Joe Scarnici/Getty Images Entertainment

It’s always tough to see strong fundamental stories souring over a single quarter, but that’s exactly what happened with Sonos (NASDAQ:SONO) in Q3. The well-known high-end speaker maker had been selling a story of strong consumer demand and tactful execution amid a constrained supply chain environment, but its recent Q3 report turned that narrative upside down. Revenue turned to negative comps, and perhaps even more concerning yet, management is citing headwinds to demand for the rest of the year.

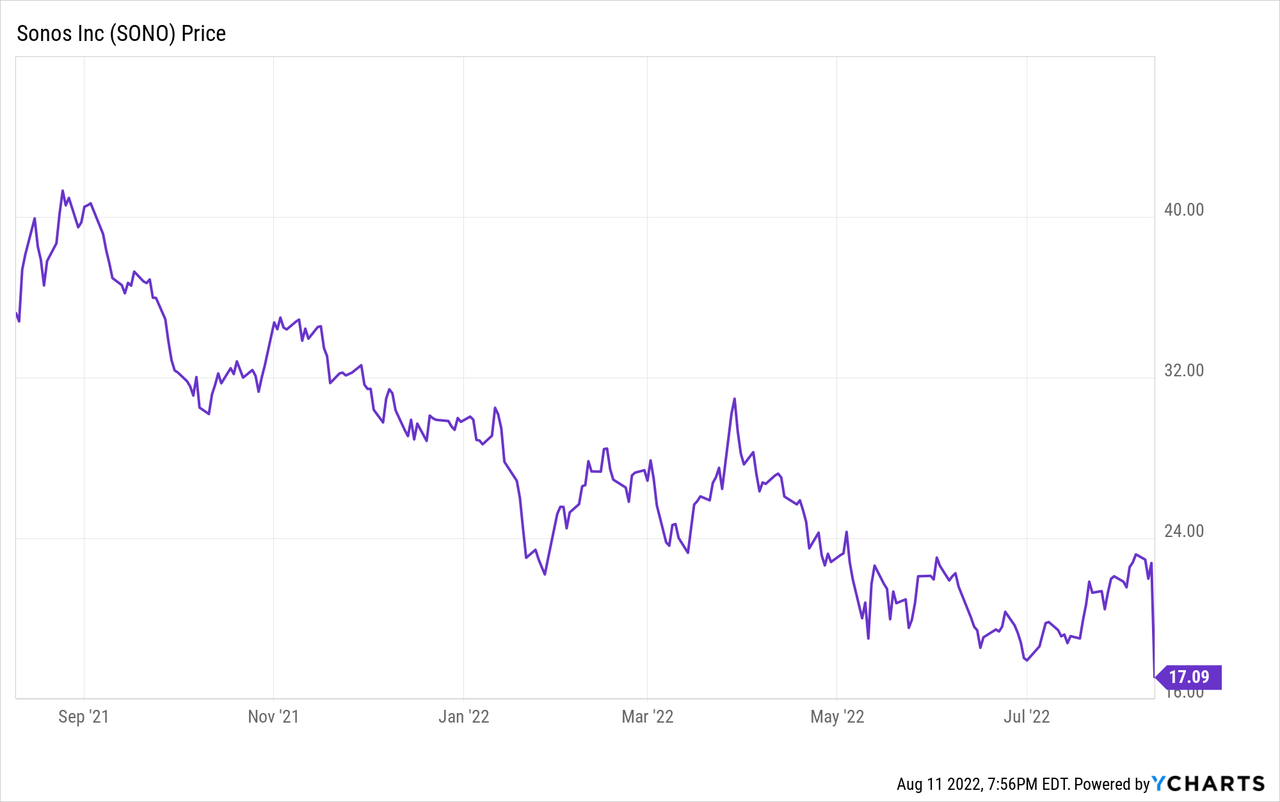

Shaken by the sudden turn of fortune, shares of Sonos lost 25% of their value post-earnings. Year to date, the stock is down more than 40%:

Let’s cut to the chase: I’m disappointed in Sonos’ earnings, and this does change my outlook on the stock’s prospects through the end of the year. Previously a Sonos bull, I’m now downgrading my view on the stock to neutral, and now see the company as a more balanced bag of positives and negatives.

