spooh

Author’s note: This article was released to CEF/ETF Income Laboratory members on September 7, 2022. Please check latest data before investing.

SMM merger closing this week

The Salient Midstream & MLP Fund (NYSE:NYSE:SMM) saga is nearing its end. From the press release:

September 1, 2022 | SALIENT MIDSTREAM & MLP FUND ANNOUNCES SHAREHOLDER APPROVAL OF REORGANIZATION WITH SALIENT MLP & ENERGY INFRASTRUCTURE FUND. Salient Midstream & MLP Fund (the “Fund”) (SMM) announced today that at a special meeting of shareholders of the Fund, shareholders approved the reorganization of the Fund with and into Salient MLP & Energy Infrastructure Fund (“SMAPX”) (the “Reorganization”). As previously announced, it is currently expected that the Reorganization will be completed after the market close of the New York Stock Exchange (“NYSE”) on September 13, 2022, subject to the satisfaction of customary closing conditions and the unwinding of the Fund’s leverage. To facilitate the anticipated Reorganization, Automated Customer Account Transfer Service (“ACATS”) will be restricted as of market close on September 2, 2022, and all shares of the Fund will cease trading on the NYSE as of market close on Thursday, September 8, 2022. On Wednesday, September 14, 2022, shareholders of the Fund who become shareholders of SMAPX pursuant to the Reorganization will hold shares of SMAPX and not the Fund. Shareholders of the Fund who become shareholders of SMAPX will receive newly issued Class A Shares of SMAPX in the Reorganization. The aggregate net asset value of SMAPX shares received by Fund shareholders will be equal to the aggregate net asset value of the shares of the Fund held by Fund shareholders, in each case as of the close of business on the date of Reorganization. Shares of SMAPX may be purchased or redeemed on any business day. SMAPX is an open-end fund that is a series of Salient MF Trust with approximately $964 million in net assets and is also managed by Salient Capital Advisors, LLC, the investment adviser of SMM, using a similar investment strategy.

SMM, an MLP/midstream CEF, was targeted by the activists, Saba Capital, earlier this year. Saba currently owns 4.2 million shares of SMM, or around $38.0 million or 23.79% of all outstanding shares, giving it considerable sway and influence over the fund’s direction.

Faced with the possibility of a liquidation or a substantial tender offer (effectively a partial liquidation) which would dramatically reduce the AUM of the fund, the board of SMM acquiesced to a merger of the CEF into one of their open-ended funds, Salient MLP & Energy Infrastructure Fund (SMLPX). We discussed the board proposal at the time in a previous CEF Weekly Roundup (public link).

The proposal was approved by shareholders last week, and hence SMM will be merged with SMLPX at the close of September 13, 2022. However, Thursday, September 8, 2022 was the last trading day for SMM.

