gahsoon/iStock via Getty Images

Simpson Manufacturing (NYSE:SSD) is doing an admirable job positioning itself for growth as it looks to expand its geographic reach and dissociate some of its revenue from a historical reliance on U.S. housing starts. However, rising steel prices over the last 2 years have slowly grown into a major margin issue for the stock, reaching a boiling point as we head into 2022. Until the company firmly addresses a plan to protect or regain their peer-group-leading margins, investors should be cautious and wait to invest in the stock.

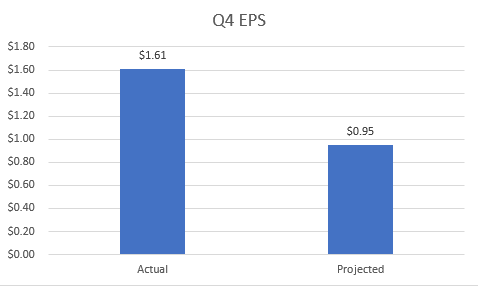

My method of analysis rests in looking at the past two earnings calls of companies and seeing what changed versus what stayed the same. I’ll then talk about what those similarities and differences mean for the stock going forward as well as how it plays into my valuation of the company through a DCF/3-Statement Model. First, some quick earnings numbers:

Company Earnings Company Earnings

What stayed from Q3 to Q4

Hyper-focus on YoY Margin Improvement

In each call, Simpson management touted their advances in improving gross profit margins when compared to respective 2020 quarters. In Q3, their gross profit margins reached 49.9%, an improvement of 230 basis points from its level of 47.6% in Q3 ’20. An even larger jump of 530 basis points was seen in Q4, rising from 42.1% in ’20 all the way up to 47.4%. One may wonder how they managed to achieve such a feat as raw material prices for companies around the globe soared. The answer to that is price increases. The company was able to implement 4 price increases throughout 2021- landing in April, June, August, and October. The increases ranged from the mid-single digits to the mid-teens depending on the product mix.

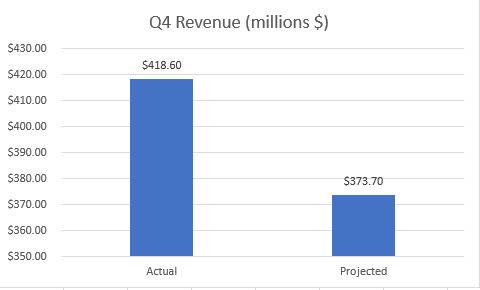

What does this mean for the stock? Well, one thing I look for if I’m ever running a margin analysis on a potential investment is how a stock’s margins stack up to its competitors. This is a strength for Simpson. They even have a graph in their earnings presentation showing how they stack up to its peers, seen below.

Company Q4 Earnings Presentation

In the grand scheme of things, better margins will translate to more income flowing into the company relative to revenue. Dividends, capex, R&D, and acquisitions all can be funded from this stream and make the stock more attractive than peers and lead to outperformance in the long-run as long as the capital is used effectively. Simpson being one of the top performers in this area surely is a competitive advantage and something that shouldn’t be overlooked by potential investors.

The Negative Effect of Steel Prices

The last few paragraphs were spent lauding Simpson’s margin levels and how well they compared to competitors. Now for some bad news that was talked about in each of the earnings calls in regards to the 2022 outlook of these precious margins.

The principal material that make up Simpson’s raw material costs is steel. According to the company, steel prices are 2-2.5x higher now than they were at the end of 2020. As 2021 progressed, the company continued to purchase steel that flowed into inventory at increasingly higher prices. This still didn’t crush margins as there was still some lower priced steel on the books that helped lower average inventory costs, and thus limiting steel’s effect on Cost of Goods Sold as that inventory got expensed out throughout the first part of 2021. However, the company is at the point where the steel they acquired at ultra-high prices makes up the majority of the steel that is in inventory. This means that as the high priced inventory gets expensed out in production, COGS will see a significant impact. Margins will take a significant hit, as the company projects 2022 operating margins will be ~500 basis points lower than FY 2021.

This is something that worries me, especially in the short and medium-term. To be fair, this is something the company saw coming. That’s why they passed along 4 separate price increases throughout the year as a way to make up for it. But that 500 basis point drop effectively wipes out any improvement in 2021 margins and actually will bring operating margins below levels seen in 2020. Sure, the company might be able to pass along further price increases in ’22, but that very well may mean higher steel costs are persisting or even increasing and end up bringing down margins even more. Such a strong headwind is hard to overcome and makes me wary about Simpson’s margins going forward – as the company did not give any reassuring plan to increase these margins in either earnings call.

