Editor’s note: Seeking Alpha is proud to welcome Liam Cosgrove as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

D-Keine

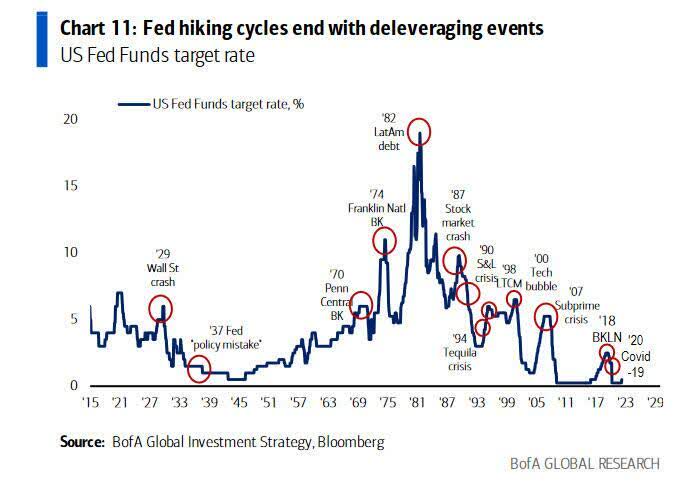

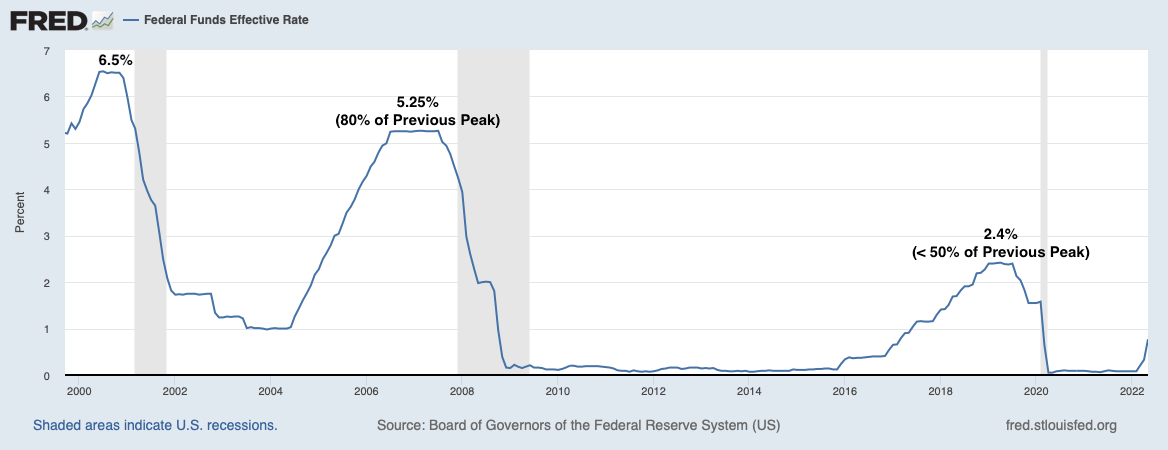

If you’re into finance and macroeconomics, you’ve likely seen this chart:

BofA Global Investment Strategy

Fed hiking cycles end in crisis – every time. The chart also illustrates that, since the 1980s, the Fed has been unable to achieve a Fed Funds Rate (FFR) at or above the peak of the preceding tightening cycle.

It’s not a mystery why this happens: lower-for-longer rates allow for greater debt accumulation and create an ever-increasing dependency on cheap rollover costs.

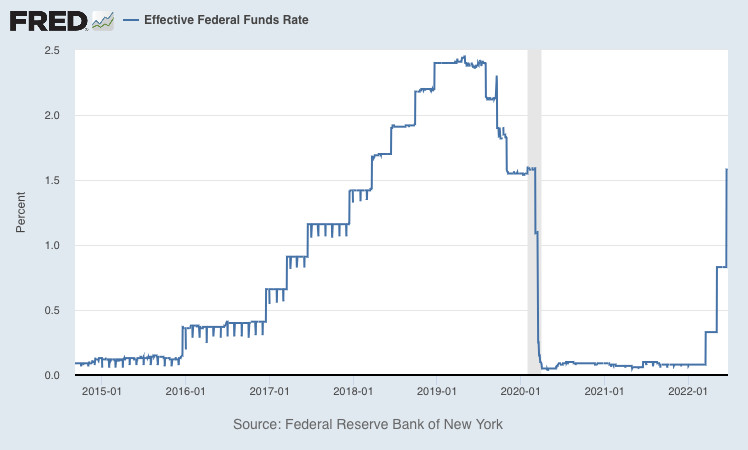

While the above chart isn’t a very large data set, it appears that crises manifest when FFR reaches 50%-80% of the immediately preceding FFR peak. Given today’s effective FFR has been jacked up from nearly 0 to 66% of the 2018 peak in a matter of four months (for reference it took over 3 years for the previous cycle to cover the same relative ground), the likelihood of “something breaking” seems high.

FRED

Before gobbling up VIX futures, it’s important to check the thesis.

