Michael Vi

Skyworks Solutions, Inc.’s (NASDAQ:SWKS) revenue is divided into Mobile and Broad markets segments. Based on the company’s latest earnings briefing, its Broad markets segment had strong growth of 30% YoY compared to the company’s total revenue growth of 7% but the Mobile segment accounted for a larger share of revenue (64%) thus translating to a growth rate of -6% YoY for the Mobile segment. Hence, we analyzed the factors behind both segments’ growth and determined the future impacts of these factors on the company.

Mobile Segment Expected to Remain Stagnant due to Low iPhone Demand

In the company’s earnings briefing, Skyworks’ Chief Financial Officer, Kris Sennesael, mentioned that there was…

softness in end customer demand in the China market.

Previously, Apple (AAPL) cut iPhone 13 production due to a decrease in demand and it does not plan to increase the iPhone 14 production due to lower demand than anticipated. Therefore, we analyzed the past % of Skyworks’ revenue from China and Apple as it is Skyworks’ largest customer to determine the expected impact of these events on Skyworks’ Mobile segment.

|

China Revenue Contribution to Skyworks |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

|

China |

69% |

30% |

28% |

25% |

21% |

21% |

19% |

Source: Skyworks, Khaveen Investments

As seen in the table above, Skyworks’ revenue contribution from China was on a decreasing trend. Hence, we believe that although there is softness in the China market, it would not impact Skyworks significantly as China only consists of 19% of Skyworks’s revenue in 2021.

|

Apple Revenue Contribution to Skyworks |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Apple Revenue Contribution |

39% |

47% |

51% |

56% |

59% |

|

Revenue ($ mln) |

1,424 |

1,818 |

1,722 |

1,879 |

3,014 |

Source: Skyworks, Khaveen Investments

However, as shown in the table, Apple’s % of revenue for the past 5 years had been increasing showing the increasing dependence of Skyworks on Apple. Additionally, Apple’s revenue in absolute value had also been increasing although it decreased in FY2021. Hence, we believe that if the low demand for Apple’s devices continues, it would impact Skyworks significantly due to Apple being Skyworks’ major customer and Skyworks’ increasing dependence on Apple. Therefore, Apple’s flat production target may indicate that Apple expects flattish sales which we then believe could result in the company’s Mobile segment revenue growth having a stagnant outlook too.

Broad Markets Growth Driven by Fast-Growing End Markets

We continue to drive design wins and revenue with innovative solutions for fast-growing end-markets, including automotive, industrial, data center, and network infrastructure. – Kris Sennesael, Chief Financial Officer

Skyworks mentioned in its previous earnings briefing for its Broad markets segment, its customer count doubled YoY through factors such as “innovative solutions” and “fast-growing end markets”. Therefore, we analyzed Skyworks’ innovativeness by comparing its number of patents over the years and to its competitors to determine its competitiveness. Additionally, we compiled the CAGR of its end markets in the Broad markets segment to determine the accuracy of management’s statement.

|

Patent Publications |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Skyworks Solutions, Inc. |

1,060 |

859 |

1,067 |

867 |

725 |

|

Growth |

-18.96% |

24.21% |

-18.74% |

-16.38% |

|

|

Broadcom Inc. (AVGO) |

2,179 |

1,566 |

1,496 |

819 |

353 |

|

Growth |

-28.13% |

-4.47% |

-45.25% |

-56.90% |

|

|

Qualcomm Inc (QCOM) |

23,124 |

23,442 |

20,748 |

19,986 |

20,868 |

|

Growth |

1.38% |

-11.49% |

-3.67% |

4.41% |

|

|

Qorvo, Inc. (QRVO) |

4 |

10 |

6 |

7 |

21 |

|

Growth |

150.00% |

-40.00% |

16.67% |

200.00% |

Source: Global Data, Khaveen Investments

In the table above based on data from Global Data, Skyworks’ patent publications were in a decreasing trend with an average 4-year growth of -7.47% which is lower than Qualcomm and Qorvo with an average 4-year growth of -2.34% and 81.67% respectively. Furthermore, in the year 2021, Skyworks had the second-highest number of patent publications (725 publications) with Qualcomm having the highest publications of 20,868 publications. Thus, we believe the negative publication growth indicates that Skyworks is less innovative as compared to previous years and Qualcomm.