What Changed from Q3 to Q4

Distribution Network Volumes Normalized

Another thing Simpson spoke about in their Q3 call was volume trends. Their top line declined by 3.3% compared to Q2 levels, driven by a decrease in sales volume from their home center channel. This is an important network for Simpson since they have a strong relationship with Lowes- a company that offers a great vehicle for Simpsons products to reach repair and remodel customers across the country. All other things being equal, a sequential decline in volumes from this segment is a negative, but there was some context provided by management that should have led investors to conclude this was a short term market realignment. Confidence levels were pretty high that this volume decline wasn’t due to loss of market share or a drop in underlying demand for products, rather, it was a function of home centers taking a more cautious stance on inventory levels- thus lowering volumes for Simpson as company’s like Lowes simply ordered less.

A similar trend on a lesser scale was also seen from the stock’s lumber yard and contractor distribution segments, as rising costs of lumber slowed down purchases from lumber yards and supply chain issues causing shortages of other materials impacted how much contractors were purchasing. Perhaps most importantly, the company saw this as a short term blip, with expectations of volumes to normalize in Q4. Sure enough all 3 of these channels saw an uptick in volume in the most recent quarter. The DIY market remains robust and the stock was able to stray away from the tough volume comps present in the middle of 2020 associated with a large Lowes order that caused volumes to surge. I don’t foresee any major issues in the near term with Simpson’s market share or product demand, leading me to believe the company can ride the coattails of a continued construction boom.

Capital Allocation Strategy

Q3 saw Simpson pay out $10.9 million in dividends along with $24.1 million worth of share repurchases. To begin the year, the company had a $100 million authorization to buy back shares, and with Q3 being the first quarter they actually repurchased these shares, the remaining amount on the authorization was $75.9 million. With the strength of the company’s balance sheet and cash position, management guided to expect future share repurchases to continue in the coming year. As a company that had no long term debt, capital allocation was pretty straightforward and it seemed that Simpson would continue business as usual so they could reach and exceed their long term goal of returning at least 50% off free cash flow back to shareholders.

Developments in Q4 threw a big wrench into this mindset, however. The company announced a $818 million dollar acquisition of Etanco- a designer and manufacturer of fastening solutions throughout Europe. That’s a large chunk of money that not only is causing the company to shift from a debt-free state, but also adds debt repayment/interest expense as a factor in the company’s capital allocation strategy. In terms of funding the acquisition, Simpson has said they will use a combination of $100 million of existing cash and $450 million from an unsecured loan, with the remaining money coming from the stocks revolving line of credit- which remained undrawn from at $300 million at the end of 2021. That’s a pretty abrupt in change in how management will need to think about deploying it’s free cash flow.

With new outflows to consider, in the Q4 call the company said it will be re-evaluating its long-term target of returning 50% of free cash flow to investors. I think a big part of this change is realizing that free cash flow is going to be down in 2022 due to the acquisition. Therefore, if the stock maintained their ’21 dividend ratio, they might actually have to lower the dividend per share. Since I’m a pretty firm believer the dividend won’t end up being cut, I think the revaluation of the 50% target will be more of a rewording to take into consideration the unique free cash flow situation that’s ahead for Simpson in 2022.

With that being said, I don’t expect a very aggressive share repurchase program in 2022 – one of the other ways they return value back to shareholders. The company announced a new $100 million authorization that expires December 31st of 2022, but there’s not a strong track record of filling out these authorizations. In ’21, where they also had a $100 million authorization, they only bought back $24.1 million- all in the third quarter. With the same amount of gunpowder but now an acquisition to fund along with related CapEx, I’m expecting an extremely light year for share repurchases for the company. For the stock itself, this makes me feel indifferent. As long as the company is able to deploy capital effectively, there isn’t an urgent need to repurchase shares, as some would even argue that share repurchases take away from other important expenses like R&D and labor.

What This All Means for SSD’s Valuation

As mentioned in the intro of my article, I derive my share price targets from a discounted cash flow model that is driven by a full three-statement model for each company I analyze. At a high level, here are some assumptions for 2022 and beyond I gained from each earnings call that is inputted into my models.

