Scott Olson/Getty Images News

Investment Thesis

With the recent rise from its lows in November, and upcoming earnings in the next week, is there room left to go up for this shoe company? My valuation analysis and conservative growth estimates with a decent margin of safety say yes. I will briefly present what I think the future holds for Crocs, Inc. (NASDAQ:CROX), and my opinion on how fast they are going to keep growing. Most of the article will focus on the company’s financials and my assumptions on growth that will drive my DCF analysis to conclude that the company, even after a run-up in stock price is still a buy at these levels.

I always like to look at companies right before their big earnings, to see whether I should be looking into investing some of my cash into the business or to avoid it if the financials and my analysis of the future cashflows say that the company is overpriced.

The next company on my list is Crocs Inc. An easy-to-understand company that sells comfortable foam clogs to a variety of audiences. It almost sounds boring when you think about it, however, when looking at its financials, it is anything but boring. The article will be light on details available to everyone about the company and will be focused more on my valuation assumptions which led me to a certain price for the stock.

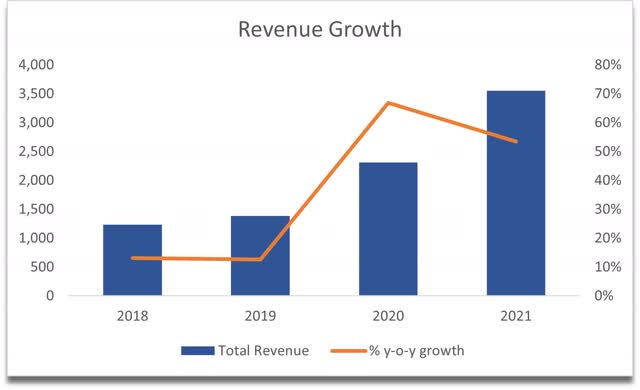

Revenue Growth

In the last couple of years, the company managed quite impressive revenue growth, even during the peak of the pandemic, the company recorded a 13% increase y-o-y. The growth from 2020 to 2021 was even more impressive, coming at 67% and most recently the management came out and said they expect the revenues for 2022 to be around 53% higher than 2021. The increase in guidance is due to their very smart acquisition of the HEYDUDE brand at the beginning of 2022, which beat the firm’s expectations by a long shot and is growing quite fast q-o-q.

Revenue Growth (Own calculations)

The management also said that the future growth revenues will come down quite a bit from the 53% they see for 2022, to around 10%-13% next year. This gives me a good start for my revenue assumptions. I chose 12.5% for next year and after that, I needed to do a lot of research to come up with some reasonable growth assumptions for the main Crocs brand and the fast-growing HEYDUDE brand.

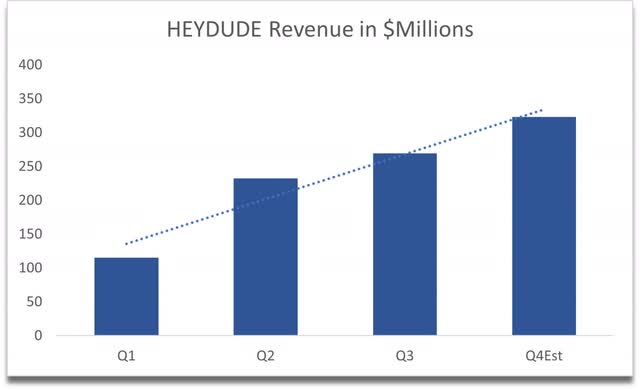

HEYDUDE

The initial reaction when the acquisition was announced back in December 2021 was bad, to say the least, the stock tanked over 15% on the day. People did not like that one bit. Fast forward to having been acquired for a year now and will report its fourth-quarter earnings this month, the HEYDUDE brand has been nothing short of amazing in its growth and now makes up almost a third of the total revenue for the company. We do not have y-o-y figures yet for obvious reasons, but looking at q-o-q growth, the brand is growing solidly. I don’t see the growth numbers slowing down as they are still quite a small company, and it is not unheard of.

HEYDUDE Revenue q-o-q (Own calculations)

The management moved up their revenue expectations for HEYDUDE to reach $1 billion by 2023 instead of 2024. This tells me that the brand is growing much faster than anticipated, so my growth assumptions will be on the optimistic side but anchored to around $1 billion in 2023. I could also see management’s expectations of being beaten again by the brand if they already had to move up by a whole year.

Brand Popularity

Piper Sandler and DECA make a semi-annual survey of US teens and Crocs have been climbing up the popularity ladder amongst the teens. Crocs brand went from being number 6 preferred footwear to number 5 and HEYDUDE went from number 9 to number 7. The popularity does not seem to be fading away with time, only increasing. I heard of the fad that happened in 2021 where a lot of celebrities were wearing the clogs and I thought it would dissipate over time, but that does not seem to be the case. Even a brand like Balenciaga is collaborating with Crocs. Foam boots sell for as much as 950$, I can’t imagine that most of it would not end up as profit because I doubt there would be much increase in the cost of production.

