melg-photography/iStock Editorial via Getty Images

Article Thesis

SoFi Technologies, Inc. (NASDAQ:SOFI) is a fast-growing and interesting digital financial services company. Due to some headwinds, such as a student loan moratorium and a lowered guidance, and due to a high initial valuation at the time when the company went public, SOFI has massively underperformed the broad market since its IPO (via SPAC). Execution has been solid, however, and growth should remain healthy going forward. Since SoFi Technologies is still not cheap, I do not believe that it is time to buy already.

SoFi Technologies’ Underlying Progress

SoFi Technologies is, as can be expected from a digital financial services company, growing quickly. This happens through the addition of new customers/members, and through rolling out new services that allow SOFI to do more business with existing customers. Overall, this has allowed SoFi Technologies to deliver compelling quarterly results. During the most recent quarter, SoFi Technologies was able to grow its revenue by 54% year over year. That compares very favorably relative to how many other fintech companies are performing. PayPal (PYPL) and Block (SQ) grew their revenue by around 13% and 29% in the most recent quarter, for example. They have larger revenue bases which means that maintaining a very high relative growth rate is harder. But still, SoFi clearly is a fintech company that delivers a highly compelling growth rate for now.

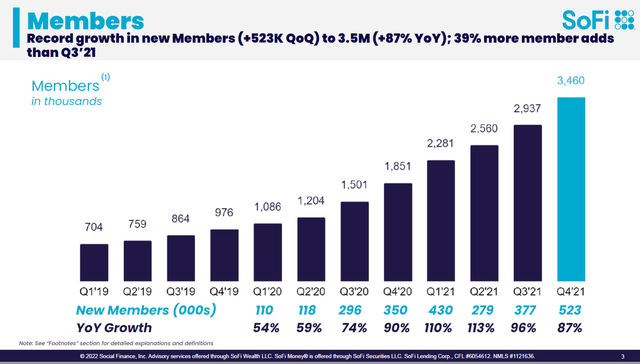

SoFi Technologies’ member growth rate has been particularly strong in recent quarters, as can be seen in the following slide:

SoFi member growth (SOFI presentation)

Growth accelerated meaningfully in 2021, with year-over-year increases hitting as much as 110% during the first half of the year. Since then, relative growth has slowed down to some degree, but growth still was at a record level in absolute terms during the most recent quarter.

In the first quarter of the current year, growth might be even better. This year’s Superbowl took place in Inglewood, California, in the SoFi Stadium. With the company name prominently displayed and mentioned during the event that was seen by around 100 million people, it would not be a huge surprise to see member additions at an above-trend level in Q1, although we won’t know for sure until SOFI reports its results, which will likely happen in early May. It should be noted that this would be a one-time effect, however. Since the stadium name does not get this much attention in other quarters (or in other years, where the Superbowl is played elsewhere), there would likely not be a long-lasting impact on SOFI’s growth. Still, even a one-time boost to new member additions could help SoFi Technologies in improving its scale and coming closer to profitability on a GAAP basis.

Speaking of profits, SOFI has reported a GAAP loss of $0.15 per share for the most recent quarter. That was worse than the result during the previous quarter (a $0.05 GAAP loss per share), but still way better than the results during the company’s first quarter as a publicly-traded company, Q2, during which the company had lost close to $0.50 per share. SOFI’s non-existent profits are mainly explained by the fact that its Financial Services segment is deeply unprofitable, at least for now. While the Lending business generated a positive contribution of $105 million, up 24% year over year, and the Technology Platform business generated a positive contribution as well, Financial Services lost $35 million during the quarter. Once accounting for corporate-level expenses such as administration, there was no profit to be found any longer.

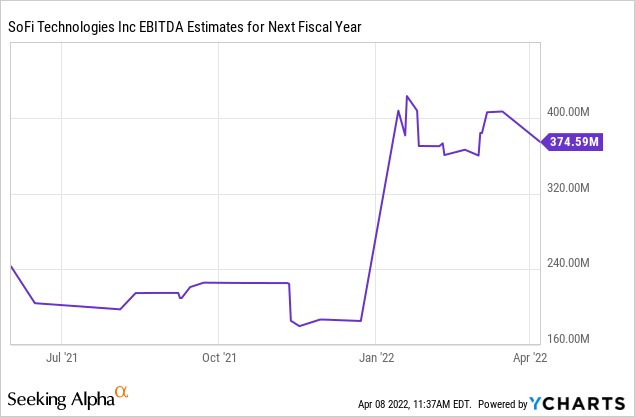

SoFi Technologies reports a positive EBITDA number, but that includes a wide range of adjustments. One of the biggest is the backing out of share-based compensation expenses. Depending on one’s point of view, that can make sense — or not. On a cash basis, backing that out makes sense, as SBC is a non-cash item that does not require any cash outlays by the company. But SBC still comes at a cost for investors, as SBC leads to a rising share count, all else equal. A rising share count results in dilution, as each original share’s claim to the value of the company as a whole shrinks. I thus am critical of backing out share-based compensation when calculating EBITDA or net profit, as SBC comes with a real cost to investors, even though it’s not a cash expense. Adjusted EBITDA came in at $30 million for the year. For a company trading at around $7 billion, that’s not a lot of adjusted profit at all. But on the other hand, investors should account for the fact that EBITDA will likely explode upwards in 2022 and beyond.

