the execution of the follow-up phase 3 clinical trial of Tebipenem HBr. Overall, Spero is keeping very tight-lipped about the composition of these milestone payments, but generally speaking, these milestone payments compensate Spero for the costs associated with the Phase 3 trial. The first milestone payments could already be due with the final design of the Phase 3 trial, but the total milestone payment will be due at the latest upon completion and delivery of the results of a clinical study. The interesting thing about this milestone: it’s not linked to the success of a clinical trial and therefore, it will certainly be achieved. For more information: The design of this milestone is very similar to the design of the milestone regarding SPR206 with Everest Medicines.

Accordingly, all investors need to receive this milestone payment is patience. Spero expects to initiate the follow-up Phase 3 trial in 2023 after final alignment with the FDA. Following the footsteps of the first phase 3 trial with Tebipenem HBr, I expect results to be published within roughly 15 months. Accordingly, this milestone should be achieved by the end of 2024.

The next milestone payments totaling $150 million will be due upon approval and successful launch in the U.S. and Europe. The exact milestone structure has not been disclosed. Approval in the USA should be possible in the second half of 2025, while in Europe it may take until the first quarter of 2026.

This milestone assumes positive Phase 3 trial results, regulatory approval and the economic attractiveness of the product and is therefore subject to uncertainty.

Nevertheless, I believe that this milestone payment is very likely to occur. Spero has already conducted a phase 3 study with Tebipenem HBr and the results are available. The study results show that oral administration of Tebipenem HBr was equally effective and safe compared to the intravenous administration of ertapenem. Simply summarized, the primary endpoint of statistical non-inferiority was met. Furthermore, the FDA has already communicated that a confirmatory study is sufficient for approval.

The estimation of a probability is of course always subjective, but for the calculation I personally assume a conservative 60% probability of an approval success.

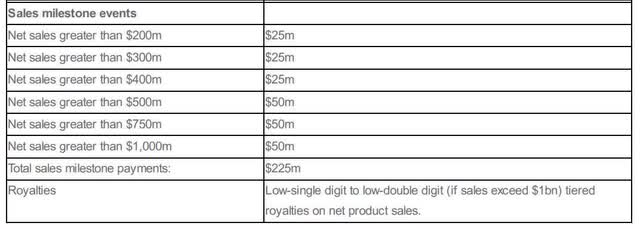

Last but not least, Spero is entitled to sales milestone payments and royalties.

Breakdown of sales milestone payments (Source: Company News)

Spero could possibly receive the first sales milestone payment for reaching net sales above $200 million in 2029. Overall, tebipenem HBr is patent-protected until 2038.

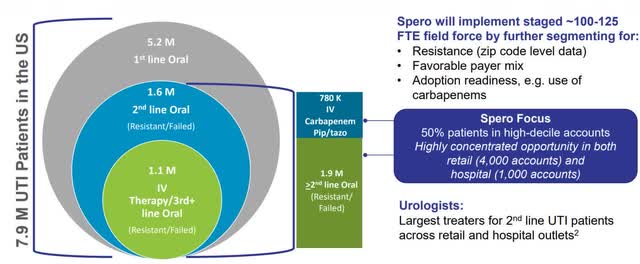

To estimate the peak sales potential, I will refer to information provided by the company and management. Overall, the carbapenem market is estimated to reach $3 billion in the United States alone. Therefore, it is not surprising that Spero sees blockbuster potential in Tebipenem HBr despite being the second line treatment and compares it with Zyvox sold by Pfizer (PFE) with peak sales of $1.4 billion.

Target patient population (Source: Company Presentation)

The deal with GSK partially confirms these assumptions. The deal confirms that tebipenem HBr is a real drug with both a clear therapeutic and economic benefit and can reach sales of up to $1 billion. If Tebipenem is approved, GSK has invested $375 million in the deal, excluding commercialization costs. GSK wouldn’t have signed this deal if they didn’t expect to profit from it at the end of the day.

Based on this information, some sales milestone targets appear to be well within reach. If everything goes very well, I believe the first target could possibly be reached in fiscal year 2028.

Since sales milestone payments are subject to a high degree of uncertainty and remain in the long term, I currently only want to mention them as a potential, but do not want to include them in the calculation. The same applies to the mentioned royalties. I believe that these are passed on directly to Meiji Pharma, in particular at the beginning of sales activities.

The timeline and scope of expected milestone payments (Source: Author’s Chart)

I calculate the NPV using the following assumptions:

- The current financial situation is required to achieve the future milestone payments and advance the clinical development pipeline. I assign a value of $0.

- The development milestone payment of $150 million is discounted (from Q4 2024 to Q42022) at an interest rate of 12%. I assign a value of $120 million, which corresponds to about $2.55 per share.

- The commercial milestone of $150 million is discounted (from Q4 2025 to Q4 2022) at an interest rate of 12%. I assign a value of $75 million, which is about $1.60 per share.

- I do not consider other sales milestone and royalty payments.

- I do not take into account the further pipeline of Spero.

Based on my conservative assumptions, I calculate a fair net present value of $4.15. Even in the worst-case scenario, meaning disappointing Phase 3 data and a discontinuation of the program, I end up with a fair NPV of $2.55, which is an upside of 27.5% based on today’s prices. Consequently, current prices represent an excellent risk-reward ratio.

Background of the Deal

Finally, I want to briefly explain why Spero hammered this deal. In short, Spero screwed up on its approval and commercialization strategy and found itself in a lousy position following the FDA’s CRL. If approved, Spero could have accessed additional non-dilutive capital or negotiated from a position of strength and start with the commercialization. Thus, however, partnering the asset was the only way to protect shareholder value from massive dilution or expropriation as more capita was needed to initiate the required Phase 3 study.

