Tom Werner/DigitalVision via Getty Images

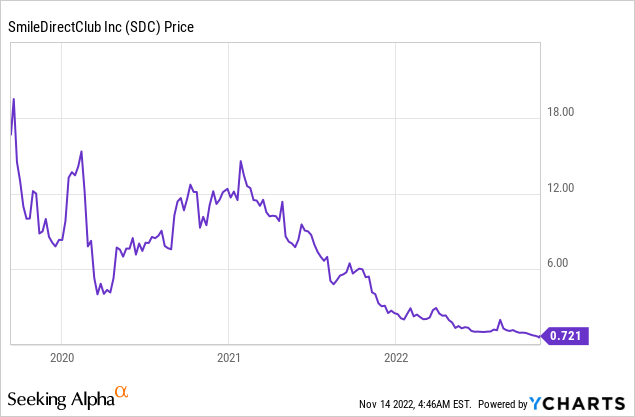

SmileDirectClub (NASDAQ:SDC) is the largest U.S based manufacturer of clear aligners which are an alternative to unattractive braces. Year to date, the company has helped over 1.8 million customers achieve a great “Smile” and saved them over $5 billion in the process (according to company estimates). The company has also reported a strong third quarter, beating both top and bottom-line financial estimates. Despite this, its stock price has been butchered by over 94% since January 2021, which has mainly been driven by the macroeconomic environment. Thus in this post, I’m going to breakdown the company’s business model, financials and valuation, let’s dive in.

Business Model

According to SmileDirectClub, 85% of people suffer from some form of malocclusion (wonky teeth), yet less than 1% of people have received treatment. This is due to a variety of reasons such as braces which are not so attractive, long waiting times at a traditional dentist, cost, and the strength of the issue.

SmileDirectClub solves these problems with its direct-to-consumer model, which uses a combination of retail locations for teeth scanning, strong online presence and of course advanced technology. The business specializes in the use of “clear aligners” of which it has 46 patents on the technology. For customers which have teeth that are not completely straight, it is pretty much a no-brainer to go for a clear aligner as opposed to the metal contraption which can make someone look like the old James Bond Villain (Jaws). But in all seriousness, a lot of younger people especially have an immense amount of insecurity with regards to physical appearance so a clear aligner makes a lot of sense. In addition, the company has exceptional marketing materials and branding, which helps to entice in new consumers who previously wouldn’t have thought they had a problem. For example, I consider myself to have pretty good teeth but upon going through the marketing materials of the website I found myself asking “Do I have a problem?”. As the previous statistic mentioned, the majority of people (85%) don’t have completely straight teeth. I would imagine that if people with a minor issue went to a traditional dentist they would inform them they don’t need any work, because medically speaking it is minor. But SmileDirectClub has played the cosmetic card, which offers perfection to the consumer.

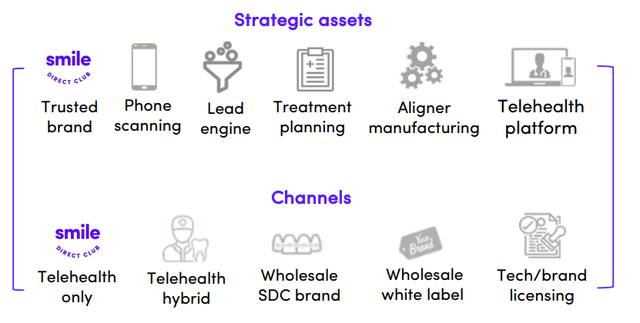

The company is effectively selling “smiles”, its website plays on the fact that almost everyone wants a great smile and a smile is associated with happiness. Its channels are fairly diverse and include telehealth, hybrid, wholesale and even licensing. Then we have a vast amount of “Social Proof” on the website, which shows before and after images from customers, reviews etc.

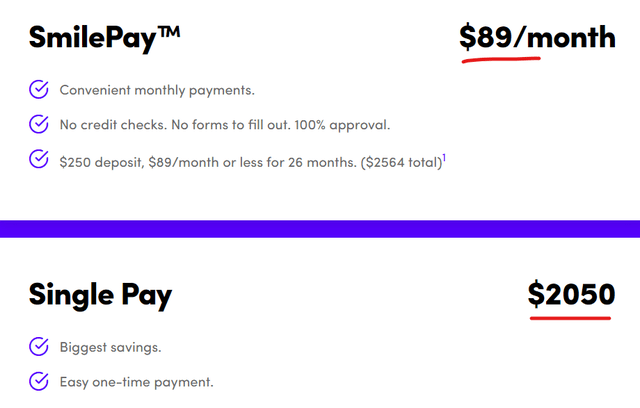

The cost of the service is ~$2,050 which is pretty hefty, but SmileDirectClub offers a payment plan of ~$89/month that makes its treatment very accessible. A traditional dentist is unlikely to have such modern payment plans.

