Sundry Photography

Thesis

Snowflake Inc. (NYSE:SNOW) stock has continued to outperform the broad market since our pre-earnings update in July, urging investors to consider less expensive high-growth stocks. Despite suffering a massive battering from its 2021 highs, SNOW’s NTM revenue multiple of 20x is still well ahead of its high-growth peer set of average of 8x.

Notwithstanding, the company’s expanded CY26 TAM of $248B has spurred SNOW bulls, as it pursues its opportunity as a cloud data platform. Furthermore, a solid FQ2’23 earnings release corroborated the resilience of its usage-based pricing model. Snowflake demonstrated that it has continued to observe robust growth in its underlying growth drivers, despite worsening macro headwinds.

Despite its recent market outperformance, SNOW has fallen nearly 17% from its August highs. Therefore, we believe some investors could wonder whether the current pullback represents an appropriate opportunity to add exposure.

Our analysis indicates that Snowflake’s underlying growth deceleration could have bottomed out in Q2. Therefore, if Snowflake can execute well moving ahead, we posit that its June lows should sustain resiliently.

Notwithstanding, we assessed that SNOW’s marked recovery from its June bottom has likely been reflected at the current levels. We believe the market had anticipated a robust Q2 release, which led to a post-earnings spike toward its August highs. However, its momentum surge also led to a price top in August, with SNOW giving back nearly 50% of its post-earnings surge.

We believe the market has justifiably de-rated SNOW and is unlikely to re-rate it much higher in the medium-term from the current levels. Hence, we don’t find the reward-to-risk profile at the current levels attractive to revise our rating.

As such, we reiterate our Hold rating on SNOW and urge investors to wait patiently for its bottoming process to transpire.

Snowflake Wants To Consolidate Its Clout With Data Sharing

Snowflake’s competitive edge as the leading multi-cloud data platform has helped sustain its rapid revenue growth rates. Furthermore, its data-sharing progress has strengthened its position with its customers, given the regulatory landscape requiring tighter privacy and data governance controls.

Consequently, Snowflake’s cloud-native architecture is well-primed to leverage the data-sharing momentum, driven by its customers’ needs to unlock deeper customer insights without infringing on data privacy regulations. Therefore, Snowflake’s competitive moat could be strengthened if more companies depend on it for their data-sharing practices. Snowflake is also confident that it would drive further platform loyalty and usage, as CFO Mike Scarpelli accentuated:

[Customers] first need to get all their data in Snowflake and whoever they’re sharing their data with needs to be Snowflake on the other end. 21% of our customers are using data sharing today, and that continues to grow every quarter. That really creates the stickiness because once you start using Snowflake for data sharing, you can’t get off of data sharing. Once you get into that network effect, whoever that supplier or vendor or whatever customers need to be on Snowflake. (Piper Sandler Growth Frontiers Conference)

We believe Snowflake’s commentary is credible. The company wants to be the critical driver for its customers’ data, leveraging the capability of its cloud data platform. Notably, it’s also expanding into app development moving forward, building on its data science capabilities.

Therefore, Salesforce’s (CRM) recent moves to try and retake the initiative in its customers’ data were likely seen as a defensive move to the success of Snowflake’s model. Insider reported:

The software giant is finding itself increasingly intertwined with another unexpected data giant: Snowflake. Increasingly, analysis of the data generated via Salesforce is not happening on Salesforce. It’s instead getting piped into Snowflake or other providers, where the work — such as building machine learning models or analyzing customer demographics and behaviors. And Salesforce is addressing that uncomfortable reality with several big strategic moves. – Insider

