Phynart Studio/iStock via Getty Images

Investment Thesis

Southwestern Energy (NYSE:SWN) has several near-term and medium-term drivers. There’s a happy mixture of drivers, but I put the bulk of my own investment case on the long-term driver for US-based natural gas.

Essentially, this is the core of my argument. There’s a positive risk reward being offered to investors right now. Meanwhile, the energy trade has run out of steam. However, I not only maintain my thesis, but I actually believe that the fundamental thesis has now significantly strengthened.

What’s Happening Right Now?

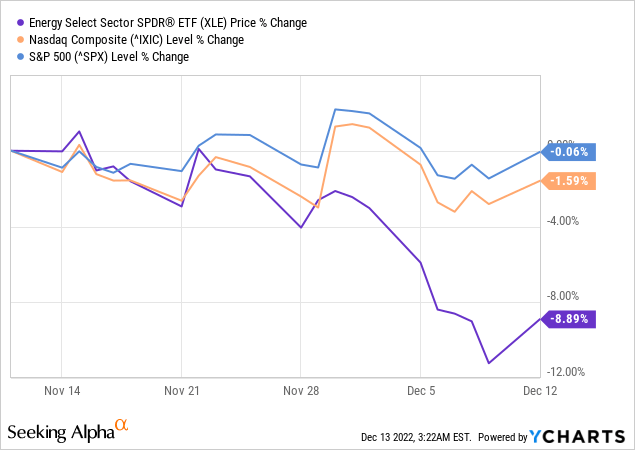

For all the talk about energy as the place to be in 2022, energy stocks are down 9% in the past month. Substantially underperforming both the S&P 500 (SPY) and the Nasdaq Composite (COMP.IND).

But is this move justified?

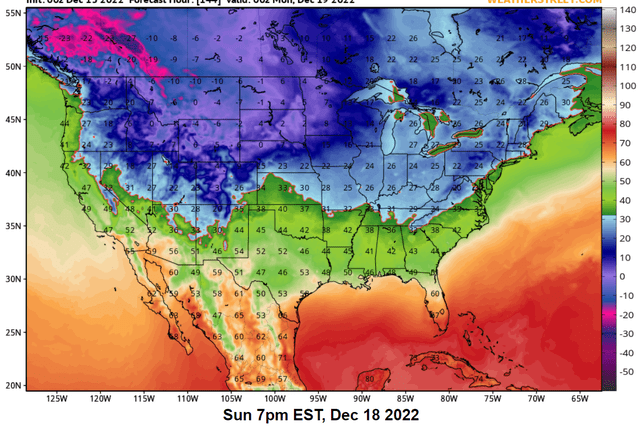

- I highlighted the above graphic mostly as a way to get your attention. It’s going to get cold. This is a near-term catalyst that’s going to get investors interested in SWN. But this is not what this investment case is about.

- My investment thesis is not even the fact that in the past several days, we’ve seen the spot price for natural gas jump 10% higher. Again, that’s a positive catalyst, but that’s not what my investment case is about.

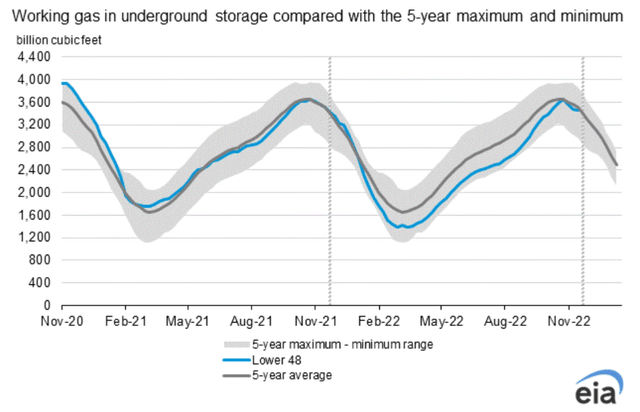

I must also note that natural gas inventory is average for this time of the year, even though the Freeport LNG facility, which exports 20% of US-based natural gas inventory is out of commission until the end of this month.

Put another way, there should be an oversupply right now, because the US’ ability to export natural gas is subdued. And yet, the opposite appears to be taking place, and supply is simply average.

