brightstars/E+ via Getty Images

The SPDR Gold Trust ETF (GLD) has been a defensive winner, time and again over my three decades of trading. This past week’s slight price gain for gold did its job vs. one of the worst weeks in almost two years for the cryptocurrency sector or the risk-heavy equity markets. Per usual, gold has proven out its utility for investors. I have been screaming at anyone that will listen over the last several months on Seeking Alpha, in a variety of articles here and here for starters, that gold related assets (plus silver/platinum proxies) are some of the cheapest hedge ideas you can add to your brokerage account. If you want to combat and offset an amazingly overvalued U.S. stock market, rising inflation, and the appearance of an Omicron-related pandemic slowdown in the world’s supply chain, gold possess sound logic. Now we have the Russia/Ukraine geopolitical mess.

Well, large hedge funds and smart financial minds all over the place are now deciding enough is enough, and want to super-size their exposure to precious metals as a vote of “no confidence” in the decision making of international politicians and bankers. If investing R-I-S-K is the new normal for 2022, the best way to hedge nutty swings in sentiment and price in the financial markets is through serious exposure to the only form of money that has no attached liability. You don’t need a password or internet connection like crypto, and it’s something you can trade for paper money or other value at your local jeweler. The old standard of hard money – gold – could be the new age antidote for financial portfolio blue’s this year.

For a serious discussion of paper asset risk in 2022, I talked about the rotten setup for both U.S. stocks and bonds last week here.

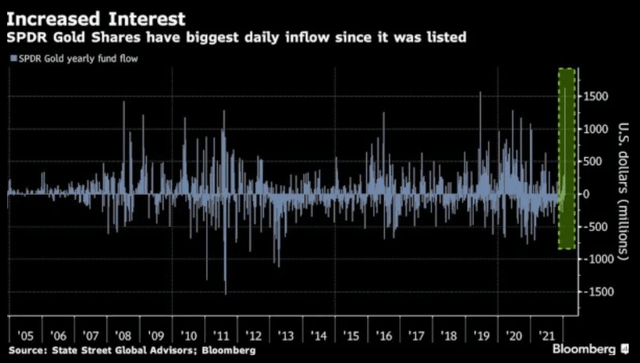

Friday, January 21st witnessed the largest dollar gain in new GLD trust issuance over its 18-year history, some $1.63 billion in net buy orders. Basically, five months of net outflows were reversed with one day of bullish interest.

Perhaps more importantly, last week’s inflows resulted in the trust adding 32.2 tonnes of gold, expanding by the strongest weighting rate since the end of March 2020, near the COVID-19 crash bottom in global financial assets. Why is this a big deal? The answer is gold prices immediately reversed and exploded to the upside as investors woke up to the unleashed size of government stimulus spending and Federal Reserve emergency money printing.

For context, during 2021 GLD witnessed its biggest annual gold bullion outflow since 2013 of 195 tonnes. The year before, during the height of the pandemic crisis in 2020, GLD’s net gold holdings expanded by 278 tonnes, which is the record annual inflow since inception in 2004.

Below is a 3-year chart of weekly price and volume trading, showing the equivalent point to today in March 2020, when EVERYBODY realized gold holdings were a good choice to hedge money supply growth, future inflation, and chaos in financial asset pricing. I have also plotted some super-bullish intermediate-term momentum indicators underneath. Lastly, I have drawn in blue the 52-week moving average of price, which is ready to turn higher with further gains.

GLD 3-Year Weekly Chart with Author Added Points of Reference StockCharts.com

Triangle Pattern

Another positive development is the daily price pattern in U.S. dollars may be about to break out of a yearlong basing triangle or wedge setup. If gold prices rise just a little bit more, a flood of new investor enthusiasm could appear with exaggerated GLD buying, at least from the technical trading group. Also, my momentum sorting system is scoring this ETF in a better position after January’s strong relative strength vs. the S&P 500, alongside noteworthy gains in several indicators like the Negative Volume Index drawn below.

NVI is one of my favorite indicators reviewing buying/selling activity on lower volume trading sessions. The solid uptick in this reading since October, marked with a red arrow, could signal sellers are in fact backing up their orders in terms of price. If large buying interest appears, price will have to rise to find sufficient supply to fulfill aggressive demand orders. Anyway, a powerful move above $173 could launch GLD through a descending price trendline (drawn in green), with rapid gains toward its all-time high of $195 next.

GLD 13-Month Daily Chart with Author Added Points of Reference StockCharts.com

Final Thoughts

I wrote an article in September here, explaining the simple fact US$1800 gold was incredibly inexpensive historically for a relative valuation to the money supply level, Treasury debt issuance, other commodity pricing, and U.S. stocks using current dollar worth. My view is gold is headed closer to its long-term fair value over the next couple of years, which I now calculate around US$2700-$3000 an ounce. For the fast-money crowd, a 40% to 60% gold gain over 24 months may not sound sexy enough, but if other assets decline in price, you will wish you had loaded up on the monetary metals like gold in late 2021 and early 2022.

What could change my bullish gold outlook? The biggest risk is a disinflationary bust or crash in the equity and/or bond markets drains liquidity in the financial system, with an outside chance banks/investors are forced to liquidate hard money gold. Another risk is any global recession or disruption to normal flows in economic supply/demand leads to a much stronger U.S. dollar value in the currency exchange market. Gold tends to rise and fall inversely to the dollar’s weakness or strength.

If you want a clue on trends in liquidity, watch changes in the pricing of other commodities like crude oil and grains. With the +44% eruption in M2 money supply since March 2020, commodities in general have been able to fly higher at their strongest clip since 2008. Assuming crude oil, natural gas, soybeans, corn, wheat, copper, aluminum, coffee, sugar, pigs, chickens and cows continue to climb in price, gold/silver/platinum will find it difficult to decline from today’s quote level.

For investors hungry for uncorrelated assets to own vs. paper assets like stocks/bonds, the SPDR Gold ETF makes perfect sense. I own GLD exposure mainly through cheaper than reasonable call options. With a 50-year average annual rise of +8% for gold prices, owning 1-year expiration call options, at-the-money for a strike price, with a 6% premium looks like a real disconnect worth the risk.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment