alexsl/iStock Unreleased via Getty Images

Snap (NYSE:SNAP) reported 1Q22 total revenue of $1.06 billion (+37.8% Y/Y) and non-GAAP EPS of -$0.02 which both came short of Street expectations of $1.07 billion and $0.01. Adj. EBITDA for the quarter was $64 million (vs. $22 million Street and guidance of breakeven), representing an adj. EBITDA margin of 6%. For 2Q22, the social media company guided revenue growth of 20-25% YoY (vs. +27% YoY Street) and adj. EBITDA of $0-50mm, short of Street estimates of $144 million.

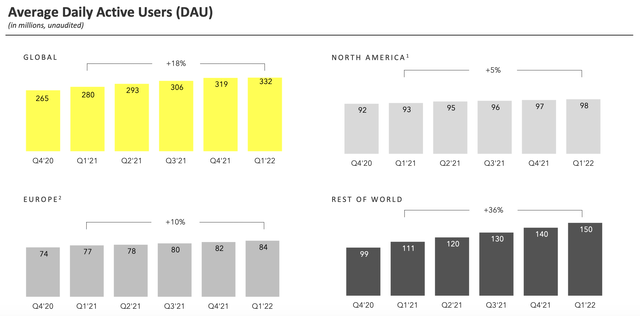

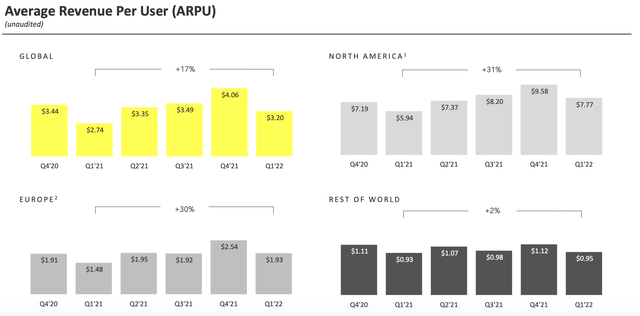

While DAUs of 332 million increased 18% YoY in Q1, this compares less favorably to the company’s multi-quarter record of 20%+ growth. Digging deeper into the user base, we can see growth stalling in North America where DAUs increased just 5% YoY in Q1 and 1% QoQ over the last 3 quarters. This is indeed concerning as the North American market is the biggest top-line driver with the highest ARPU. It appears that Snap’s user base has likely reached a point of saturation in the region, and it’s unclear how investors will react upon seeing the first QoQ decline in DAUs at some point in the future.

DAU growth in Rest of World appears to be picking up the slack in North America and Europe by contributing 10 million incremental users in Q1. However, RoW ARPU remains significantly below North America at just $0.95 vs. $7.77 in the quarter. In my view, the structurally lower revenue per user outside of Snap’s core North American market poses a challenge to incremental revenue acceleration as the US market eventually slows.

Granted, revenue growth was very strong in Q1 at 38% (vs. 66% in 1Q21), and Q2 guidance of 23% growth at midpoint is still respectable against +116% in 2Q21. But I believe investors are looking to check all the boxes (revenue/user/earnings growth) before stepping back into the stock in this environment.

It’s true that Snap has a younger audience which older platforms like Facebook (FB) are having trouble attracting and retaining. Like many social media channels, however, Snap is grappling with slowing user growth in the post-Covid world. Considering the company is yet to turn a profit, I believe investors are unlikely to stick with the stock through thick and thin under a hawkish Fed. That said, I would generally stay on the sidelines and recommend investors to do the same for all social media stocks including Twitter (TWTR), Pinterest (PINS) and Meta (FB).

Be the first to comment