Additionally, based on various research reports, the market forecast CAGR of the end-markets in the Broad markets segment includes the automotive market which is expected to grow at a CAGR of 9.47% through 2030, the industrial market at a forecasted CAGR of 9.2% through 2029, the data center market at a forecasted CAGR of 21.98% to 2026, and network infrastructure market at a forecasted CAGR of 11.27% through 2029. We believe that the end markets all have relatively high growth with the data center market having the highest forecasted CAGR of 21.98% to 2026.

To conclude, we believe Skyworks’ decreasing patent publication growth trend contradicts management’s claim and is less innovative as compared to previous years and Qualcomm. Notwithstanding, we believe its Broad markets segment’s growth could benefit from the high growth end market tailwinds especially data center which has the highest forecasted CAGR.

Increasing Data Volume Drives Data Centers Demand

Skyworks’ Broad markets segment grew by 30% YoY and consisted of 36% of revenue which had increased compared to a revenue contribution of 30% of revenue in Q4 2020. Therefore, we analyzed whether would Skyworks be able to achieve double-digit growth in the broad markets through its high growth end-markets.

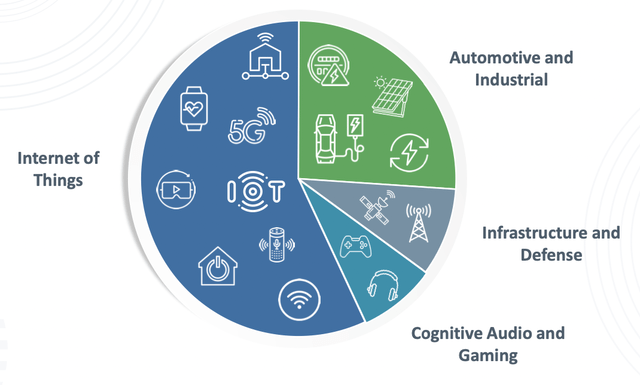

As mentioned previously, the data center market is forecasted to have the highest CAGR, and as shown in Skyworks’ company presentation, IoT which (consists of the data centers) occupies the largest portion of the Broad markets segment at >50%. Additionally, the company’s presentation states it expects the cloud to be growing at 50% annually, and that the company has partnerships with the Top 10 data center interconnect providers (which include Intel (INTC), Cisco (CSCO), Microsoft (MSFT), Ciena (CIEN), Juniper (JNPR), AWS (AMZN), IBM (IBM), Ericsson (ERIC), Dell (DELL) and Nokia). When comparing these partners with the companies from the Cloud Market Share chart from our previous Amazon analysis, we find that AWS (Amazon) had the largest adoption % in 2021 (35%), followed by Microsoft Azure (22%), and IBM (5%).

