metamorworks

The fundamental cause of the trouble is that in the modern world the stupid are cocksure while the intelligent are full of doubt.” – Bertrand Russell

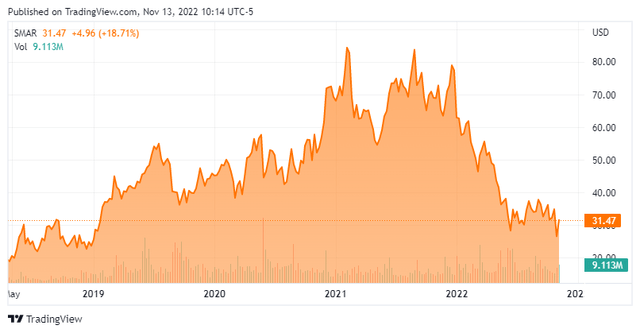

Today, we put Smartsheet Inc. (NYSE:SMAR) in the spotlight for the first time. The shares have been more than cut in half over the past year as rising interest rates have crushed many growth names. Has the equity sunk into bargain territory yet? An analysis follows below.

Company Overview:

Smartsheet, Inc. is based just outside of Seattle, WA. The company provides cloud-based enterprise platform that helps plan, capture, manage, automate, and report on work for teams and organizations via a variety of Dashboards and Portals for real-time visibility into the status of work to align individuals, managers, and executives. Putting more simply, Smartsheet offers an easy-to-use Project Portfolio Management or PPM software platform, which makes workflow management easier and more efficient.

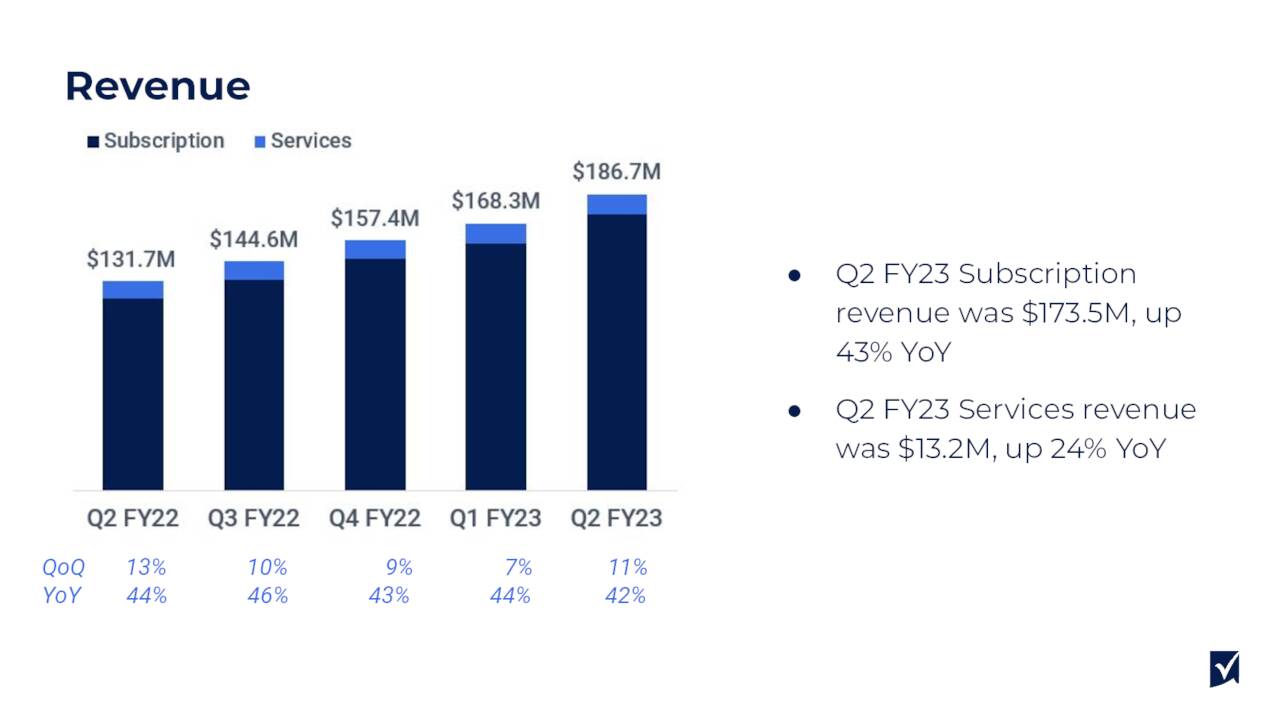

Subscription fees account for just over 85% of overall revenues with the rest coming from professional services. The stock currently trades just north of thirty bucks a share and sports an approximate market capitalization of $4.1 billion. The company is currently operating in its 2023 fiscal year.

