mixmotive/iStock Editorial via Getty Images

Investment thesis

With the recent share price weakness for S&P Global (NYSE:SPGI) due to outsized worries on the ratings segment amid uncertainties in a weak global issuance environment, I think that the risk reward perspective looks interesting for the company and as such, this is my investment thesis for S&P Global:

- Upside from IHS Markit merger completion from revenue and cost synergies, additional cash from divestitures, and higher recurring revenue mix.

- While ratings business may seem weak currently, the business is inherently cyclical and remains structurally sound. The outsized worries in the ratings business provides huge opportunities for patient investors that can time the turnaround in the issuance market well, in my view.

- Additional upside comes from the increase in dividends and share buybacks, with multiple levers to pull.

- ESG could be the next long-term driver for both the indices and ratings segment.

Overview

S&P Global services financial and commodities markets by providing them with information products and services. Its key business includes:

- S&P Ratings

- S&P Indices

- Market Intelligence

- Platts (More on the businesses below)

S&P Global announced completion of its merger with IHS Markit earlier in 2022. IHS Markit is a leading information services provider with a unique portfolio of many industries including financial services, energy, and automotive.

Revenue mix:

It is important to understand the revenue mix of S&P Global in order to get a grasp of what is resilient and defensive in a downturn and what parts of its business are more cyclical.

Firstly, the ratings segment makes up 49% of S&P Global’s revenues and 57% of operating income. The segment earns a solid operating margin of 62% and this comes from its unique industry positioning. S&P Global’s Ratings segment is a leading provider of credit ratings, research and analytics, and provides customers with information, ratings and benchmarks. The ratings industry is rather consolidated, with 3 big ratings companies known as the Big Three. S&P Global is one of the Big Three in credit rating, along with Moody’s (MCO) and Fitch. It has 40% market share, similar to Moody’s, while Fitch has 15% market share. The 3 players make up 95% of the market, representing an oligopoly market structure. This segment has been S&P Global’s dominant segment as evident by the significant revenue and operating income contribution.

Secondly, the indices segment makes up 14% of S&P Global’s revenues and 17% of operating income. This segment earns a solid operating margin of 68%. It is the largest domestic index provider maintaining a wide variety of valuation and index benchmarks for the financial industry.

Thirdly, the market intelligence segment makes up 27% of S&P Global’s revenues and 15% of operating income. The segment earns a decent operating margin of 30%. It is a global provider of multi-asset class data, research and analytical capabilities which includes analytics and Capital IQ. Almost 95% of market intelligence revenues are recurring revenues based on subscription.

Lastly, Platts makes up 11% of S&P Global’s revenues and 11% of operating income. The segment earns a decent operating margin of 43%. It is a leading provider of data and benchmark prices for the commodities and energy markets. More than 90% of Platts revenues are recurring revenues based on subscription.

S&P Global revenue mix (Annual reports)

Closure of IHS Markit deal brings upside that is not priced in

The merger with IHS Markit is completed and this merger can enhance S&P Global’s earnings profile through accelerating organic growth to drive robust margin expansion, and bringing about deal synergies.

First, the merger will shift S&P Global’s business mix to be more recurring in nature, resulting in 75% of the business mix becoming recurring after the deal.

Second, there are significant synergies to be reaped as the two businesses are merged. The merger is expected to be earnings-accretive by end-2023 and in the near term, there are also cost synergies that can be realised. According to the company, there could be cost synergies of about $600 million, with 80% of this expected to be realised in 2023. This means that $480 million of cost synergies could easily be met by delivering on business and corporate overlaps. In addition, S&P Global could optimise IHS Markit’s standalone cost by lowering the company’s SG&A and operating costs to be more in-line with S&P Global.

Lastly, the company expects revenue synergies, with a revenue synergy target of $350 million to be completed over the next 5 years, with 60% to be driven by the introduction of new products and 40% by cross-sell opportunities. Most of these would come from the financial services segment at the beginning.

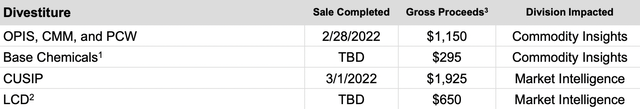

In addition, S&P Global has divested certain businesses from IHS Markit that are considered non-core to its business. This sale generated approximately $2.9 billion in net proceeds that can be distributed back to shareholders.

Proceeds from IHS Markit divestures (S&P Global 1Q22)

Ratings business

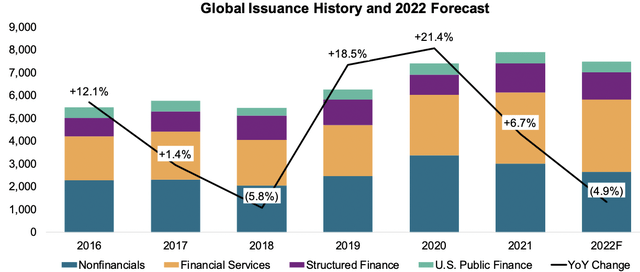

There are near-term headwinds for the ratings business due to the current macroeconomic environment and the low debt issuance environment. As evident from the graph below, this depicts S&P Global Ratings segment’s forecasts for 2022 global issuance, which is expected to decline by about 5%.

