Ultima_Gaina

Thesis

On September 13 major US indices crashed, with the S&P 500 (SPX) and the Nasdaq 100 (NDX) being down 4.3% and 5.2% respectively. Notably, out of Nasdaq’s 100 stocks there was not one single name that appreciated in value. This sell-off, the sharpest since June 2020, was provoked by a higher than expected August CPI report. And although markets have a tendency to overreact, I argue that the price-action after the inflation data on Tuesday was reasonable, as I argue in this article. Personally, I agree with Ray Dalio’s thesis – as published on LinkedIn – that if the Fed would rise rates to 4.5%, stocks would have 20% more downside.

August CPI Report

In late August and early September, many investors and economists started to believe that inflation has already started to cool down. The CPI report for July was encouraging – as price increases largely stopped in mid-summer. Accordingly, investors started to bet on an early Fed pivot and accumulated bullish bets going into the CPI print for August.

But sentiment turned quickly, as the inflation data highlighted that in August US consumer prices increased by 0.1% per cent month over month, while consensus estimated a decrease of 0.1%. Respectively, the annual rate was reported at 8.3%, materially higher than the 8.1% predicted.

As a response to the report, markets started to reprice the Federal Reserve’s likely action: yields shot up and stocks crashed down.

Fed Response Provokes Higher Yields

Following an unfavourable inflation report, the Fed is in a tough spot – forced to keep the hawkish policy stance in order not to lose credibility. In context of the Jackson Hole symposium, Fed Chair Jay Powell has forcefully highlighted that:

We are taking forceful and rapid steps to moderate demand so that it comes into better alignment with supply, and to keep inflation expectations anchored

Powell added that the Federal Reserve “must keep at it until the job is done” and that this will likely lead to some softening of labour market conditions as well as “some pain” for households. This means, in other words that the Federal Reserve will likely continue an aggressive interest rate hiking path. Notably, according to data compiled by Bloomberg, yields now price an approximately 30% probability that the Fed will hike by a full percentage point this month and a greater than 50% probability that the Fed’s benchmark interest rate would be higher than 4% by year-end. Note how the Treasury yield shot up to the highest level in 15 years, to above 3.8%.

Impact Of Higher Yields

There are multiple powerful channels how higher interest rates will impact economic activity. First, higher interest rates limit credit expansion and thus demand in an economy. Second, higher interest rates pressure the housing market through higher mortgage payments and general funding. Third, higher interest rates increase the cost of debt, which in turn lowers free income available for consumption and/or investment. All this will eventually lead to a slower economy, if not recession.

Note, however, that the above arguments are only examples of first round effects. A slowing economy will eventually provoke an EPS contraction, which leads to lower investor confidence and consequently also to even lower stock prices. This in turn will further pressure the economy. Needless to say, this is the anatomy of an anti-virtuous cycle that is likely to continue until something breaks, and the Fed will need to step in with a liquidity put.

What To Expect For Stocks

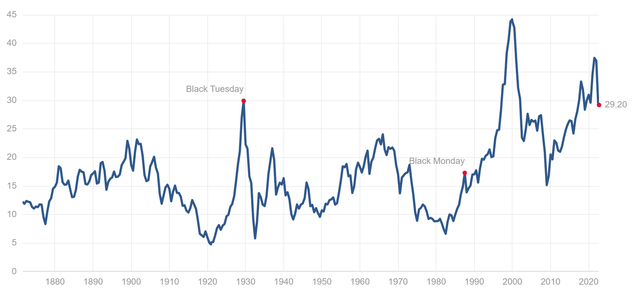

Based on the arguments made in the previous section of the article, the actions of the Fed will likely be very bad for stocks. But arguably, the market has yet to fully price in the higher yields. Notably, without incorporating the possibility for EPS contraction – which is very likely in my opinion – the SPX trades at a x20 P/E and the NDX trades at a x24.5 P/E. This is materially above the historical average cyclically adjusted PE.

Ray Dalio has recently shared his opinion that if the Fed were to hike interest rates to 4.5%, the market would drop by approximately 20%.

An equity strategy report published by Citigroup’s Scott Chronert highlighted that if the relationship between rates and P/E multiples for stocks holds (approximately 85% correlation in the past) than equities would need to trade 20% to 25% lower, with growth-sensitive stocks being the most vulnerable to a rerating (Source: Citigroup Velocity).

Conclusion

Investor Implication

Following a scary August CPI report, the Fed’s actions are poised to pressure the stock market lower. And I believe a 20% drop – as estimated by Ray Dalio – isn’t unreasonable, with perhaps even more room to fall for tech/growth stocks. When will be the time to turn bullish? Well, honestly I do not know. But here is what Michael Burry has recently tweeted: “No, we have not hit bottom yet … watch for failure, then look for the bottom.“

In my opinion, a hard landing is likely. And this must yet to be priced in.

Trade Recommendation

Personally, I argue there is currently no better trade than buying 95/85 %-Moneyness PUT spreads on the SPX. Consider that valuation is still elevated versus both yields and historical levels and multi-dimensional risk is pending over markets – waiting to take the market to new intra-year lows. That said, I advise and target 60 DTE, which would give a payout of approximately 5:1, if the SPX closes at 85% moneyness at expiration (ref, ca. 3300 strike).

Be the first to comment