chombosan/iStock via Getty Images

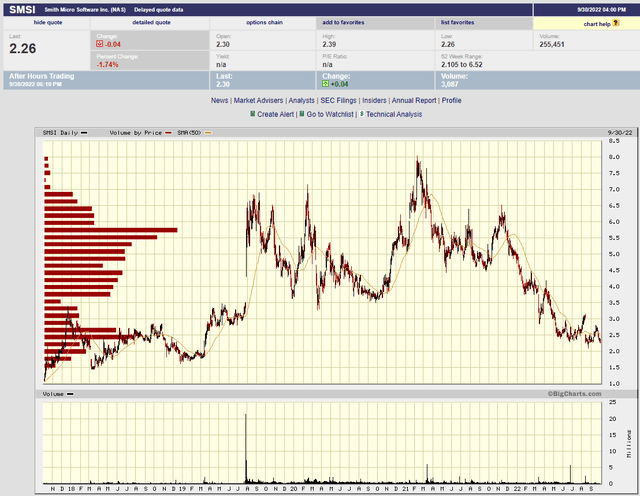

Smith Micro Software (NASDAQ:SMSI) is a company that has executed quite poorly and has thereby disappointed and distanced its shareholders, resulting in a very beaten down share price.

However, as I’ll explain in this article, I personally believe the worst is now over and that the company is poised for future growth and profitability.

The combination of dejected shareholders and a forthcoming turnaround explain why SMSI is currently my best contrarian equity pick.

What SMSI Does

SMSI is an experienced software developer that’s been around for almost 40 years. It provides software to wireless & cable providers and original equipment manufacturers worldwide. These providers and OEMs then package the software to sell to consumers; i.e. SMSI’s software is intended for consumers but it doesn’t ever sell directly to consumers. Thus it leverages its customers’ sales forces to ultimately get its software solutions into consumers’ hands. This model also ensures that there are no (or at least lessened) conflicts between SMSI and the big operators in the industry.

The types of solutions it provides are well described in its filings, e.g. from the most recent 10-Q:

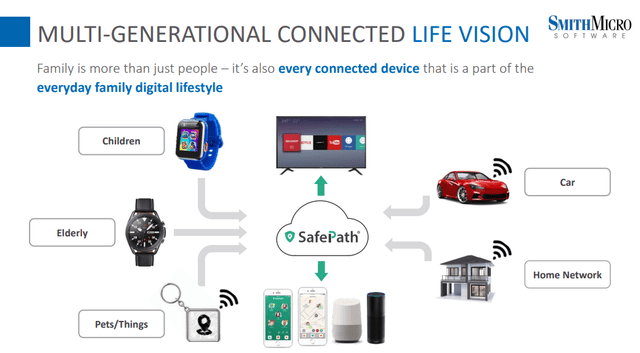

From enabling the family digital lifestyle to providing powerful voice messaging capabilities, the Company strives to enrich today’s connected lifestyles while creating new opportunities to engage consumers via smartphones and consumer Internet of Things (“IoT”) devices. Smith Micro’s portfolio includes a wide range of products for creating, sharing, and monetizing rich content, such as visual voice messaging, retail content display optimization and performance analytics on various product sets.

Smith Micro’s solution portfolio is comprised of proven products that enable its customers to provide:

- In-demand digital services that connect today’s digital lifestyle, including family location services, parental controls, and consumer IoT devices to mobile consumers worldwide;

- Easy visual access to voice messages on mobile devices through visual voicemail and voice-to-text transcription functionality; and

- Strategic, consistent, and measurable digital demonstration experiences that educate retail shoppers, create awareness of products and services, drive in-store sales, and optimize retail experiences with actionable analytics derived from in-store customer behavior.

Of these, the first bullet is the most important and this solution, known as SafePath, can be visualized as shown in this slide from the most recent Investor Presentation:

Why the Stock is Down

In the following subsections I list several factors which I believe have led to the current low stock price and investor disappointment.

