Justin Sullivan/Getty Images News

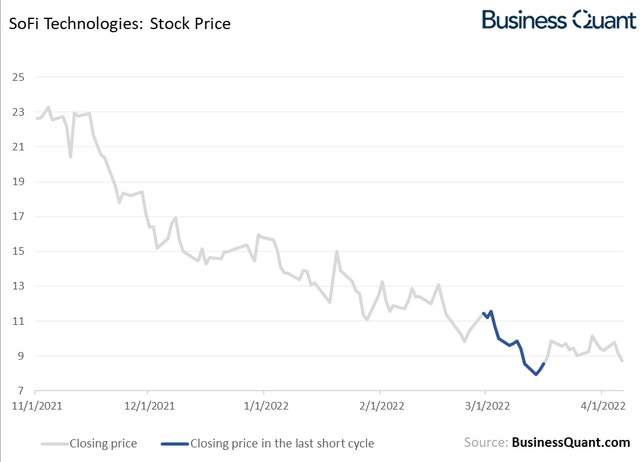

SoFi Technologies’ (NASDAQ:SOFI) shares are down 50% over the last 6 months but the downtrend could still continue. Latest data reveals that short interest in the name rose by 7.7%, to reach record highs, in the latest cycle. This is indicative of intensifying shorting activity in the stock and suggests that it may further decline in value over the coming days and weeks. This should come across as a concerning sign for the company’s long-side shareholders.

Shorting Activity Intensifies

Let me quickly explain the short interest metric for the uninitiated. It’s the total number of short positions that are still open against a stock, at the end of bi-monthly reporting cycles. A sharp buildup in the metric indicates that traders actively placed short bets against a particular stock as, perhaps, they anticipate it to quickly decline in value in the near-term time frame. Conversely, a sharp decline in the metric indicates that market participants actively wound up their short bets against a stock as, perhaps, they anticipate it to bottom out or appreciate in value going forward. So, the short interest metric basically provides us with the pulse of the Street.

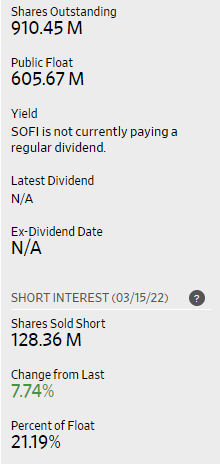

As far as SoFi is concerned, its short interest rose to a record high of 128.3 million at the end of the last reporting cycle. The figure is up 7.7% sequentially and up 1041% (yes you read that right) from its 52-week lows. As a reminder, the company has 605.6 million floating shares. This means that over 21% of its entire public float now stands shorted.

Wall Street Journal

This is indicative of intensifying shorting pressure in SoFi’s shares which is rather unexpected as the security has been on a continuous decline for the better part of the past year. Many investors believe the worst has been priced into SoFi’s shares at current levels and that they’re in the process of bottoming out. If this were truly the case, short-side market participants would be winding up their positions in SoFi, booking profits and we’d have seen its short interest figure decline. But what we see here, instead, is that market participants are actively initiating short bets against SoFi. This suggests that the Street perceives the stock to still be overvalued and anticipates it to further correct in coming weeks.

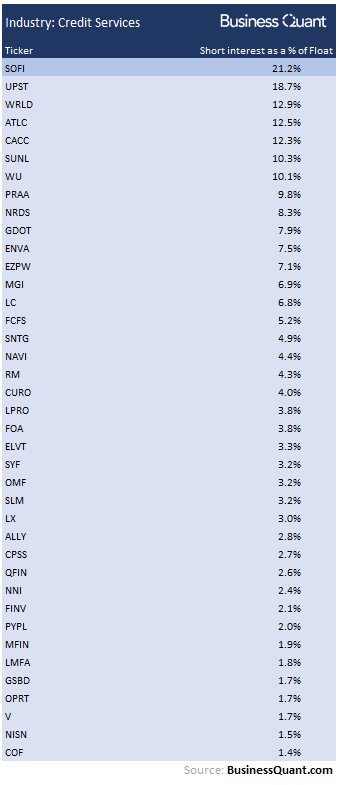

Here’s another perspective. I pulled the short interest data for 38 other US-listed stocks that are classified in the credit services industry. Note how short interest as a percentage of total public float, is particularly high in the case of SoFi Technologies. This suggests that shorting activity in the FinTech firm is particularly elevated when compared to its industry group.

But all this begs the question – Why are market participants betting against SoFi’s shares in the first place?

Skeptical for Good Reason

A major reason why market participants have been growing skeptical about SoFi’s growth prospects, has been the deteriorating outlook for the federal student loan moratorium. The government had already extended the deadline twice in the last two years and they extended it once again yesterday. The extension is now supposed to end on August 31, 2022 which further delays the economic recovery for banks, FinTech firms and financial institutions such as SoFi.

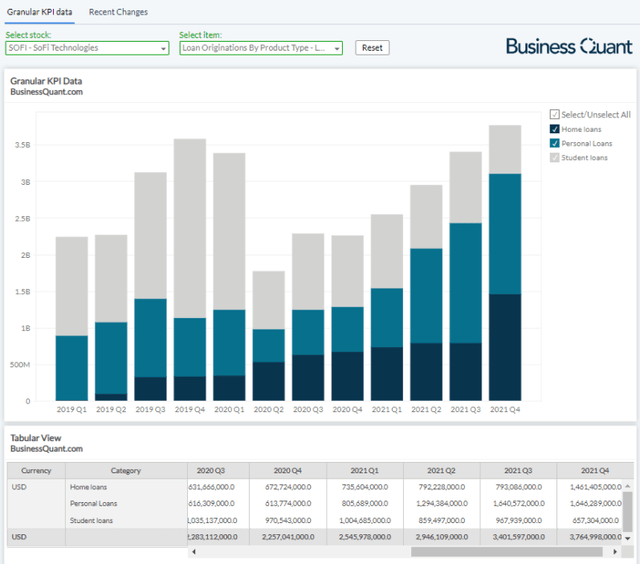

See, SoFi’s loan originations mainly consisted of student loans prior to the COVID-19 pandemic. But once the federal student loan moratorium was introduced in 2020, students did not face any immediate need to refinance their loans with SoFi. The latest moratorium deadline extension basically means that SoFi’s overall loan originations growth is likely to remain subdued for an extended period of time.

The problem doesn’t just end there. Analysts are estimating that there is likely going to another moratorium extension that could extend well into 2023. SoFi’s management, too, expects the moratorium to be extended well past the August 31, 2022 deadline. They just lowered their adjusted net revenue and adjusted EBITDA guidance for FY22 by 6.4% and 44%, respectively. From the company’s latest 8-K filing:

Management now expects that a number of factors including the impending fall midterm elections will precipitate a likely seventh extension beyond August 2022 by the Administration… SoFi’s updated Adjusted Net Revenue and Adjusted EBITDA guidance for full-year 2022 is $1.47 billion and $100 million, respectively, a reduction from previous guidance of $1.57 billion and $180 million, respectively.

What further exacerbates the problem is that SoFi is unprofitable on a GAAP basis. This subdued growth, as a result of the deadline extension, essentially means that the company’s break-even point gets pushed further into the future. The company may have to dilute existing shareholders, and/or raise debt in a rising interest rate environment, to meet its capital needs and fund its growth. Either of the scenarios present a bleak outlook for SoFi’s shareholders.

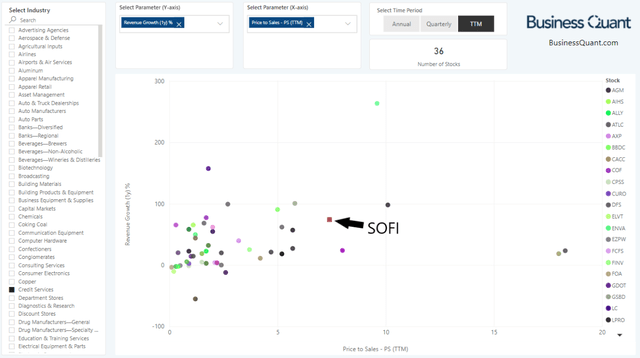

Unfortunately, for the company’s investors at least, there’s more bad news. SoFi’s shares are trading at a premium compared to many of its rapidly growing peers in the credit services industry. Let’s take a look at the chart below to put things in perspective. The Y-axis plots the revenue growth rates for 36 stocks trading in the credit services industry. Note how SoFi Technologies is vertically positioned around the middle, indicating that its revenue growth rate is more or less at par with many of its mentioned peers.

Now let’s shift attention to the X-axis, which plots the Price-to-Sales (or P/S) multiples for the same set of companies. Note how SoFi is horizontally positioned towards the right, indicating that its shares are trading at a steep premium. These axes collectively suggest that SoFi’s revenue growth rate is in-line with many of its other rapidly growing peers but its shares are trading at a steep premium nonetheless. This means that SoFi’s stock still has room to correct further, perhaps by another 20% to 30%, for it to trade at par with other rapidly growing companies in the space. So, in the meantime, investors may want to consider investing in the other 12 stocks that are growing at par with SoFi but trading at significantly lower P/S multiples.

Final Thoughts

I understand that SoFi, as an independent company, is making banking easier for the masses. But at the same time, we must also realize that good companies don’t always make for good investments. The stock seems overvalued when compared its industry peers; it’s likely to correct further and experience a mean reversion in the coming weeks. So, investors may want to avoid SoFi’s shares for the time being. I might change my stance on the company once its shares hit $6 per share, implying a 30% correction from its current levels. Good Luck!

Be the first to comment