Second Quarter Results:

On the opening day of September, Smartsheet reported second quarter numbers. The company posted a non-GAAP loss of 10 cents a share, half the loss the consensus was expecting. Sales rose just over 40% on a year-over-year basis to $186.7 million, beating expectations by roughly $6 million. Subscription services saw $173.5 million in revenues during the quarter, up 42% from 2Q2021. Professional Services grew 24% year-over-year to $13.2 million.

Management noted the following around growth in its customer base:

- The number of all customers with annualized contract values (“ACV”) of $100,000 or more grew to 1,220, an increase of 63% year over year.

- The number of all customers with ACV of $50,000 or more grew to 2,738, an increase of 48% year over year.

- The number of all customers with ACV of $5,000 or more grew to 16,682, an increase of 24% year over year.

September Company Presentation

Calculated Billings for the quarter rose 44% on year-over-year basis to $205.6 million, while dollar-based net retention rate was 131% for the quarter.

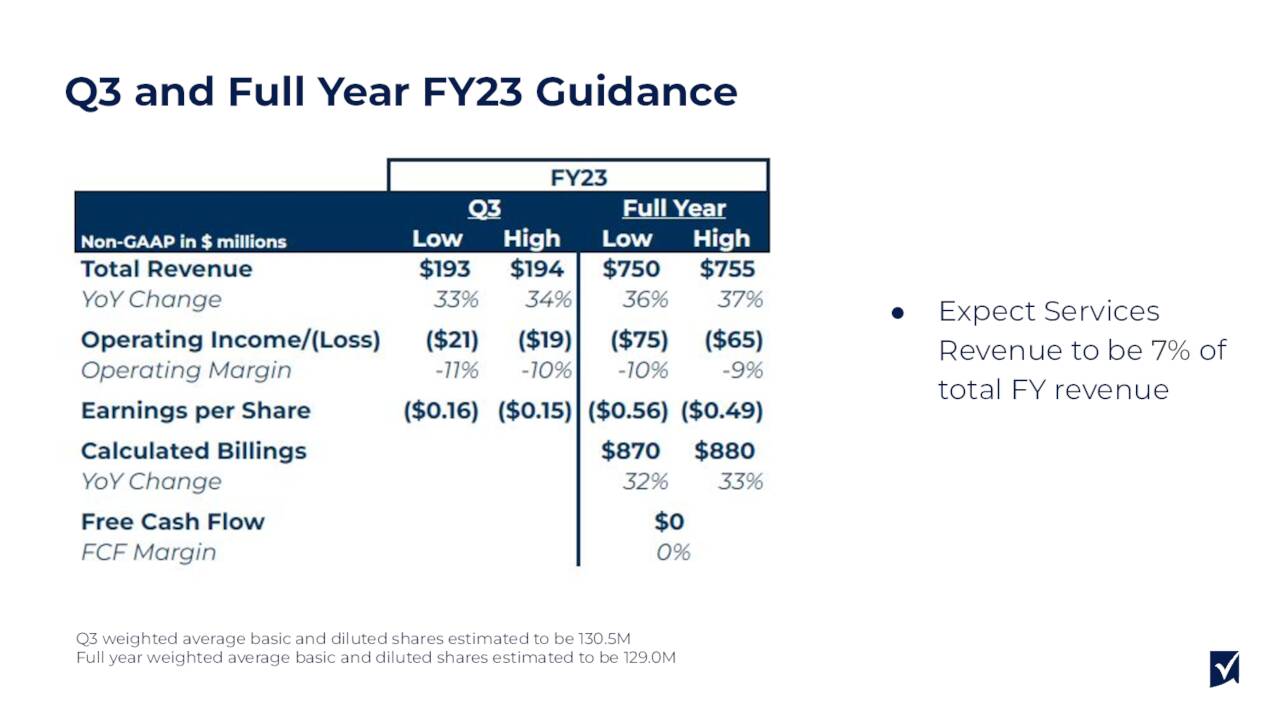

Leadership then projected FY2023 sales and earnings as follows:

- Total revenue of $750 million to $755 million versus the $756 million consensus at the time of the new guidance

- Non-GAAP net loss per share of $0.56 to $0.49 versus the -$0.63 consensus

September Company Presentation

Analyst Commentary & Balance Sheet:

Since second quarter numbers were posted, four analyst firms including Morgan Stanley and KeyBanc have reiterated Buy/Outperform ratings on SmartSheet. Price targets proffered ranged from $46 to $54 a share.