Poor Execution: Over-Promise – Under-Deliver

For several years now SMSI has led investors to think that revenues and carrier deals were coming sooner rather than later. SA author Aaron Warwick is the absolute authority on the company (and a must read for anyone wishing to get into the weeds of SMSI’s prospects and technology), yet in November of 2020 his research and discussions with the company led him to conclude that (with my emphasis):

Sometime between SMSI’s Q2 call and last week’s Q3 call, something transpired between the two companies to the extent that CEO Smith is now publicly notifying investors that: (A) the plan at TMUS is to have a new, unified offering that would allow TMUS users and Sprint acquired customers to use the same SMSI white-labeled product on the New TMUS network and (B) SMSI is now discussing the actual marketing plan with TMUS for such a launch, which according to Smith on the call, is slated for the first half of 2021.

[…]

While my contact correctly noted that nothing is 100% certain in life or in business, it is now highly probable that TMUS and SMSI team together to offer New TMUS customers a white-labeled SMSI SafePath product in 2021.

In the same article he cites a conversation between SMSI CEO Bill Smith and an analyst leading to the expectations of new contracts in 2020 and early 2021 (again with my emphasis):

In the meantime, this possible US Tier-1 new customer is not the only customer SMSI expects to win. In fact, Lake Street Capital analyst Eric Martinuzzi asked CEO Bill Smith directly on the Q3 call:

You’ve talked pretty confidently about at least a couple [new contracts] in the next 30 days, perhaps a third one by year end. Do you recommit to that same number of new customer signings in 2020?”

CEO Bill Smith responded quite simply

That’s our game plan.“

Unfortunately, no major contracts were signed (or at least disclosed) in this period.

In Aug of 2021 Aaron reprised the subject, with his research and discussions with the company again leading him to believe that (my emphasis):

After 18 months of investing in its SafePath 7.0 platform, SMSI is now on the verge of launching its new product with multiple carriers. Although a further delay with TMUS caused by that company’s reorganization set off alarm bells for me, a deep dive into the situation leads me to believe everything is still on track for SMSI to launch a product with TMUS. Further, I believe VZ is getting ready to offer more robust SMSI products to expand their family safety offerings, which should significantly benefit SMSI. And for a cherry on top, T recently re-engaged with SMSI to discuss expanding their family safety products.

A year later, there still isn’t much tangible to justify SMSI management’s perpetual optimism.

No wonder stockholders no longer hold out much hope.

Poor Execution: Financing at the Stock Lows

Despite maintaining that it had adequate cash on hand to see it through commercialization of its software products, on August 11, 2022, with the stock at then recent lows, the company announced an offering that included heavy warrant coverage (with my emphasis):

In a transaction with expected gross proceeds of $15 million, the Company has entered into and closed a private placement of senior secured convertible notes with an aggregate original principal amount of $15 million and a conversion price of $3.35 per share, subject to adjustment, and warrants to acquire up to an aggregate amount of 2,238,805 additional shares of the Company’s common stock. The warrants are exercisable immediately at an exercise price of $3.35 per share and expire five years from the date of issuance.

[…]

Concurrently with the senior secured convertible notes and warrant transaction, in a registered direct offering with expected gross proceeds of $3 million, the Company today entered into a securities purchase agreement with certain institutional and accredited investors to sell an aggregate of 1,132,075 shares of the Company’s common stock and warrants to purchase up to an aggregate of 1,132,075 shares of the Company’s common stock at a purchase price of $2.65 per share of Company common stock and associated warrant. Each warrant will be exercisable on the sixth month anniversary of the date of its issuance at an exercise price of $2.65 per share and will expire five (5) years from the date it first becomes exercisable.

With better execution, either the raise wouldn’t have been necessary at all, or it could have been done earlier when the company was in a much better bargaining position, and therefore at much better prices and terms.

Again, this kind of behavior has rightly disenchanted the company’s shareholder base.