Victory for Saba…

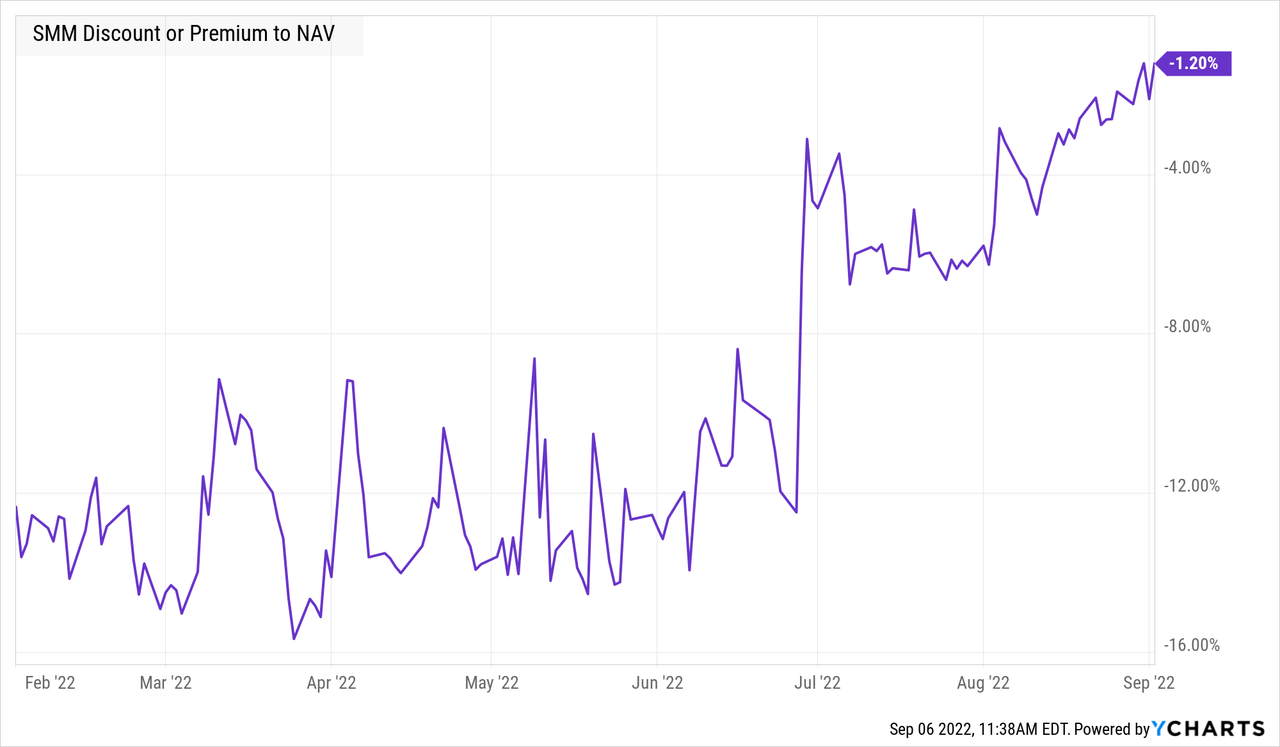

Since open-ended funds (unlike closed-end funds) can always be redeemed at NAV, the merger is beneficial for SMM shareholders in terms of closing the wide discount of the fund. Indeed, SMM’s discount narrowed sharply upon the announcement of the merger proposal and has gradually closed to near zero as the shareholder vote neared. Hence, the merger is one of the best possible outcome scenarios for Saba who will see significant capital gains from their investment.

YCharts

For the Salient managers, it’s definitely not the worst outcome. While assets in an open-ended fund are obviously less “sticky” than in a CEF, they managed to avoid a liquidation or substantial tender offer which would shrink AUM instantly.

Oh, and Saba also managed to wrangle one more concession out of the fund managers. Before agreeing to support management’s proposal for the merger in return for desisting in further activist agitations, Saba required the managers to make a single payment of $300,000 to SMM, to be paid out to shareholders as an unsubtly-named “Saba Special Distribution”. Probably just making sure everyone knew who was pulling the strings behind the scenes! Granted, $300K isn’t much when split over 17.7 million shares (corresponding to a special distribution of $0.0169), but it still represented a nice +0.18% boost to NAV, courtesy of the management.

…(and our Tactical Income-100 portfolio)

Our Tactical Income-100 portfolio in the members’ area of the CEF/ETF Income Laboratory also benefited from piggybacking on Saba’s successful efforts. On February 1, 2022, we purchased SMM in that portfolio. The rationale was that Saba was scooping up shares of SMM, and so we placed our bet on Saba succeeding in some measure, which should lead to a narrowing of the discount (which stood at -13.25% at the time).

