Melpomenem/iStock via Getty Images

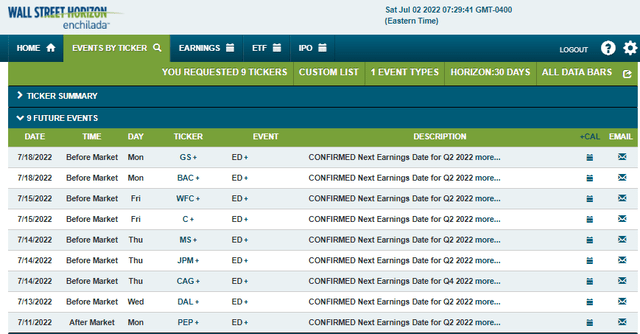

Earnings season is on our doorstep. The fireworks are ignited on Monday, July 11, when Pepsi (PEP) reports after the market’s close. Delta (DAL) then hopes its share price takes off Wednesday morning, the 13th. Then come the banks – JPM’s report hits the tape Thursday morning that week along with Morgan Stanley (MS). Friday morning, we hear from Citigroup (C) and Wells Fargo (WFC) while Bank of America (BAC) and Goldman Sachs (GS) report Monday, July 18, before market open. All these earnings dates are confirmed, according to corporate event data provided by Wall Street Horizon.

Early Earnings Season Movers and Shakers: Banks In Focus

Wall Street Horizon

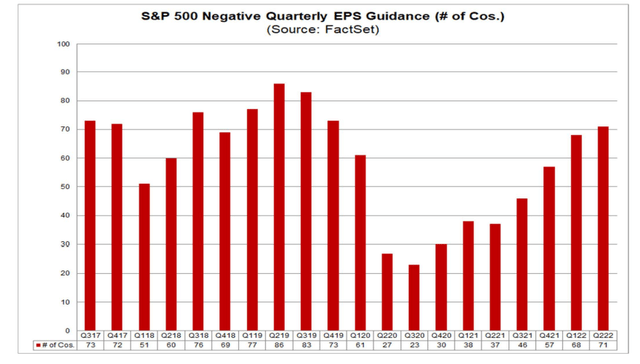

I expect corporations to throw the kitchen sink at Q2 earnings reports and guidance estimates. What I mean by that is management teams might seek to lower the bar for the remainder of 2022 so that they can appear to show exceptionally strong results come the Q3 and Q4 reporting periods. Consider that, according to last Friday’s FactSet Earnings Insights report by John Butters, for Q2 there has been the highest number of negative earnings guidance announcements from S&P 500 companies since 4Q19.

Negative Earnings Revisions Mounting

FactSet

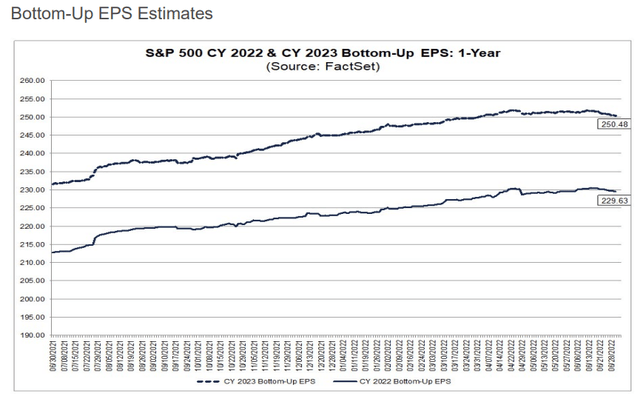

As far as Wall Street estimates go, this year’s S&P 500 earnings outlook is still uncomfortably high. The consensus profit per share estimate is $230 for this year and $250 for 2023, per FactSet. Many pundits expect those figures to come down sharply, and I think they will as we progress through Q2 earnings season. Sell side analysts need an excuse to bring down profit forecasts and price targets – poor guidance from companies is a reasonable trigger for such changes.

2022 and 2023 S&P 500 EPS Forecast Trends

FactSet

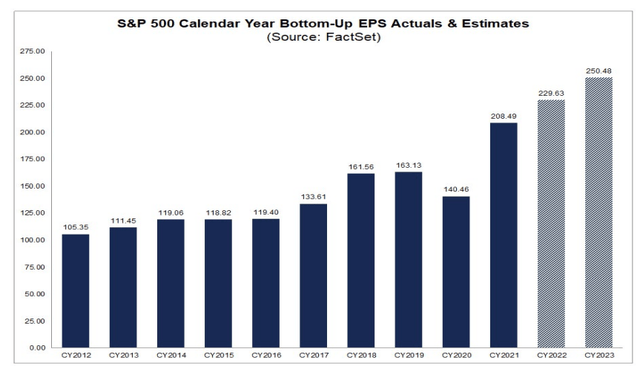

The million-dollar question right now is where will this year’s and 2023’s earnings land? Could we round-trip to 2019 levels? If so, that would mean the market’s EPS must drop demonstrably. 2019’s S&P 500 bottom-up EPS number was $163 – a far cry from this year’s current estimate. I think a pullback to the low-$200s would make more sense.