Financials

Let’s have a look at how the company is managed.

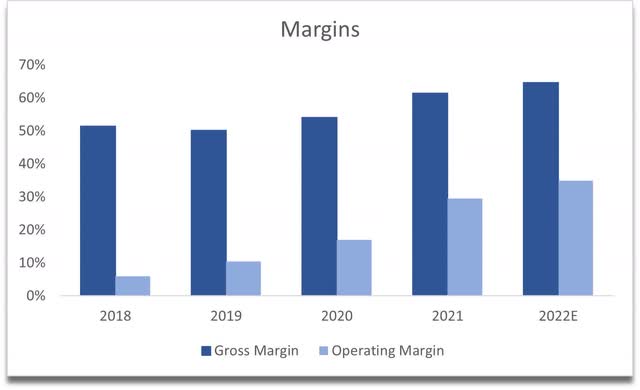

The company has had very solid gross margins for the last 4 years and I don’t see how the margins would contract in 2022 either, which I expect to be somewhere over 60% and operating margins are very healthy too.

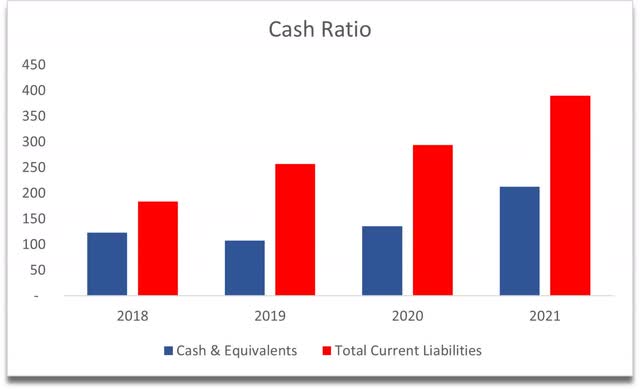

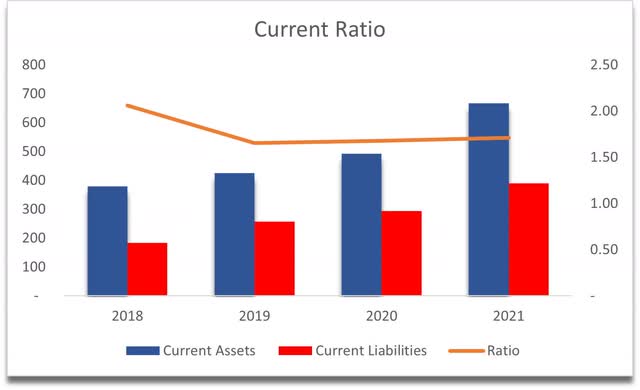

The next thing I like to look at is how is the company doing on its cash on hand and how well it is covered against its short-term obligations. The story for Crocs is a little different here as the cash cannot cover its current liabilities, however, I do not see this as being an actual problem as the current ratio is more than acceptable.

Cash Ratio (Own calculations) Current Ratio (Own calculations)

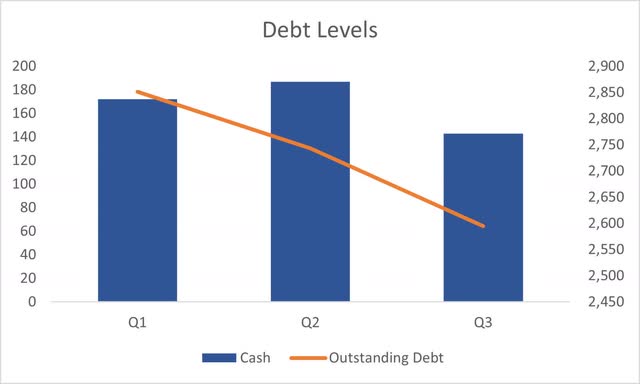

A lot of people do not like debt, including me, however, the debt acquired by Crocs I believe was a very smart move as the HEYDUDE acquisition turned out to be a very good investment and the management is focusing on deleveraging right now as a priority, so I don’t expect this to be much of an issue to the company. They paid down 350mil towards debt in 2022 and paid down $155.3m of debt in Q3 alone. The company wants to go down to ~2.0x Net Debt/ Adjusted EBITDA ratio by mid-2023. Currently sitting at around 2.5x.

It looks like the management’s priority to decrease debt is seen as very favorable by investors, and I would agree. Looks like most of the available cash is going toward the repayment of debt.

Debt reduction (Own calculations)

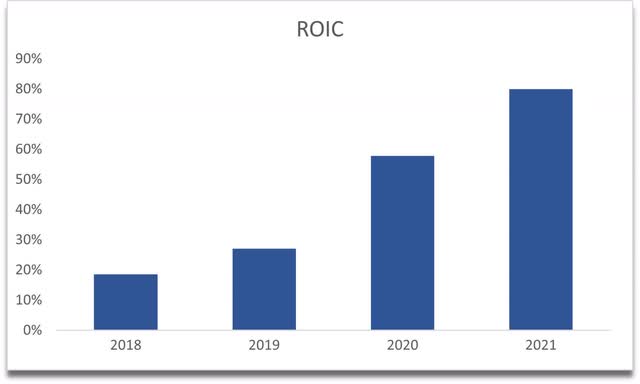

Return on invested capital is also very high and has been growing over the years too. I would venture a guess that it would not be this high in 2022, however, it will still be above acceptable levels.

