TU IS/iStock via Getty Images

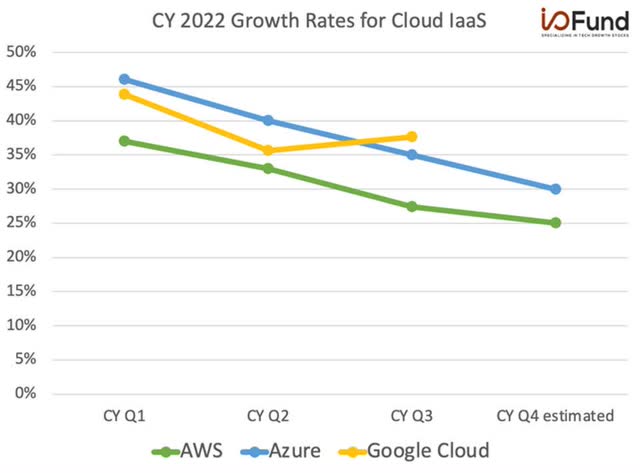

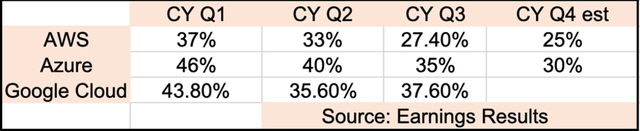

Nearly all cloud companies are reporting a notable sequential slowdown between Q3 and Q4. Amazon (AMZN) and Microsoft’s (MSFT) cloud infrastructure services slowed from mid-30 percent growth in prior years to 24 percent growth and 30% growth. Only a quarter ago – in Q2 – the growth was at 29 percent and 35%. This quarter marks a 5 percent decline sequentially, which is considered a rapid decline for these two companies.

For many more highly valued cloud software companies, the sequential decline is much steeper and is closer to a 15% sequential decline. On a YoY basis, the Q3 to Q4 growth is 70% lower than it was tracking last year. For example, Snowflake (SNOW) grew 15% QoQ last year and is expected to grow 3% QoQ this year, marking a 12-point decline in its growth rate. This is true for most best-of-breed cloud stocks.

We covered this point on popular cloud software stocks in granular detail in a premium note for our research Members when we said:

“In some ways, the Q4 guides – assuming most come in at or near those guides – marks a historic slowdown for cloud as it’s always been a resilient category.”

The question is, at this rate of rapid decline, when will we hit a bottom on slowing growth?

Gartner, a reputable and accurate third-party analyst firm, is indirectly calling for a bottom in cloud in 2022, per its recent two surveys. However, judging by the most recent earnings results provided by the Big 3 and cloud’s top performing stocks, I believe this could be premature and it’s more likely we bottom sometime in 2023.

Gartner 2023 Surveys

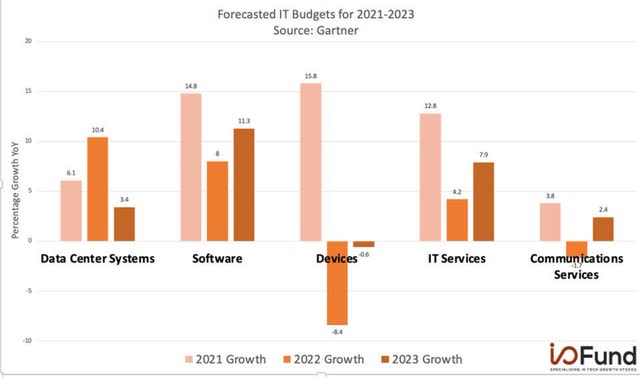

In a recent report, Gartner predicted that in 2023, IT spending will recover from a notable low in 2022 in all areas except Data Center Systems. Devices will still remain negative to flat, yet show a remarkable recovery from (8.4%) to (0.6%), per the CFO 2023 survey. Software will accelerate from 8% to 11.3% while IT services will double in growth from 4.2% to 7.9%.

Across all categories of IT spending, Gartner is calling for combined growth of 5.1% in IT budgets compared to 0.8% growth in 2022. This will be down from 10.2% in 2021.