- The company’s 2022 forecast for operating margins is 17.5-19%. Making sure the operating margins are near this target is important for any semblance of accuracy in my 3 statement model and will serve as a good check tool. This number is a steep drop from 2021 operating margins, but as mentioned earlier, higher steel costs being expensed out of inventory is the primary driver.

- 2022 revenue will see a large YoY increase due to the Etanco acquisition. Their 2021 revenue was $291 million, so I added this number on top of the growth rate I assumed for the rest of the company.

- In 2021, Simpson had no long term debt. That’s not the case anymore, as part of the acquisition is being funded through a $450 million dollar loan. The Q4 earnings call didn’t provide any detail on the interest rate on the debt, so I picked a 4% rate as my base assumption. The rate is important because it will determine the interest expense the company has to pay- flowing through the income statement.

- CapEx guidance for 2022 was given at between $65 and $70 million. Since I project this number in the forecast period as a percentage of revenue, I need to make sure proper adjustments are made that end up showing 2022 FY CapEx spend within that range.

- Simpson spent $61 million, $76 million, and $24 million on share repurchases in 2019, 2020, and 2021, respectively. I expect a continuation of ’21 into ’22 with the company having a new debt load to manage. The assumption I put in my model for 2022 spend on buybacks is $20 million.

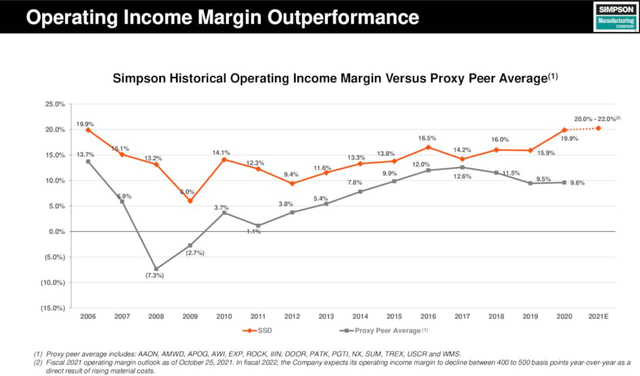

For those familiar with these types of models, there are obviously a lot more assumptions that go into it. In future articles, I plan on digging into my assumptions and what went wrong versus what went right. But to oversimplify everything and provide some numbers, here is a snippet of a valuation sensitivity table with a range of WACC (Weighted Average Cost of Capital) and Long-term growth rate assumptions (both very important for the terminal value of a DCF).

Personal Financial Model

A few notes about the inner-workings of my model and DCFs in general. A DCF sums the present value of all future years’ cash flows. There are two periods we project unlevered free cash flow for. The first stage is your forecast period, which for this model is 5 years. The stage one cash flows are ultimately determined by various assumptions such as revenue growth rate and profit margins, among other things. These 5 years of free cash flows are then discounted by some factor to get the present value of each and then summed together. For Simpson, the sum of its present valued cash flows for the next 5 years is $397 million, driven down by poor 2022 levels due to large outflows of cash related to the acquisition.

This completes the first half of the enterprise value calculation. The remaining step is to find a way to quantify the present value of all future cash flows after the initial 5 year forecast period. There are a few methods of doing this, but I use the Perpetuity Growth Model. At a high level, this model assumes an infinite long-term growth rate of free cash flows and utilizes this growth rate and Weighted Average Cost of Capital to arrive at the terminal value. This terminal value is then discounted to find the present value, and for Simpson this number is $4.6 billion. Adding this $4.6 billion terminal value of cash flows to the $397 million of stage 1 cash flows brings us to the Enterprise Value of $5.0 billion.

We then need to get to Equity Value, which is obtained by subtracting long-term debt from cash & equivalents to get Net Debt. For SSD, Net Debt is equal to -$301 million (no long term debt on the books yet). This number is subtracted from Enterprise Value and leaves us with an Equity Value of $4.7 billion. To get our final share price estimate, take this equity value and divide it by our diluted common shares outstanding (43.335 million) to get an average share price of $108.64.

As mentioned earlier, I will be reviewing particular assumptions and their accuracy (or lack thereof) in future articles when more company actuals are available.