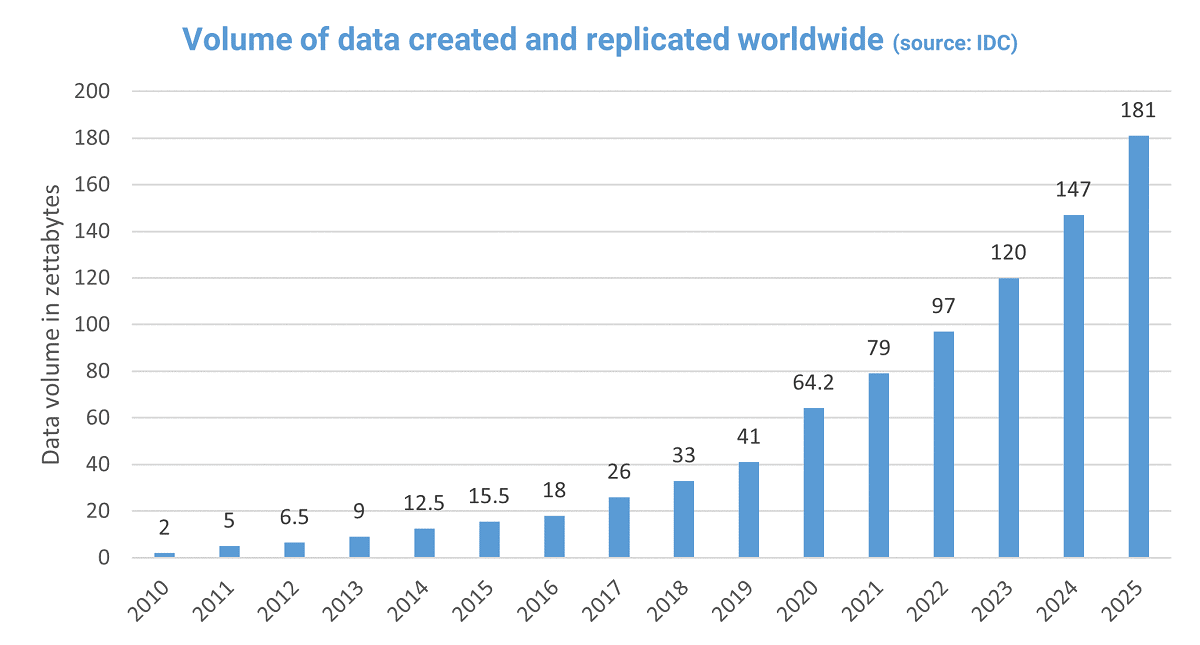

Besides that, from our previous analysis of Amazon, we also believe that data volume growth would continue to drive the cloud market growth at a 10-year average of 30.5%.

IDC

We believe that data volume would continue to increase which would be the main driver of Skyworks’ double-digit growth in the Broad markets segment.

Risk: Losing Competitiveness due to Supply Chain Issues

As the company mentioned previously, due to the supply chain constraints in the segment of the Broad Markets, they plan to increase their prices by “a little bit”. Therefore, we believe that the price increase may pose the risk of affecting Skyworks’ competitiveness.

Verdict

To conclude, we believe that China softening in demand would not impact Skyworks’ Mobile segment significantly as its revenue contribution had decreased since 2015. However, we believe that Apple’s flattish production outlook could result in a stagnant growth outlook for Skyworks’ Mobile segment due to an increasing dependence on Apple at 59% of revenue. We also believe innovative solutions are not the main factor behind Skyworks’ Broad markets segment double-digit growth but rather high-growth end-markets, especially data center in the IoT segment, are its main growth driver.

Therefore, we believe the total company’s revenue growth would be lower than the Broad markets segment’s growth as we expect the Mobile segment to be stagnant due to expected flat sales for the iPhone 14 whereas the Broad markets segment to grow at around 15% (driven by >50% revenue contribution from IoT where the data center is forecasted to have >20% growth). Therefore, from our analysis, we believe that the Broad markets segment has more growth opportunities as compared to the Mobile segment and would continue to have a double-digit growth rate.

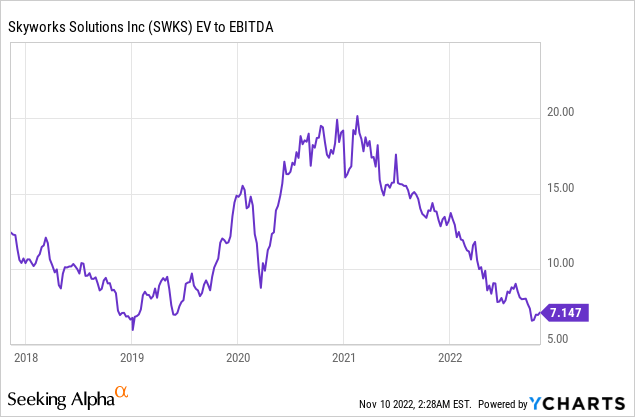

The analyst consensus price target for Skyworks is $109.71 representing a 28% upside from the current price. Therefore, we rate the company a Buy following a 47% decline in its share price over the past 1 year and its current EV/EBITDA at 7.1x is 42% lower than its 5-year average of 12.29x.

Be the first to comment