Sundry Photography

Snowflake (NYSE:SNOW), a major player in cloud data storage and applications, reported FY 2023 Q3 results after market hours on Nov. 30, beating expectations on earnings and revenues. The YoY product (as opposed to professional services) revenue growth for Q3 was 67% (see slide 14). This is the key metric because professional services and other growth is a small fraction of total revenue (see slide 17).

The company did especially well in growing revenue from large customers (which they define as spending $1M or more) and serves an impressive cadre of major firms across a number of industries (see slide 10). While revenue growth is certainly robust, the current YoY results represent considerably slower growth than in previous years and management’s forward guidance for FY 2023 as a whole is for growth well below previous years (see slide 28).

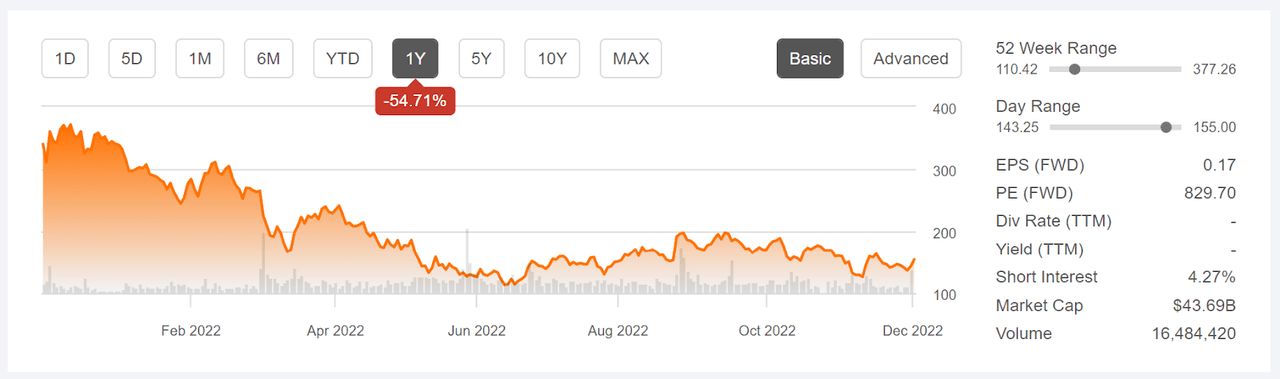

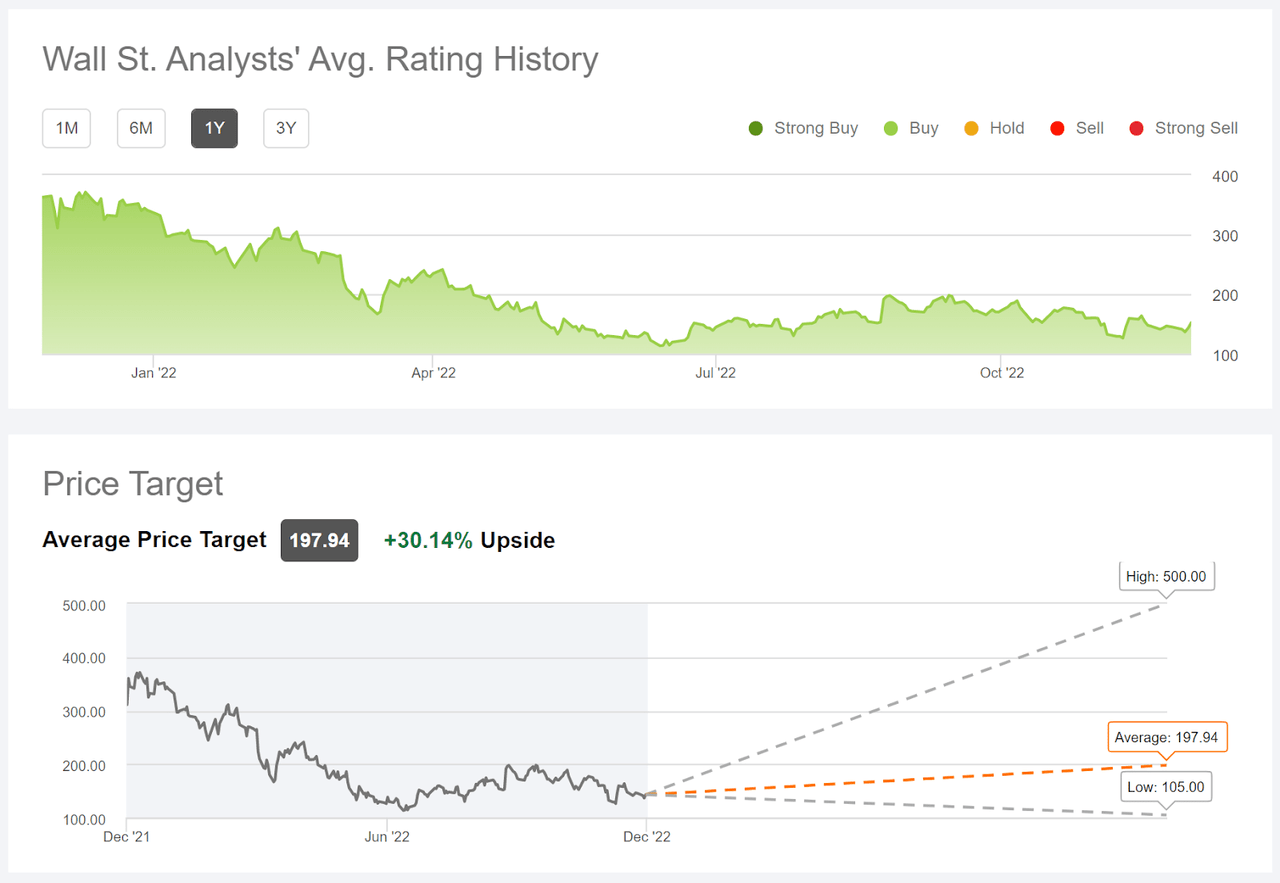

Seeking Alpha

12-Month price history and basic statistics for SNOW (Source: Seeking Alpha)

