jetcityimage/iStock Editorial via Getty Images

Article Thesis

Simon Property Group (NYSE:SPG) is a leading mall real estate company. It weathered the pandemic relatively well, and its results in recent quarters were convincing. The company also has served several dividend increases in recent quarters, following a dividend cut during the midst of the pandemic. Still, shares have pulled back meaningfully over the last couple of months, and Simon Property Group is now trading at a relatively attractive valuation again. With a yield of 6% and more dividend increases being likely in the coming quarters and years, SPG also has merit as an income investment at current prices.

Malls Aren’t Dead – At Least Not The Good Ones

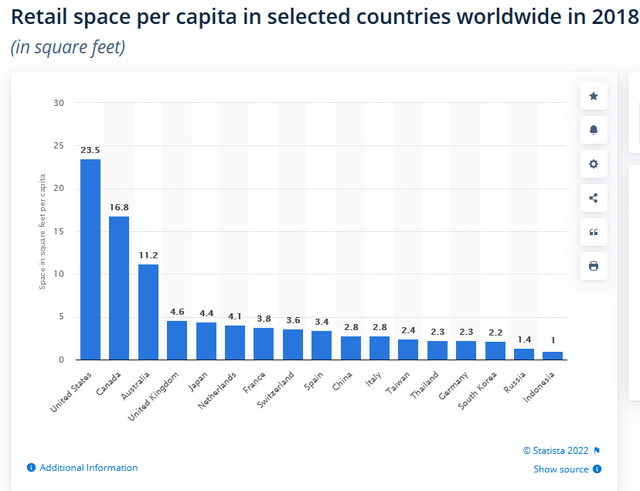

Even before the pandemic, there was a lot of talk about malls dying. And that was true to some extent – but it wasn’t true for all malls. Instead, there was a clear distinction between lower-quality malls and higher-quality malls. Malls with weak tenants, in areas that aren’t densely populated and/or where average disposable income is at a below-average level, have been facing considerable problems for years. Those are primarily the properties either held privately or by lower-quality mall REITs such as Washington Prime Group or CBL Properties (both went bankrupt). Compared to many other higher-income countries around the globe, the average retail space per capita is pretty high in the US:

Note that this data is from 2018, i.e. two years before the pandemic began (statista.com)

We see that the US, and also Canada, have had a lot of retail space compared to countries such as Japan or most higher-income European countries. To some degree, that makes sense as the overall population density in North America is significantly lower compared to other regions around the world. But still, it’s not hard to see that retail space was overbuilt in the US in the past. The destruction of weak/low-quality malls that aren’t actually needed in many cases is thus a natural process that makes a lot of sense.

Not all malls are impacted to the same degree. Instead, higher-quality malls have actually performed very well prior to the pandemic. These high-quality malls are located in densely-populated areas where consumers have above-average disposable incomes/spending power. Since they oftentimes house attractive tenants such as Apple (AAPL), they are still highly relevant to consumers, despite macro trends such as online shopping.

Simon Property Group Is Recovering From The Pandemic

Simon Property Group owns some of the strongest malls in the nation and has an above-average quality portfolio overall. This article shows that Simon Property owns 7 out of the top 10 malls in the US in terms of annual sales being generated (data from prior to the pandemic). Some of these malls have generated close to $2 billion in annual sales, and with a full recovery from the pandemic looking likely, this amount should grow to even higher levels in the future. During 2020 and 2021, sales productivity declined, but that hardly was a surprise. Lockdown measures and social distancing led to fewer mall visits. With these restrictions coming to an end, mall traffic should get back to normal levels. Over the last couple of quarters, Simon Property has experienced a clear upwards trend in the performance of its malls. Funds from operations also have almost fully recovered already. In 2021, FFO per share came in at $11.94, just 0.7% below 2019’s levels, and up by close to 40% from the lows seen in 2020 when more lockdowns were in place.

2021 was thus not yet a “normal” year for Simon Property Group when it comes to operating activities, as some COVID restrictions were still in place. But when it comes to underlying results, 2021 was pretty close to pre-crisis levels again. Especially the profit/FFO performance was compelling, thanks to factors such as cost-cutting and the refinancing of debt at record-low rates.