Risks

One risk to this valuation level that has already been touched on is steel prices. There is already some of this risk baked into the company’s lower margin guidance, but my model has Simpson operating margins improving from a low of 18.28% in 2022 up to 21.8% in 2026. If steel prices maintain their current high levels or increase further, margins will have a hard time recovering to the levels assumed in the valuation. One slight piece of good news for steel prices that have arisen of late is that the U.S. and U.K. struck a trade accord that will remove U.S. tariffs on British steel and aluminum, while the U.K. will lift levies on U.S. whiskey, motorcycles, and tobacco. The steel tariff of 25% being removed surely won’t solve all of the pricing issues Simpson will have with steel due to the fact that British steel exports to the U.S. aren’t enormous, but it’s a step in the right direction for a company that’s seeing steel prices 2-2.5x higher now than at the end of 2021.

Another risk is the housing market. Demand still seems to be strong overall, but there has been some slowdowns in existing home sales, a vast rise in the average 30-year mortgage rate, and persistent inflation that continues to break records and will cause 6 potential rate hikes from the Fed before year’s end. If the housing market weakens and the consumer’s pocket continues to get eaten away by inflation, Simpson will have a hard time attaining their goals in terms of volume and pricing, especially if lower DIY customer demand works itself up through the home centers and back to the manufacturers and distributors.

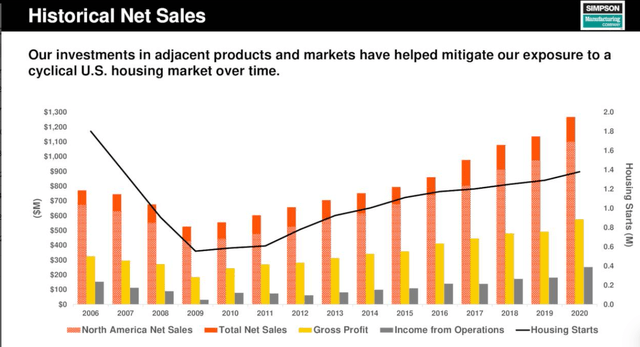

A good strategy the company has taken to mitigate the risk of being correlated to U.S. new residential construction is to expand adjacent product offerings, most notably through their acquisition of Etanco. This new addition will not only help create nearly $30 million of operating income synergies, but also expand the company’s geographical footprint as well as enter more commercial building markets such as facades, waterproofing, and safety/solar. Attached below is a graph showing that, while still correlated, the company has been able to decrease their reliance on increasing housing starts and still manage to grow sales.

Company Q4 Earnings Presentation

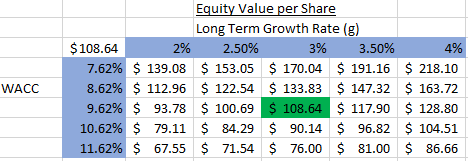

Comps

For reference sake, here are some comparable companies and how Simpson stacks up regarding certain key metrics. These companies were picked from the company’s FY earnings presentation, where they listed 15 of their peers. Looking at the details of each of these companies, it’s certainly not an apples to apples comparison, with the only real similarity is the fact that they are mid-sized manufacturers in the building materials industry. There is not a lot of overlap in terms of product offerings. Simpson seems to be currently valued slightly higher than some of its peers, but not in a way that jumps off the page.

| Simpson (SSD) | AAON (AAON) | Eagle Materials (EXP) | Quanex (NX) | |

| P/E Ratio | 18.26 | 46.59 | 14.77 | 12.26 |

| ’21 EPS | $6.15 | $1.12 | $8.87 | $1.82 |

| EV/EBITDA | 11.23 | 27.9 | 10.44 | 6.58 |

| EV/Sales | 2.93 | 5.24 | 3.37 | .75 |

The Bottom Line

There are certainly shortcomings to primarily analyzing earnings calls, but I believe it can be a very useful tool in a holistic analysis of a stock – especially as wording from executives across these calls can be so strategic and have a deeper meaning than face-value. Financial models also rely on forecasts and inputted assumptions, but just like earnings calls, if they are utilized correctly they can provide valuable insights into the valuation and financial health of a company.

My Discounted Cash Flow valuation model suggests the intrinsic value of Simpson Manufacturing’s stock is $108.64, representing a ~3% downside from the most recent closing price of $112.27.

Ultimately, I think Simpson has plenty of room to grow revenues and volume due to the strength of the residential and commercial building markets. I also think the acquisition of Etanco will offer some needed diversification in both geography and products. However, the worry that lingers for me is margins and steel’s effect on them. There’s a certainty in margins dropping in the near term, but where it gets cloudy is how long these elevated costs are going to stick around. Until management is able to give shareholders more color on this topic, I would rate the stock as a hold.

Be the first to comment