Even though SNOW has beaten earnings expectations for each of the past 5 quarters, the shares have fallen 55% over the past 12 months. This sell-off is largely due to rising interest rates, which reduce the net present value of future earnings. Companies that rely on high growth rates to justify their valuations are particularly hard hit when rates rise. Macroeconomic conditions also have reduced SNOW’s ability to grow, as potential clients ratchet back on spending.

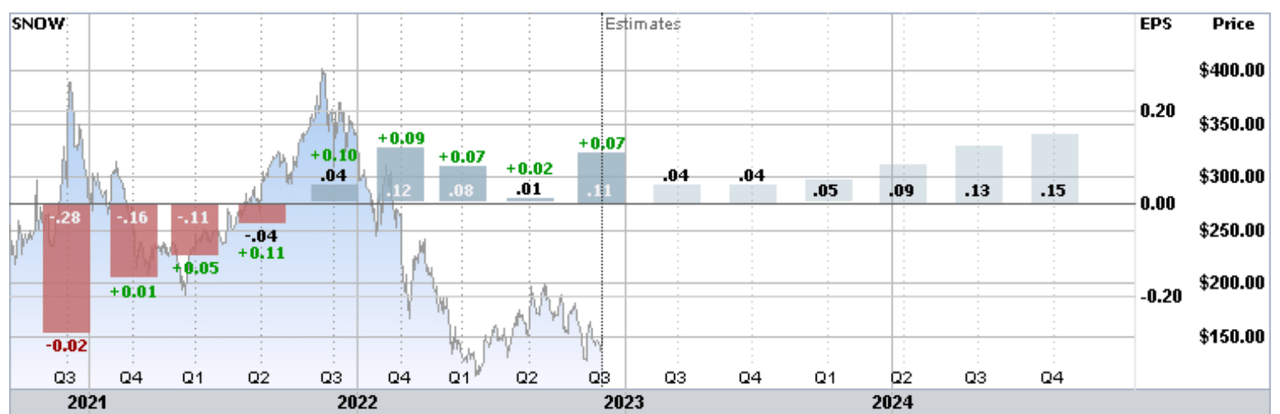

ETrade

Trailing and estimated future quarterly EPS for SNOW. Green (red) values are amounts by which EPS beat (missed) the consensus expected value (Source: ETrade)

The consensus outlook is for continued slower growth (as compared to past years) in EPS for the next couple of years and particularly over the next 12 months. Given the company’s forward P/E of 829.7, along with expectations for an extended period of high interest rates (even if increases slow dramatically), the current share value will be hard to maintain. The company is performing very well and current offerings have been well received (also see here and here), but the current valuation has the shares priced for (near) perfection. The question is not whether SNOW is a great firm – it is. The challenge is in justifying the current valuation.