Valuation & Ratings

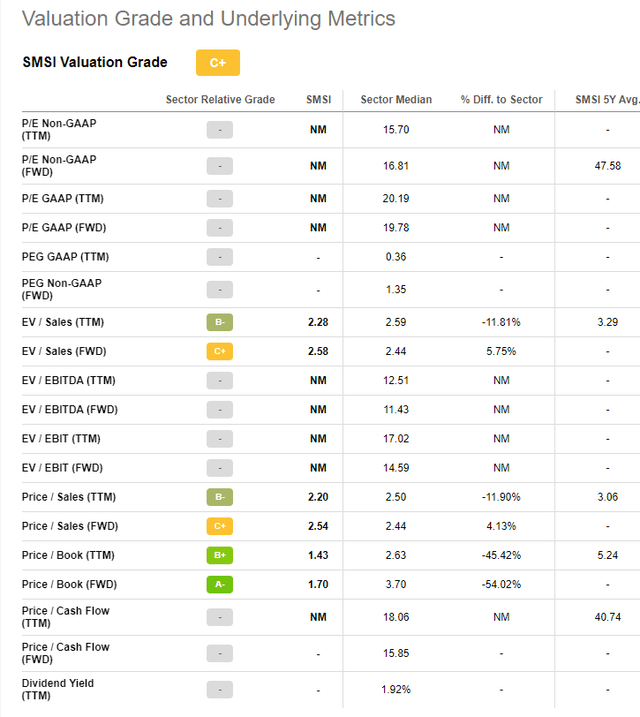

As a result of its delays and longer than expected software development times, SMSI has gone from being a valuation leader to a valuation laggard. Consider this helpful tabular summary from Seeking Alpha’s ratings pages. All of the profitability measures are NM because it’s been too long since the company made any money:

Note however that the ratios to revenue and book are still reasonable: this feeds into my bullish stance as discussed next.

Why A Turnaround?

With all of these genuine reasons to be bearish on the company, why am I taking a contrarian stance? The reasons are twofold, as I explain in the next two subsections.

#1 SMSI has Essentially Created a Monopoly

SMSI was already a major player in the space, but over the past few years it has acquired all of its significant competition to become a monopoly (albeit in a very delimited sense, such that anti-trust is not a concern).

Consider this recap from the most recent earnings call (with my emphasis):

Over two years ago in February of 2020 Smith Micro embarked on a mission to takeover absolute industry leadership and the delivery of Digital Family Lifestyle solutions for wireless carriers around the world. The first step of this journey was the acquisition of Circle Media’s carrier business, through which we gained contracts with T-Mobile, US and Sky in the UK. A little over a year later, in April of 2021, we concluded the second acquisition. This time we acquired Avast Family Safety business securing additional contracts with Verizon, AT&T and Wind Tre, a Hutchison property in Italy, as well as additional business with T-Mobile US.

[…]

when we set out to consolidate the best features of the acquired technology into our SafePath Digital Family Lifestyle platform we had to significantly grow our engineering teams to meet that goal.

The exciting news is that, we are quickly approaching the completion of our mission. In March of this year, we completed the integration of the best of the Circle code base which culminated in our launch of the first release of SafePath 7. We are now about to complete the integration of the best of the Avast code base into SafePath 7 as well. This has been a massive undertaking for our engineering teams and the successful completion will allow us to migrate all of our customers to the same SafePath platform going forward.

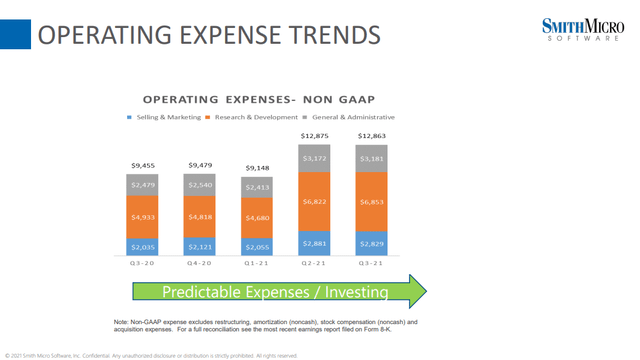

The achievement of the migration will also result in another profound effect on our business, as it allows us to significantly reduce our operating expenses beginning in the current third quarter. We expect that the full effect of the cost optimization will be realized by the start of the second quarter of 2023.

