Kevin Dietsch

Investment Thesis

Snowflake (NYSE:SNOW) reported results that weren’t disastrous. That’s the best way to describe the state of affairs.

Author’s work

Having been consistently bearish on this stock for the majority of 2022, I now upwards revise my rating to a hold. There’s no point selling out of Snow at this point in time.

On the Road to Hope

Tech stocks are starting to bifurcate. Although tech has been a challenging place to be in for more than 12 months, companies that are able to show investors that they have stable GAAP profits are getting nicely rewarded.

But companies that are significantly unprofitable are being left behind. And then we are left with the middle group. Stocks that are showing slowing revenue growth rates, but are not significantly unprofitable.

Companies with alluring narratives, that the market hasn’t quite yet figured out. That is where there’s a battleground if you will.

Given that Snowflake has already lost more than 60% of its valuation in the past 12 months, I don’t believe that bears are going to be too heavy on it going forward.

Snowflake’s Near-Term Prospects

Snowflake is a data warehouse platform. The appeal of its platform is that data doesn’t operate in silos, but in one central platform. There’s a network effect on the platform.

And in certain sectors, where sharing data can be beneficial, such as financials, Snowflake is performing very strongly. And as more companies share their data, the data becomes more valuable, thus more customers in turn use the data.

Furthermore, given that the business model is a usage-based revenue stream, that means that a few customers on the platform can use the platform substantially, to tick revenues higher.

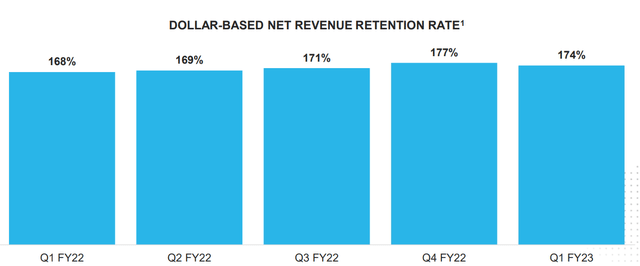

And that’s why we see these impressive net retention rates, which are nothing short of astounding.

SNOW Q3 2023

So even though the total number of customers joining the platform was relatively unimpressive, once customers are on the platform, through their usage of the platform, they get charged. And charged a lot.

SNOW Q3 2022

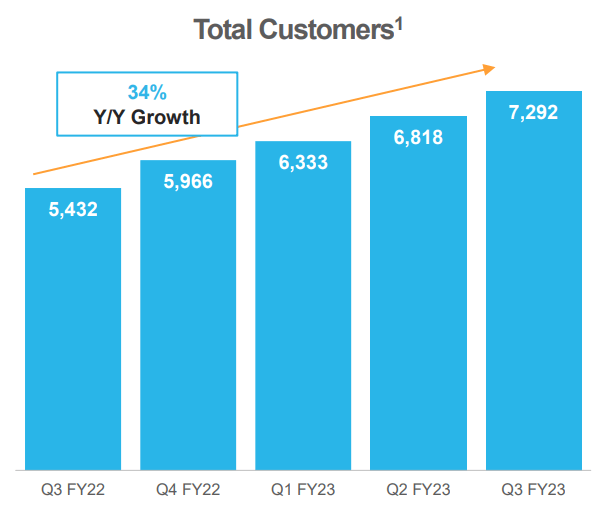

That being said, recall that 2 quarters ago, total customers were up 40% y/y, followed by last quarter, where total customers were up 36% y/y.

Thus, given that for this quarter total customers were up 34% y/y, there appears to be a trend, that getting more customers onboard is slowing down.

On this front, Snowflake’s CFO Mike Scarpelli said,

It’s not really the quantity. It’s the quality of new customers. We tend to focus very much on the largest enterprises and Global 2000 is one of the metrics that we give. But it’s not just Global 2000, it’s large public sector clients as well as a lot of the big private companies in the world as well, too.

And given what we’ve already discussed this makes sense. It’s all about getting a handful of customers, using the platform viciously.

Revenue Growth Rates Are Slowing Fast

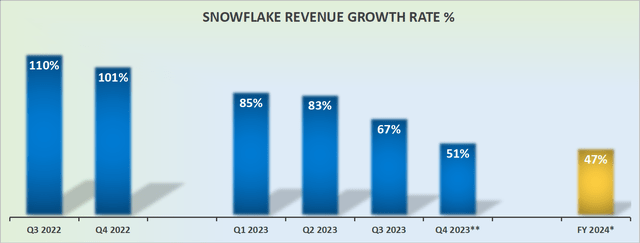

SNOW revenue growth rates

The problem though as it appears to me, is that Snowflake’s revenue growth rates are slowing down. This time last year, Snowflake was growing at triple digits. Today, its revenue growth rates are approximately half the rate of last year.

With this in mind, I question whether it’s worthwhile paying up such a high premium for something so cyclical? When the economy is doing well, there are triple digits growth rates, but as the economy slows, growth rates also slow down significantly.

Given that question being on everyone’s mind, Snowflake wanted to get ahead of that and already guide for next year. And can you blame them? They put out guidance that was high enough to assure investors. But low enough that they can then upwards revise as the quarters unfold. It’s a tough needle to thread.

And even went so far as to guide all the way to fiscal 2029.

Highly Profitable (Not Including SBC)

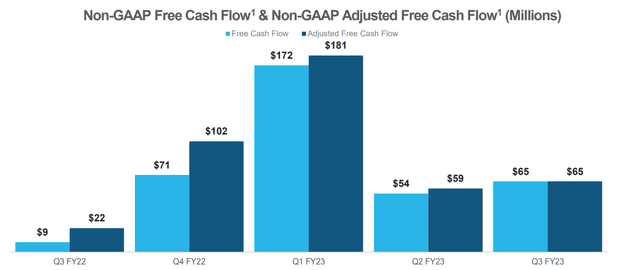

SNOW Q3 2023

For Q3 2023, Snowflake’s free cash flow margin was positive 12% and reached $65 million in the quarter. Of that figure, stock-based compensation was $235 million.

Put another way, after stock-based compensation, Snowflake is still substantially a money-losing endeavor.

SNOW Stock Valuation – Difficult to Quantify

Personally, I have to admit that I don’t know how to value a company with decelerating revenue growth rates, where the bulk of its profits goes to the management team.

More specifically, 42% of Snowflake’s revenues go to the management team, as compensation. On the other hand, I recognize that this stock has the Berkshire Hathaway (BRK.A)(BRK.B) seal of approval, which perhaps adds to the overall investor confidence.

The Bottom Line

Snowflake is supposed to benefit as more and more customers join its platform. After all, there’s a viral aspect to data sharing. And yet, its growth rates are unquestionably slowing down.

All that being said, I don’t see enough here to put a sell rating on the stock. I believe that with the stock already down 60% from its highs, a lot of derisking has already taken place.

Be the first to comment