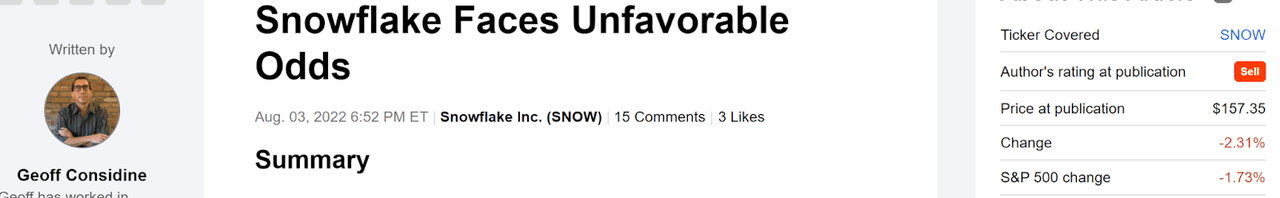

I last wrote about SNOW on Aug. 3, 2022, at which time I downgraded SNOW from a hold to a sell. Valuation, then as now, was extremely high. The justification for the share price depended on massive growth. The Wall Street consensus rating was a buy, with a consensus 12-month price target that was 19.4% above the share price at that time. This was not a lot of expected return, given the very high volatility.

The trailing volatility for SNOW and the implied volatility of options on SNOW on Aug. 3 were both about 70% (Source: ETrade). As a rule of thumb for a buy rating, I want to see an expected return that’s at least ½ the expected volatility. Taking the Wall Street consensus price target at face value and using the implied volatility, SNOW was well below the threshold for an attractive return for the risk level.

I largely discounted the bullish Wall Street outlook for two reasons. First, the consensus rating had been a buy across the entire period as the share price was halved. This suggested that the analysts were consistently too optimistic on SNOW. Second, there was a high level of dispersion among the individual analyst price targets. When there’s a wide spread in price targets, the predictive value of the consensus disappears.

Seeking Alpha

Previous analysis and subsequent performance for SNOW vs. the S&P 500 (Source: Seeking Alpha)

I also consider the market-implied outlook, a probabilistic price forecast that represents the consensus view among buyers and sellers of options. The market-implied outlook into the start of 2023 (calculated using options that expire on Jan. 20, 2023) was bearish, with expected volatility of 69%.

With the 7.7% rise in the share price following Q3 earnings, SNOW has just slightly underperformed the S&P 500 over the past four months (the S&P 500 results above don’t include dividends).

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it’s possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

With the solid results for Q3, I have calculated updated market-implied outlooks for SNOW and compared these with the current Wall Street consensus outlook in revisiting my rating.

