Andy Schelling/iStock via Getty Images

Company Overview

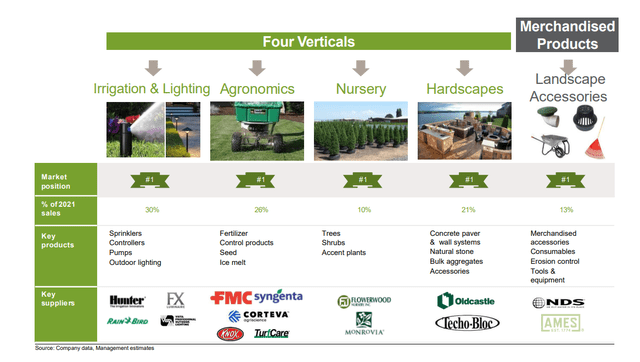

SiteOne Landscape Supply, Inc. (NYSE:SITE) is a wholesale distributor to green industry professionals of irrigation supplies, fertilizer and control products (e.g., herbicides), hardscapes (including pavers, natural stone, and blocks), landscape accessories, nursery goods, outdoor lighting, and ice melt products. In addition to its product offerings, the company offers value-added consultancy services to assist customers in running and expanding their businesses. The company’s sales are primarily to customers in the United States of America. In 2021, 60% of sales were to residential construction customers, 30% to commercial construction customers and 10% to recreational customers.

Investment Case

SITE is an incredibly strong business that has largely flown under the radar of Wall Street and professional stock market observers. Management is in the process of building a truly national landscaping supply company that already has a scale which will be difficult for competitors to replicate. Today, SITE has more than 590 distribution branches across the U.S. and Canada. This is far and away the largest number of branches in the industry and the company is creating a “network” that provides significant value to customers.

Through its distribution network, the company offers 135,000 products SKUs and ensures customers can quickly access products at any time at prices that are generally cheaper than competitors. Many of SITE’s competitors are local outfits lacking the scale of SITE, and thus are more likely to experience inventory fluctuations. With the landscaping industry very much being an on-demand and day-of business, SITE’s ability to quickly supply customers is a competitive advantage.

SITE is also an industry consolidator that is leveraging its massive scale and distribution network to provide more affordable options to its customers. The company estimates that it is 5.0x larger than its nearest competitor and that it has a 15% share of the very fragmented $23 billion wholesale landscaping products distribution market. Management frequently engages in value-enhancing acquisitions of local landscaping supply businesses to further build out its national network. In 2021 alone, the company continued its rollup strategy and acquired 19 landscape suppliers across the US. SITE has used both inorganic and organic expansion to negotiate lower product prices from suppliers and pass these savings along to customers.

The growth story for SITE is not simply inorganic. In fact, management estimates that the company currently only has its full product line offered at just 30% of U.S. Metropolitan Statistical Areas. Management is committed to further growing product sales in its top markets and expects significant organic expansion in the coming years. Supporting this expansion is the most complete product catalog in the industry, whereas competitors often have only a fraction of the offerings.

In recent years, management has also undertaken a number of growth initiatives aimed at further strengthening SITE’s moat and customer relationships. Several years back, the company introduced a loyalty rewards program to further boost ties with frequent buyers. The program provides discounts and rewards to frequent purchasers, and for SITE helps increase the “stickiness” of customer relationships. Additionally, in recent years, SITE has heavily invested in CRM, eCommerce, and Data Analytics to further drive sales and improve customer relations. These efforts seem to be paying off, as the Company has grown sales by over 100% and EBITDA by over 200% over the last 5 years.

While SITE’s business is not entirely recession-resistant, it is one of steady demand. During recessions, a spend pullback would likely be expected for New Properties as construction and building activity decline. Existing customers, however, are less likely to pull back on landscape supply spending, since doing so would impact the value and ultimately the health of some of their outdoor real estate.

Backing the growth and strategic plans above is an extremely experienced management team. CEO Doug Black has been with the company for 8 years, while CFO John Guthrie has been with the firm for over 20 years. During their tenures, SITE has grown into a very diversified business that’s not dependent on any one customer or business line. As noted in the annual report:

“Our customers are primarily residential and commercial landscape professionals who specialize in the design, installation, and maintenance of lawns, gardens, golf courses, and other outdoor spaces. Our customer base consists of more than 280,000 firms and individuals, with our top 10 customers collectively accounting for approximately 4% of our 2021 Fiscal Year Net sales, with no single customer accounting for more than 2% of Net sales.” Source: Company Annual Report

Additionally, in recent years management has made a focused effort to move higher up the value chain to offering higher-priced & margin products and services such as landscape design.

Financial Overview

The financials for SITE show that the company has been executing against its core strategic and operational plans. Over the last 5 years, revenue has virtually doubled from $1.9B in 2017 to $3.6B in the TTM period. YoY growth for the period ending Jan2022 was 29%. While 2021 was a record year, some of this growth can be attributed to COVID, and continued work/stay at home policies in the U.S. and Canada where many homeowners poured money into landscaping projects.

