Svetlana123/iStock via Getty Images

Simon Property Group, Inc. (NYSE:SPG) has dropped more than 40% since its late-2021 highs. Not only is the company still recovering from the impacts of COVID-19, but for years, the company has suffered from a trend away from traditional shopping centers to online shopping. Traditional anchor tenants, for example, have seen substantial pain and bankruptcies.

However, we feel the company stands to benefit heavily from an increase of mixed-use centers while maintaining its strong asset portfolios, driving strong returns from its current weak share price.

Mixed-Use Development

Mixed-use development is a new trend, one where people live above the same developments where they shop. That development has been growing rapidly, and it’s one that real estate investment trust (“REIT”) Simon Property Group has continued to take advantage of in new developments such as “The Domain” in Austin. In our view, these developments are much longer term.

Living in the same place where you work is an essential trend and one that we expect to grow. Mixed-used developments are better for the environment and better for property tax revenues for governments as well. They increase density and people like them more. That means that there’ll also be governmental support for their development.

Putting this all together, we see Simon Property Group’s purported terminal declines of malls as over.

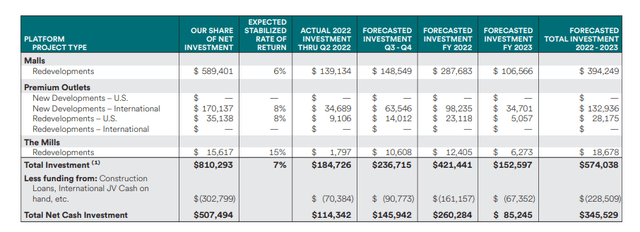

Simon Property Group Earnings

Financially, Simon Property Group has continued to perform incredibly well with its business through a recovery in the markets.

The company saw more than $2 billion in funds from operations (“FFO”) in the most recent year, or more than $5.60 / share. The company managed to increase domestic property NOI by almost 6% with almost 94% occupancy. Base minimum rent per square foot of just under $55 remains strong as the company continues to manage inflation.

The company is continuing to work on constructing new projects in both Tokyo, Japan and Normandy, France. The company also continues to work on new mixed-use developments in Atlanta, GA, and other places throughout the United States, such as Stanford Shopping Center. These businesses will continue to provide steady growth.

The company continues to use its financial strategy of non-recourse mortgage loans. The company had almost $1 billion in non-recourse mortgage loans attributable to the company. The company also had $8.5 billion in liquidity with $1.2 billion in cash. The company continues to pay its substantial dividend of almost 6.5%.

Simon Property Group Portfolio

Simon Property Group continues to have a strong portfolio of assets that’ll support additional shareholder returns.

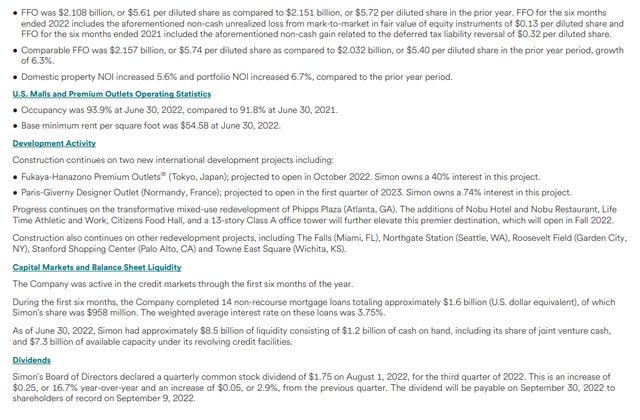

The company’s assets are primarily focused in the United States, with a Florida focus followed by California. The company’s largest customer in the U.S. is The Gap store. However, even then it makes up only 3.0% of total base minimum rent for U.S. properties. The company’s top 10 customers account for roughly 15% of its base minimum rent while top anchors are less space.

The company’s diversified portfolio means heavily diversified rent and reliable cash flow even in a massive market downturn. The company’s lease expirations are also well diversified. In 2023 and 2024, each company only has 11% of its rent expiring. In 2025, that’s 8% decreasing steadily from that point going forward.

That means the worst-case scenario for the company in a 2-year recession with no renewals is only 20% revenue loss. That’s a level that the company can comfortably manage in its focus on driving additional shareholder returns.

Simon Property Group Growth

Simon Property Group has continued to focus on growth given the company’s impressive asset portfolio.

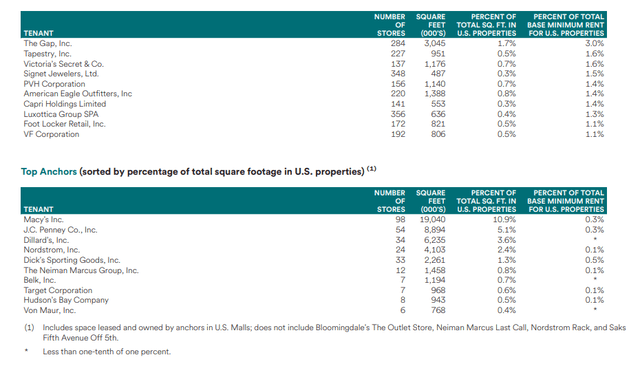

The company’s annualized growth capital spending is almost $400 million. That’s substantial in dollar value, but not overly so for a company with a market capitalization of just under $40 billion. It’s worth noting that the company has other programs that are funded with mortgages that don’t have recourse to the company.

The company’s share of net investment from its projects is expected to be more than $800 million with cash investment at just over $500 million. The company’s projects are split across both redevelopments and new developments in both the U.S. and internationally. These projects will provide the company with strong continued growth.

Simon Property Growth Shareholder Returns

Simon Property Group has the ability to drive massive cash flow with its continued funds generation.

The company can, for the most part, increase rents in line with inflation. It can continue to build impressive assets and, most importantly, it can build those assets without taking out debt that could drive the owning company bankrupt. That means that, for the most part, it can structure these underlying assets so that it gets all of the benefit with none of the risk.

The company’s announced dividends increase is almost 17% over the last dividend, and the company’s new yield is more than 6.4%. We’d like to see the company opportunistically use share repurchases for growth after weakness over the past year. Regardless of how the company pays out its cash flow, we expect strong and growing shareholder returns.

The company’s low-risk assets and cash flow potential highlights how the company is a valuable investment.

Thesis Risk

The largest risk to the thesis is that real estate remains a competitive industry where plenty of individuals have the $10s of $100s of millions to invest in opportunities. As a result, that drives the margins of the industry lower and hurt the company’s ability to achieve long-term higher returns. In a recession, that gets even worse for the company.

Conclusion

Simon Property Group is one of the largest mall operators in the world. Before, especially with the COVID-19 lockdowns and the shift to online shopping, Simon Property Group was viewed as a dying company. From the company’s mid-2016 peak, it dropped almost 80% into its lows during the early-2020s before recovering.

We expect the company’s recovery to continue. Mixed-use developments are expanding significantly, and it’s a development strategy that’ll lead to increased revenue and property valuations for Simon Property Group. We expect that’ll allow the company’s dividends to grow, dividends that are already above 6.4%, making Simon Property Group a valuable and reliable long-term investment.

Be the first to comment