On the back of strong expected revenue growth of close to 50%, which already includes the reduced guidance due to the recent student loan moratorium, EBITDA is forecasted to rise by more than 200%, to $100 million. This is the result of operating leverage: The company’s fixed or semi-fixed costs, such as overhead and administration expenses (or what the company pays to have its name on the SoFi Stadium) do not rise in line with revenue. Growing revenues thus allow the company to grow its profits at a faster pace.

Not surprisingly, EBITDA is forecasted to expand rapidly in 2023 as well:

Analysts are currently predicting that EBITDA will climb by another 200%+ in 2023, relative to current 2022 estimates (and guidance). This will be the result of ongoing business growth, operating leverage, and the end of the student loan moratorium — even though that has been extended recently, most analysts see it not being an issue in 2023. The current end date of the moratorium is August 31, thus even if it were to be extended by another couple of months later this year, it may very well end before 2023 begins.

SOFI Stock – Dropping From IPO Bubble Levels

SoFi Technologies is active in an attractive industry, and it is growing at a compelling pace. Not too surprisingly, the company and its owners cashed in on that in 2021, when valuations for many not-yet-profitable growth stocks were at bubble-like valuations. SOFI, which went public via a SPAC combination, first started trading at a price of $23 per share. That’s 190% more than the current share price of $7.90. In other words, SOFI has lost close to 70% of its value (on a per-share basis) in less than a single year. That worked out great for legacy investors cashing in on the SPAC craze, whereas it didn’t work out for those that chased a growth name at a way-too-high valuation. Using the current share count of 910 million, SOFI was valued at $21 billion last summer — despite only doing $30 million in (adjusted EBITDA) last year, which makes for an incredible 700x EBITDA multiple.

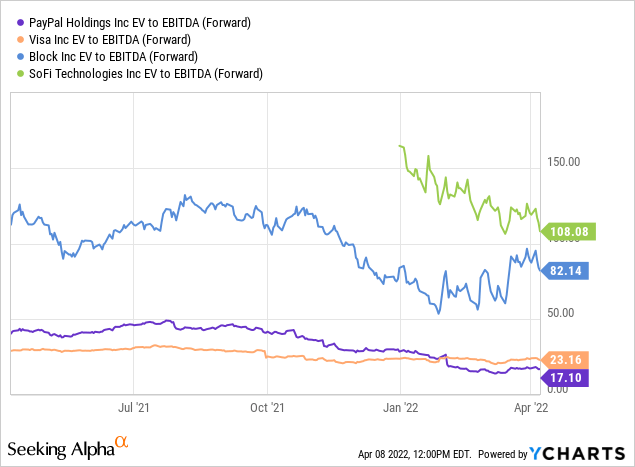

Today, SOFI is trading for around 70x this year’s EBITDA. Looking beyond 2022, to 2023, we get to an EBITDA multiple of 19. That’s still not a low valuation, and investors should keep in mind that this number does back out share-based compensation. Still, a high-teens EBITDA multiple is at least somewhat reasonable for a growth name, and it is tremendously lower compared to how SOFI was valued at the bubble top.

Other Fintechs Could Be A Better Value

SOFI is growing quickly, but its profitability is not proven, its share count keeps climbing rapidly, and its valuation is still far from low. I do believe that there are better fintech picks available.

PayPal and Visa (V) trade at around one-fifth and one-fourth the valuation SOFI trades at, respectively, looking at 2022 EV/EBITDA. They are not growing their revenues at a similar pace but still deliver very solid revenue growth overall. Their proven profitability, stronger fundamentals, and much lower valuation make them the better choice at current prices, I believe.

Takeaway

SoFi Technologies has been an extremely bad performer since the company started trading publicly. That was the result of a massive decline in the stock’s valuation, as underlying business progress was actually very solid. Despite the huge multiple contraction experienced to date, SOFI is not a cheap stock. I do believe that shares are still too pricy to warrant a buy rating today, although they are way more reasonably valued today compared to last summer. With other fintech names trading at way more attractive valuations, even when we consider their somewhat lower growth compared to SOFI, I do believe that staying on the sideline could be the right choice when it comes to SoFi Technologies.

Be the first to comment