S&P Global Ratings global issuance forecast (S&P Global 1Q22)

While I acknowledge that this may not look good in the near term for S&P Global Ratings segment, I think we need to remember the cyclical nature of this business and that structurally, S&P Global is well positioned to capture the upswing in global issuance when the tide reverses. In fact, when looking at a similar scenario in 2018, we can see that 2018 was a similar scenario when global issuance fell by about 6% and subsequently rebounded to grow 19% and 21% in the next 2 years. While S&P Global’s stock price was down 20% in 2018 due to the weaker global issuance environment, it subsequently recovered and gained more than 100% in the next 2 years.

Furthermore, S&P Global has other businesses that can help to act as a source of business diversification in an environment where global issuance is weak. At the same time, recurring ratings revenue could provide some downside protection. Lastly, there are plenty of levers to pull to improve bottom-line growth, especially from the IHS Markit merger. While there is a weaker global issuance environment now, there are signs, according to management, that there is pent-up demand for issuance supply as evident from significant refinancing walls. All in all, I think that the outsized worries on the S&P ratings business is misplaced and has essentially de-risked S&P Global’s earnings estimates, which could then provide decent upside if things just turn out average or better than expected.

Visible upside in either cash dividends or buybacks

As a cash generative machine, S&P Global has several levers to pull to either increase cash dividends or buybacks.

Firstly, it has significant cash on hand of $4.4 billion. Secondly, as mentioned earlier, there are the $2.9 billion in net proceeds from divestitures from the IHS Markit merger, of which 100% will be distributed. Thirdly, S&P Global has strong FCF generation of $4 billion to $5 billion, and about 85% of this is to be redistributed to shareholders. Fourthly, the company has a low leverage level, currently with only 18% net debt to equity, net debt to EBITDA being healthy at 1.4x, and EBITDA to interest exp ratio being at 36x. Lastly, when taking into account the merger of IHS Markit, this increases the total combined buybacks to $18.5 billion, including the share buyback capacity for IHS Markit, representing 15% of market cap.

ESG could bring further long term upside

There is a huge tailwind for ESG rated opportunities, especially in the indices segment as large inflows have continued into ESG passive funds and ETFs.

S&P Global’s ESG revenues currently only make up 1% of the total revenues but grew by 57% last year to about $47 million in revenues.

In the indices segment, there were multiple ESG related indices launched, namely the S&P 500 ESG Leaders Index, S&P Net Zero 2050 PACT Expansion, S&P Low Carbon and the ESG Select structured product indices. Interesting, there were already 17 ESG ETFs that have been launched based on these new ESG indices. As of 1Q22, there was $33 billion in AUM for S&P 500 ESG ETFs, which grew 28% from a year ago.

Furthermore, for the ratings segment, there are 2 growth areas related to ESG, including ESG Evaluations and Green Evaluations, which saw 48% growth and 79% growth respectively in 2021.

In my view, ESG is likely the next big growth driver for index providers like S&P Global and the early traction that the company is seeing in its indices segment is encouraging, although other major index providers like MSCI (MSCI) are also focusing heavily on innovation and new products in the space. Thus, it is important for S&P Global to invest and innovate in the ESG space to become a market leader in ESG related indices for the future. There are also opportunities for S&P Global’s ratings business in the form of evaluations for ESG purposes.

Valuation

Firstly, the company is currently trading at 23x 2023 P/E, which is at a 26% discount to its 5-year average P/E of 31x.

Secondly, I identified similar historical periods when there was weakness in bond issuance and lower EPS growth and found that the most similar period was in 2013 when its P/E was 22x when EPS growth was -8%. As such, its current valuation is already pricing in these negatives.

However, if a recession scenario like the GFC were to occur, there could be more downside as its P/E in 2008/2009/2010 was 12x/11x/14x respectively.

My current price target for S&P Global is $450, assuming a 27x 2023F P/E, which is still 10% lower than its 5-year average P/E. This implies 40% upside potential from current levels.

Risks

Market volatility and the impact to fees linked to assets

While S&P Global’s indices segment is typically rather recurring and defensive in nature, a portion of it relates to fees linked to assets. These asset-linked fees make up 65% of the indices segment and can thus be affected by market volatility. This is because market volatility affects trading volumes and assets under management of the ETFs linked to S&P’s indices, thereby also affecting S&P’s asset-linked fees.

In its 1Q22 results, it reported a period-end ETF AUM at $2,892 billion. During the period, there was net inflows into ETFs of $68 billion, but this was offset by price depreciation of $123 billion. The net effect of both net inflows into ETFs and price depreciation was -$55 billion, which translates into a smaller -2% in total AUM.

Weakness in issuance market

As highlighted above, the global issuance market is expected to decrease by 5% in 2022, compared to a very strong 2021. There is the risk that the weakness might accelerate further if global macroeconomic factors worsen. This will then have further downside to management’s 2022 expectations for global issuance.

Conclusion

While there is uncertainty on the impact of S&P Global’s ratings business by the current very uncertain macroeconomic environment, the market has priced in significant amount of negativity for the Ratings segment and this leads to current estimates being de-risked and expectations have been reset. That said, while most of the focus is on the ratings business, I think that S&P Global’s other businesses are performing decently as evident from the 1Q22 results and the diversified nature of the business as well as the defensiveness of its business model makes S&P Global very attractive in the current environment. The risk-reward skew is positive and my current price target for S&P Global is $450. This implies 40% upside potential from current levels.

Be the first to comment