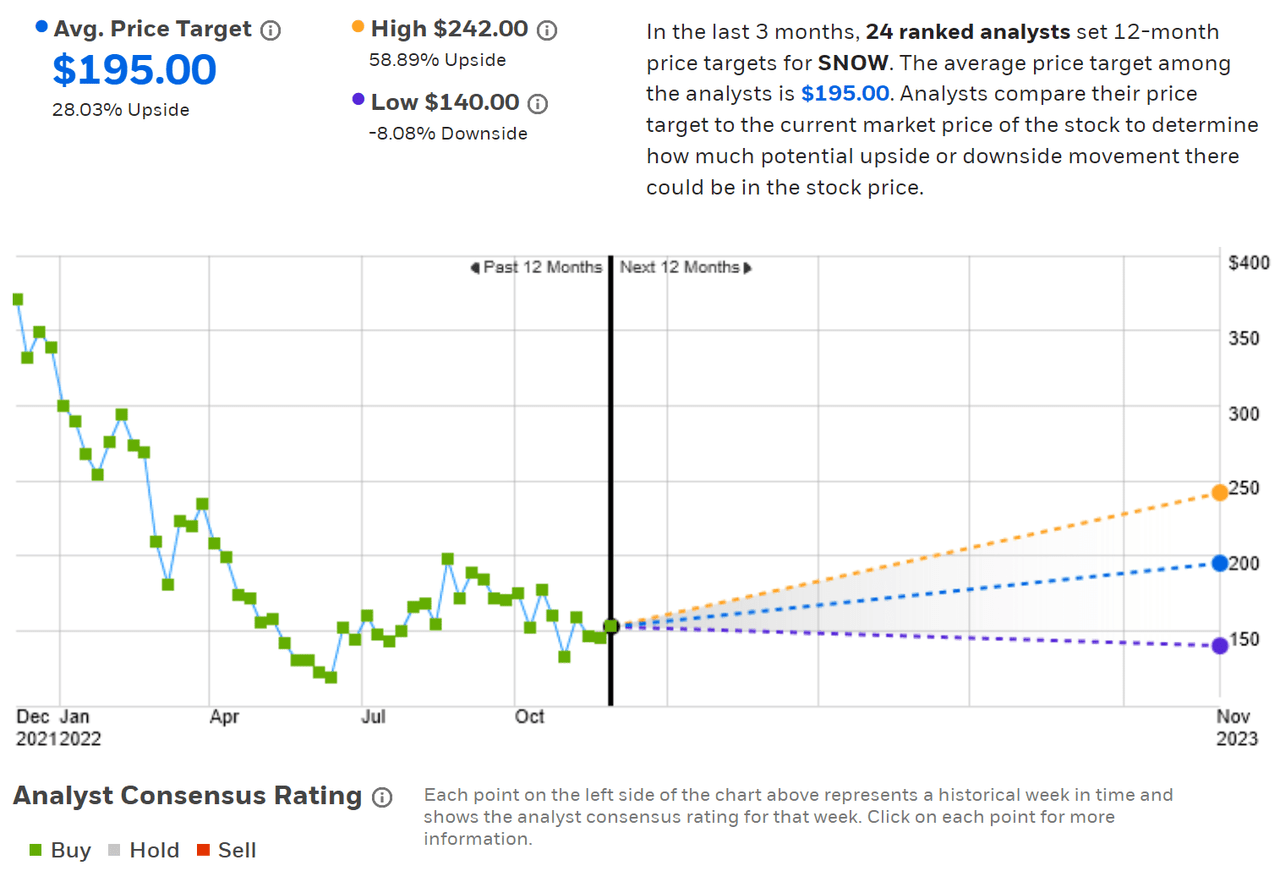

Wall Street Consensus Outlook for SNOW

ETrade calculates the Wall Street consensus outlook for SNOW using the views of 24 ranked analysts who have published ratings and price targets over the past three months. The consensus rating is a buy, as it has been for all of the past year, and the consensus 12-month price target is 28% above the current share price. The spread among the individual analyst price targets has fallen over the four months since my last analysis. The ratio of the highest price target to the lowest on Aug. 3 was 2.45. Today, this ratio is 1.73 ($242 / $140).

ETrade

Wall Street analyst consensus rating and 12-month price target for SNOW (Source: ETrade)

Seeking Alpha’s version of the Wall Street consensus outlook is calculated using price targets and ratings from 39 analysts who have published their views in the past 90 days. The consensus rating is a buy and the consensus 12-month price target is 30.1% above the current share price. The spread among the individual analyst price targets continues to be extremely high.

Seeking Alpha

Wall Street analyst consensus rating and 12-month price target for SNOW (Source: Seeking Alpha)

On the positive side, the Wall Street consensus rating continues to be a buy and the consensus 12-month price target implies a return of about 29% from the current level. On the negative side, the consensus rating has been unwaveringly bullish as the share price has fallen about 55% over the past year and the dispersion in individual price targets indicates that the consensus is likely to have little or no predictive value.

Market-Implied Outlook for SNOW

I have calculated market-implied outlooks for SNOW for the 6.4-month period from now until June 16, 2023, and for the 13.6-month period from now until Jan. 19, 2023, using the prices of options that expire on these dates. I analyzed these specific options to provide a view to the middle, and through the end, of 2023.