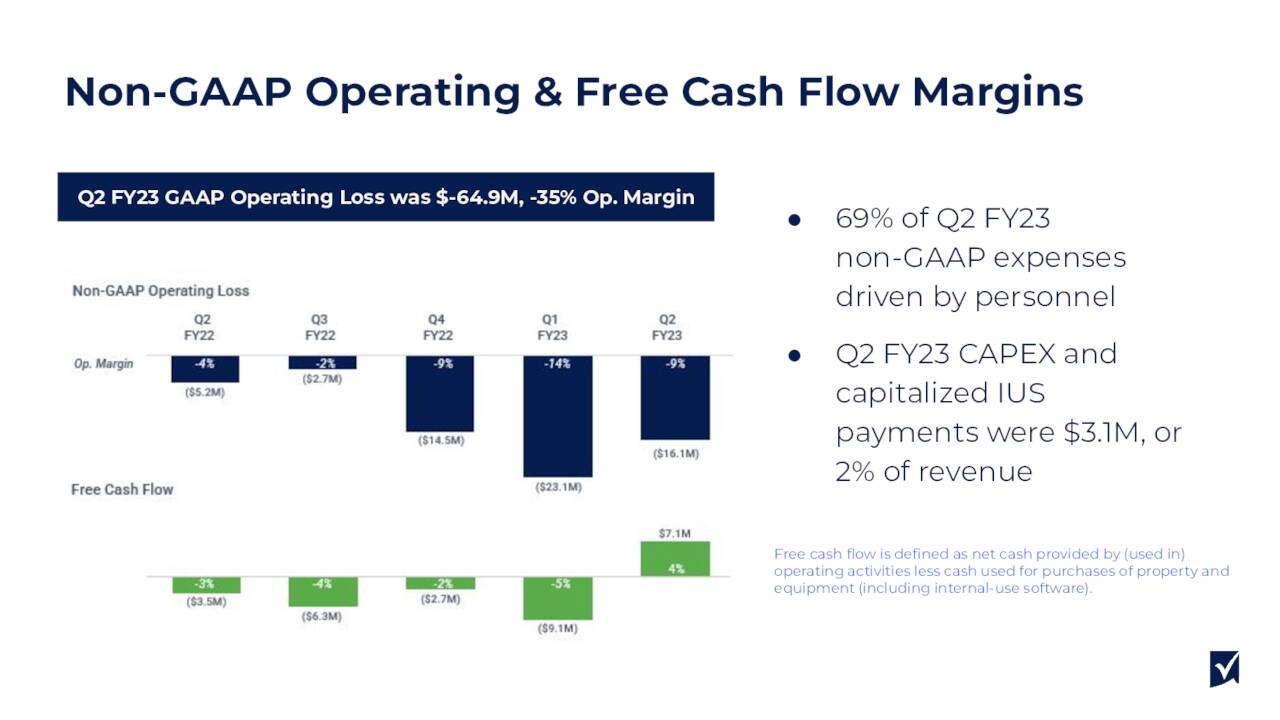

Under three percent of the outstanding float in SMAR is currently held short. Several insiders have been consistent and frequent sellers of the shares so far in 2022. They disposed of approximately $1.2 million worth of shares in the third quarter and two insiders have sold nearly $400,000 worth of stock so far in the fourth quarter. The company has no long-term debt and ended the second quarter with just over $450 million worth of cash and marketable securities after posting a non-GAAP net loss of $13.5 million during the quarter. Free cash flow was a positive $7.1 million it should be noted. This compared to free cash flow of negative $3.5 million in the second quarter of fiscal 2022.

September Company Presentation

Verdict:

The current analyst firm consensus has the company losing 53 cents a share in FY2023 even as revenues rise by more than 35% to just over $750 million. Sales growth is predicted to cool somewhat to just under 30% in FY2024 as Smartsheet’s losses are projected narrow to 30 cents a share.

September Company Presentation

Smartsheet continues to deliver impressive revenue growth in what has been a challenging year to accomplish this in most sectors of the economy. SMAR changes hands at a little less than five and a half times forward sales. A decent bit cheaper if you subtract the company’s net cash from the equation.

The stock is down some 55% over the past year even as the company has continued to deliver impressive sales growth and is narrowing its losses. This fall in the share price seems mainly due to the deflating impact much higher interest rates have had on growth stocks, especially around names that are not quite profitable yet. I believe Smartsheet’s long-term risk/reward profile is attractive enough at current trading levels to take a small initial holding. I have done so via covered call orders as this simple strategy provides significant downside mitigation and the options against this equity are lucrative and liquid.

Half of being smart is knowing what you are dumb about.” – Solomon Short

Be the first to comment