SITE has demonstrated a history of improving operations and expanding margins as well. Since 2012, the gross profit margin has expanded a full 5 points from 29.89% to 34.89%, while operating margins expanded from 3.8% to 9.0% over this same time. In my view, both data points show that the company is executing on its industry consolidation strategy and becoming more efficient along the way. Profits are also falling to the bottom line along the way, as EPS has grown from $1.29 to $5.20 per share over the last 5 years. Management has conservatively managed stock awards too, with total diluted shares outstanding growing from just 42.2 million shares in 2017 to 45.8 million shares in 2022.

Although the company has been highly acquisitive, long-term debt has fallen from over $550 million in 2018 to $251 million today. Over this same time, SITE has greatly increased its free cash flow (“FCF”) generation. FCF in 2018 was $20 million but has now grown to over $114 million.

Further evidence of the Company’s financial performance can be seen through its streak of beating analyst estimates. On the earnings front, SITE has surpassed consensus analyst estimates in 10 straight quarters. Looking ahead, for full year 2022, analysts expect SITE to reach $3.9B of revenue and EPS of $5.74 per share.

Perhaps the best indicator of shareholder value in recent years is SITE’s return on invested capital (“ROIC”), which has increased from 8.0% in 2017 to over 17% today. According to management:

“We are still in the third or fourth inning of our overall development as a truly world-class company. Accordingly, we remain highly focused on our commercial and operational initiatives to further build our capabilities and improve the value that we deliver to customers and suppliers.”

In my view, this is a solid indicator that ROIC can continue to expand in the coming years as management further pursues the multiple growth opportunities discussed earlier.

Investment Risks

The most immediate near-term risk for investors to consider is likely the somewhat cyclical nature of SITE’s business model and the fact that lower net sales and reduced cash flows could result due to troubles in the broader U.S. economy. If a significant recession were to result, it’s likely that there would be declines in new residential and commercial construction activity, which in turn would likely temporarily hamper the company’s growth prospects. In this scenario, existing customers would likely also hold off on non-core product purchases and sometimes reduce usage of existing services if possible. Although likely temporary in nature, this could lead to a flatlining of sales growth or even an interim decline. Given management’s history of navigating economic cycles, this risk is unlikely to result in long-term harm to the company.

Customers in the landscape supply industry are also quite price sensitive. SITE has carved out a niche as being the low-cost provider with strong customer loyalty programs. Although no direct risks appear on the horizon here, if other competitors were to gain significant scale, this would likely materially impact the investment case for SITE.

The company is also exposed to certain supply chain and inventory management considerations. To help lower prices, the company has traditionally made volume-based inventory commitments. If the company is unable to meet these commitments, it could have a material impact on the prices customers pay and SITE’s financial results.

“We generally procure our products through purchase orders rather than under long-term contracts with firm commitments. We work to develop strong relationships with select suppliers that we target based on a number of factors, including brand and market recognition, price, quality, product support, service levels, delivery terms, and strategic positioning. We typically have annual supplier agreements, and while they generally do not provide for specific product pricing, many include volume-based financial incentives that we earn by meeting or exceeding purchase volume targets. Our ability to earn these volume-based incentives is an important factor in our financial results. In certain cases, we have entered into supply contracts with terms that exceed one year for the manufacture of our LESCO branded fertilizer, some nursery goods, and grass seed, which may require us to purchase products in the future.” Source: Company Annual report.

Historically, SITE has successfully been highly acquisitive and oftentimes purchases anywhere from 10-25+ “local” landscape supply businesses in any given year. Investors will want to keep a close eye on this area and ensure future acquisitions continue to generate value for the company. Although it comes with the industry, certain of SITE’s products are also exposed to product liability claims and other legal proceedings. These developments should also be a watch item for investors.

Valuation

SITE has a current market cap of $5.05 billion, trades at $112.34 per share, with analyst consensus earnings expected at $5.74 per share. Based on this year’s expected EPS, SITE has a forward P/E of 19.6x. As recent as 2021, SITE traded as high as $242 per share and sported a P/E of over 44.0x. Over the last 5 years, SITE’s P/E has traded within a range of 31.0x – 60.0x. Given, the quality of the company’s business model, historical track record of execution and remaining growth opportunities, SITE would appear to be a buy at today’s 19.6x multiple.

The current macroeconomic environment, however, does present certain challenges, and we can’t rule out further multiple contraction due to potentially recessionary impacts. As such, our targeted buy point would be closer $95 per share and a forward P/E of 16.5x.

Over the next 3 years, it’s very likely that SITE can continue to grow earnings at a 15% annual clip. Additionally, it’s P/E is likely to normalize in the 23.0x range once the economy stabilizes. Using these assumptions, earnings could hit $8.72 per share in 2025 and SITE could achieve a price of $201 per share, representing 80% total upside. This level would provide a reasonable entry point, where investors could continue to accumulate based on current market fluctuations and limit downside risk.

Conclusion

SITE has built a dominant position in the market for landscape supply products and services. The company’s distribution network is a unique competitive advantage that allows it to serve more customers in more locations and at cheaper prices. Although the market is fragmented today, SITE is an industry consolidator that benefits from organic and inorganic growth opportunities. At this point, it is unlikely that competitors will be able to match SITE’s scale without committing significant amounts of capital to such an effort. SITE is a long-term growth-at-a-reasonable-price play that offers significant upside to investors.

Be the first to comment