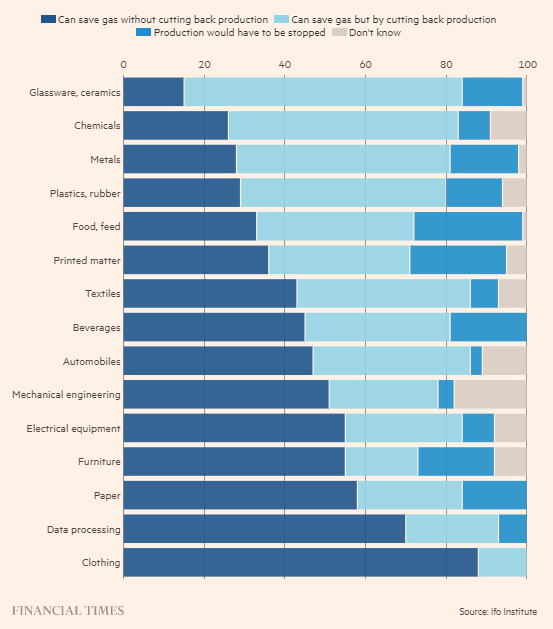

FT.com, German manufacturers’ view on natural gas

Furthermore, also note that the FT.com reported a few days ago, how some German manufacturers are considering moving to the US since energy prices are significantly lower, allowing these businesses to increase their profitability with lower feedstock prices.

In sum, this is my argument. There’s overall support for natural gas prices in the US. But at the same time, demand for US natural gas is going to be significantly higher in 2023.

You have the European companies that are too small to uproot to the US thirsty for cheap energy. And at the same time, you have energy-intensive European companies cutting back on production.

And on top of that, a lot of commodities, for example, fertilizer, food, chemicals, and metals, will be cost advantages operating in the US.

So, this will once more stimulate further demand for cheap US-based natural gas in 2023, as the globe looks to replace European-based supplies that have been reduced because of high energy prices, with US-based energy-intensive products.

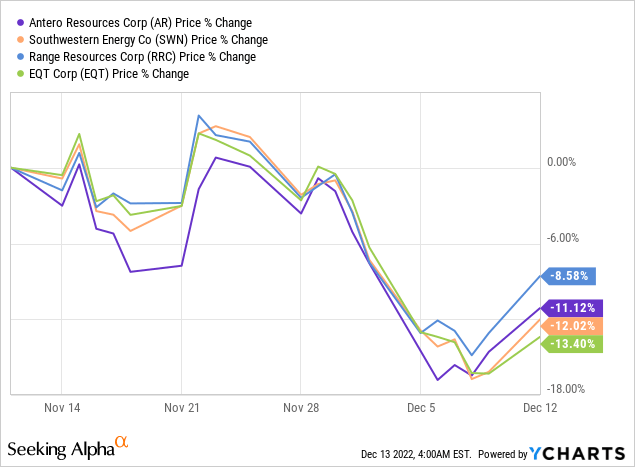

Sounds Good, But

The backdrop sounds compelling, I’m confident you’ll agree. But why are energy stocks not responding positively to all these drivers? Why have energy stocks sold off? Or more specifically, why have natural gas stocks sold off lately?

That’s a critical question that I don’t know the answer to. To the best of my knowledge, US-based natural gas is less discretionary than oil. Oil is highly sensitive to the global macro environment.

While the performance of US-based equities driven by US-based natural gas should not be performing in this manner. And yet.

Perhaps, this is a temporary sell-off, but is there anything else that we should discuss when it comes to SWN?

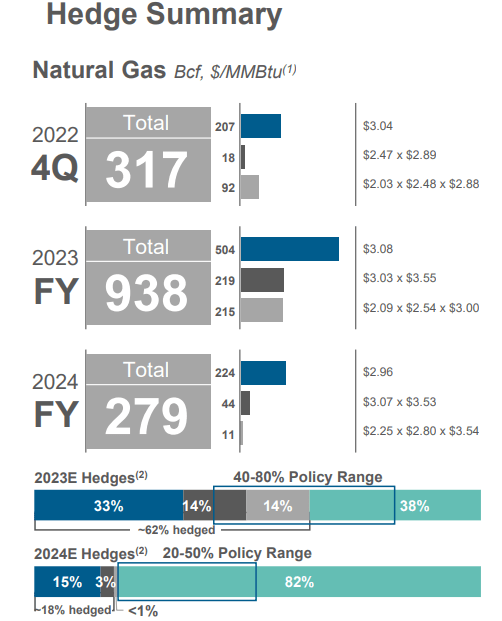

Hedges Could be an Issue

As I noted in my previous article, going into 2023, SWN is 60% hedged. This is less than the 80% SWN that was hedged in 2022.

SWN Q3 2022

SWN Stock Valuation — 6x 2022 Free Cash Flow

If we presume that SWN makes close to $250 million of free cash flow in Q4 2022, that would bring SWN’s 2022 free cash flow to approximately $1 billion. This implies that the stock is priced at close to 6x this year’s free cash flow.

If we were to believe that in 2023, SWN makes around $1.2 billion of free cash flow, this would mean that by this time next year, SWN’s balance sheet will be around their target level of inching close to $3.5 billion net debt.

Hence, this is my point, the company has some issues, such as hedges and leverage, but within 12 months, its position will be hugely improved.

The Bottom Line

I believe that there’s a positive reward being offered to investors. The stock is cheaply valued. While at the same time, the fundamental natural gas secular growth story remains very strong.

Be the first to comment