Return on Invested Capital (Own calculations)

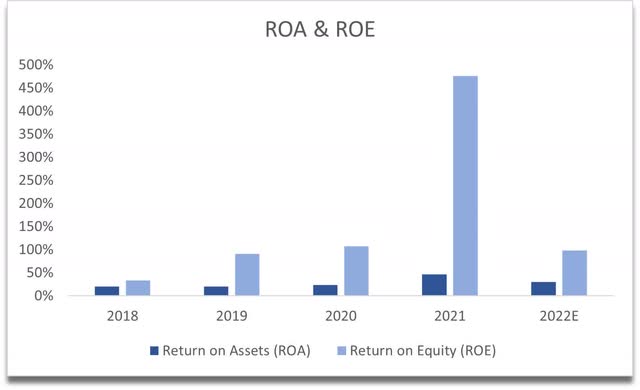

ROA and ROE have also been exceptional over the last 4 years. Share buybacks have increased ROE considerably.

ROA and ROE (Own calculations)

From the above metrics, I see a lot more good than bad, even with high debt which is easily explainable and the management’s priority on reducing it puts me at ease. The company is a well-oiled machine and so far, looks like a candidate for future investment.

Valuation

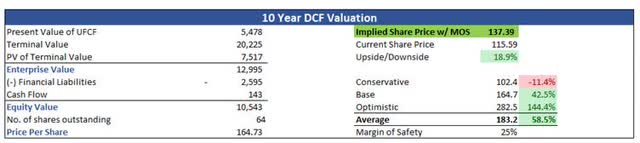

For my valuation analysis, I separated the main Crocs brand and HEYDUDE brand into their revenue segments as I believe the HEYDUDE brand will keep growing at a higher pace than the clogs. From the above information that I gathered, the management’s outlook for 2023 gave me an anchor for my growth assumptions. As usual, I will present 3 scenarios for my valuation, one being the base case and the most reasonable, one conservative approach where I reduced growth figures by a couple of percentage points, and one optimistic approach where I increased revenue growth by a couple of points.

I believe that the HEYDUDE brand will become quite a revenue generator for Crocs as it already has beaten the management’s expectations early, and so my base assumptions lead towards higher growth numbers in the next few years, at around 20% and then reduce by a couple of percentages every few years to end up at 10% by 2032, which gives me around 15% average growth rate over 10 years. In my opinion, these numbers seem to be quite reasonable, mainly because the brand, although may not be very new, since it was founded in 2008, will reach more customers after the acquisition.

For the main Crocs brand shoes, I see an average growth of 10% over the next 10 years, and for total revenue, I see an 11.5% average over 10 years.

With all the inputs forecasted, I also like to apply a good margin of safety, which I usually go for 25%. I made no exception for Crocs. You can buy a great company for the long term, however, you can also overpay and get poor returns over time, so it is better to have some margin of error in valuation to protect you from buying at the wrong time. With that said, my 10-year DCF is sitting at an average price of $137.39, which means around 19% upside from the current share price and is a buy in my books.

10-Year DCF valuation (Own calculations)

Quick Comps Analysis

I also decided to have a look at some relevant competition, however, I don’t see a perfect competition in the clogs space. Comparing Crocs’ valuation metrics to somewhat similar competition does show that it is undervalued also, at least in terms of average EV/EBITDA. By performing a Comps analysis against similar market cap players, excluding adidas (OTCQX:ADDYY) and Nike (NKE) as they are a little too big, I got a share price of $209. I will add a 25% discount to that as my margin of safety and I get $156.76, which is still above the current share price.

Comparison Companies for Crocs (Spreadsheet screengrab)

Risks

The growth numbers may not be reached if the Crocs fad by the kids will dissipate, however, the HEYDUDE acquisition paving the way to diversification into other stylish shoes may not lower the growth of the sales too much. As mentioned earlier the popularity in 2021 has not dissipated at all, which can only be good for the company in the long run, however, tastes change, and I would have to adjust my analysis accordingly once we get more data over the next couple of years.

Conclusion

I believe that the management made some great decisions over the last year or two and the acquisition of HEYDUDE has been paying off already. The valuations above tell me this is a good investment at the current share price with a decent margin of safety baked in, however, that is just one person’s opinion and people who are looking into investing should look for more research and do their due diligence before jumping on board. In my opinion, Crocs is positioning itself to perform very well in the upcoming years and warrants to be in a lot of people’s diversified portfolios. I would look at putting in my money at a lower share price because the recent run-up of around 70% in the last 3 months or so is a bit too high in my opinion and I would look at selling cash-secured puts at a lower price.

Thank you all for taking the time to read my analysis and I hope this will help you decide whether you want to have this company in your portfolio.

Be the first to comment