Leveraging Business Development Activities to Advance the Pipeline

As already mentioned, I do not value the other assets in Spero’s pipeline for my NPV calculation. Nevertheless, I am convinced that these assets can create massive shareholder value. Most notably, this is related to Spero’s strategy of actively leveraging business development activities to advance its assets. In the following, I want to give an overview of the pipeline and upcoming milestones.

Spero is very actively leveraging business development activities (Source: Author’s Chart)

SPR720

SPR720, in-licensed from Vertex (VRTX), is an orally administered antibiotic for the treatment of non-tuberculous mycobacteria (NTM). NTM describes a cluster of very common bacteria in water or soil, but which, in rare cases, can cause severe and chronic lung infections with debilitating pulmonary symptoms. In most cases, people with a weak immune systems or damaged lungs are more likely to be affected.

The current treatment regimen includes a cocktail mix of different antibiotics for a treatment period of approximately 12-24 months. Even with early identification and treatment, the therapeutic effect is limited and can cause side effects.

SPR720 has orphan drug status and, if approved, could be the first and only oral treatment focusing on Treatment Naïve and Treatment Inexperienced NTM patients. Overall, the disease affects 95,000 patients in the U.S. and a total of 245,000 in the U.S., Europe, and Japan, with 75% of all NTM patients being non-refractory and representing the target population of SPR720. For refractory patients, there is an approved product with limited therapeutic benefit, Insmed’s (INSM) Arikayce.

As early as the fourth quarter of 2022, Spero plans to initiate a phase 2 proof-of-concept study with the objective to show an early microbiological response in the 35 enrolled patients. While topline data will not be available until early 2024, analysis of interim data in mid-2023 could provide early evidence of SPR720’s efficacy.

SPR206

SPR206 is a novel intravenous antibiotic for the treatment of multidrug-resistant bacterial infections. In particular, severely ill patients are often treated with multiple agents in parallel, which are often associated with a poor risk-benefit profile and nephrotoxicity. SPR206 is being developed with the goal of providing an effective and safe treatment alternative.

Spero plans to initiate a Phase 2 study across multiple indications by the third quarter of 2023. The study will include patients with complicated urinary tract infections, Hospital-acquired / ventilator associated bacterial pneumonia, and bloodstream infections.

While the full, external, and non-dilutive funding of this study is a major advantage, it has a drawback for the schedule or progress of the clinical development of the drug. Instead of working on several processes in parallel, as is often the case, a sequential order is adopted here. Remarkable partnerships with Pfizer and Everest Medicines should be mentioned, while Spero still retains the rights in the US. Overall, external funding and partnerships validate the potential of SPR206.

Particularly in this scenario, I can imagine that Pfizer is also interested in the rights in the US. However, Spero had originally planned to handle the commercialization in the US themselves. Once they started with Tebipenem HBr, they could have leveraged their sales organization with SPR720 and SPR206. It would therefore be fair to assign a value to the pipeline as well, although this is much more difficult to estimate than calculating the NPV of the milestones.

Institutional Ownership

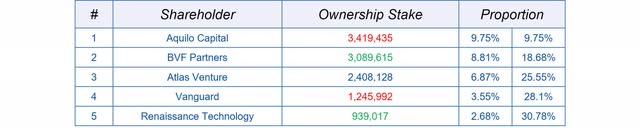

After such drastic corporate changes, there is always the question of how the largest institutional investors will react to the changes. Either existing institutional investors take advantage of the extremely high volume to sell their shares, or new ones are attracted by the new situation. So far, it is too early to analyze the impact of the deal on institutional holdings. Nonetheless, I want to give an overview of the 5 largest Institutional Holders, holding a combined stake of over 30% of Spero.

Overview: institutional holdings (Source: Author’s Chart)

It is noteworthy that the renowned BVF, for example, almost doubled its share in the last quarter and thus possibly after the Spero’s announcement of a strategic realignment. On the other hand, Aquilo Capital sold nearly 2 million of its previously more than 5 million shares in Spero after the deal with GSK. The interesting thing here is that the high volume was not used for a complete divestment in Spero. In general, it should be noted that most institutional investors bought their shares at significantly higher prices.

Risks

In my opinion, I have explained very well in my article why Spero is an interesting investment for me with an appealing risk-reward ratio. Nonetheless, in this section I would like to specifically address potential risks. Overall, I believe that by focusing on the deal and the potential milestone payments, I have excluded most of the risks.

- The deal is fundamental for my investment thesis. Therefore, I have to mention that the deal is still pending. However, I currently have no concerns about the finalization of the deal. Spero expects the deal to be approved and closed in the fourth quarter of 2022.

- The achievement of my full price target is dependent on the approval of tebipenem HBr. If the phase 3 trial fails, this limits the upside and reduces the price target to $2.55.

- Due to its small market capitalization of about $100 million, Spero’s share price can be more easily influenced by speculators. Overall, the share price may be subject to higher volatility.

- Although I did not include Spero’s pipeline in my price target, negative interim study results may negatively impact the share price in mid-2023.

Summary

In summary, I believe that in the long run both Spero and GSK will benefit from the deal. While the deal relieves Spero from this troublesome situation, GSK benefits in acquiring an attractive asset at an reasonable price.

More interesting is the fact that GSK did not simply buy out the company; after all, Spero’s market cap was only $30 million (before the deal). In my opinion, this fact reflects Spero’s deep belief in its pipeline and capabilities.

Due to the ongoing significant undervaluation, the shares have an excellent risk-reward ratio for new investors. Even in the event of a failure of the phase 3 trial with Tebipenem HBr, I still derive a fair value of $2.55. In the coming weeks, the market will have to understand that the high price surge due to the GSK deal is more than justified.

Be the first to comment