Here are the new risks that have opened up:

- Management’s commentary on weaker consumer demand may be a longer-term slump with no clear fix. The consumer base may be adopting longer replacement cycles, especially as economic conditions tighten

- Profitability is being hammered by higher operating spend, as Sonos is both increasing wages as well as investing into headcount and technology

On the bright side:

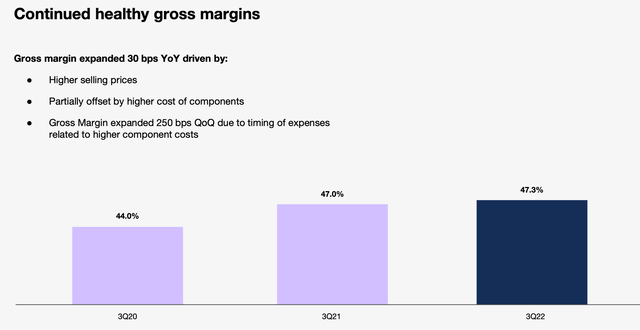

- Sonos is still modestly boosting its gross margins, which is no small feat in the current inflationary environment, though this is being offset by higher opex spend

- Supply constraints may still be holding back reported growth rates

- Valuation is still opportunistic and may compensate for the additional risk

We’ll go into each of these items in greater detail, but the bottom line here: if you’ve been holding Sonos, it’s a good time to de-risk a chunk of your portfolio. I don’t see this stock materially outperforming the broader market over a 9-12 month timeframe, though investors with a longer time horizon who continue to believe in Sonos’ products could have an attractive entry point for a multi-year investment.

The bombshell quarter and guidance cut

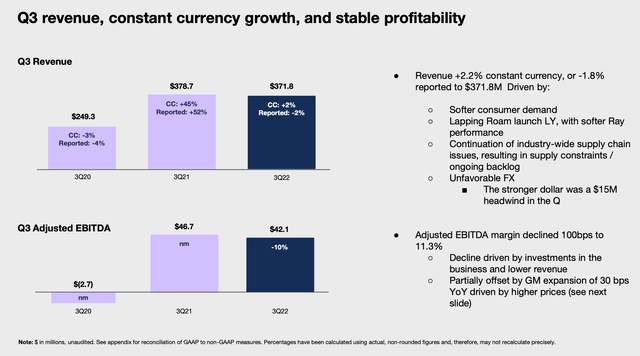

We’ll address the elephant in the room first: what exactly happened with Sonos in Q3 (the June fiscal quarter)?

Well, third-quarter revenue declined -2% y/y to $271.8 million, dramatically missing Wall Street’s expectations of $421.6 million (+11% y/y) by a huge thirteen-point margin. Revenue growth also decelerated substantially from 20% y/y growth in Q3.

Sonos revenue trend (Sonos Q2 earnings deck)

As shown in the chart above, part of the drop was explained by unfavorable currency movements (a four-point negative impact), as well as a tough comp versus the launch of the Roam product last year. Yet the company also cited softening consumer demand as a factor here, which gave investors a big spook.

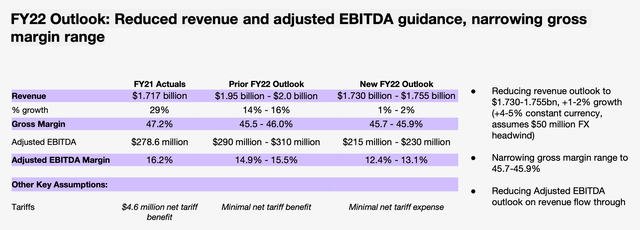

Reacting to the unexpected weakness in Q3, Sonos also dramatically cut its guidance for the year. It’s now only expecting 1-2% y/y growth for the full year, a huge cut versus a 14-16% y/y growth expectation in its prior outlook. It also slashed its adjusted EBITDA guidance down from $290-$310 million to just $215-$230 million, which is a 26% cut at the midpoint.