Across all categories of IT spending, Gartner is calling for combined growth of 5.1% in IT budgets compared to 0.8% growth in 2022. This will be down from 10.2% in 2021. (I/O Fund)

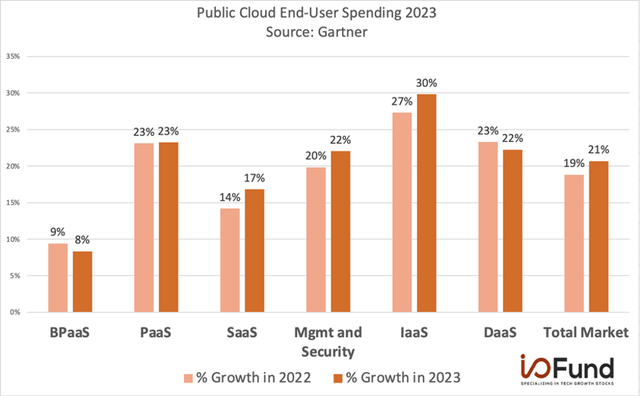

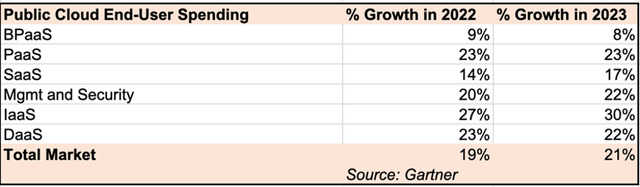

Gartner is also forecasting that 2022 is the bottom for a few public cloud end-user verticals with a year-over-year increase in software-as-a-service (SAAS), cloud management and security, and infrastructure-as-a-service (IaaS).

Of these, Cloud IaaS is expected to see the most growth from 27% in 2022 to 30% in 2023. This is on a large revenue base of $115 billion, expected to grow to $150 billion in 2023. Software-as-a-service is the largest category in cloud with revenue of $167 billion, expected to grow to $195 billion at a rate of 17%.

Notably, some areas are expected to decline, such as BPaaS and DaaS.

Cloud IaaS is expected to see the most growth from 27% in 2022 to 30% in 2023. This is on a large revenue base of $115 billion, expected to grow to $150 billion in 2023. Software-as-a-service is the largest category in cloud with revenue of $167 billion, expected to grow to $195 billion at a rate of 17%. (I/O FUND)

Shown below, the overall cloud market is expected to grow 21%, up from 19% in 2022. This will outpace overall IT spending with growth of 5.1% by over 5X.

The 5.1% growth lags the current inflation rate of 6.5%.

The overall cloud market is expected to grow 21%, up from 19% in 2022. This will outpace overall IT spending with growth of 5.1% by over 5X. (GARTNER: PUBLIC CLOUD END-USER SPENDING)

Source: Gartner: Public Cloud End-User Spending

Cloud IaaS Growth Saw 3% Headwind in 2022, More to Come?

Gartner released the 2023 survey results in October, and later that month, Q3 earnings results from Big Tech reported a decline in Cloud IaaS. Perhaps the survey is predicting a rebound from H2 2022 to H1 2023, but this would be hard to determine until budgets are set in the earlier part of next year.

In most cases, we are seeing a 10% deceleration from the early part of the year to the second half of the year. For now, actual results from the Big 3 Cloud IaaS providers disagree with Gartner’s survey predictions that a rebound is coming. This is despite Cloud IaaS predicted to be the more resilient line item in public cloud end-user spending.

In most cases, we are seeing a 10% deceleration from the early part of the year to the second half of the year. For now, actual results from the Big 3 Cloud IaaS providers disagree with Gartner’s survey predictions that a rebound is coming. This is despite Cloud IaaS predicted to be the more resilient line item in public cloud end-user spending. (I/O FUND)

CY 2022 Growth Rates for Cloud Iaas (EARNINGS RESULTS)

Mixed Reports Following Q3 Results

Gartner’s prediction that cloud budgets will expand contrasts with other surveys that suggest the opposite. For example, according to a survey by Wanclouds, 81% of companies were directed by the C-suite to reduce cloud spending or to occur no additional costs.

The venture capital firm Accel published a report that showed private funding for cloud companies dropped as much as 42% across Europe, Israel, and the United States in Q3. This often translates to lower valuations and/or lacking a clear path to a strong exit on the public markets or through an acquisition.

This doesn’t mean the migration to the cloud is slowing down, by any means. According to Accel, spending on automation and digital transformation is expected to rise from $1.8 trillion to $2.8 trillion by 2025. The drawback to these kinds of forecasts is that it may slow considerably in 2023 before a rebound occurs.

Conclusion:

Cloud spending may turn out to be softer than industry surveys indicate, especially until inflation cools off. This is because surveys capture a perception while earnings results are the culmination of a 7.1% inflation rate, plus a softer Chinese market and a softer European market.

The Big 3 are the best proxy because their reports represent the layer in the tech stack that tends to be the most resilient in terms of churn. The switching costs are quite high for cloud IaaS services. The Big 3 also afford a more concentrated view by owning 66% of market share across three companies whereas SaaS is spread across thousands of companies.

For our premium members, we dig deeper into mid-cap cloud companies to determine which ones are decelerating more quickly than their peers and also which leading cloud stocks we plan to buy when we sense there is a rebound.

Be the first to comment