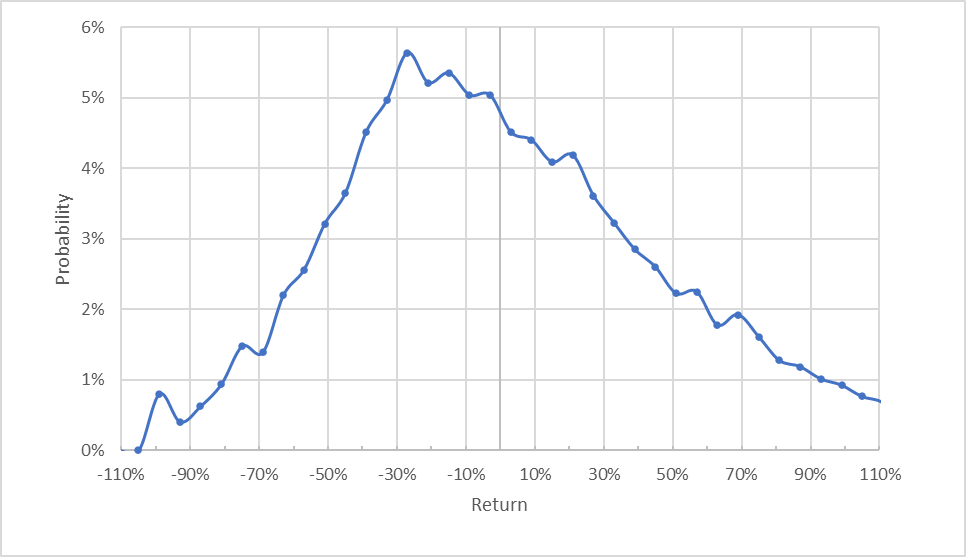

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Geoff Considine

Market-implied price return probabilities for SNOW for the 6.4-month period from now until June 16, 2023 (Source: Author’s calculations using options quotes from ETrade)

The outlook to the middle of 2023 is positively skewed, with the peak probabilities tilted to favor negative returns. The maximum probability corresponds to a price return of -27% over the next 6.4 months. This is a bearish outlook. The expected volatility calculated from this distribution is 66%, slightly lower than ETrade’s calculated implied volatility for the June 2023 options, 74%.

To make it easier to compare the relative probabilities of positive and negative returns, I rotate the negative return side of the distribution about the vertical axis (see chart below).

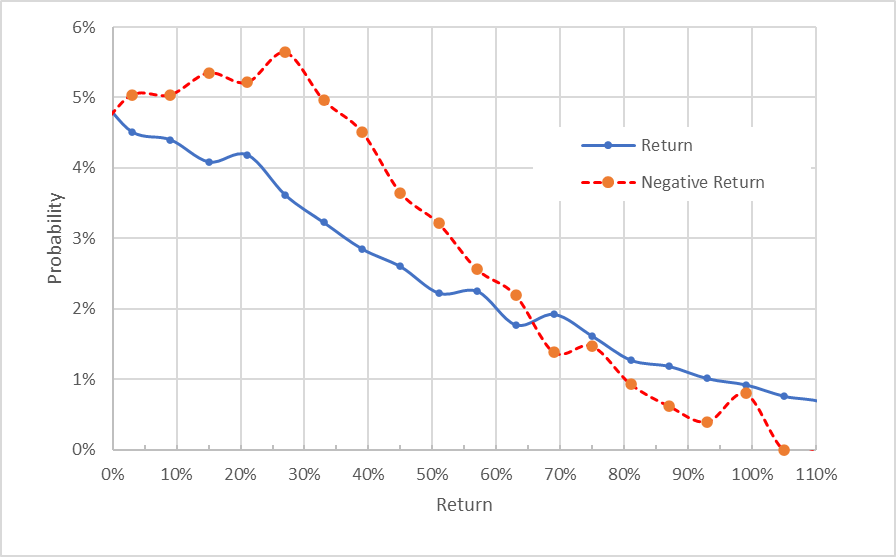

Geoff Considine

Market-implied price return probabilities for SNOW for the 6.4-month period from now until June 16, 2023. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

This view emphasizes how much higher the probabilities of negative returns are than for positive returns of the same magnitudes, across a wide range of the most probable outcomes (the dashed red line is well above the solid blue line over the left ½ of the chart above). The probabilities of extremely large positive returns are higher than for negative returns of the same size, although these outcomes occur with a low overall probability (the solid blue line is above the dashed red line over the right 1/3rd of the chart below.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. Even considering this potential bias, based on the array of results that I have generated for different stocks, this market-implied outlook looks substantially bearish.

