John Kevin

The 60%/40% benchmark portfolio’s YTD return as of 12/9/22 was -16.24%. Here’s how the YTD returns have unfolded since 9/30/22:

- 11/30/22: -12.81%

- 10/31/22: -16.84%

- 9/30/22: -20.11%

The low water market in terms of YTD returns at weekend was 10/14/22’s -20.57% print, which was worse than the week the June ’22 S&P 500 lows were made, which was -17.98%.

The point is that sentiment remains very dour, both retail and institutional sentiment, even though “balanced account” YTD returns have improved in the last 8 weeks.

The Fed: 2018 and 1994

The one aspect of the last 2018 monetary tightening period by Jay Powell and the FOMC, that I still remember today, is how fast Powell pivoted in the last week of December ’18 towards a much more friendly monetary stance, even after the hawkish mid-December, 2018, comments. At that time, it was a clear 180-degree shift and the S&P 500 sniffed it out within 10 days of that previously-mentioned mid-December, 2018 stance.

Contrast this with Greenspan’s much more deliberate and often data-rigorous decisions like 1994 where the Fed Chair continued to raise rates into early 1995 even though the S&P 500 bottomed in late 1994. Investors were shell-shocked back then even though the AGG was down just 2% in 1994, a paltry drawdown considering the -11.6% drop in the Barclays AGG YTD in 2022.

Here’s an interesting link from the Dallas Fed written this summer, 2022, on the connection between Fed rate hikes and emerging markets. Assuming it was written by 3 Fed staffers, and not necessarily the Wall Street crowd, I found myself disagreeing with some of the articles. The article talks about the peso collapse in 1994, which was one of the catalysts which eventually forced Greenspan to change monetary policy in early 1995, but I was a fixed-income/credit analyst at that time and was listening to one of our other analysts talk about Mexico’s large amount of dollar-denominated debt, in addition to their dwindling forex reserves prior to the peso collapse. This kid called the Mexican peso collapse before it happened but because it was on the fixed-income/credit side of the business it was the “tree falling in the forest” so to speak. My own opinion is that 2022 is different from 1994 because of Ukraine and the energy markets and that aftermath, not to mention the very strong dollar this year. (Anyway, didn’t mean to distract readers. In this blog’s brief and concise 2023 stock and bond market(s) preview written last Thursday night, emerging markets and international non-US asset classes look very attractive from a long-term return perspective, coming into 2023.)

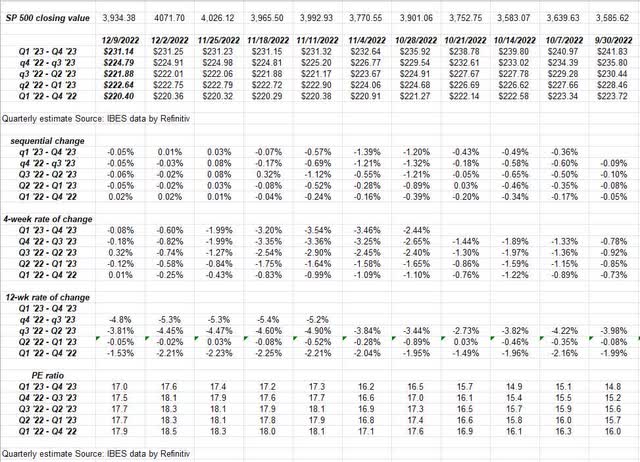

S&P 500 earnings data: (Source data is IBES data by Refinitiv, calculations are my own):

- The forward 4-quarter estimate (FFQE) fell slightly this week to $224.78 from $224.91, for a minor sequential decline of -0.6%. Since 9/30/22, the FFQE has fallen from $230 to today’s $224.

- The PE ratio on the current estimate is 17.5x versus the 9/30/22 PE of 15.5x

- The S&P 500 earnings yield is now 5.71% after Friday’s weak close, the highest earnings yield since 11/4/22.

- The Q4 ’22 bottom-up estimate has fallen roughly 6% from its 9/30/22 value of $57.91 to today’s value of $54.44.

For reader’s edification, Ed Yardeni, the dean of S&P 500 EPS forecasters still has – to my knowledge – a $215 EPS estimate on the S&P 500 for full-year 2022, which won’t be known until mid-February ’23, but that estimate would imply that Q4 ’22 bottom-up EPS estimate is below $50 per share, from its current estimate this weekend of $54.44 per share, which would be a sharp decline, so watch for negative earnings pre-announcements as we head into year-end 2022.

