Justin Sullivan/Getty Images News

Price Action Thesis

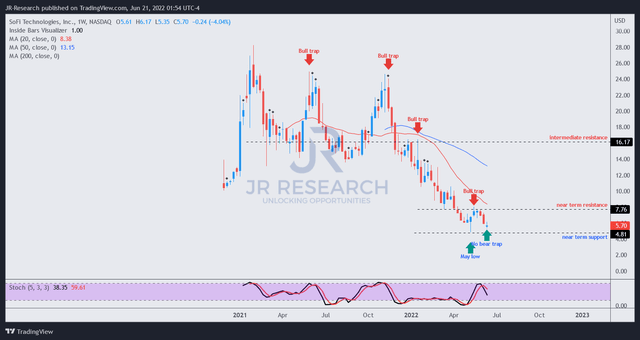

We follow up with a detailed price action analysis on SoFi Technologies, Inc. (NASDAQ:SOFI) stock from our previous article, as there have been significant developments in its price action.

As we posited, SOFI stock met with sustained selling pressure at its near-term resistance, as the market rejected the buying momentum from its May bottom.

The recent sell-off has forced SOFI back near its May lows, but we noticed it could be a near-term bottom. As a result, we believe it’s apt to revise our Sell rating to Speculative Buy as we await the price action re-test. We also urge sellers who sold short to consider covering their positions. Notably, the selling pressure has fallen short of taking out its May lows, which is constructive for the stock to base.

Our reverse cash flow valuation analysis indicates that SoFi could meet its revenue targets through CQ2’26 at the current levels. But, our parameters are predicated on SoFi improving its FCF profitability markedly through FY24. Therefore, investors should consider our basis less reliable than average and thus should require a higher hurdle rate for adding exposure.

As such, we revise our rating from Sell to Speculative Buy. However, we have not observed a bear trap price action to signal a potential reversal in its bearish bias. Therefore, investors should consider using appropriate risk management strategies to minimize steep losses in SOFI stock if its May low fails to hold.

SOFI’s May Low Is Holding Up Well So Far

SOFI price chart (weekly) (TradingView)

SOFI stock surged from its May lows and formed a bull trap at its near-term resistance, as we postulated in our previous article (Sell rating). As a result, SOFI stock has dropped about 25% (at writing) since we published our last article.

Notably, a bear trap price action that can help stanch a further decline remains elusive. Therefore, we have not observed a price action trigger that could signal a sustained reversal in its bearish momentum.

Notwithstanding, we noticed that its price action could form a bottom above its May lows and start to base (but still too early to validate). Therefore, more conservative investors can consider observing a sustained consolidation in SOFI stock first before adding exposure. Otherwise, it seems possible that SOFI holds its May lows and potentially forms a bear trap price trigger subsequently.

SOFI Valuation Is Less Aggressive Now

| Stock | SOFI |

| Current market cap | $5.22B |

| Hurdle rate (CAGR) | 30% |

| Projection through | CQ2’26 |

| Required FCF yield in CQ2’26 | 2.5% |

| Assumed TTM FCF margin in CQ2’26 | 12.5% |

| Implied TTM revenue by CQ2’26 | $2.98B |

SOFI stock reverse cash flow valuation model. Data source: S&P Cap IQ, author

Given its more constructive price action, we revisited our reverse cash flow valuation model to try and model the market’s valuation of SOFI stock.

We believe a 30% hurdle rate is appropriate, reducing from our previous rate of 35%. However, we increased our FCF yield requirement (which we use for typical high-growth opportunities) to 2.5%, up from our previous requirement of 2%. Therefore, we intended to strengthen our model but give space for SoFi to prove its ability to grow rapidly.

We applied a TTM FCF margin of 12.5%, markedly lower than the Street’s consensus (analysts are bullish) for FY24, to factor in an appropriate discount. Consequently, we arrived at a TTM revenue requirement of $2.98B that SoFi needs to post by CQ2’26.

The revised consensus estimates indicate that SoFi could deliver revenue of $2.74B in FY24. As a result, SoFi needs to deliver a revenue CAGR of 5.76% from FY24-CQ2’26.

We think it’s achievable for SoFi to deliver our revenue targets at the current valuation as long as it continues to execute. Notwithstanding, it’s imperative for SoFi to continue improving its FCF profitability. Therefore, investors should carefully watch management’s commentary and guidance on its profitability, as it could markedly impact its valuation.

Furthermore, SoFi is expected to remain unprofitable on a GAAP EPS basis, which could affect investors’ sentiments.

Is SOFI Stock A Buy, Sell, Or Hold?

We revise our rating on SOFI stock from Sell to Speculative Buy. Given its unprofitability, we urge investors to be stringent with their hurdle rates. Furthermore, its FCF profitability estimates remain highly speculative at the moment.

Notwithstanding, we believe that it could be at a near-term bottom. Therefore, observing how the market intends to value SOFI stock as selling pressure has been absorbed at the current levels is essential. Consequently, it’s constructive to help SOFI stock consolidate / base at the current levels moving forward.

However, we have not observed a bear trap price action to help stymie its bearish momentum. As a result, a further sell-off to force liquidation before forming a validated bear trap cannot be ruled out. As a result, investors are urged to use sound risk management, given its dominant bearish momentum.

Be the first to comment