Improving Financials

SmileDirectClub generated solid financial results for the third quarter of 2022. Revenue was $106.77 million which beat analyst expectations by $8.23 million. However, Revenue did decline by 23% year over year which was mainly caused by macroeconomic issues and inflation, according to management. I personally agree that customers will be less inclined to spend $2,050 on fixing their teeth if economic times are tough or just may delay purchases. However, the issue is that if customers really had a problem they would fix it no matter what the economic climate, especially with the reasonably priced payment plans. This highlights an obvious point, that the service is discretionary by nature and not essential, which needs to be taken into account. Interestingly enough, Apple’s iPhone sales have continued to boom during the current climate therefore it could be deemed “essential” that someone needs an iPhone which is the power of the brand and the value it provides at a similar price bracket. Unfavorable FX exchange rates also hurt the average selling price of the product which was down 16% sequentially to $1,902.

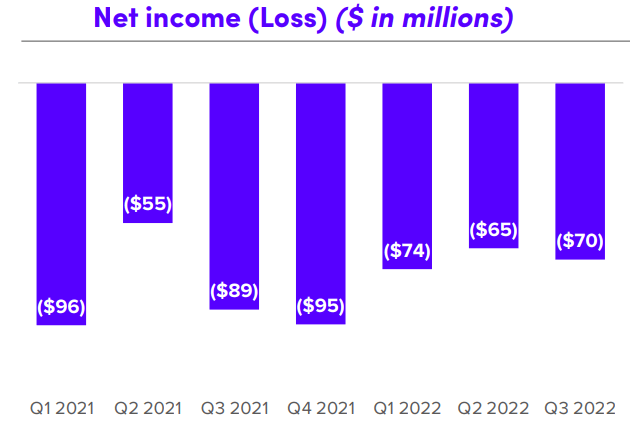

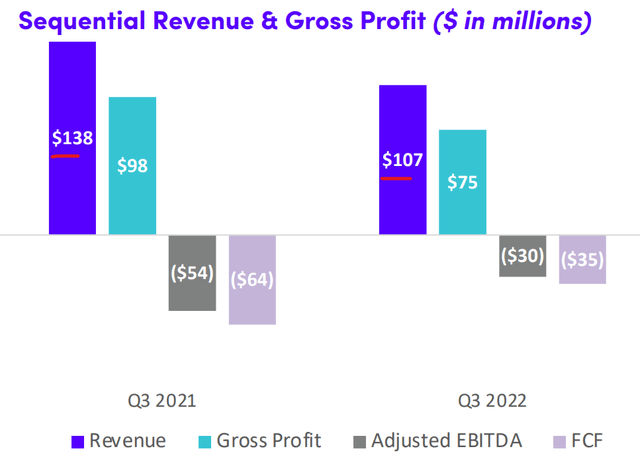

The company generated Earnings per share [EPS] of negative $0.18 which beat analyst expectations by $0.05. Adjusted EBITDA has improved from negative $54 million in Q3,21 to negative $30 million by Q3,2022. While Net Income (Loss) has improved from negative $89 million in Q3,21 to negative $70 million by Q3,22. This improvement in costs has mainly been driven by a series of cost-cutting measures implemented at the start of the year. Marketing and selling expenses make up 55% of net revenue, which was a 2% improvement sequentially. The business is driving greater efficiency in its marketing spend as its brand has been built and it is focusing on more qualified leads.

Income Loss (Q3,22)

The company ended the quarter with 950 active locations, which has increased by 260 over the prior quarter. I believe the in-house location helps with conversions but as its brand is built I believe these may become less necessary. SmileDirectClub continues to build a community with its products and has increased its (Net Promoter Score) NPS by 4% to 41 in the third quarter of 2022. The NPS score is an industry-standard that basically tracks how likely a customer is to refer its product. The business currently generates ~20% of its orders from referrals.

SmileDirectClub is also rolling out its “SmileMaker Platform” which enables customers to scan their teeth directly via their smartphone which would be a gamechanger. In addition, the company is rolling out its Care+ partner problem which will enable the upselling of medical dentistry services, which should increase revenue through upsells.