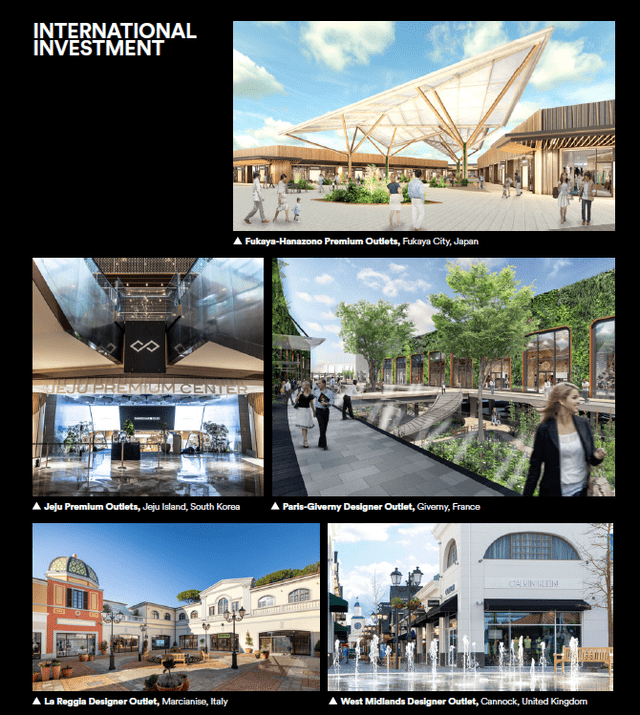

In 2021, SPG has issued more than $3 billion in non-recourse mortgage loans. The average interest rate on those is 3.1% – way less than the current rate of inflation, and only marginally higher than the rate of inflation in case the Fed manages to get inflation down to the 2% level. Taking on debt at rates this low provides for ample liquidity, allows SPG to pay down higher-cost debt, and also provides funds for other purposes, such as the building of new malls or the redevelopment of existing assets. In France, Italy, the UK, South Korea, and Japan, SPG is investing in new properties:

In these countries, average retail footage per capita is considerably lower compared to the US, as we have seen earlier. Focusing growth investments on these markets could thus be a wise move, as demand by potential tenants should be stronger, all else equal.

In the US, SPG regularly redevelops assets in order to make them even more attractive, which allows SPG to demand higher rents once these upgrades are done. In some cases, this includes mixed-use investments, where former mall space can be repurposed for hotels, office space, etc. Simon Property thus has the ability to decide what’s the best way to maximize the value of its properties by deciding whether doubling down on retail space is best for shareholders, or if adding new tenant groups could be more value-creating in the long run.

Occupancy rates have also improved last year, rising by 210 base points compared to 2020. Occupancy rates were still not ultra-high, at 93.4% at the end of Q4, but the trend seems to be very positive. We believe that further occupancy rate increases are likely in the coming years, which should help drive revenue and profit upwards over the years.

Dividend Growth Following The Harsh Decision To Cut The Payout

In 2020, Simon Property Group decided to cut its dividend by close to 40%, from $2.10 per quarter to $1.30 per quarter. In retrospect, that wasn’t really needed, as SPG easily remained profitable even in 2020 and since FFO per share is almost back at pre-crisis levels today. That was not a certainty during the first half of 2020, however. At the time, investors and executives all were very uncertain about what the impact of the pandemic would look like, when/if vaccination would become available, what new mutants might emerge, etc.

In hindsight, it would have been better for SPG to maintain the dividend, as that would not have been an issue thanks to its strong finances and quick recovery. But management did not know what we know today when they made that decision close to two years ago, and I don’t think that the decision was a bad one. It was conservative for sure, but that’s not necessarily a bad thing.

Since cutting the dividend in 2020, SPG has raised it several times already. It looks like management wants to get the payout back to pre-crisis levels in the foreseeable future. Following an 8% increase and a 7% increase in H1 of 2020, Simon Property Group has raised its dividend by another 10% during the latter half of the year. Today, the annual dividend is $6.60 per share. That’s still below pre-crisis levels but makes for an attractive dividend yield of 5.9% nevertheless. I do believe that the dividend will rise meaningfully over the coming years, and would not be surprised to see a double-digit raise this year. But even if SPG were to grow its dividend by just 2%-4% a year going forward, investors might still reasonably expect total returns in the 8%-10% range thanks to a high initial dividend yield and an undemanding valuation.

Today, Simon Property Group trades at a little less than 11x this year’s expected funds from operations. For a quality company that is the leader in its industry and that has a compelling longer-term track record and a strong balance sheet, this does not seem like a high valuation at all.

Takeaway

SPG stock sold off dramatically during the initial phase of the pandemic. In September 2020, we argued that SPG had an upside potential of at least 100%, and shares indeed rose from $70 to more than $170, for a 140% gain before dividends. At $150, $160, or even $170, SPG arguably was not a great value any longer. Over the last couple of months, shares have pulled back again, however. Today, in the $120s, this quality mall REIT seems like a reasonable purchase. Not as great as it was in 2020, but with an initial yield of 6%, not a lot of capital appreciation is required for SPG to deliver compelling returns in the long run.

Be the first to comment