(The second and third highlighted portions are relevant to the second point below.) The monopoly aspect is also highlighted in this slide:

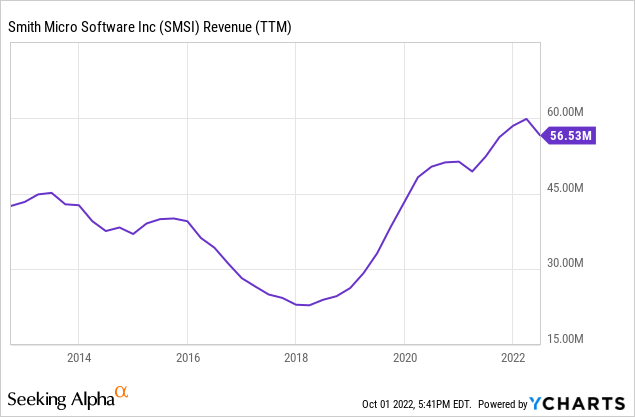

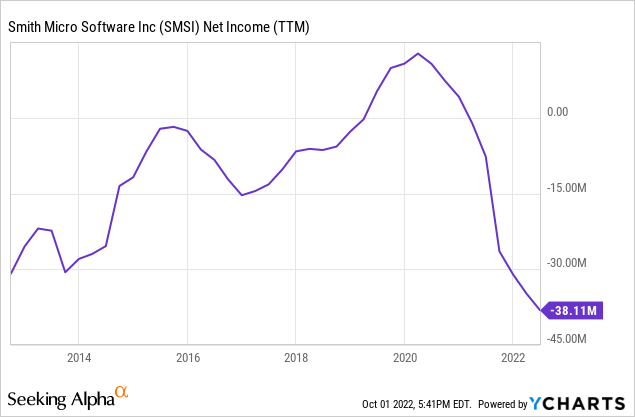

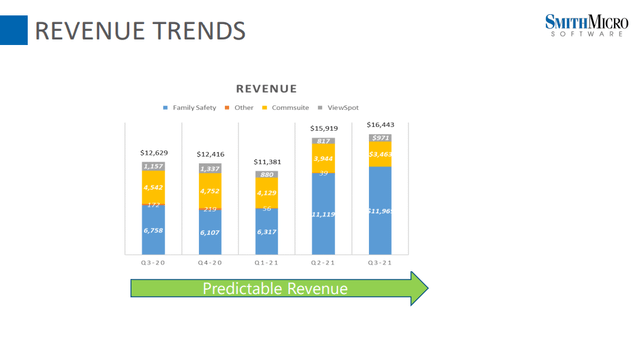

#2 Revenues are Already Trending Up and Profits Should Follow

The next several slides and charts show that despite not having landed a major carrier who is aggressively marketing the product, SMSI’s revenues are already on the rise. If and when major carriers start using and promoting the product, revenues should explode. Couple this with the decline in operating expenses, as highlighted above, and we could see sustainable earnings per share in the $0.50 to $1.00 range. This is the key to my contrarian stance.

As further support for this, consider the addressable market as seen by SMSI management (again from the earnings call):

Industry data indicates that all three Tier 1 carriers in the US had between 15 million and 20 million multi-line family plan subscribers. While there are thousands of other subscribers at each carrier’s universe that are interested in digital family solution, let’s just focus in on the multi-line users first. Since we believe this group represents the most likely source for SafePath subscribers. Based on our customer discovery efforts, we believe that SafePath subscriber population in the range of 3 million to 5 million subscribers seems to be attainable for each of our three Tier 1 customers by 2025.

Risks

The risks here are simple. If the company continues on its current path of over promising and under-delivering, then I’ll be just another analyst who has mistakenly predicted a turn-around. Certainly, it would be much less risky to only buy the stock once a deal and promotion of the product by a major carrier are assured. But personally I’m taking the risk because I believe potential returns will be better that way. That said, my position size is commensurate with a speculative investment, and I would only add to it if/when we learn that a major carrier is actually promoting the product in a meaningful way.

Be the first to comment