Advanced valuation

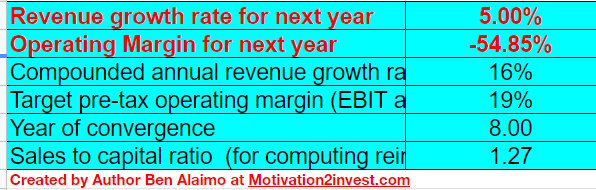

In order to value SmileDirectClub, I have plugged the latest financials into my advanced valuation model which uses the discounted cash flow method of valuation. I have forecasted 5% revenue growth for next year and 16% revenue growth in years 2 to 5, as the economy recovers from the recessionary environment.

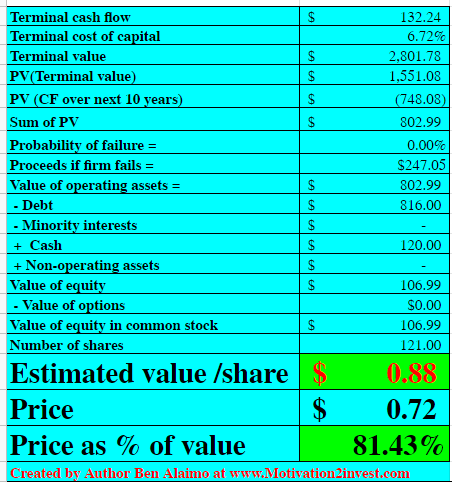

SmileDirectClub stock valuation (created by author Ben at Motivation 2 Invest)

I have forecasted optimistically that the company can increase its operating margin to 19% over the next 8 years. I forecast this to be driven by improving marketing efficiencies, a growing brand, increased referrals and upsells with its Care+ program.

SmileDirectClub Stock Valuation (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $0.88 per share, the stock is trading at $0.72 per share at the time of writing and thus is ~18% undervalued.

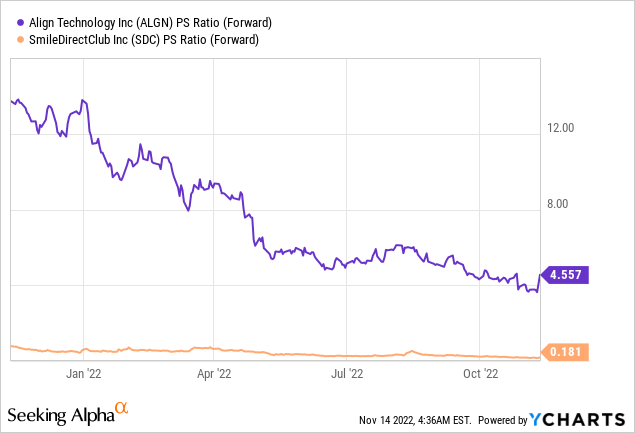

SmileDirectClub is also trading at a Price to Sales ratio = 0.18 which is 85% cheaper than its 5-year average. The company also trades significantly cheaper than its competitor Align Technology (ALGN) which offers the Invisalign clear aligner.

Risks

Recession/Discretionary Product

The high inflation and rising interest rate environment have caused analysts to forecast a recession. As the consumer has their input costs squeezed they are less inclined to splash out on discretionary purchases. We are already seeing this occur in SmileDirectClub’s declining revenue. Therefore this is a risk given the company is unprofitable and it has competition despite patents.

Net Income Losses/Capital Raise Possible

The company has $120 million in cash and cash equivalents on its Balance sheet with ~$792 million in total debt. At its average “cash burn” of $76 million over the past four quarters the company may need to raise more capital within the next two quarters. However, as mentioned prior $55 million of its quarterly expenses are for Marketing and Selling and therefore the business has flexibility. In addition, the company is implementing a number of strategic cost-cutting measures which could save the business up to $120 million each year. This includes $35 million to $40 million in reduced Capex, and $45 to $50 million in savings from exiting international markets. The company has also taken on convertible debt financing of $650 million and has a secured debt facility of $255 million with a 42-month maturity. Management states these factors have helped to “protect against shareholder dilution”. Raising capital on the public markets is still a possibility, but given the cost of capital is high (given low share prices), it looks as though debt is a better option to fund the growth model.

Final Thoughts

SmileDirectClub offers a smart solution and it’s marketed exceptionally well, much better than its competitors such as Align Technology. From my analysis, I believe the business does have a strong value proposition but given the declining sales, it looks as though macroeconomic headwinds are causing consumers to delay non-essential purchases. I do believe long term the business will be able to grow, especially if management can continue to improve the efficiency of the operation. Therefore I will deem this stock as a “hold” at the current levels.

Be the first to comment