Either we’ll see negative pre-announcements heading into year-end 2022 or even very early January ’23, or the current EPS estimate for the S&P 500 of $220’ish, will hold up through Q4 ’22 earnings.

Rate-of-change: Heavy downward revisions have slowed:

This “rate-of-change” spreadsheet shows the heavy downward revisions have slowed but it’s also now the proverbial “dead zone” in terms of corporate earnings releases for the next 5 weeks.

This week, Oracle (ORCL) and Lennar (LEN) report. Given TOL’s good report last week, LEN is the more “mid-market” homebuilder while Toll Brothers (TOL) is higher-end, and per the Briefing.com data, LEN is expected to report 25-26% EPS growth given the consensus, i.e. not too shabby given the general sentiment around housing today.

Clients have a small position in ORCL since old Tech has done better this year. Oracle’s EPS “growth” is expected to fall 3-4% y.y, some of that due to the Cerner acquisition, so it’s likely non-operating. Oracle’s big quarter every year is the May quarter which will be reported in June ’23, so if the stock winds up the week lower, some more Oracle could be added.

Summary/conclusion: Tuesday’s CPI and the FOMC announcement are the big news for the week, and then don’t be surprised if trading activity begins to shut down into year-end 2022, with Christmas now two weeks from today.

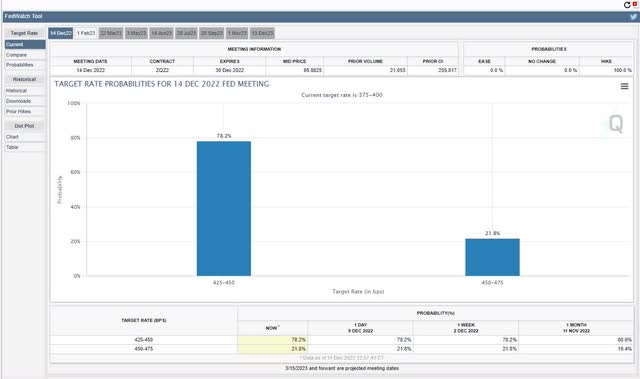

Here are the current Chicago Merc fed funds futures probabilities for the Wednesday FOMC meeting with a 78% chance of a 50 bp increase to 4.375% (midpoint) as of Wednesday’s announcement. Jay Powell has stated previously, that there is a “substantial majority” of FOMC voting members that wish to temper the rate of fed funds point increases.

Sentiment around December 13, ’22 (Tuesday’s) CPI release is expecting a weak number (maybe sentiment for a weak number is too high) with the Briefing.com consensus expecting 0.3%, and the Core CPI expected at +0.3%. I believe CPI and other inflation data have peaked and will decline, but the rate and slope of the decline will be uneven as the US economy works off the final effects of Covid-19 and the pandemic.

The week prior to Christmas, on Tuesday, December 20, we will get the latest earnings releases from Nike (NKE) and FedEx (FDX), so while it’s just 4 companies, this week and next we hear from old tech software ORCL, a middle-market homebuilder, Lennar, a high-end athletic and footwear company, with a major link to the Chinese consumer, Nike, and then one of the largest transport components, FedEx, with a global reach and insight into major geographies around the world.

With just these 4 companies, readers will get a good look into a wide cross-section of US business (ORCL), the US consumer, and the economy.

My enduring memory of December 2018 was how fast Powell pivoted and changed his mind between the mid-December ’18 FOMC announcement and then early January 2019. Looking at the FFQE S&P 500 EPS from September to December, ’18, the forward estimate was unchanged from late September to December ’18 at $168 per share.

No question, this tightening cycle, which hasn’t been as long but much more dramatic in its speed in ’22 versus ’18, has begun to wear down forward estimates, which Jay Powell has to have taken notice of.

If inflation would capitulate and show some breakage, it would give Powell and the FOMC room to temper fed funds rate hikes, but food/grocery inflation seems to be remaining stubborn: Costco (COST) noted with their latest earnings that grocery inflation was between 6% and 7%, down from 7% and 8% the August and May ’22 quarters, so it’s trending the right direction, just not fast enough. Kroger (KR) also reported last week and when asked about food inflation for calendar ’23, seemed particularly guarded about saying food/grocery inflation would decline.

A sharp drop in Core CPI would help, no question, as investors and shoppers await lower grocery prices, which is eventually expected given this.

Take all of the above with substantial skepticism and a serious dose of salt. Capital markets change quickly for both good and bad. Past performance is no guarantee of future results and none of the info above may be updated.

Thanks for reading.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment