naphtalina/iStock via Getty Images

(This is our daily morning note from Friday, Nov 4. A letter like this goes out 4 days per week)

Good Morning!

The non-farm payrolls report set off a spark in the markets with the Dow rising more than 600 points. It has since given up all of those gains. It appears that the markets changed their conclusion about what the jobs report will bring from the Fed next month.

October’s nonfarm payrolls report on Friday left investors divided, fueling some concerns that the Fed will persist with its hiking campaign as the labor market added 261,000 jobs. Others interpreted the findings as a sign that the labor market is beginning to cool – albeit at a slow pace – since the unemployment rate rose to 3.7%.

In other news, rates are moving up on the short-end while the long end is fairly flat but near its 52-wk high again. Commodities are stronger with the weaker dollar. Terminal rate expectations are now at 5.13% as the stronger jobs report means the Fed will have to do more to inflict more pain to see the labor market roll over.

Yesterday, equity markets finished lower again, after Wednesday’s sell-off on the back of disappointing Fed commentary. The Fed raised rates by the expected 75 bps but signaled rates could stay higher for longer to combat inflation. Growth-style stocks underperformed, which has become a trend this year as policy rates rise. Treasury yields were also on the move, with the 2yr hitting a level not seen since 2007 and the 10yr trading around 4.2%.

The Fed pivoted all right, but not in the direction that investors had expected. At this point, it’s quite obvious that the Fed will go ABOVE the 5.13% implied terminal rate by the markets. Thus, we will reiterate that this is not the time to stick your neck out and being over risked or adding more to your risk assets. If anything, I would be reducing risk.

Today’s spiking 2-year Treasury yields are due to yesterday’s Fed Chair press conference, where Powell explicitly said the FOMC is revising upward its view on where Fed Funds will eventually peak. He did not offer up a view on peak rates, however, so markets are left to their own devices at least until policymakers weigh in on this topic. The history above is some guide, and it says 5.0 – 5.5% is a reasonable level to note. All that seems certain is that until 2yr yields stabilize equities will remain under pressure…

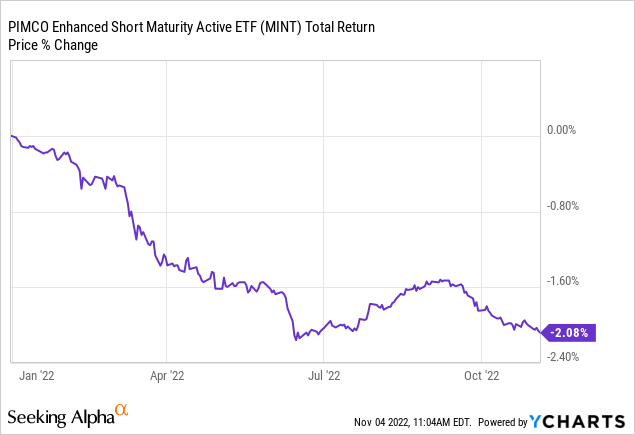

Even owning short-duration bond funds as a cash substitute means losses. MINT, for example, is down over 2%. While it doesn’t seem like much in the face of ~40% losses in the Nasdaq, it is not what one wants to see with regards to their “cash.”

chart

The question is, where do you “hide out?” If you lose money in cash substitutes like MINT, NEAR, GSY, JSPT, and others as the 2-year rises towards that 5.5% likely terminal rate, then why invest in them here?

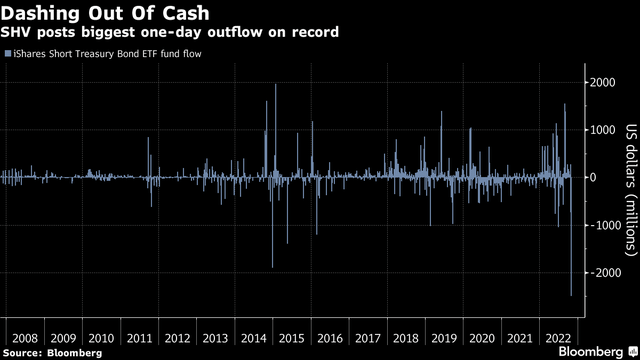

Money has been draining from ultra-short duration funds for this reason, taking liquidity with it. In fact, nearly $2.5B exited from the $21B iShares Short Treasury Bond ETF (SHV) on Tuesday alone. This is the biggest one day exodus since the fund was launched in 2007.

This could be a result of the latest rally in stocks as investors pull money out of ‘cash’ and go into longer-duration risk assets that has sent the S&P up 8% in the last few weeks.

The other thought is that investors are buying up long-duration debt like 10-yr treasuries. The thinking is that the Fed is going to hike further than originally believed and that a recession is more likely than ever.

Investors have a choice. Lock in these juicy yields today for multiple years and if rates move higher, be content with the mark-to-market unrealized losses knowing that eventually, you get back par. Or you can stay short, very short, in something like SHV above or a target iBond ETF that is 2024 or sooner.

We will be discussing this in more depth in the coming weeks. For now, we continue to espouse a risk-off strategy. Mike Wilson just stated that he sees S&P 2,950 in the next few months. That is another 20% downside from here.

Below is a new issue coming to market that looks interesting.

Wells Fargo & Co. (WFC) 5-Year Step -Up Note

Coupon Step-Up Schedule:

6.00% From 11/09/2022 – 11/13/2025

6.25% From 11/14/2025 – 11/13/2026

8.05% From 11/14/2026 – 11/14/2027

Maturity: 11/14/2027 – Year Maturity

Call Info: 5/24 @ 100 – Non-Call 6 Months

YTW: 6.00%

Price: $100.00

Rating: A1/BBB+

CUSIP: 95001DCM0

Trade Date: 11/09/2022

Or you could venture into some of these high-quality preferreds that are well under par right now. The chance of being called is essentially zero right now. But regardless, you could see some strong appreciation if rates come down.

For instance, you should check out:

- RiverNorth/DoubleLine Strategic Opp (OPP-B), yield 6.74%

- RiverNorth Opp (RIV-A), yield 6.82%

- Schwab Series D (SCHW-D), yield 6.43%

- JP Morgan series K (JPM-K), yield 6.35%

- Wells Fargo series Z (WFC-Z), yield 6.70%

- Capital One series J (COP-J), yield 7.05%

These issues could be a good replacement for those who do not want to own individual bond issues (like the one I posted below). The big difference being that these do not have a maturity date that gives it that pull-to-par (price converges with par as it approaches maturity date), which is a huge advantage in this market.

Or investors can pair their current bond holdings by adding some of these positions to their portfolio to diversify and lock in some yields without the chance for a call anytime soon.

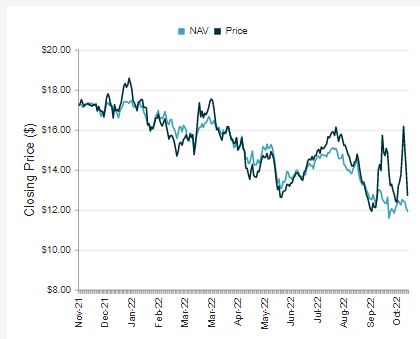

Lastly, check out JCE, a fund we called out a few days ago as being ridiculously overpriced.

cefconnect

Have a great week!

Be the first to comment