Sonos guidance (Sonos Q2 earnings deck)

Even more worrying still, the company issued a statement that its previous long-term FY24 target is no longer achievable to hit. In its Q3 earnings release, it wrote: “Due to the uncertain and evolving macroeconomic backdrop, the timeline to achieve the Company’s previously issued targets of $2.5 billion revenue, 45-47% gross margins and 15-18% Adjusted EBITDA margins is being extended beyond FY2024.”

Here’s some further color on what the company is observing in demand softness from CEO Patrick Spence’s prepared remarks on the Q3 earnings call:

Let me provide some additional detail on what we saw from a consumer demand and product perspective in the quarter and how that’s informing our view of Q4. Softening consumer demand across our product categories had an outsized impact on Roam, which was lapping its successful launch in the same quarter last year. In June, we launched Ray, our compact sound bar, which offers the best bang for your buck under $300. We observed that the launch was impacted by softening consumer demand, compounded by a substantial drop in TV sales versus last year. As a result, Ray is significantly missing our expectations for the year. Nonetheless, we remain incredibly excited about having a terrific product at a new price point that has the potential to reach new customers. Looking beyond the short term, we expect that Ray will be very successful as it continues to receive excellent reviews from tech and lifestyle media.

Changing consumer spending patterns influenced our retail partners’ outlook who in turn are taking a cautious approach to their inventory position. As a result of the macroeconomic softness we are seeing, we are extending the time line we expect it to take to hit our long-term targets with $2.5 billion in revenue, 45% to 47% gross margins and 15% to 18% adjusted EBITDA margin.

The company added its belief that in the short term, consumers are allocating more of their discretionary spend toward services and travel, and pausing purchases of goods.

Either way, the message is ringing clear: expect a bumpy road ahead, and one without any near-term solutions.

The bright side

This all being said, I do note a couple of bright spots for Sonos.

The first is that supply constraints have to be acknowledged in Q3. The company exited Q3 with backlog – which means that had supply been available, revenue growth would have been higher. This gives us hope that the negative revenue comps we saw in Q3 may not fully be a demand statement and can be rectified in the coming quarters, even if demand isn’t expected to return back to the high teens/low 20s.

We also note that much of Sonos’ Q3 weakness was due to a drop in orders from channel partners. This is “indirect” demand as retailers tighten their belts in anticipation of macro pressures, but if actual end-customer sell through remains high, reseller orders may recover. The company uses product registrations as its best proxy for sell-through, and it is forecasting this to be flat to slightly down.

Another bright spot in Q3: Sonos still managed to lift its gross margins by 30bps to 47.3%. Many consumer-goods companies have reported steep declines in gross margin as raw material costs increased and logistics rates climbed. Sonos, however, managers to offset these effects by improving its ASPs.

Sonos gross margins (Sonos Q2 earnings deck)

Lastly, we’ll note that in spite of added risks, Sonos’ dramatic cut in share prices may also compensate for its fundamental missteps. At current share prices near $17, Sonos’ market cap is $2.19 billion. After we net off the $439.7 million of cash on Sonos’ most recent balance sheet, the company’s resulting enterprise value is $1.75 billion. This puts Sonos’ valuation at just 7.8x EV/FY22 adjusted EBITDA, based on the midpoint of the company’s lowered adjusted EBITDA range for the year at $215-$230 million.

Key takeaways

Net/net, I’m far less confident in Sonos’ ability to stage a rebound rally and beat the broader market. Demand softness is a tough hole to climb out of, especially if channel partners (which make up a large portion of Sonos’ sales) pull back. Don’t expect a quick turnaround here; however, patient investors who can stomach some volatility may be able to build a small stake at a cheap price.

Be the first to comment