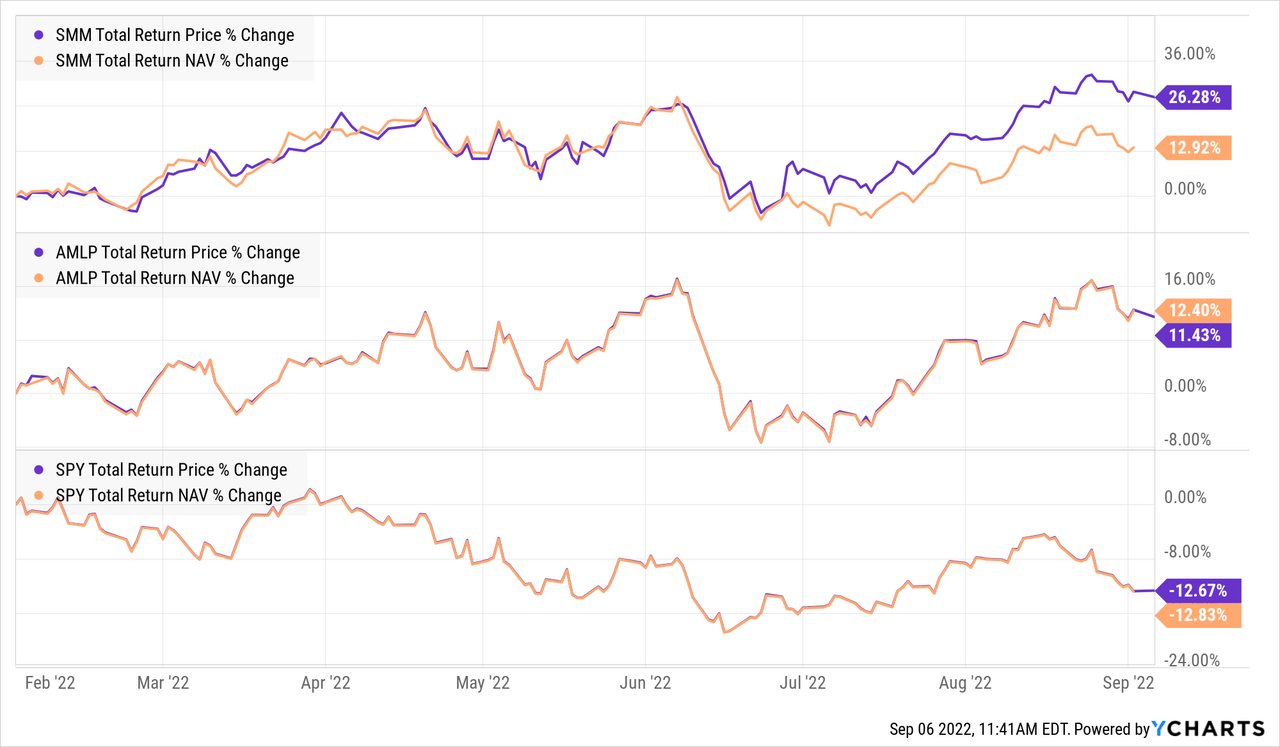

As a result, we were able to sell SMM last week and reap the significant gains of this position since we purchased it due in large part to discount contraction. SMM has returned around +26% since we purchased the position in February, which is an excellent result, especially considering that the market (SPY) is down by over -12% in the meantime. However, the more important result is that SMM has greatly outperformed its NAV (+12.92%) and the benchmark AMLP (+11.43%) as a result of discount contraction. This is what we mean by generating alpha, and is something that is right up the alley for our Tactical Income-100 portfolio, although we do owe Saba a round of gratitude for this result. Thanks!