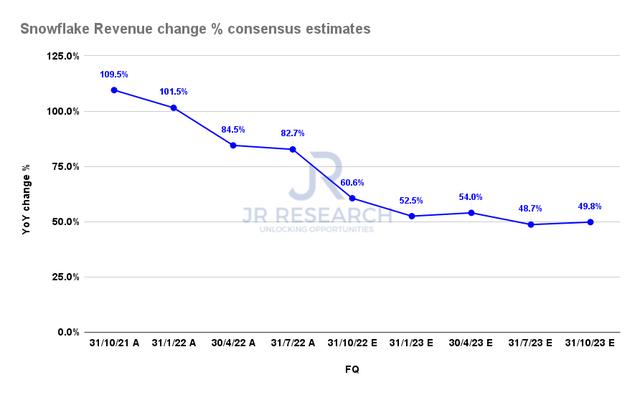

Snowflake Revenue change % consensus estimates (S&P Cap IQ)

Therefore, we believe the market is increasingly convinced that Snowflake represents a credible and highly competitive threat to the market’s incumbents.

Accordingly, Snowflake is expected to report a slower H2’22, as seen above, in line with the company’s guidance. Still, a revenue growth rate of more than 50% to exit 2022 (FQ4’23) is highly commendable in a harsh macroeconomic climate. Hence, Snowflake’s robust execution has likely drawn higher conviction from investors.

Is SNOW Stock A Buy, Sell, Or Hold?

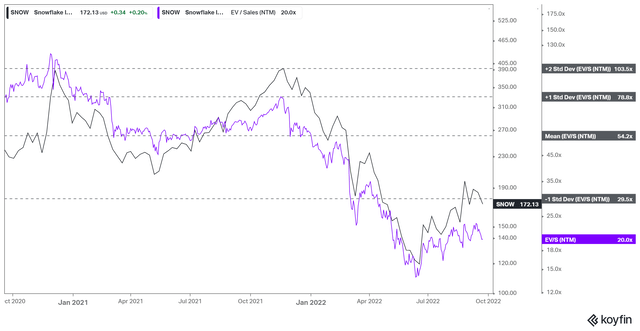

SNOW NTM Revenue multiples valuation trend (koyfin)

SNOW was pummeled as it bottomed out in June at a valuation well below its mean. However, we believe the de-rating was justified, given its weak operating profitability. Furthermore, a discernible growth premium is still embedded at the current levels.

Notwithstanding, we assessed that the market is unlikely to push it below its June bottom, given Snowflake’s competitive moat, as discussed earlier. Its ability to gain share rapidly against the leading hyperscalers demonstrates its execution prowess.

Furthermore, it has improved its operating leverage further as it scales, driving more efficiencies through larger enterprise customers. Notwithstanding, SNOW’s valuation and aggressive growth estimates behoove the company to continue executing very well.

However, given the increasingly challenging macro environment, the market could adjust its expectations to de-risk Snowflake’s valuation, reflecting higher execution risks. Hence, we view SNOW as quite well-balanced for now, and thus don’t see an attractive reward-to-risk profile at the current levels.

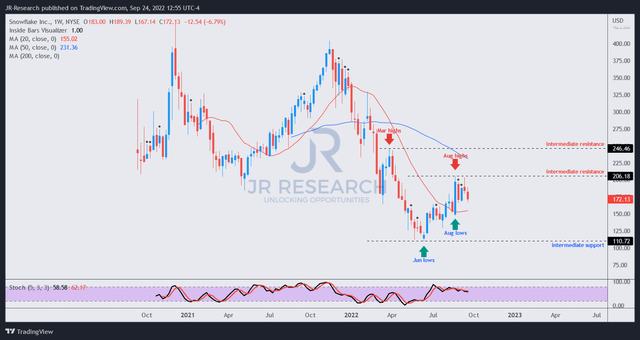

SNOW price chart (weekly) (TradingView)

SNOW’s June bottom should hold resiliently over the medium-term. However, we postulate that the market could still be digesting its post-earnings spike, which led to its recent August highs.

Therefore, we urge investors to be patient to allow the market to demonstrate its intention for SNOW to form its bottoming process before adding exposure.

Coupled with our assessment of a more well-balanced valuation (an inadequate margin of safety), we reiterate our Hold rating on SNOW stock for now.

Be the first to comment