Justin Sullivan

The Biden administration just dealt SoFi Technologies (NASDAQ:SOFI) a major blow by unexpectedly extending the Federal Student Loan Payment Moratorium from December 2022 to June 2023 on Tuesday. The extension is set to push out SoFi’s earnings from its student loan business further out into the future and it limits new student loan refinancings. While I have to adjust my EBITDA outlook for next year, I still believe that SoFi has considerable potential to become a major player in the FinTech space over the long term. Because of the unexpected extension of the student loan moratorium, I am changing my rating on SoFi from buy to hold!

Another extension of the Federal Student Loan Payment Moratorium

The repayment of student loans was first frozen in FY 2020 in reaction to the Covid-19 pandemic and it was meant to provide financial relief for student loan borrowers at a time when the US economy was shut down. The US government subsequently extended the student loan payment pause multiple times. On Tuesday, the Biden administration announced that it was yet again extending the Federal Student Loan Payment Moratorium from December 2022 to June 2023, meaning SoFi will continue to see a delay in student loan repayments which limits the FinTech’s earnings potential in FY 2023.

Because student loans are a big business for SoFi, the extension of the student loan moratorium in April of this year specifically resulted in SoFi massively down-grading its net revenue and adjusted EBITDA outlook for FY 2022. The personal finance company at the time reduced its net revenue outlook from $1.57B to $1.47B and its adjusted EBITDA guidance from $180M to just $100M, showing a decrease of $80M. SoFi later raised its FY 2022 guidance to account for strong member and product growth as well as improving customer monetization.

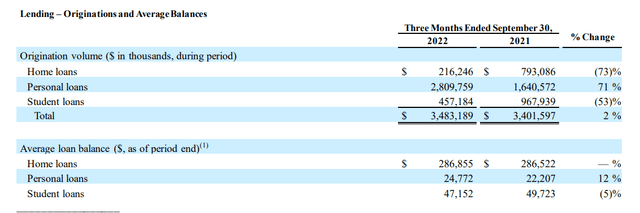

Repeated extensions of the Federal Student Loan Payment Moratorium have resulted in a major decline in SoFi’s student loan business. Originations of student loans were a key driver of growth for SoFi before the pandemic, but the current situation has not helped the business very much. In the third-quarter, SoFi’s student loan originations dropped 53% year over year to just $457.2M as borrowers have no reason to do student loan refinancings. Student loans accounted for an origination share of just 13% in Q3’22, down from more than twice this amount in the year-earlier period. Subsequent extensions of the student loan moratorium are set to suppress SoFi’s origination business for even longer which could result in growing valuation pressure on SoFi’s shares.

Updated adjusted EBITDA guidance

Before the extension, I estimated that SoFi could generate $200M in adjusted EBITDA in FY 2023 which was based on the assumption that student loan payments would resume in January. This clearly is now no longer possible and I therefore have to take accountability and lower my estimate. I believe that SoFi may achieve adjusted EBITDA closer to $150M in FY 2023 as the moratorium will last at least through half of the next year.

SoFi’s valuation remains attractive for long term investors

SoFi’ shares have revalued 71% to the down-side this year and the personal finance company is a major loser in my portfolio. However, I believe the FinTech’s strong member and product growth help make a strong investment case for SoFi. Although growth is slowing, SoFi has no problems acquiring hundreds of thousands of new members a quarter.

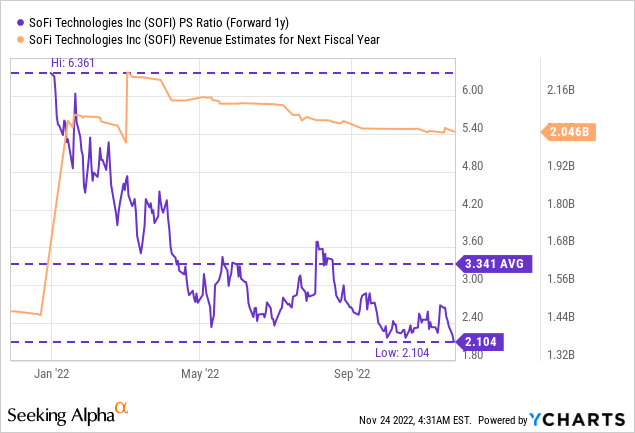

SoFi is currently expected to generate $2.05B in revenues in FY 2023, implying 34% year over year top line growth. This year, SoFi is projected to grow its revenues by 50%. The FinTech is also expected to be profitable in FY 2024. Based off of revenues (since SoFi is not yet profitable), shares have a P/S ratio of 2.1 X which is 37% below the 1-year average P/S ratio.

Risks with SoFi

Although SoFi is adding a significant number of new members to its platform each quarter, it is also true that the FinTech’s growth is decelerating, post-pandemic. The personal finance company added 424 thousand new members to its ecosystem just in the third-quarter, but Q3’22 was also the fifth straight quarter of revenue deceleration. SoFi benefited from a wave of customer sign-ups during the pandemic, but this period of hyper-growth is clearly coming to an end. Slowing top line growth is as big a risk for SoFi as another extension of the Federal Student Loan Payment Moratorium in June 2023 which would be set to hurt SoFi’s student loan origination business.

Final thoughts

The Biden administration really dealt a blow to SoFi this week and I didn’t expect the extension of the student loan moratorium at all. As a result, SoFi’s adjusted EBITDA may not be as high as I estimated recently. While SoFi’s earnings are only going to be pushed out in the future, the Federal Student Loan Payment Moratorium extension is a net-negative for SoFi and I was clearly wrong assuming that payments would resume in January. While I still like SoFi due to its excellent (although decelerating) member growth rates and expanding product offerings, especially in financial services, I believe SoFi’s shares may continue to struggle in the near term!

Be the first to comment