YCharts

Going forward

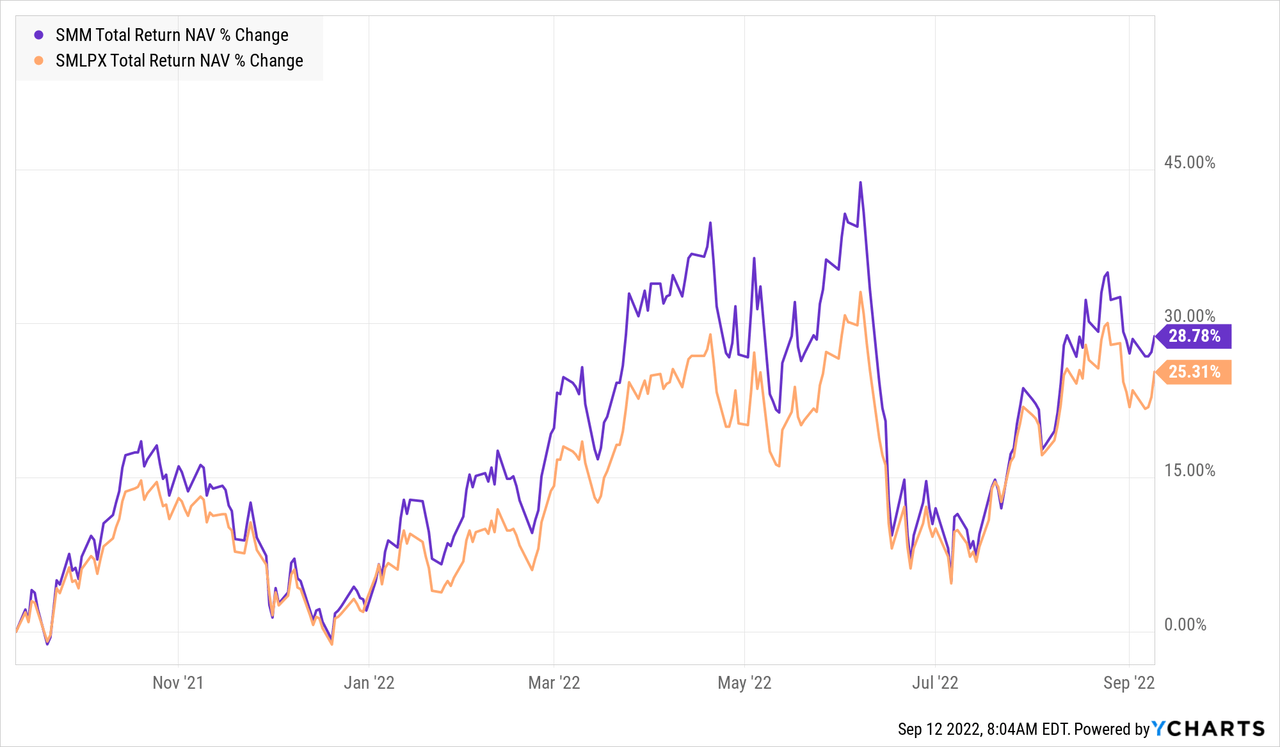

For longer term shareholders of SMM, they can access a similar investment in the open-ended fund SMLPX, which also has a slightly lower fee structure to boot. One difference however is that SMLPX is unleveraged, giving it a lower risk/reward profile compared to the leveraged SMM. Other than that, the two portfolios have tracked each other quite closely over the past year, with SMM being more volatile due to use of said leverage.

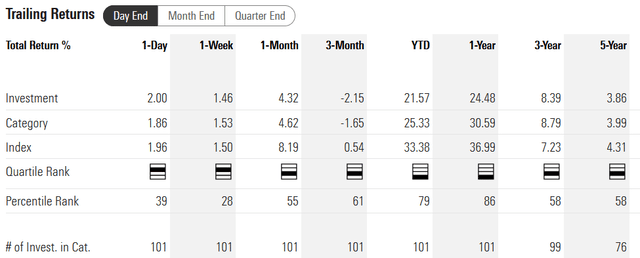

Morningstar gives SMLPX a 4-star rating, and it ranks in the upper-half of funds in its category across 1, 3 and 5-year time frames. Hence, longer-term shareholders of SMM can feel comfortable remaining in SMLPX.

Be the first to comment