S&P 500 Bottom-Up Consensus EPS Forecast

FactSet

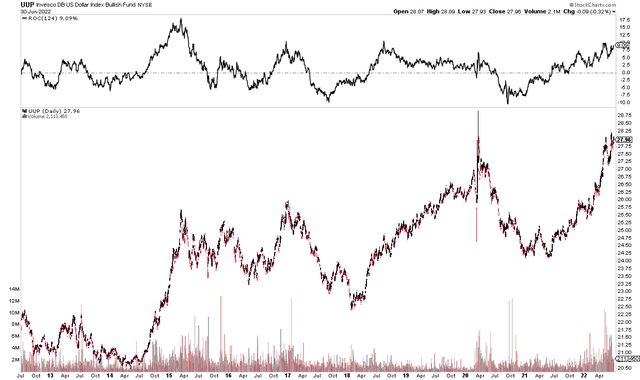

Something to watch out for is guidance cuts due to FX. Consider that the U.S. Dollar Index (DXY) had one of its best H1’s ever, rallying some 9% over the last six months. For large multinational corporations domiciled in the U.S., that means repatriating foreign sales comes with a currency ding. A lower U.S. dollar during the second half would help to stave off an earnings recession.

U.S. Dollar Index ETF (UUP): Massive First-Half Gains

StockCharts

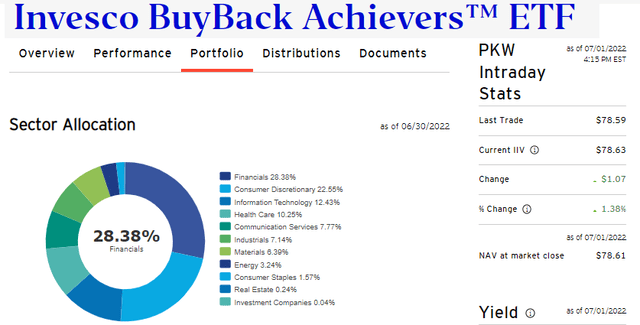

So what’s the trade? I think a near-term bullish play on financials could be in the works, but through earnings season, I have another idea – go with strong buyback companies. The Invesco BuyBack Achievers ETF (NASDAQ:PKW) is 28% allocated in the Financials sector, according to Invesco. So, if we indeed see a rally ahead of bank earnings reports, PKW should benefit. Moreover, if companies use Q2 earnings season to issue beefier buyback programs, PKW would likely rally on a relative basis on that trend.

Financials: Biggest Sector Weight in PKW

Invesco

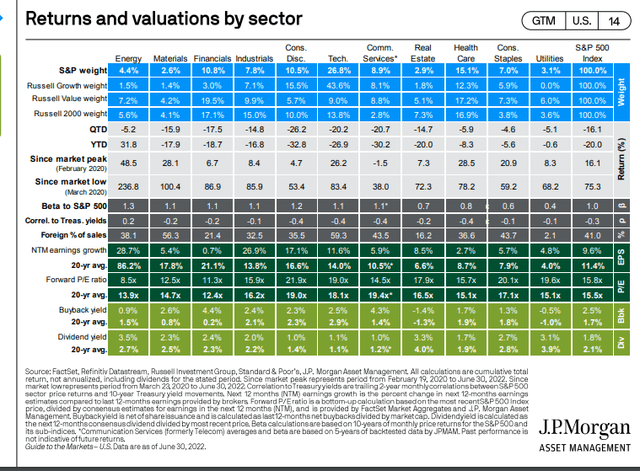

JPMorgan Asset Management shows that the Financials sector has the highest buyback yield among the 11 S&P 500 sectors. Investors are familiar with a stock’s dividend yield, but the second piece of total shareholder yield is the return from when a company repurchases its shares. While the market’s buyback yield is 2.5%, financials’ is 4.4% – well above its 20-year average.

S&P 500 Sector Breakdowns: Buyback Yield Highest Within Financials

J.P. Morgan Asset Management

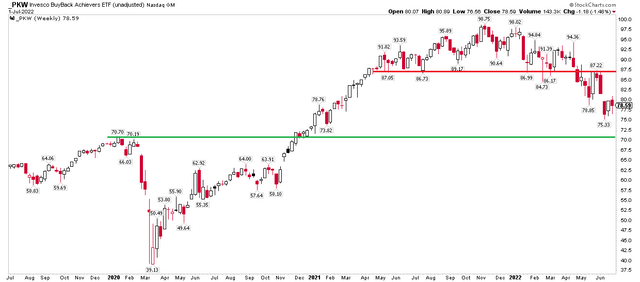

The Technical Take

PKW’s chart is not the best out there. Its relative strength vs the S&P 500 is nothing to write home about either. I see support, however, around $70 while $87 is resistance. Keep those levels in mind when swing trading this ETF.

PKW Technicals: Vulnerable To A Dip Near $70

StockCharts

The Bottom Line

A rally into earnings season makes sense to me. We often see bullish seasonality into mid-July before some shakiness ensues. Financials report first and while companies might sandbag for the rest of the year, cash on the balance sheets and cheaper stock valuations might lead to big buyback activity later in 2022. PKW is a good way to play buyback achiever companies.

Be the first to comment