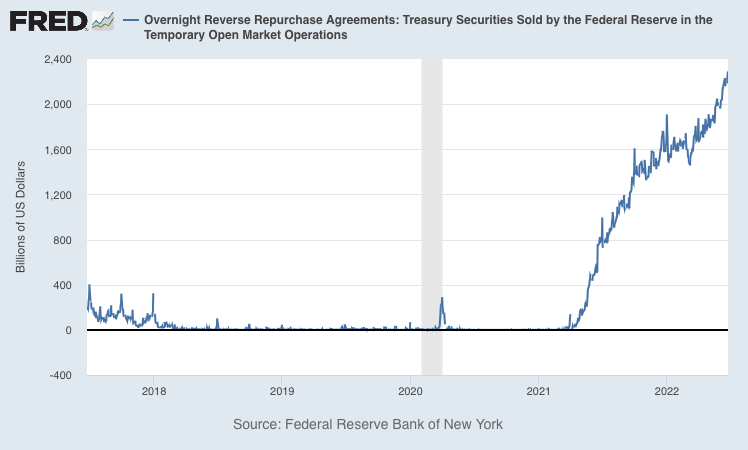

Many are pointing to the huge sums parked the Fed’s Reverse Repo (RRP) facility, excess cash earning overnight yield from the Fed, as one reason why “things may be different this time”. Translation: there’s too much cash for a liquidity crisis.

FRED

First, the majority (88%) of RRP participants are Money Mutual Funds. This is A LOT of cash that would otherwise be chasing T bills, commercial paper, or lent in the repo market. This means an inter-bank lending crisis is unlikely.

That is not to say we will not see “something break”’ in the private sector – in the form of margin calls, mass layoffs, or bankruptcies – due to the rapid uptick in costs of capital. Ironically, the high RRP balance may be giving false confidence to FOMC members that further tightening can be sustained.

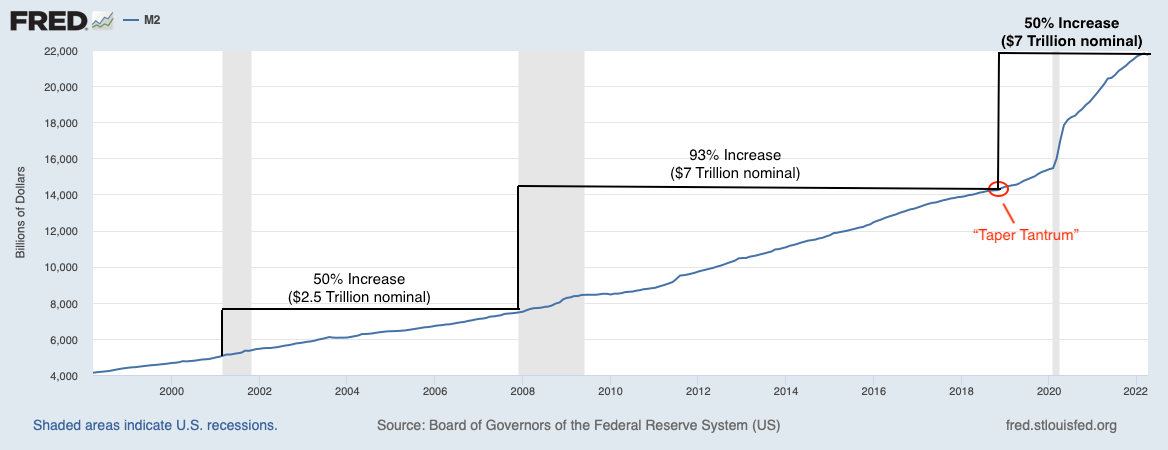

Let’s look more broadly at money supply:

FRED

The interesting thing to note here is the vast increase in money supply (both nominal and percentage wise) during post-GFC era as compared to post-Dot Com. When comparing the “success” of each hiking cycle that concluded these two eras (see below), it appears that money supply and economic robustness are inversely correlated. This is especially odd given that post-GFC was supposedly when regulators cleaned up the financial system with stricter collateral and lending criteria.

FRED

So, the suggestion that excessive liquidity will save us from a crisis is not supported by the data (and in fact the opposite may be true).

I know the recession-will-force-a-Fed-pivot trade is becoming popular now, but I would be careful. The pace of this tightening cycle dwarfs those of the last three bubble bursts shown above, and our economy is more dependent on cheap debt than ever before. Short duration debt (< 1 year) has also seen an unprecedented surge during the COVID era – meaning our countdown-to-crisis could be much shorter than previous cycles. Something may break before the Fed even has time to pivot.

Or, perhaps the Fed cautiously pauses hikes. The markets would undoubtedly smell blood and rally on Fed capitulation. But we’re forgetting that our economy has been nursed at 0% rates for roughly a decade – we can’t sustain 2%! Therefore, I would NOT attempt to trade for such a rally and would brace for lower lows.

For those looking to invest in this environment, remember the Wall Street adage: “Don’t fight the Fed”. If you’re currently in markets that’s exactly what you’re doing. Consider sitting on a majority position in cash. Each new inflation headline will hurt, but don’t add to the pain with nominal losses. And don’t be tempted by a Fed pause – wait for the truly capitulatory Fed pivot. As was the case during the last two crashes, interest rates will likely drop straight to zero and fast! Yes, it would be nice to predict the exact moment this might occur, but if you’re investing for the long haul, just wait it out and buy back in when Fed policy is more friendly towards asset valuations.

Which assets to buy after such a pivot, in a world where Fed policy is accommodative while inflation remains high, is another discussion entirely. In short, inflation hedges are a safe bet while the meteoric returns in unprofitable growth names may become ancient history.

Be the first to comment