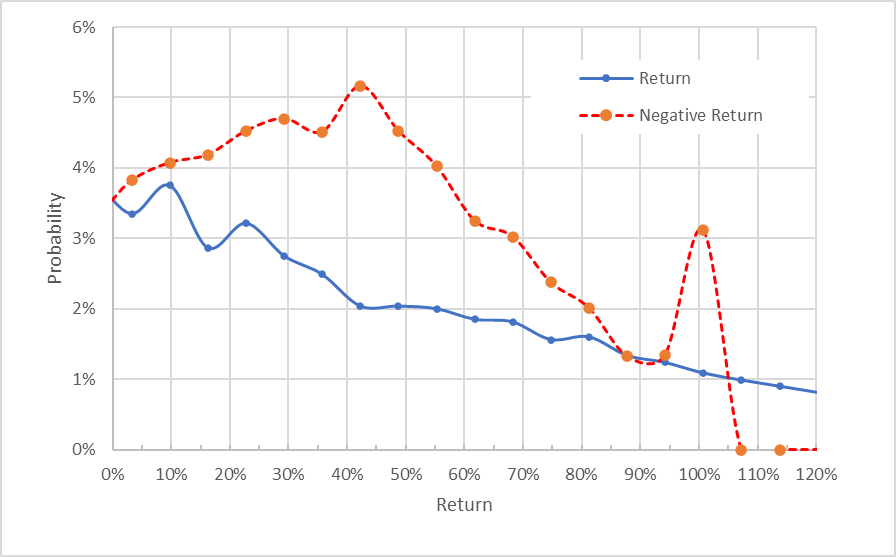

The market-implied outlook for the 13.6-month period to Jan. 19, 2024, also is bearish, with the maximum probability corresponding to a price return of -42% over this period. The secondary peak in probability represents the estimated probability that the shares go to zero, but this type of extreme event is not meaningfully modeled using the market-implied outlook. The expected volatility from this distribution is 69% (annualized).

Geoff Considine

Market-implied price return probabilities for SNOW for the 13.6-month period from now until January 19, 2024. The negative return side of the distribution has been rotated about the vertical axis (Source: Author’s calculations using options quotes from ETrade)

Consistent with my past three analyses of SNOW (Aug. 3, 2022, Aug. 20, 2021, and March 2, 2021), the current market-implied outlooks are bearish. The expected volatility continues to be high, at 66% to 69%.

Summary

The market has very high expectations for SNOW, as reflected in the forward P/E of 830. It’s normal for young, fast-growing companies to have elevated P/Es as they scale up, of course. Given the substantial rise in interest rates, the subsequent devaluation of growth stocks, and an overall slowing in the global economy, justifying the current valuation is hard. SNOW has demonstrated dramatic growth and the market response to the firm’s products are very favorable. That said, the growth rate is slowing.

The Wall Street consensus outlook continues to be a buy, as it has been since the end of 2020. An investor who followed this guidance over the subsequent period has taken a beating (the shares ended 2020 at about $281 per share). The Wall Street analysts have been too optimistic. Even taking the Wall Street consensus price target at face value, the expected return is not especially high compared to the risk.

As I noted earlier, I want to see a ratio of expected return to expected volatility that is at or above 1/2 for a stock to be a buy. With about a 29% return from the consensus price target and expected volatility of 69% over the next year, SNOW is slightly below this threshold. The market-implied outlooks for SNOW to the middle of 2023 and into the start of 2024 are both bearish. SNOW’s just-reported Q3 is a positive sign, but I’m maintaining my sell rating.

Be the first to comment