milan2099

A year ago, everything seemed to be moving in the right direction for Spectrum Brands (NYSE:SPB). Spectrum’s pet and home & garden businesses were benefitting from stay-at-home trends which lead to increased consumer interest in gardening and an uptick in pet ownership. In the midst of a housing boom, Spectrum agreed to sell its hardware & home improvement (HHI) business to Sweden’s ASSA ABLOY (OTCPK:ASAZY) for a top of the cycle price of $4.3 billion (14x peak EBITDA) which would lead to the payoff of the company’s debt and a substantial cash balance. Management talked of significant share repurchases upon consummation of the sale. The future appeared bright and shares traded near $100.

Today the picture is reversed as:

-The DOJ is suing to prevent completion of the sale of the locks business due to competition concerns.

-The typically stable branded consumer products businesses (home & garden and pet care), are suffering from an ugly combination of higher input costs and reduced demand as ‘stay at home’ trends have reversed.

-Without a large inflow of cash from the sale of the locks business, not only will SPB have to forego share repurchases but the company appears over-leveraged (nearly 6x ND/ trough EBITDA; 4.6x ND to ‘normal’ EBITDA) as business conditions deteriorate.

While 2022 news flow for SPB has been almost completely negative, the stock looks very inexpensive even assuming that it is unable to complete the sale of its HHI business to Assa Abloy. Should Assa make concessions to the DOJ to complete the deal (reported here), shares could be a home run, even if the economy continues to soften.

Historical Financials

Here is a look at Spectrum Brands historical figures by segment:

|

Revenue |

2018 |

2019 |

2020 |

2021 |

2022e |

Assumed ‘Normal’ |

|

Global Pet Care |

820 |

870 |

963 |

1130 |

1130 |

1100 |

|

Home & Garden |

500 |

508 |

552 |

608 |

585 |

600 |

|

Personal Care |

1110 |

1068 |

1108 |

1200 |

1350 |

1600 |

|

Hardware & Home Improvement |

1378 |

1356 |

1342 |

1616 |

1616 |

1400 |

|

Total Revenue |

||||||

|

Organic Growth |

||||||

|

Global Pet Care |

-6.6% |

7.7% |

9.9% |

5.1% |

0.0% |

|

|

Home & Garden |

-0.7% |

1.6% |

8.6% |

6.0% |

0.0% |

|

|

Personal Care |

-3.9% |

-0.1% |

5.5% |

11.0% |

0.0% |

|

|

Hardware & Home Improvement |

7.6% |

-1.1% |

-1.0% |

19.1% |

0.0% |

|

|

EBITDA |

||||||

|

Global Pet Care |

137 |

143 |

172 |

212 |

180 |

200 |

|

Home & Garden |

108 |

106 |

112 |

124 |

95 |

114 |

|

Personal Care |

119 |

87 |

92 |

103 |

75 |

120 |

|

Hardware & Home Improvement |

255 |

254 |

256 |

297 |

255 |

259 |

|

Central Expenses |

-50 |

-40 |

||||

|

Total EBITDA |

555 |

653 |

||||

|

EBITDA Margin |

||||||

|

Global Pet Care |

16.7% |

16.4% |

17.9% |

18.8% |

15.9% |

17.5% |

|

Home & Garden |

21.6% |

20.9% |

20.3% |

20.4% |

16.2% |

19% |

|

Personal Care |

10.7% |

8.1% |

8.3% |

8.6% |

5.6% |

7% |

|

Hardware & Home Improvement |

18.5% |

18.7% |

19.1% |

18.4% |

15.8% |

18.5% |

As you can see, while pet care, home & garden, and hardware & home improvement (HHI) have seen margin compression in 2022 as a result of factors described above, over the past several years these businesses have shown reasonable top-line growth and stable margins. On the other hand, the personal care segment has seen margins deteriorate over time.

Valuation & Conclusion

Assuming Spectrum retains HHI, at today’s price of $41 per share, I estimate SPB trades at the following multiples:

|

Share Price |

41.27 |

A |

|

Shares Outstanding |

40.8 |

B |

|

Market Cap |

1,684 |

C=A * B |

|

Net Debt |

3000 |

D |

|

Break fee from Assa |

245 |

E |

|

Total Cap |

4,439 |

F=C+D-E |

|

Normalized EBITDA |

653 |

G |

|

Capex |

75 |

H |

|

EBITDAX |

578 |

I=G-H |

|

EV/ EBITDA |

6.8 |

=F/G |

|

EV/ EBITDAX |

7.7 |

J=F/I |

|

EBITAX |

578 |

I |

|

Less Interest @5.5% |

165 |

K |

|

Less Taxes @25% |

103.25 |

L |

|

Net Inc/ FCF |

309.75 |

M=I-K-L |

|

Shares o/s |

40.8 |

N |

|

FCF /share |

7.59 |

O=M/N |

|

P/ FCF |

5.4 |

P=A/O |

At just 7.7x EBITDAX (EBITDA minus capex), 5.4x FCF/share, Spectrum is trading at bargain basement multiples, especially given the stability and profitability of three of its four segments. A 10-12x FCF multiple seems more reasonable which would value the stock at $76-91 per share indicating 85-120% potential upside when the market looks past the (likely) failed sale of HHI. Further, if the HHI deal is somehow rescued (via Assa making divestitures- reported here), there is further upside to the stock. This seems like a heads I win, tails I win situation.

Risks

1. It is possible that shares will fall further if/when it is announced that Spectrum is abandoning the deal to sell HHI to Assa. Note that in this case, Spectrum will receive a $350 million break fee (~$9/share pre-tax).

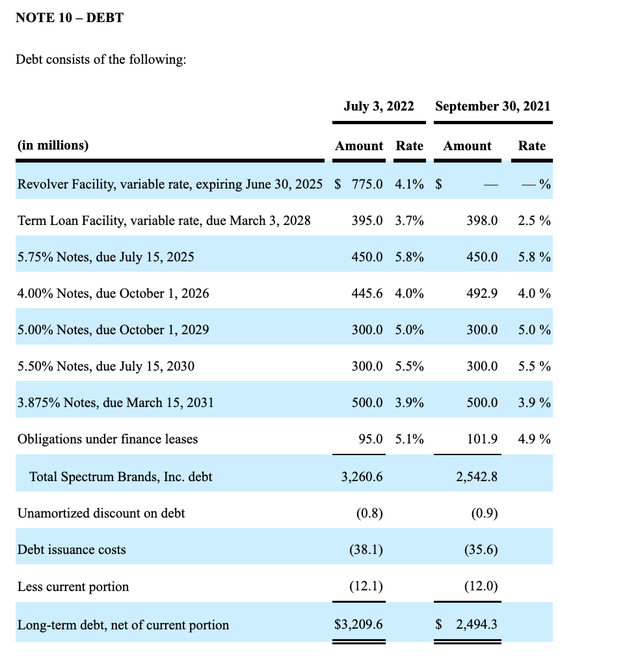

2. Spectrum carries a hefty debt load of nearly 6x estimated trough EBITDA and ~4.6x normalized EBITDA. As shown below, none of the company’s credit facilities expire until late 2025, giving SPB plenty of time to pay down debt with internally generated FCF (3 years of debt pay down would put ND/EBITDA at ~3.5x), sell HHI to another bidder, or refinance.

Spectrum Debt (Spectrum 10-Q)

Be the first to comment